Apple Stock: Key Levels And Q2 Earnings Report

Table of Contents

Apple Q2 2024 Earnings Report: A Deep Dive

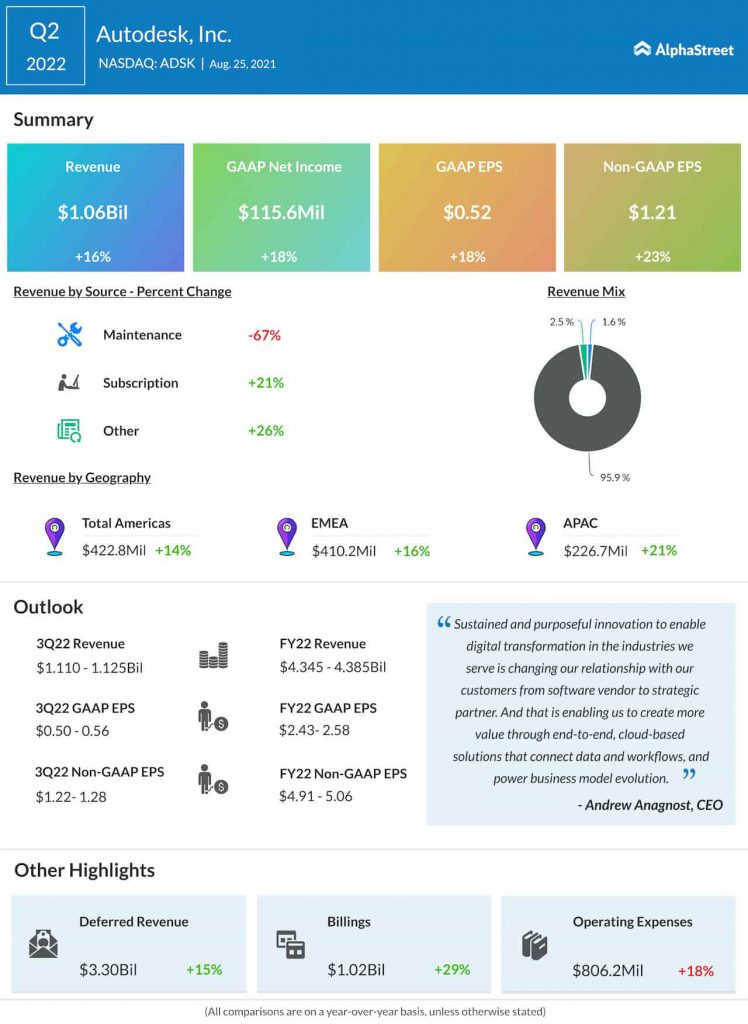

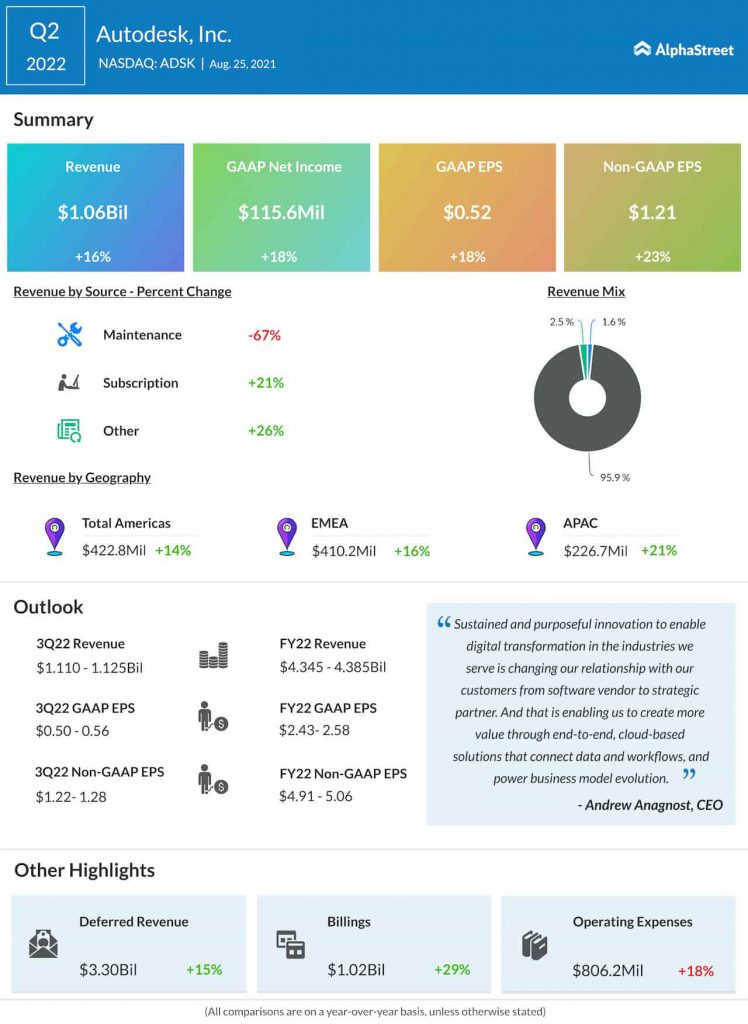

The Apple Q2 2024 earnings report provided a mixed bag for investors. While certain segments performed strongly, others faced headwinds. Let's examine the key financial figures:

-

Revenue: Apple reported [Insert Actual Revenue Figure] in Q2 2024, representing a [Insert Percentage Change - e.g., 5%] [Increase/Decrease] compared to the same period last year and a [Insert Percentage Change] compared to Q1 2024. This signifies [brief interpretation of revenue change - e.g., slower growth compared to previous years].

-

Earnings Per Share (EPS): The reported EPS was [Insert Actual EPS Figure], exceeding/falling short of analyst expectations of [Insert Analyst Expectation Figure] by [Insert Difference]. This shows [brief interpretation of EPS performance].

-

Key Performance Indicators (KPIs):

- iPhone Sales: [Insert Sales Figures and Percentage Change]. This suggests [brief interpretation of iPhone sales performance].

- Mac Sales: [Insert Sales Figures and Percentage Change]. This indicates [brief interpretation of Mac sales performance].

- Services Revenue: [Insert Sales Figures and Percentage Change]. Growth in this sector continues to be a key strength for Apple.

- Wearables, Home, and Accessories Revenue: [Insert Sales Figures and Percentage Change]. This segment shows [brief interpretation of Wearables revenue performance].

-

Management Commentary and Guidance: Apple's management commentary highlighted [Summarize key points from the earnings call – e.g., challenges in specific markets, expectations for future product launches, etc.]. Their guidance for the next quarter suggests [Summarize the guidance – e.g., cautious optimism, expectation of continued growth, etc.].

-

Key Takeaways:

- Revenue growth slowed compared to previous years.

- EPS beat/missed expectations.

- Services revenue remains a strong growth driver.

- [Insert other significant takeaways]

Key Support and Resistance Levels for Apple Stock

Technical analysis of the AAPL chart reveals crucial support and resistance levels that could influence the Apple stock price.

-

Recent Highs and Lows: The recent high was around [Insert Price] and the recent low was around [Insert Price].

-

Support and Resistance Levels: Based on chart patterns and historical data, key support levels are observed around [Insert Price Levels], while key resistance levels lie around [Insert Price Levels]. (Include a chart here if possible)

-

Potential Breakout Scenarios: A break above the [Insert Resistance Level] could signal further upside potential, potentially targeting [Insert Price Target]. Conversely, a break below the [Insert Support Level] could trigger a downward move towards [Insert Price Target].

-

Moving Averages: The 50-day moving average is currently at [Insert Price], while the 200-day moving average is at [Insert Price]. The relationship between these moving averages can provide additional insights into the short-term and long-term trends.

-

Potential Price Targets:

- Bullish Scenario: [Insert Price Target]

- Bearish Scenario: [Insert Price Target]

- Neutral Scenario: [Insert Price Target]

Impact of Macroeconomic Factors on Apple Stock

Macroeconomic factors significantly influence Apple stock valuation.

-

Inflation and Interest Rates: High inflation and rising interest rates can dampen consumer spending and impact Apple's sales, particularly in discretionary items.

-

Potential Recession: A potential recession could further reduce consumer spending and negatively impact Apple's stock price.

-

Global Economy: Geopolitical uncertainties and global economic slowdown can also affect Apple's international sales.

-

Market Sentiment: Overall market sentiment plays a crucial role. Negative market sentiment can lead to a sell-off in tech stocks, including Apple.

Apple Stock Forecast and Investment Strategies

Predicting the future of Apple stock is inherently challenging, but based on Q2 results and market analysis, several scenarios are possible.

-

Potential Scenarios:

- Bullish Scenario: Continued growth in services, strong product launches, and improved macroeconomic conditions could push Apple stock higher.

- Bearish Scenario: A prolonged economic downturn, increased competition, or supply chain disruptions could lead to lower stock prices.

- Neutral Scenario: A period of consolidation, with prices trading within a defined range.

-

Investment Strategies:

- Long-Term Investment: For long-term investors with a high risk tolerance, Apple stock could be a worthwhile addition to a diversified portfolio.

- Short-Term Trading: Short-term traders may focus on exploiting price fluctuations around support and resistance levels.

-

Disclaimer: Investing in the stock market involves significant risk, and investors could lose money. This analysis should not be considered financial advice.

-

Potential Investment Strategies Based on Risk Tolerance:

- Low Risk: Hold existing Apple stock or consider diversifying into other less volatile assets.

- Medium Risk: Buy Apple stock on dips near support levels.

- High Risk: Employ short-term trading strategies utilizing options or leveraged ETFs (with caution).

Conclusion

The Apple Q2 2024 earnings report presented a complex picture, with mixed signals for Apple stock. While certain segments performed well, others faced challenges. Analyzing key support and resistance levels, coupled with an understanding of macroeconomic factors, is crucial for navigating the market. Remember, before making any investment decisions regarding Apple stock or any other asset, conduct thorough research and consider your individual risk tolerance and investment goals. Stay informed about the latest developments in Apple stock and make well-informed decisions based on your own risk tolerance and investment goals.

Featured Posts

-

M56 Motorway Closure Live Traffic Updates Following Serious Crash

May 24, 2025

M56 Motorway Closure Live Traffic Updates Following Serious Crash

May 24, 2025 -

Mamma Mia A Closer Look At The New Ferrari Hot Wheels

May 24, 2025

Mamma Mia A Closer Look At The New Ferrari Hot Wheels

May 24, 2025 -

Escape To The Country Affordable Luxury Homes Under 1 Million

May 24, 2025

Escape To The Country Affordable Luxury Homes Under 1 Million

May 24, 2025 -

Florida Film Festival 2024 Celebrity Sightings Mia Farrow And Christina Ricci

May 24, 2025

Florida Film Festival 2024 Celebrity Sightings Mia Farrow And Christina Ricci

May 24, 2025 -

Maryland Softball Rallies From 4 Run Deficit To Beat Delaware 5 4

May 24, 2025

Maryland Softball Rallies From 4 Run Deficit To Beat Delaware 5 4

May 24, 2025

Latest Posts

-

The Impact Of Trump Era Funding Cuts On Us Museums

May 24, 2025

The Impact Of Trump Era Funding Cuts On Us Museums

May 24, 2025 -

Trumps Budget Cuts Threaten Museum Programs A Deep Dive

May 24, 2025

Trumps Budget Cuts Threaten Museum Programs A Deep Dive

May 24, 2025 -

Accessing Italian Citizenship The New Great Grandparent Clause

May 24, 2025

Accessing Italian Citizenship The New Great Grandparent Clause

May 24, 2025 -

Revised Italian Citizenship Law Great Grandparent Lineage And Eligibility

May 24, 2025

Revised Italian Citizenship Law Great Grandparent Lineage And Eligibility

May 24, 2025 -

Italian Citizenship New Rules For Claiming Through Great Grandparents

May 24, 2025

Italian Citizenship New Rules For Claiming Through Great Grandparents

May 24, 2025