Are Delayed ECB Rate Cuts A Mistake? Economists Weigh In

Table of Contents

The Arguments for Delayed ECB Rate Cuts

The ECB's cautious approach to further rate cuts is supported by several key arguments. These arguments primarily center around inflation concerns and projections for future economic growth.

Inflation Concerns

Persistent inflation remains a significant obstacle to further monetary easing. Premature rate cuts risk exacerbating existing inflationary pressures.

- Persistent inflation remains a significant concern: The Eurozone's inflation rate, while showing signs of easing, remains above the ECB's target of 2%. A hasty reduction in interest rates could reignite inflationary pressures.

- Premature rate cuts could exacerbate inflation, potentially leading to a wage-price spiral: Lower interest rates can stimulate demand, putting upward pressure on prices. If this leads to increased wage demands to compensate for higher living costs, a self-perpetuating wage-price spiral could emerge.

- Analyzing core inflation rates and their implications for ECB decisions: Core inflation, which excludes volatile food and energy prices, offers a clearer picture of underlying inflationary pressures. The ECB carefully monitors core inflation to gauge the persistence of inflationary trends and guide its monetary policy decisions.

Detailed explanation: The current inflation rate in the Eurozone needs careful consideration. While headline inflation may be declining due to falling energy prices, core inflation remains stubbornly high. Further rate cuts, before core inflation shows a clear and sustained downward trend, risk fueling a resurgence of price increases. This conflict between the need to stimulate economic growth and the need to maintain price stability lies at the heart of the ECB's dilemma.

Economic Growth Projections

Uncertainty surrounding future economic growth adds another layer of complexity to the ECB's decision-making process.

- Uncertainty surrounding future economic growth warrants a more cautious approach: The global economic outlook remains uncertain, with risks such as geopolitical instability and potential supply chain disruptions impacting growth projections.

- Analysis of GDP growth forecasts and their influence on rate cut decisions: The ECB carefully considers forecasts for GDP growth in the Eurozone when determining its monetary policy stance. Slow or negative growth forecasts might lead to more aggressive rate cuts, but uncertain projections necessitate caution.

- Exploring the potential impact of premature rate cuts on already fragile economic recovery: A premature easing of monetary policy could jeopardize the fragile economic recovery, potentially leading to unsustainable growth and future instability.

Detailed explanation: Current forecasts suggest moderate growth for the Eurozone, but these projections are subject to considerable uncertainty. Aggressive rate cuts in the face of this uncertainty could lead to unintended consequences, potentially creating asset bubbles or exacerbating existing inflationary pressures. A more cautious approach allows the ECB to monitor economic developments closely before committing to further monetary easing.

The Arguments Against Delayed ECB Rate Cuts

Conversely, delaying rate cuts carries significant risks, particularly regarding stagnant economic growth and the threat of deflation.

Stagnant Economic Growth

Prolonged stagnation increases the likelihood of deflation and necessitates more aggressive intervention by the ECB.

- Prolonged stagnation risks deflationary pressures, requiring more aggressive intervention: Stagnant economic activity can lead to falling prices, creating a deflationary spiral that is difficult to reverse.

- The potential for a deeper recession if the ECB doesn't act decisively: Delaying rate cuts risks prolonging the period of slow growth, potentially pushing the Eurozone into a deeper recession.

- Examining the effectiveness of previous monetary policy interventions: Analyzing past ECB interventions, including quantitative easing and other unconventional measures, helps assess their effectiveness in stimulating economic activity.

Detailed explanation: Several Eurozone economies are experiencing sluggish growth. Delaying rate cuts could exacerbate this situation, leading to further job losses and reduced consumer spending. The longer the stagnation persists, the greater the risk of deflation. Deflation discourages spending as consumers anticipate further price reductions, creating a vicious cycle that can severely damage the economy.

Risks of Deflation

Deflationary pressures can severely impact consumer spending and investment, potentially leading to a deflationary spiral.

- Deflationary pressures could significantly impact consumer spending and investment: Falling prices can deter consumers from making purchases, expecting further price drops, leading to reduced demand and economic slowdown.

- The potential for a deflationary spiral if the ECB delays further action: A deflationary spiral is a self-reinforcing cycle where falling prices lead to lower demand, further reducing prices, and creating a vicious cycle of economic decline.

- Historical examples of deflationary spirals and their devastating economic impact: History provides numerous examples of deflationary spirals, such as the Great Depression, highlighting the severe economic consequences of such events.

Detailed explanation: The devastating impact of deflation on consumer and business confidence cannot be overstated. Falling prices, while seemingly beneficial, erode consumer confidence, as people delay purchases anticipating lower prices in the future. This reduced demand further depresses prices, creating a self-fulfilling prophecy of economic downturn. The ECB must act decisively to prevent such a scenario.

Conclusion

The debate surrounding delayed ECB rate cuts highlights the difficult choices policymakers face. While inflation concerns and uncertain growth necessitate caution, the risks of stagnation and deflation are equally significant. Economists remain divided, underscoring the complexity of the situation. Further analysis and close monitoring of economic indicators are crucial to determine the best course of action. Will the ECB maintain its current strategy, or will a shift toward more aggressive ECB rate cuts become necessary to protect the Eurozone economy? The ongoing impact of these decisions will shape the Eurozone's future. Stay informed on the latest developments regarding ECB rate cuts and their impact on the European economy.

Featured Posts

-

Brascada Valenciana Receta Original Y Facil De Hacer

May 31, 2025

Brascada Valenciana Receta Original Y Facil De Hacer

May 31, 2025 -

The Jn 1 Variant A Deep Dive Into The Latest Covid 19 Resurgence

May 31, 2025

The Jn 1 Variant A Deep Dive Into The Latest Covid 19 Resurgence

May 31, 2025 -

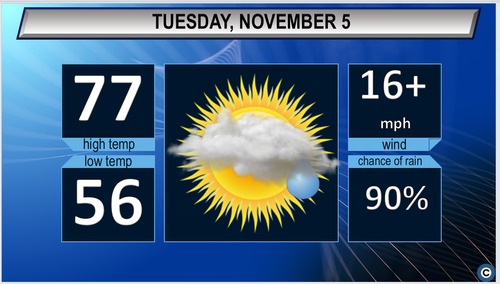

Northeast Ohio Tuesday Forecast Sunny And Dry

May 31, 2025

Northeast Ohio Tuesday Forecast Sunny And Dry

May 31, 2025 -

Ais Learning Process Why Responsible Use Requires A Deeper Understanding

May 31, 2025

Ais Learning Process Why Responsible Use Requires A Deeper Understanding

May 31, 2025 -

Glastonbury Coach Resale Tickets Timing Availability And Booking Guide

May 31, 2025

Glastonbury Coach Resale Tickets Timing Availability And Booking Guide

May 31, 2025