Andreessen Horowitz-Backed Omada Health Files For Initial Public Offering

Table of Contents

Omada Health's Business Model and Market Opportunity

Omada Health operates a comprehensive telehealth platform focused on virtual chronic disease management. Their programs primarily target individuals with conditions like type 2 diabetes and hypertension, providing remote monitoring, personalized coaching, and digital therapeutics. This approach addresses a critical need in healthcare: proactive, accessible, and affordable management of chronic conditions.

- Personalized Programs: Omada Health's programs utilize data-driven insights to create personalized care plans for each patient, enhancing engagement and improving outcomes.

- Remote Patient Monitoring: Continuous monitoring through connected devices allows for early intervention and adjustments to treatment plans, optimizing patient health.

- Digital Therapeutics: The platform incorporates evidence-based digital therapeutics, providing patients with tools and resources to actively manage their health.

The market opportunity for Omada Health is substantial. The global telehealth market is experiencing explosive growth, driven by an aging population, rising healthcare costs, and increasing demand for convenient and accessible care. The increasing prevalence of chronic diseases like diabetes and hypertension further fuels this demand. Omada Health’s virtual care platform is uniquely positioned to capitalize on this growing market, offering a scalable and cost-effective solution to traditional healthcare models. The potential for growth in this sector is immense, making the Omada Health IPO a particularly attractive proposition for investors.

Andreessen Horowitz's Investment and Influence

Andreessen Horowitz (a16z), a leading venture capital firm known for its investments in disruptive technology companies, has played a crucial role in Omada Health's journey. Their significant investment, spanning multiple funding rounds (including Series A and Series B funding), has provided Omada Health with the capital necessary to build and scale its platform. This substantial financial backing, coupled with a16z’s extensive network and expertise in the tech industry, has undoubtedly contributed significantly to Omada Health’s success and preparedness for this IPO.

- Strategic Guidance: Beyond financial investment, a16z likely provided Omada Health with valuable strategic guidance, helping to shape its business model and navigate the complexities of the healthcare market.

- Network Access: a16z's vast network of industry contacts has likely facilitated partnerships and collaborations for Omada Health, accelerating its growth.

- IPO Expertise: a16z's experience in guiding portfolio companies through the IPO process has been invaluable in Omada Health's preparation for this significant step.

The success of the Omada Health IPO is, in part, a testament to the effectiveness of venture capital investment in the digital health space. It showcases the potential for venture capital to foster innovation and support the growth of companies addressing significant healthcare challenges.

IPO Details and Financial Projections

While the precise details of Omada Health's IPO – such as the proposed share price and the expected proceeds – are subject to change and will be fully disclosed in the official SEC filing, early indications suggest a considerable valuation. The company's financial performance, as reflected in its revenue growth and trajectory towards profitability, will be key factors in determining the success of the IPO. Naturally, investors will carefully scrutinize the financial projections and associated risk factors before making investment decisions. The SEC filing will offer a detailed breakdown of these financial aspects, providing transparency to potential investors. Key elements to watch include:

- Revenue Growth: Analyzing the historical and projected revenue growth will be critical in assessing the company's long-term potential.

- Market Capitalization: The market capitalization upon listing will be a crucial indicator of investor confidence and the company's overall value.

- Risk Factors: The SEC filing will outline the inherent risks associated with the company and the IPO itself, offering crucial information for prospective investors.

Implications for the Telehealth Industry

Omada Health's successful IPO will undoubtedly have significant implications for the broader telehealth industry. It validates the growing market demand for virtual care solutions and could encourage further investment in the sector. This success story may inspire other telehealth companies to pursue similar paths, potentially leading to increased competition and innovation within the industry.

- Increased Investment: The successful IPO could stimulate further investment in telehealth startups and encourage the development of innovative digital health solutions.

- Market Consolidation: The IPO may also lead to increased market consolidation, with larger players acquiring smaller companies to expand their reach and capabilities.

- Industry Maturity: Omada Health’s IPO signifies a maturing telehealth industry, transitioning from an early-stage market to one with established players and robust investment opportunities.

The long-term effects of Omada Health's public offering on the telehealth landscape remain to be seen, but it's poised to be a significant catalyst for growth and innovation in the years to come.

Conclusion: The Future of Omada Health and the Telehealth IPO Market

Omada Health's journey to its Initial Public Offering is a compelling example of how technology and venture capital can revolutionize healthcare delivery. The success of their virtual chronic disease management platform demonstrates the significant market opportunity within the rapidly expanding telehealth sector. Andreessen Horowitz's substantial investment and strategic guidance have been instrumental in Omada Health's growth, highlighting the critical role of venture capital in fostering innovation. This IPO is not just a landmark event for Omada Health but also a significant indicator of the continued maturation and investment potential within the telehealth industry. To stay updated on Omada Health's public offering and the latest developments in the dynamic telehealth landscape, keep an eye on financial news outlets and official company announcements. Follow Omada Health's IPO news closely for further insights into this transformative moment for digital health.

Featured Posts

-

Former Becker Sentencing Judge Heads Nottingham Attack Investigation

May 10, 2025

Former Becker Sentencing Judge Heads Nottingham Attack Investigation

May 10, 2025 -

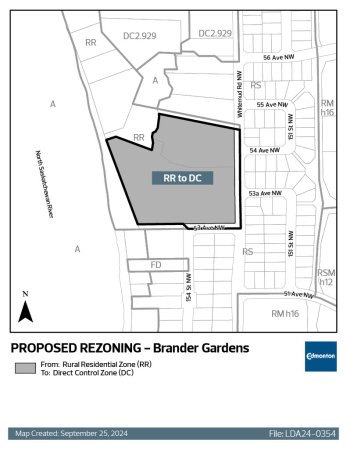

Council Approves Rezoning Edmonton Nordic Spa Closer To Construction

May 10, 2025

Council Approves Rezoning Edmonton Nordic Spa Closer To Construction

May 10, 2025 -

X Blocks Jailed Turkish Mayors Facebook Page Opposition Protests Trigger Action

May 10, 2025

X Blocks Jailed Turkish Mayors Facebook Page Opposition Protests Trigger Action

May 10, 2025 -

Trump Announces New Trade Agreement With The United Kingdom

May 10, 2025

Trump Announces New Trade Agreement With The United Kingdom

May 10, 2025 -

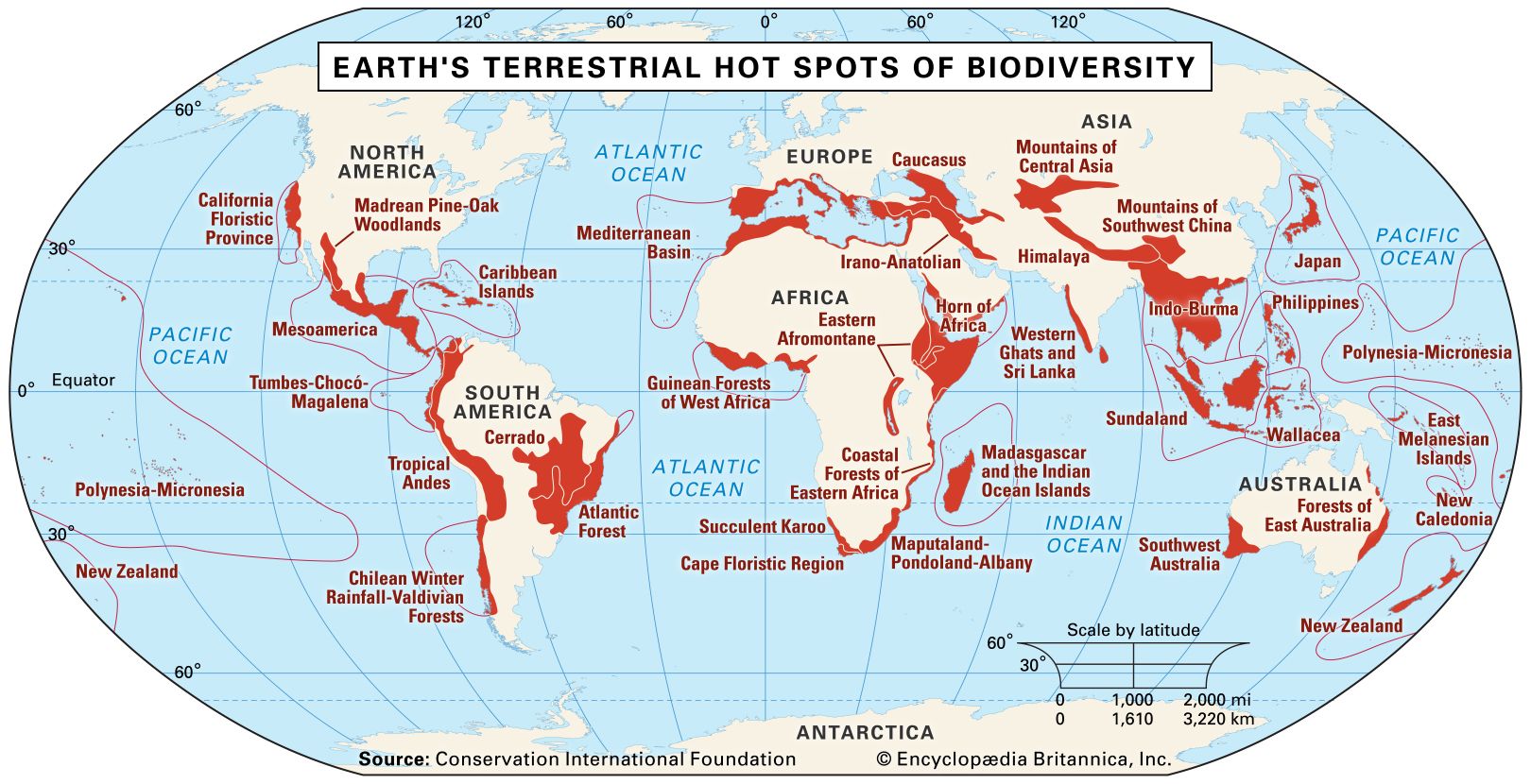

Where To Start Your Business A Map Of The Countrys Hot Spots

May 10, 2025

Where To Start Your Business A Map Of The Countrys Hot Spots

May 10, 2025