Appeal Filed: FTC Challenges Microsoft's Activision Deal

Table of Contents

The FTC's Concerns Regarding Competition

The FTC's core argument centers on the potential for the Microsoft-Activision Blizzard merger to stifle competition across various gaming sectors: consoles, PC games, and, crucially, cloud gaming. The commission argues that Microsoft, already a major player in the industry with its Xbox console and Game Pass subscription service, acquiring Activision Blizzard – home to iconic franchises like Call of Duty, World of Warcraft, and Candy Crush Saga – would grant them an unfair competitive advantage. Call of Duty, in particular, is highlighted as a key area of concern due to its massive player base and consistent popularity across multiple platforms. The FTC fears that Microsoft could leverage its ownership of Call of Duty to exclude competitors, particularly Sony PlayStation, from accessing the game or making it significantly less attractive on rival platforms.

- Reduced competition among game publishers: The merger significantly reduces the number of major players in the game publishing market, potentially leading to less innovation and higher prices.

- Potential for higher game prices: With less competition, Microsoft could potentially increase the prices of Activision Blizzard games, directly impacting consumers.

- Less innovation in gaming technology: A lack of competition can stifle innovation as the merged entity may have less incentive to invest in new technologies or features.

- Harm to consumers through limited choice: Exclusive titles or limited availability on competing platforms would restrict consumer choice and limit their access to popular games.

Microsoft's Counterarguments and Defense Strategy

Microsoft has vigorously defended its acquisition, arguing that it would ultimately benefit gamers. The company has repeatedly pledged to keep Call of Duty available on PlayStation, emphasizing its commitment to maintaining the game's cross-platform availability. They've presented this commitment as a key element of their defense strategy, aiming to alleviate the FTC's concerns about anti-competitive behavior. Microsoft has also pointed to the competitive nature of the gaming market, arguing that the deal won't create a monopoly. They further contend that the merger will fuel innovation and bring more games to a wider audience through their Game Pass subscription service.

- Promises to maintain Call of Duty availability on PlayStation: This is a central point in Microsoft's defense, aimed at showing a commitment to fair competition.

- Arguments regarding the competitive landscape and market share: Microsoft argues that even with the acquisition, they will not dominate the market, citing the presence of strong competitors like Sony and Nintendo.

- Claims about the deal benefiting gamers through increased innovation: Microsoft contends that the combined resources will accelerate development and bring more innovative games to the market.

The Potential Outcomes and Implications

The FTC's challenge against the Microsoft-Activision Blizzard deal has several possible outcomes. The FTC could successfully block the merger entirely, forcing Microsoft to abandon its acquisition plans. Alternatively, a negotiated settlement might be reached, potentially involving Microsoft agreeing to certain concessions, such as extending Call of Duty's availability on competing platforms or other structural changes. Finally, the lawsuit could be dismissed, allowing the merger to proceed as planned. Each scenario has significant ramifications for Microsoft's gaming strategy, Activision Blizzard's future, and the wider gaming industry. This legal battle sets a critical precedent for future mergers and acquisitions in the tech sector, potentially influencing how regulators approach similar deals moving forward.

- Successful FTC lawsuit resulting in blocked merger: This would be a significant blow to Microsoft's gaming ambitions and could reshape its long-term strategy.

- Negotiated settlement with modifications: This outcome would likely involve compromises from both sides, potentially impacting the scope and benefits of the original acquisition.

- Dismissal of the lawsuit and merger completion: This would pave the way for Microsoft to integrate Activision Blizzard, potentially leading to significant changes in the gaming landscape.

- Impact on future mergers and acquisitions in the gaming industry: The outcome will heavily influence how future mergers and acquisitions in the gaming industry are assessed and regulated.

Legal Precedents and Similar Cases

The FTC's challenge against the Microsoft-Activision Blizzard merger isn't unprecedented. Several large tech mergers have faced similar regulatory scrutiny in recent years, offering relevant precedents. Examining the outcomes of these past cases – and the arguments made by both sides – provides valuable context for understanding the current situation. The legal precedent set by this case will shape future regulatory actions concerning large-scale mergers in the technology sector, particularly in the rapidly evolving gaming landscape.

Conclusion: The Future of the Microsoft-Activision Deal

The FTC's challenge to the Microsoft-Activision Blizzard deal highlights a fundamental tension between corporate ambition and regulatory oversight in the gaming industry. The central conflict revolves around the potential anti-competitive effects of the merger, specifically regarding the availability and pricing of key titles like Call of Duty. The outcome will have significant repercussions for gamers, impacting their access to games, prices, and the overall competitive landscape. This case holds immense significance for the future of the gaming industry, setting a precedent for future consolidation and highlighting the increasing importance of regulatory scrutiny in this rapidly evolving market. Stay informed about developments in the FTC Challenges Microsoft's Activision Deal case, the Microsoft Activision Merger, the FTC Activision Lawsuit, and the Activision Blizzard Acquisition by following further updates on this crucial legal battle.

Featured Posts

-

Blue Ivy And Rumi Carter A Super Bowl Sunday With Dad Jay Z

Apr 30, 2025

Blue Ivy And Rumi Carter A Super Bowl Sunday With Dad Jay Z

Apr 30, 2025 -

Minority Government Election Implications For The Canadian Dollar Exchange Rate

Apr 30, 2025

Minority Government Election Implications For The Canadian Dollar Exchange Rate

Apr 30, 2025 -

Lich Thi Dau Chinh Thuc Vong Chung Ket Giai Bong Da Thaco Cup 2025

Apr 30, 2025

Lich Thi Dau Chinh Thuc Vong Chung Ket Giai Bong Da Thaco Cup 2025

Apr 30, 2025 -

Garland Explodes For 32 As Cavs Edge Blazers In Overtime Thriller

Apr 30, 2025

Garland Explodes For 32 As Cavs Edge Blazers In Overtime Thriller

Apr 30, 2025 -

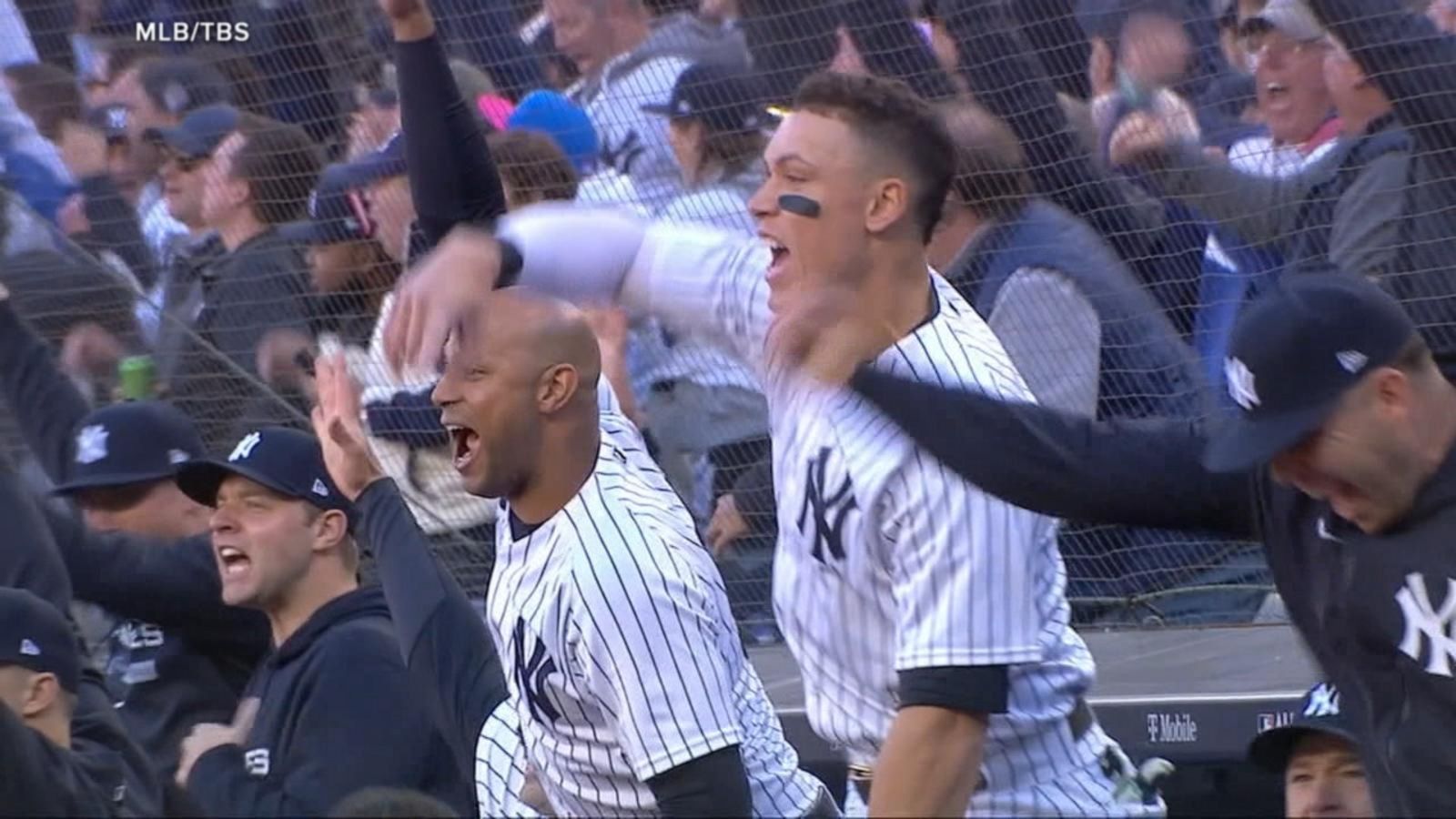

Rodons Strong Start Fuels Yankees Series Finale Win Against Guardians

Apr 30, 2025

Rodons Strong Start Fuels Yankees Series Finale Win Against Guardians

Apr 30, 2025