Apple Stock Performance: Q2 Earnings Preview

Table of Contents

The Q2 earnings report is crucial for investors because it offers a snapshot of Apple's financial health and future prospects. This particular quarter is significant as it typically reflects the performance of the recently released iPhone models and the overall health of the consumer electronics market. The purpose of this article is to preview Apple's Q2 earnings and assess their potential impact on Apple stock performance.

Analyst Predictions and Expectations for Apple Stock Performance in Q2

Analysts and financial institutions have offered a range of predictions for Apple's Q2 performance, offering insights into potential Apple stock performance.

Revenue Projections

Revenue projections for Apple's Q2 vary, with estimates ranging from a modest increase to a more significant jump depending on the source. For example, Goldman Sachs projects X billion in revenue, while Morgan Stanley predicts Y billion. These variations reflect differing assessments of various factors:

- iPhone Sales: The success of the latest iPhone models will significantly impact overall revenue. Strong pre-orders and early sales suggest robust demand, but economic uncertainty could temper this.

- Services Revenue: Apple's services sector, encompassing the App Store, Apple Music, iCloud, and other subscription services, is expected to continue its growth trajectory.

- Wearables: Sales of Apple Watch, AirPods, and other wearables are anticipated to contribute positively to overall revenue, though the extent of this contribution remains subject to various economic factors.

While positive trends exist, downside risks include potential supply chain disruptions or weaker-than-expected consumer spending due to inflation.

Earnings Per Share (EPS) Estimates

The consensus EPS estimate from various analysts hovers around Z dollars per share. However, there is a range of predictions, highlighting the uncertainty inherent in forecasting.

- Cost of Goods Sold: Increases in component costs and manufacturing expenses could impact the EPS.

- Operating Expenses: Rising expenses related to research and development, marketing, and other operational activities could also put downward pressure on EPS.

Macroeconomic factors, such as inflation and interest rate hikes, could further influence EPS by affecting consumer spending and impacting Apple's overall profitability.

Key Factors Influencing Apple Stock Performance during Q2

Several key factors will significantly influence Apple's stock performance in Q2.

iPhone Sales and Demand

iPhone sales represent a major component of Apple's revenue. The anticipated sales figures for Q2 depend heavily on several variables:

- New iPhone Models/Updates: The introduction of new models or significant software updates can stimulate demand, while a lack of innovation could lead to softer sales.

- Competitor Activity: The actions of competitors, particularly in the Android market, will impact iPhone sales and the overall market share.

Analyzing sales figures against historical data and comparing them to competitor performance provides insights into the effectiveness of Apple's strategy.

Services Revenue Growth

Apple's services sector is a key driver of its long-term growth and profitability, and its performance in Q2 will significantly influence Apple stock performance.

- Growth Catalysts: New subscription services, expanding app store offerings, and increased user engagement are potential catalysts for growth.

- Challenges: Increasing competition, regulatory scrutiny, and potential shifts in user behavior pose challenges.

The strength and resilience of this revenue stream is an important indicator of Apple's overall future prospects.

Supply Chain and Production

Potential supply chain disruptions could significantly impact Apple's production capabilities and sales in Q2.

- Geopolitical Risks: Geopolitical tensions and trade conflicts could disrupt the supply chain.

- Manufacturing Challenges: Unexpected component shortages or manufacturing delays could also impact production levels.

Apple's ability to mitigate these risks is a crucial factor to consider when assessing its stock performance.

Potential Risks and Opportunities for Apple Stock

Several risks and opportunities could significantly affect Apple's stock in the coming months.

Macroeconomic Headwinds

Global macroeconomic conditions could present headwinds for Apple.

- Inflation and Interest Rates: High inflation and rising interest rates can reduce consumer spending and impact Apple's sales.

- Regulatory Risks: Government regulations and antitrust concerns could also negatively influence Apple's business.

Navigating these macroeconomic challenges successfully will be key to Apple's continued success.

Competitive Landscape

The competitive landscape will significantly impact Apple's market share and profitability.

- Key Competitors: Samsung, Google, and other tech companies are aggressively competing with Apple across various product categories.

- Competitive Advantages: Apple's brand strength, strong ecosystem, and innovative products are key competitive advantages, but maintaining its market leadership will require continued investment in R&D and effective marketing strategies.

Strategies for Investors Based on Q2 Apple Stock Performance

Investors should develop strategies based on their risk tolerance and expectations for Q2 results.

Investment Strategies

- Exceeding Expectations: If Apple surpasses expectations, investors may consider buying or holding the stock, potentially benefiting from price appreciation.

- Meeting Expectations: Meeting expectations might suggest a hold strategy or considering taking partial profits.

- Underperforming: If Apple underperforms, investors might consider selling or diversifying their portfolio to mitigate risks.

Diversification is crucial for mitigating risk in any investment portfolio.

Conclusion: Apple Stock Performance: Q2 Earnings and Beyond

Apple's Q2 earnings will provide valuable insights into the company's financial health and future prospects. Factors such as iPhone sales, services revenue growth, and macroeconomic conditions will significantly shape Apple stock performance. Investors should carefully monitor the earnings report and its impact on Apple's stock price. For a deeper understanding of the Apple Stock Outlook, stay updated on financial news and analyst reports. Closely monitoring Apple's Q2 earnings is crucial for informed investment decisions, ensuring you're positioned to navigate the dynamic world of Apple stock performance.

Featured Posts

-

Drapers Maiden Atp Masters 1000 Triumph In Indian Wells

May 25, 2025

Drapers Maiden Atp Masters 1000 Triumph In Indian Wells

May 25, 2025 -

Porsche Macan Buying Guide Models Specs And Price Comparison

May 25, 2025

Porsche Macan Buying Guide Models Specs And Price Comparison

May 25, 2025 -

Louisiana Inmates Hair Trimmer Escape Attempt New Orleans Jail Break

May 25, 2025

Louisiana Inmates Hair Trimmer Escape Attempt New Orleans Jail Break

May 25, 2025 -

Kyle Vs Teddi A Heated Confrontation Over Their Dog Walker

May 25, 2025

Kyle Vs Teddi A Heated Confrontation Over Their Dog Walker

May 25, 2025 -

Is An Escape To The Country Right For You A Checklist

May 25, 2025

Is An Escape To The Country Right For You A Checklist

May 25, 2025

Latest Posts

-

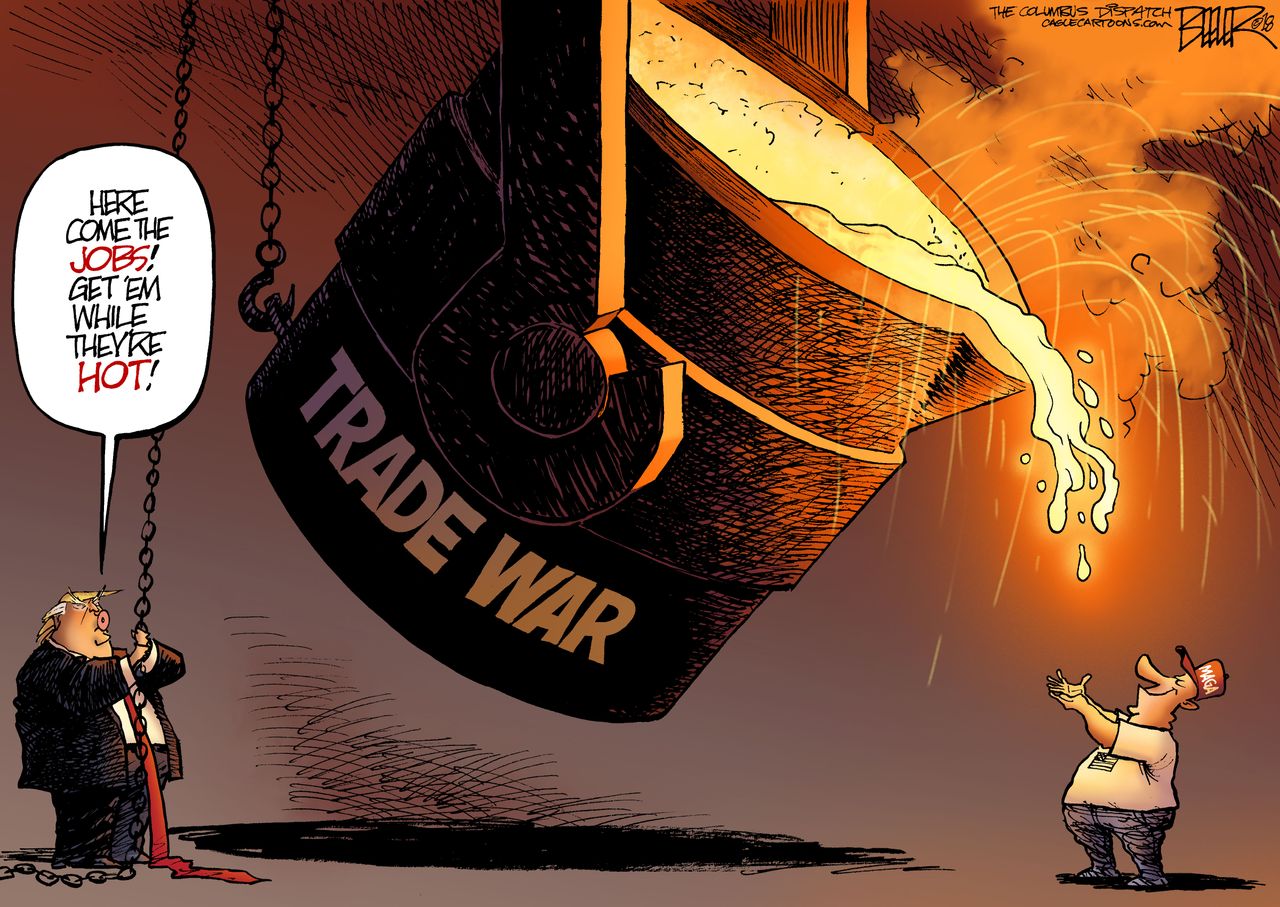

Why Did Trump Target Europe In His Trade Battles A Deep Dive

May 25, 2025

Why Did Trump Target Europe In His Trade Battles A Deep Dive

May 25, 2025 -

Trumps Trade War With Europe Understanding The Reasons Behind His Outrage

May 25, 2025

Trumps Trade War With Europe Understanding The Reasons Behind His Outrage

May 25, 2025 -

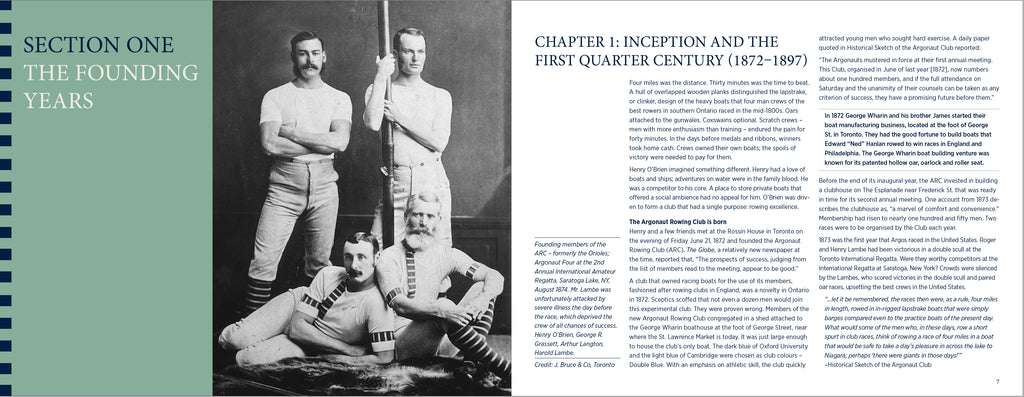

Rowing For A Sons Life One Fathers 2 2 Million Challenge

May 25, 2025

Rowing For A Sons Life One Fathers 2 2 Million Challenge

May 25, 2025 -

2 2 Million Treatment A Fathers Perseverance And Rowing Feat

May 25, 2025

2 2 Million Treatment A Fathers Perseverance And Rowing Feat

May 25, 2025 -

Fathers Desperate Row For Sons 2 2 Million Treatment An Inspiring Story

May 25, 2025

Fathers Desperate Row For Sons 2 2 Million Treatment An Inspiring Story

May 25, 2025