Apple Stock Under Pressure: Tariffs And Buffett's Holdings

Table of Contents

The Impact of Tariffs on Apple's Stock Price

Tariffs on imported goods, particularly components used in Apple's products, significantly impact the company's profitability and, consequently, its stock price. These increased costs directly affect Apple's bottom line, squeezing profit margins and potentially leading to higher prices for consumers. The uncertainty surrounding future tariff increases adds another layer of complexity, making accurate earnings predictions challenging. For example, a recent tariff announcement saw a [insert percentage]% drop in Apple's stock price within [ timeframe].

- Increased production costs: Tariffs increase the cost of manufacturing iPhones, iPads, and other Apple products.

- Reduced profit margins: Higher production costs translate to lower profit margins unless Apple passes the increased cost onto the consumer.

- Potential price increases for consumers: Passing on increased costs to consumers risks reducing demand, particularly in price-sensitive markets.

- Shifting production to avoid tariffs: Relocating manufacturing facilities to avoid tariffs is a costly and time-consuming endeavor.

Analyzing Warren Buffett's Recent Apple Stock Holdings

Berkshire Hathaway, Warren Buffett's investment firm, holds a substantial stake in Apple, making Buffett's investment decisions a crucial factor influencing Apple's stock price. Buffett's long-term investment strategy and his views on Apple's future prospects significantly impact investor sentiment. Any changes in Berkshire Hathaway's Apple holdings, whether buying or selling, are closely scrutinized by the market. [Insert details on recent buying/selling activity and any statements made by Buffett or his team about Apple].

- Berkshire Hathaway's percentage ownership of Apple: [Insert current percentage].

- Recent changes in Berkshire Hathaway's Apple holdings: [Insert details on recent transactions].

- Buffett's stated reasons for investing in Apple: [Summarize Buffett's rationale, if publicly available].

- Market reaction to Buffett's actions: [Describe how the market reacted to Buffett’s investment decisions].

Other Factors Contributing to Apple Stock Volatility

Beyond tariffs and Buffett's moves, several other factors contribute to the volatility of Apple stock. Intense competition from other tech companies, particularly in the Android smartphone market, puts pressure on Apple's market share and profitability. Supply chain disruptions, geopolitical instability, and the market reception of new product launches also play a role.

- Competition from Android devices: The Android ecosystem poses a significant competitive challenge to Apple's iPhone dominance.

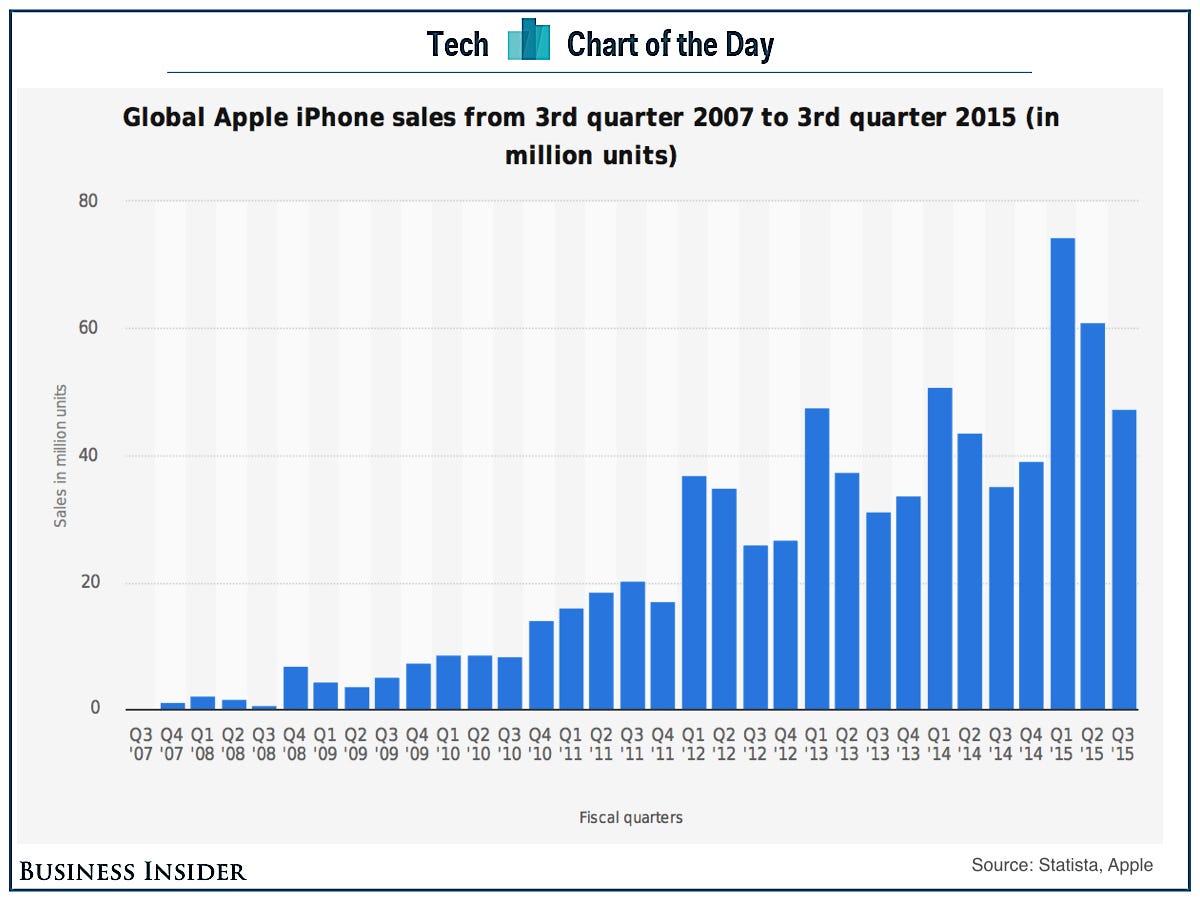

- iPhone sales trends: Any slowdown in iPhone sales directly affects Apple's revenue and stock price.

- Development of new technologies (e.g., AR/VR): Apple's success in emerging technologies will significantly impact its future growth.

- Global economic conditions: Recessions or economic downturns can reduce consumer spending on discretionary items like Apple products.

Predicting Future Trends for Apple Stock

Predicting the future of Apple stock requires a nuanced understanding of all the factors discussed above. While Apple possesses strong brand loyalty and a robust ecosystem, the challenges posed by tariffs, competition, and economic uncertainty cannot be ignored. Investors should carefully consider these risks alongside Apple's long-term growth potential.

- Potential upside and downside risks: Analyze the potential for growth in emerging markets versus the risk of declining sales in mature markets.

- Long-term growth potential of Apple: Apple's potential for growth in services and new technologies should be considered.

- Recommendations for investors (general advice only): Diversification is crucial. Consult a financial advisor before making investment decisions.

Conclusion: Understanding the Pressures on Apple Stock

Apple stock's performance is influenced by a complex interplay of factors, including tariffs, Warren Buffett's investment decisions, and broader market forces. While Apple maintains a strong position in the tech industry, navigating the current pressures requires careful consideration of the risks and opportunities. Remember, predicting stock market movements is inherently challenging. Conduct your own thorough research, and consult with a financial advisor before making any investment decisions. Stay informed on the latest developments affecting Apple stock under pressure by regularly checking reputable financial news sources. For further insights, explore resources on "Apple Stock Forecast."

Featured Posts

-

Trump E I Dazi Del 20 Conseguenze Per Nike Lululemon E Il Mercato Europeo Della Moda

May 25, 2025

Trump E I Dazi Del 20 Conseguenze Per Nike Lululemon E Il Mercato Europeo Della Moda

May 25, 2025 -

8 Stock Market Rally In Amsterdam Impact Of Trumps Tariff Decision

May 25, 2025

8 Stock Market Rally In Amsterdam Impact Of Trumps Tariff Decision

May 25, 2025 -

Pmi Beats Expectations Supporting Dow Joness Measured Climb

May 25, 2025

Pmi Beats Expectations Supporting Dow Joness Measured Climb

May 25, 2025 -

Sejarah Porsche 356 Pabrik Zuffenhausen Dan Legenda Yang Tercipta

May 25, 2025

Sejarah Porsche 356 Pabrik Zuffenhausen Dan Legenda Yang Tercipta

May 25, 2025 -

Apple Stock Q2 Earnings I Phone Sales Fuel Growth

May 25, 2025

Apple Stock Q2 Earnings I Phone Sales Fuel Growth

May 25, 2025

Latest Posts

-

Turning Poop Into Prose An Ai Powered Podcast Revolution

May 25, 2025

Turning Poop Into Prose An Ai Powered Podcast Revolution

May 25, 2025 -

Investigating The Connections Presidential Seals Luxury Goods And Exclusive Afterparties

May 25, 2025

Investigating The Connections Presidential Seals Luxury Goods And Exclusive Afterparties

May 25, 2025 -

The I O And Io Battleground How Google And Open Ai Are Shaping The Future Of Tech

May 25, 2025

The I O And Io Battleground How Google And Open Ai Are Shaping The Future Of Tech

May 25, 2025 -

The Symbolism Of Power Presidential Seals Expensive Watches And Elite Gatherings

May 25, 2025

The Symbolism Of Power Presidential Seals Expensive Watches And Elite Gatherings

May 25, 2025 -

The Trump Factor Influencing Republican Negotiations

May 25, 2025

The Trump Factor Influencing Republican Negotiations

May 25, 2025