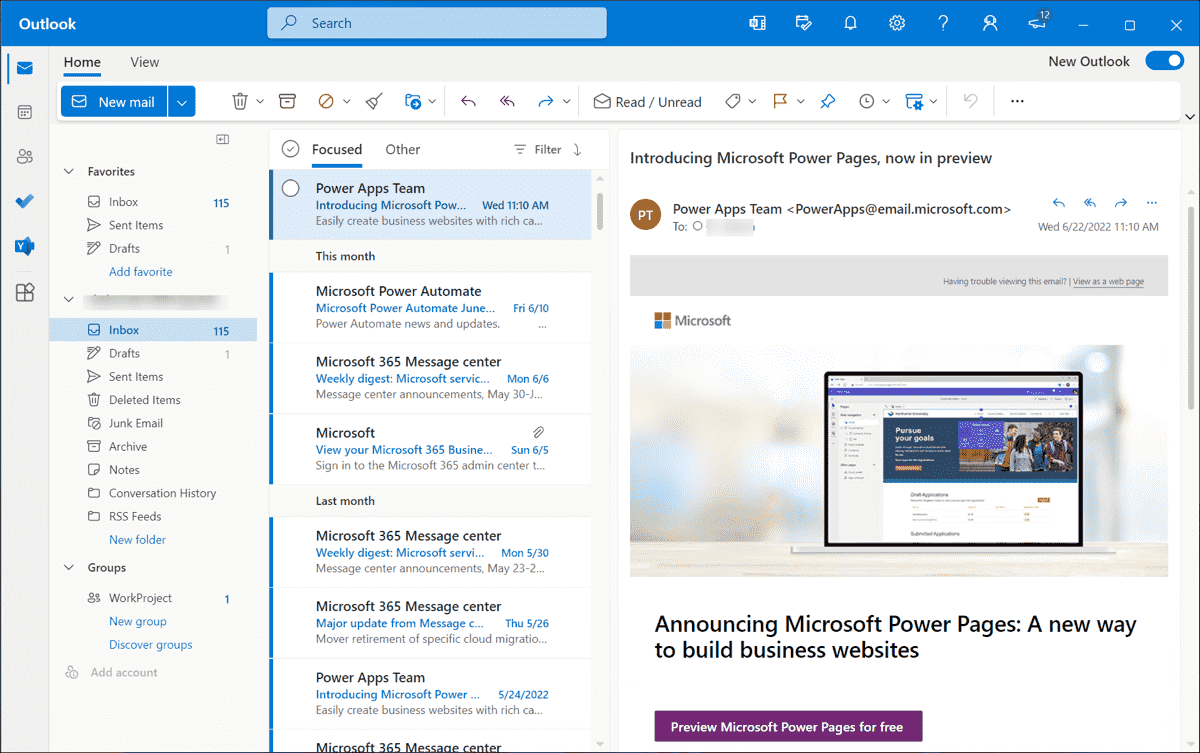

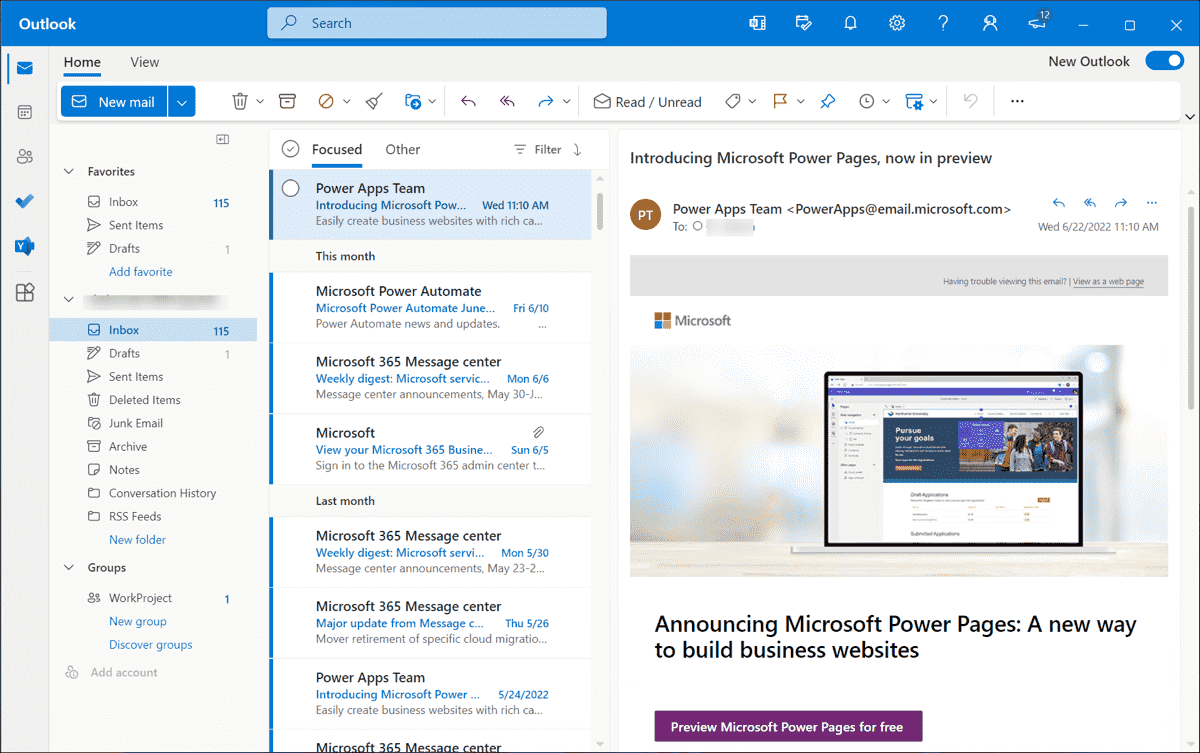

April 2024 Outlook Update: What's New

Table of Contents

Global Economic Outlook for April 2024

The global economic situation in April 2024 presents a mixed picture. While some regions show signs of recovery, others face persistent challenges. Several key factors are influencing the overall economic forecast.

-

Inflationary Pressures and Central Bank Responses: Inflation remains a significant concern in many parts of the world. Central banks continue to grapple with balancing inflation control with the need to avoid triggering a recession. Interest rate hikes, while aiming to curb inflation, also risk slowing economic growth. The effectiveness of these policies in April 2024 will significantly impact future economic trajectories.

-

Impact of Geopolitical Instability on Global Markets: Geopolitical events continue to create uncertainty in the global marketplace. The ongoing conflict in Ukraine, coupled with other regional tensions, contributes to supply chain disruptions and energy price volatility. These uncertainties directly impact investor confidence and market stability.

-

Growth Prospects for Major Economies: The growth outlook varies considerably across major economies. Some regions are expected to experience moderate growth, while others may face stagnation or even contraction. This disparity is largely driven by factors like domestic policy, external shocks, and the effectiveness of responses to inflation.

-

Supply Chain Disruptions and Their Ongoing Effects: While supply chain issues have eased somewhat from their peak, disruptions persist. These continue to impact production costs, inflation, and the availability of goods in certain sectors. The April 2024 outlook reveals ongoing efforts to improve resilience and diversification in global supply chains.

Key Sectoral Updates in April 2024

Significant developments are underway across various sectors, influencing the April 2024 outlook and beyond.

-

Technology Sector: Advancements in artificial intelligence (AI) continue to drive innovation and investment. However, semiconductor shortages and increasing regulatory scrutiny pose challenges to the sector's growth trajectory. The April 2024 outlook indicates ongoing efforts to address these challenges.

-

Finance Sector: Interest rate changes by central banks are significantly impacting market volatility. The stability of the banking sector remains a key concern, requiring careful monitoring. The April 2024 economic forecast necessitates a cautious approach to financial investments.

-

Energy Sector: Oil prices remain volatile, influenced by geopolitical factors and the ongoing energy transition. The growth of renewable energy sources continues, but the speed of this transition and its impact on energy security remain crucial aspects of the April 2024 economic forecast.

-

Manufacturing Sector: Supply chain challenges continue to constrain production levels, while consumer demand remains a key driver of economic activity. Understanding the interplay of these factors is critical for analyzing the April 2024 outlook for manufacturing.

Investment Strategies for April 2024

The April 2024 outlook necessitates a nuanced approach to investment strategies, emphasizing risk management and diversification.

-

Potential Investment Opportunities in Specific Sectors: While the overall market presents challenges, opportunities exist within specific sectors demonstrating resilience or strong growth potential. Careful analysis of individual companies and industry trends is crucial.

-

Strategies for Mitigating Risks in a Volatile Market: Diversification across asset classes and geographical regions remains a cornerstone of effective risk management. Hedging strategies and careful portfolio construction are essential.

-

Recommended Asset Allocation Strategies for Different Risk Profiles: The optimal asset allocation strategy depends heavily on individual risk tolerance and investment objectives. Conservative investors may favor lower-risk assets, while more aggressive investors might consider higher-growth opportunities.

-

The Role of Diversification in Investment Portfolios: Diversification remains paramount in mitigating risk. Spreading investments across different asset classes reduces the impact of any single investment's underperformance.

Emerging Market Trends to Watch in April 2024

Several emerging trends warrant close attention in April 2024 and beyond:

-

Growth of Sustainable Investing: The increasing focus on environmental, social, and governance (ESG) factors is driving significant investment flows towards sustainable and responsible businesses.

-

Impact of Technological Disruption on Various Industries: Rapid technological advancements are reshaping industries, creating both opportunities and challenges for businesses. Adaptability and innovation are crucial for success.

-

Geopolitical Shifts and Their Influence on Investment Decisions: Geopolitical events significantly influence market sentiment and investment decisions. Careful monitoring of global political developments is crucial for informed investment strategies.

Conclusion: Staying Ahead with the April 2024 Outlook

This April 2024 outlook update highlights a dynamic economic landscape characterized by both challenges and opportunities. Staying informed about market trends and economic forecasts is crucial for navigating this complex environment. By understanding the key factors impacting the global economy and individual sectors, you can make more informed decisions and build a resilient investment strategy. Stay informed with our regular outlook updates for the latest insights and make informed decisions based on the evolving April 2024 outlook and beyond. Subscribe to our newsletter for more detailed analyses and timely updates.

Featured Posts

-

The Limitations Of Ai Learning Towards More Ethical And Responsible Ai

May 31, 2025

The Limitations Of Ai Learning Towards More Ethical And Responsible Ai

May 31, 2025 -

Boxer Munguia Rejects Doping Claims Following Adverse Finding

May 31, 2025

Boxer Munguia Rejects Doping Claims Following Adverse Finding

May 31, 2025 -

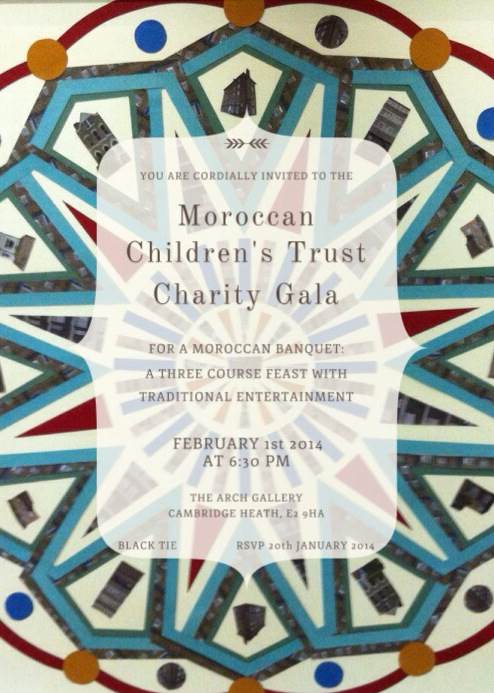

Dragons Den Star Backs Life Changing Moroccan Childrens Charity

May 31, 2025

Dragons Den Star Backs Life Changing Moroccan Childrens Charity

May 31, 2025 -

Metro Detroit Weather Sunny Monday After Cloudy Start

May 31, 2025

Metro Detroit Weather Sunny Monday After Cloudy Start

May 31, 2025 -

Tenis Yildizindan Rekor Kirici Performans Djokovic In Yeni Ilkesi

May 31, 2025

Tenis Yildizindan Rekor Kirici Performans Djokovic In Yeni Ilkesi

May 31, 2025