Apple Stock Price Prediction: Reaching $254 – A $200 Buy Opportunity?

Table of Contents

Analyzing Current Market Conditions and Apple's Financial Performance

Strong Fundamentals

Apple boasts consistently strong fundamentals, underpinning its potential for future growth. Its impressive financial performance is characterized by:

- High Revenue Streams from iPhone Sales: The iPhone remains a cash cow, generating billions in revenue annually and consistently exceeding sales expectations.

- Growing Services Sector: Apple's services ecosystem (App Store, iCloud, Apple Music, Apple TV+, etc.) is a significant and rapidly expanding revenue generator, demonstrating impressive recurring revenue streams and high user engagement.

- Expansion into Wearables and Other Markets: The Apple Watch, AirPods, and other wearables are experiencing substantial growth, diversifying Apple's revenue streams and tapping into new markets.

- Strong Financial Reports and Positive Earnings Calls: Consistently positive earnings reports and optimistic guidance from Apple's management team further solidify the company's financial strength. For example, [insert recent data on EPS, revenue growth, etc.].

Macroeconomic Factors

While Apple's internal strengths are undeniable, macroeconomic factors significantly influence its stock price. Key considerations include:

- Inflation and Interest Rates: Rising interest rates can impact consumer spending and potentially slow down the demand for Apple products, particularly high-priced items like iPhones.

- Global Economic Uncertainty: A potential recession or global economic slowdown could negatively affect consumer confidence and reduce demand for discretionary electronics.

- Supply Chain Issues: Although improving, persistent supply chain disruptions can impact Apple's production and delivery timelines, affecting both revenue and stock price.

Future Growth Drivers for Apple Stock

Innovation and New Product Launches

Apple's continued innovation is a primary driver of its stock price. Upcoming product launches hold significant promise:

- New iPhones: Annual iPhone releases generate immense hype and significant sales, often driving substantial stock price movements. New features and improved performance always create significant consumer demand.

- AR/VR Headsets: Entry into the augmented and virtual reality market represents a potentially disruptive opportunity, offering significant long-term growth potential if successful.

- Improved Services: Ongoing improvements and expansions within Apple's services ecosystem will likely continue to contribute to significant revenue growth.

Expansion into New Markets and Services

Apple's global expansion and exploration of new service offerings are key elements of its future growth strategy:

- Emerging Markets: Penetrating new markets in developing economies presents considerable growth potential, offering access to millions of new potential customers.

- New Subscription Services: Apple is actively exploring new subscription services beyond its current offerings, aiming to increase recurring revenue and customer loyalty. This diversification strategy mitigates reliance on hardware sales alone.

Risks and Potential Downsides

Competition and Market Saturation

Despite its market leadership, Apple faces ongoing competitive pressures:

- Samsung and Google: Samsung's strong presence in the Android market and Google's expanding ecosystem present significant competition, particularly in the smartphone and services sectors.

- Market Saturation: Saturation in mature markets like the US could limit growth opportunities, making expansion into new markets crucial.

Geopolitical Risks and Regulatory Concerns

Geopolitical risks and regulatory scrutiny pose potential challenges to Apple:

- Trade Wars and Sanctions: Global trade tensions and potential sanctions could disrupt Apple's supply chains and impact its international operations.

- Privacy Regulations: Increasingly stringent privacy regulations worldwide could affect Apple's data collection practices and potentially impact its services business.

Conclusion

This analysis suggests that while Apple's strong fundamentals and innovative products offer significant potential for growth, leading to a possible $254 stock price, several risks need consideration. A potential dip to $200 might present a compelling entry point, balancing the risks with the potential rewards. However, the precise Apple stock price is inherently unpredictable.

Call to Action: While predicting the exact Apple stock price is impossible, the analysis suggests a potential upside. If you believe in Apple's long-term growth prospects and are comfortable with the inherent risks, a strategic investment at around $200 might offer a significant opportunity. Conduct thorough due diligence and consider your own risk tolerance before making any investment decisions related to the Apple stock price prediction and Apple stock forecast. Remember to always consult with a financial advisor before investing in any stock, including Apple stock.

Featured Posts

-

90 Let So Dnya Rozhdeniya Sergeya Yurskogo Intellekt Yumor I Paradoksy Geniya

May 25, 2025

90 Let So Dnya Rozhdeniya Sergeya Yurskogo Intellekt Yumor I Paradoksy Geniya

May 25, 2025 -

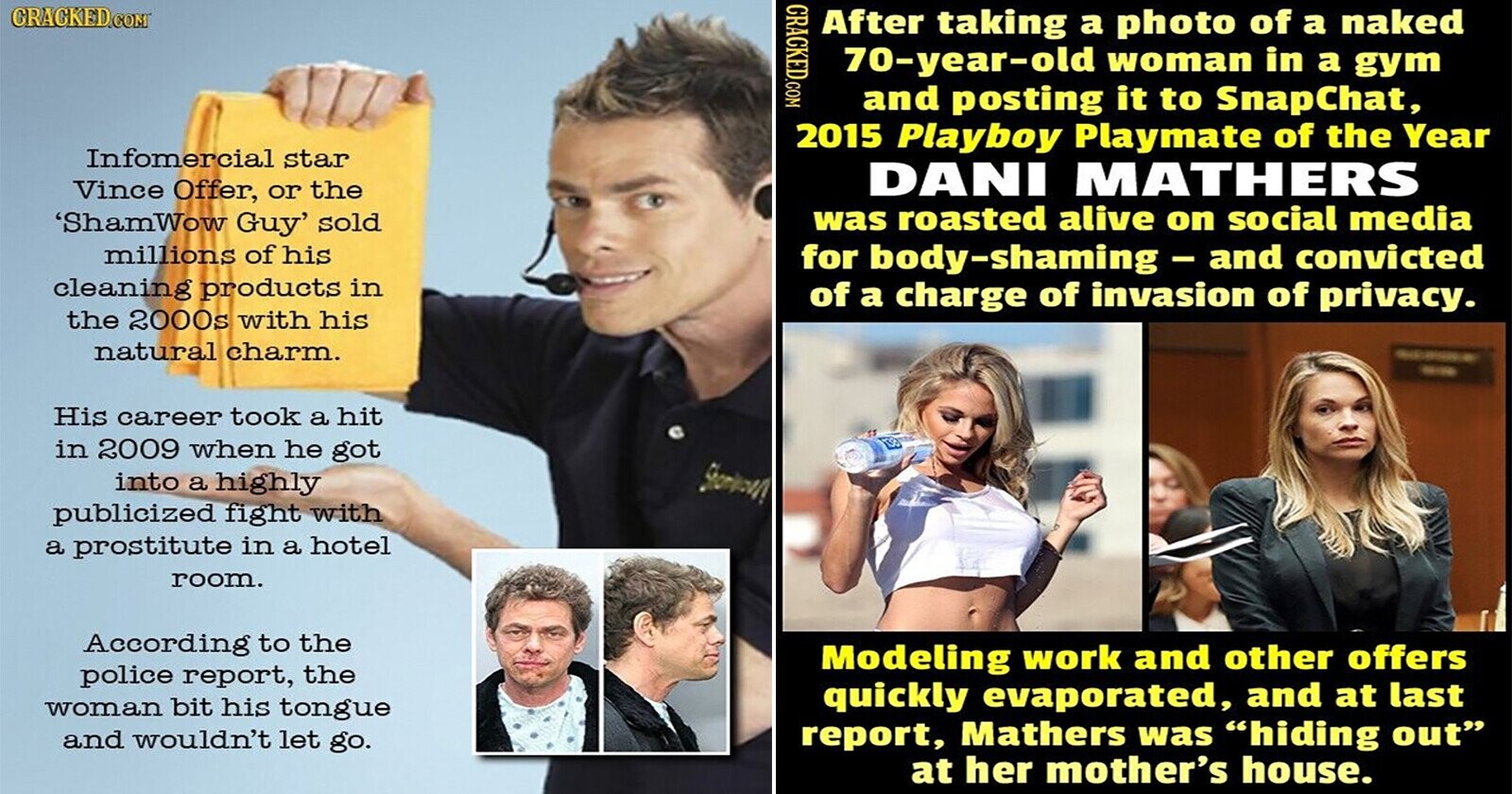

17 Celebrities Who Destroyed Their Careers Overnight

May 25, 2025

17 Celebrities Who Destroyed Their Careers Overnight

May 25, 2025 -

Fatal Nightcliff Stabbing Teen Arrested For Murder Of Shop Owner In Darwin

May 25, 2025

Fatal Nightcliff Stabbing Teen Arrested For Murder Of Shop Owner In Darwin

May 25, 2025 -

Boosting Collaboration Bangladeshs Strategic Return To Europe

May 25, 2025

Boosting Collaboration Bangladeshs Strategic Return To Europe

May 25, 2025 -

130 Years After Injustice Call To Promote Alfred Dreyfus In France

May 25, 2025

130 Years After Injustice Call To Promote Alfred Dreyfus In France

May 25, 2025

Latest Posts

-

Building Voice Assistants Made Easy Key Announcements From Open Ais 2024 Developer Conference

May 25, 2025

Building Voice Assistants Made Easy Key Announcements From Open Ais 2024 Developer Conference

May 25, 2025 -

T Mobile Data Breaches Result In 16 Million Fine After Three Year Investigation

May 25, 2025

T Mobile Data Breaches Result In 16 Million Fine After Three Year Investigation

May 25, 2025 -

Dogecoin Price Prediction The Impact Of Elon Musks Actions

May 25, 2025

Dogecoin Price Prediction The Impact Of Elon Musks Actions

May 25, 2025 -

The Elon Musk Dogecoin Relationship An Update

May 25, 2025

The Elon Musk Dogecoin Relationship An Update

May 25, 2025 -

The Rtx 5060 A Case Study In Graphics Card Review Transparency

May 25, 2025

The Rtx 5060 A Case Study In Graphics Card Review Transparency

May 25, 2025