April's Uber Stock Rally: Factors Contributing To The Significant Gain

Table of Contents

- Stronger-Than-Expected Q1 Earnings

- Revenue Growth and Profitability

- Growth in Key Segments

- Positive Market Sentiment and Investor Confidence

- Overall Market Conditions

- Strategic Initiatives and Future Outlook

- Short Squeeze and Increased Trading Activity

- Increased Buying Pressure

- Retail Investor Interest

- Conclusion

Stronger-Than-Expected Q1 Earnings

Uber's Q1 2024 earnings report played a pivotal role in the Uber stock rally. The results significantly exceeded analyst expectations, boosting investor confidence and driving up the Uber stock price.

Revenue Growth and Profitability

Uber reported substantial revenue growth, surpassing predictions and indicating a healthy trajectory for the company. This positive financial performance was further enhanced by improvements in profitability metrics.

- Key Financial Figures: Revenue growth exceeded 20% year-over-year, with a significant increase in EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). Net income also showed a positive trend, exceeding analyst forecasts.

- Analyst Reactions: Following the earnings release, several prominent analysts upgraded their price targets for Uber stock, reflecting a more optimistic outlook. This positive sentiment further fueled the Uber stock rally.

Growth in Key Segments

Uber's success wasn't confined to a single segment; growth was evident across multiple areas of its business.

- Rides: The ride-sharing segment experienced a strong rebound in demand, outperforming expectations and indicating a recovery from the pandemic's impact.

- Delivery: Uber Eats continued its robust growth trajectory, benefiting from increasing demand for food delivery services and strategic partnerships. Market share gains were also noted in this segment.

- Freight: Uber Freight also showed positive growth, indicating success in expanding its logistics and transportation services.

These robust performances across key segments reinforced the narrative of a healthy and growing business, contributing significantly to the Uber stock rally.

Positive Market Sentiment and Investor Confidence

The April Uber stock rally wasn't solely attributable to the company's performance; broader market conditions and investor sentiment played a crucial role.

Overall Market Conditions

A generally positive market environment for tech stocks in April created a favorable backdrop for Uber's stock price increase.

- Macroeconomic Indicators: Positive macroeconomic indicators, such as improved consumer confidence and reduced inflation concerns, helped to boost investor appetite for riskier assets, including tech stocks.

- Competitor Performance: While not directly impacting Uber, positive performance from other major tech companies generally strengthened the overall tech sector sentiment, creating a tailwind for Uber's stock.

Strategic Initiatives and Future Outlook

Uber's strategic initiatives further enhanced investor confidence and contributed to the Uber stock rally.

- New Partnerships: Strategic partnerships with other companies expanded Uber's reach and service offerings, enhancing its appeal to both customers and investors.

- Technological Advancements: Investments in technology and innovation helped to streamline operations and improve efficiency, which was perceived positively by investors.

- Expansion Plans: Announcements of plans to expand into new markets further fuelled expectations of future growth, strengthening investor confidence. This also fueled positive analyst forecasts and predictions about Uber's future performance, further bolstering the Uber stock price.

Short Squeeze and Increased Trading Activity

While the fundamentals were strong, other market dynamics likely contributed to the April Uber stock rally's intensity.

Increased Buying Pressure

A potential short squeeze could have amplified the upward momentum of the Uber stock price.

- Short Squeeze Mechanics: A high level of short selling in Uber stock, followed by a surge in buying, could have triggered a short squeeze, forcing short sellers to buy back shares to cover their positions, further increasing demand and driving up the price.

- Trading Volume Data: Increased trading volume during the rally suggests heightened activity, potentially indicative of a short squeeze. Data on short interest changes would support this theory further.

Retail Investor Interest

Retail investor activity also likely influenced the intensity of the Uber stock rally.

- Social Media Influence: Social media discussions and online forums likely played a role, potentially amplifying the rally through increased retail investor interest.

- Meme Stock Correlation: While not directly a "meme stock," Uber's increased volatility could have attracted retail traders interested in similar high-growth, high-volatility stocks.

Conclusion

April's Uber stock rally resulted from a confluence of factors: exceptionally strong Q1 earnings showcasing revenue growth and improved profitability across key segments (rides, delivery, freight); a generally positive market sentiment benefiting tech stocks; strategic initiatives enhancing investor confidence in Uber's future; and potentially, a short squeeze amplified by increased retail investor participation. Understanding these factors behind April's Uber stock rally is crucial for informed investment decisions. Stay tuned for further analysis and insights into Uber's future performance and potential investment opportunities, as the ongoing Uber stock price trajectory remains an important factor for investors.

Australia No Junior Eurovision Return In 2025

Australia No Junior Eurovision Return In 2025

Visit Orlando 2025 Event Pictures And Travel Guide Orlando Sentinel

Visit Orlando 2025 Event Pictures And Travel Guide Orlando Sentinel

Ufc Vegas 106 Burns Vs Morales A Comprehensive Betting Preview And Predictions

Ufc Vegas 106 Burns Vs Morales A Comprehensive Betting Preview And Predictions

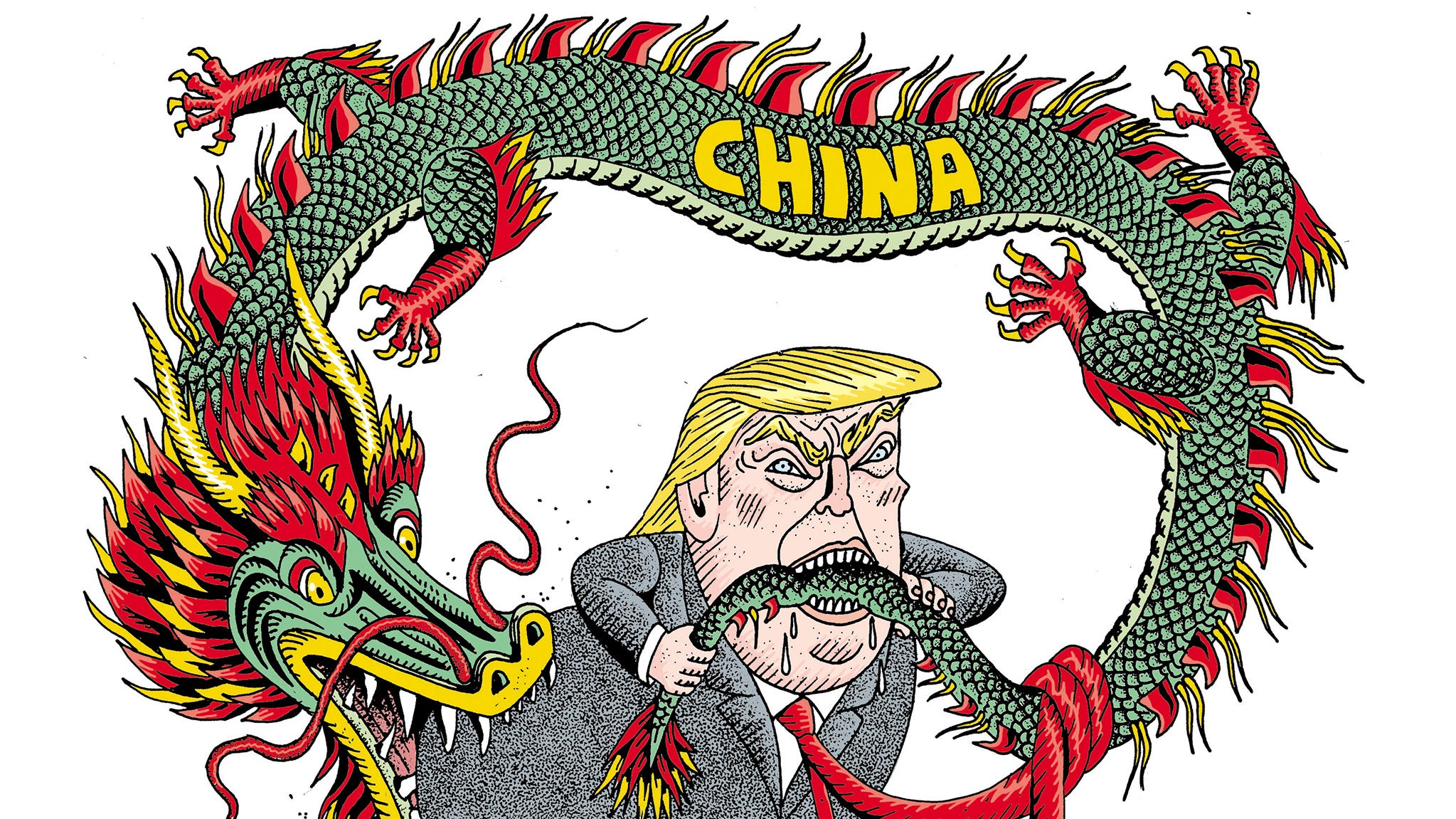

Analyst Outlook Trumps China Tariffs To Persist Through 2025

Analyst Outlook Trumps China Tariffs To Persist Through 2025

Met Steve Cohen Addresses Pete Alonsos Future And Juan Sotos Slow Start

Met Steve Cohen Addresses Pete Alonsos Future And Juan Sotos Slow Start