Analyzing VusionGroup's AMF CP Document (2025E1029754)

Table of Contents

Key Financial Highlights from VusionGroup's AMF CP Filing (2025E1029754)

This section delves into the core financial data presented in the VusionGroup AMF report (2025E1029754). A thorough understanding of these figures is critical for assessing the company's financial performance and stability.

Revenue Analysis:

The VusionGroup AMF filing reveals [insert specific data from the filing, e.g., a 15% year-over-year revenue growth]. Key revenue streams include [list key revenue streams, e.g., software licensing, subscription services, consulting].

- Year-over-year growth: [Insert percentage and comment on its significance].

- Segment performance: [Discuss performance of different segments, highlighting strengths and weaknesses].

- Geographical breakdown of revenue: [Analyze revenue distribution across different geographical regions].

These data points provide a detailed picture of VusionGroup's revenue generation capabilities and its growth trajectory, offering crucial insights for investors considering the VusionGroup revenue stream and overall financial performance.

Profitability and Margins:

Analyzing VusionGroup's profitability requires examining its gross profit, operating profit, and net profit margins. The AMF report indicates [insert specific data, e.g., a gross margin of 60%, slightly down from the previous year].

- Gross margin trends: [Analyze trends and explain contributing factors].

- Operating expenses: [Discuss key operating expenses and their impact on profitability].

- Net income analysis: [Analyze net income figures and their implications for VusionGroup's financial health].

This analysis of VusionGroup profitability, combined with the margin analysis provided in the AMF financial statements, allows for a more complete understanding of its financial standing.

Balance Sheet Overview:

A review of VusionGroup's balance sheet, as presented in the AMF filing (2025E1029754), provides crucial insights into its financial health and stability. Key aspects to consider include liquidity, leverage, and capital structure.

- Liquidity ratios: [Analyze liquidity ratios like current ratio and quick ratio].

- Leverage ratios: [Analyze leverage ratios like debt-to-equity ratio and debt-to-asset ratio].

- Capital structure: [Discuss the composition of VusionGroup's capital structure, highlighting equity and debt].

Understanding these metrics, provided in the VusionGroup balance sheet within the AMF filing analysis, is crucial for evaluating the company's long-term financial sustainability.

VusionGroup's Strategic Initiatives and Outlook as Revealed in the AMF CP Document (2025E1029754)

This section examines VusionGroup's strategic plans and outlook as detailed in the AMF CP document (2025E1029754). This understanding is vital for investors to assess the company's future prospects.

Growth Strategies:

VusionGroup's AMF filing highlights several key growth strategies, including [mention specific strategies found in the filing, e.g., expansion into new markets, development of new product lines].

- Mergers and acquisitions: [Discuss any potential M&A activity mentioned in the filing].

- Research and development investments: [Analyze the company's investment in R&D and its potential impact on future growth].

- New market penetration: [Discuss the company's plans to enter new markets and the potential challenges and opportunities involved].

These growth strategies, detailed within the VusionGroup growth strategy section of the AMF CP document insights, will likely drive future performance and shape the company's competitive position.

Risk Factors and Mitigation Strategies:

The AMF CP document identifies several risk factors that could impact VusionGroup's performance. These include [mention specific risks, e.g., competition, regulatory changes, economic downturns].

- Competitive landscape: [Discuss the competitive intensity in VusionGroup's industry].

- Regulatory risks: [Analyze the regulatory risks and their potential impact on the company].

- Financial risks: [Discuss potential financial risks, such as currency fluctuations or interest rate changes].

- Operational risks: [Analyze operational risks, such as supply chain disruptions].

Understanding these risks and VusionGroup's risk management strategies, as outlined in the AMF regulatory compliance section, is crucial for a thorough assessment of the company.

Management Discussion and Analysis:

The management discussion and analysis (MD&A) section of the AMF document provides valuable insights into VusionGroup's performance and future outlook. Key aspects discussed include [mention key points from the MD&A].

- Management's outlook: [Summarize management's perspective on the company's future].

- Key performance indicators (KPIs): [Discuss the key KPIs used by management to track performance].

- Future investment plans: [Analyze the company's plans for future investments].

This section, providing the VusionGroup management commentary and future outlook, offers critical insights into the company's strategic direction and priorities.

Regulatory Compliance and Implications of VusionGroup's AMF CP Document (2025E1029754)

This section examines VusionGroup's compliance with AMF regulations and potential legal or regulatory implications.

AMF Reporting Requirements:

VusionGroup's AMF CP filing adheres to specific reporting requirements outlined by the Autorité des marchés financiers (AMF). These requirements include [list specific regulations].

- Specific regulations covered: [Detail the specific regulations addressed in the filing].

- Compliance standards: [Explain how VusionGroup meets the AMF's compliance standards].

- Potential penalties for non-compliance: [Highlight the potential consequences of non-compliance with AMF regulations].

Understanding the AMF regulations and VusionGroup filing compliance is critical for assessing the company's adherence to legal and regulatory frameworks.

Potential Legal and Regulatory Implications:

The information disclosed in the AMF CP document may have several legal and regulatory implications for VusionGroup. These include [mention potential implications].

- Potential legal challenges: [Discuss any potential legal challenges facing the company].

- Future regulatory scrutiny: [Analyze the potential for future regulatory scrutiny].

- Investor relations considerations: [Discuss implications for investor relations and communication].

This analysis of VusionGroup legal implications and regulatory risks, as discussed in relation to AMF oversight, provides a comprehensive picture of the regulatory landscape surrounding the company.

Conclusion: Understanding the Insights from VusionGroup's AMF CP Document (2025E1029754)

Analyzing VusionGroup's AMF CP document (2025E1029754) reveals key insights into its financial performance, strategic direction, and regulatory compliance. The financial highlights demonstrate [summarize key financial findings]. The strategic initiatives showcase [summarize key strategic plans], while the regulatory compliance section underlines [summarize key compliance aspects]. Understanding these aspects is crucial for investors and stakeholders to make informed decisions. To stay updated on VusionGroup's performance and regulatory compliance, regularly review their VusionGroup AMF filings and other relevant documents available on the AMF website and VusionGroup's investor relations page. Staying informed about future VusionGroup AMF filings is essential for a thorough understanding of the company’s trajectory.

Featured Posts

-

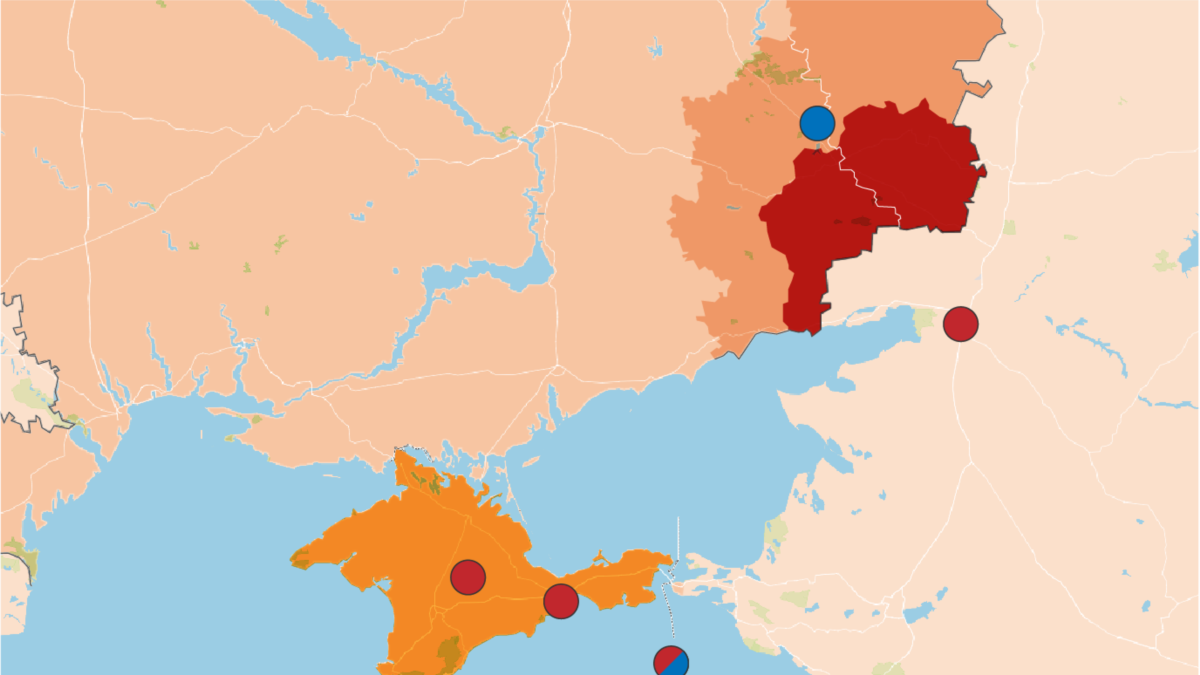

Military Buildup In Europe A Consequence Of Russias Actions

Apr 30, 2025

Military Buildup In Europe A Consequence Of Russias Actions

Apr 30, 2025 -

Cruises Com Launches Innovative Points Based Rewards Program

Apr 30, 2025

Cruises Com Launches Innovative Points Based Rewards Program

Apr 30, 2025 -

Gas Explosion In Yate Bristol Three People Injured

Apr 30, 2025

Gas Explosion In Yate Bristol Three People Injured

Apr 30, 2025 -

Vorombe Zhizn I Vymiranie Rekordsmenov Po Vesu Sredi Ptits

Apr 30, 2025

Vorombe Zhizn I Vymiranie Rekordsmenov Po Vesu Sredi Ptits

Apr 30, 2025 -

The X Files Ryan Coogler On Discussions With Gillian Anderson For A Reboot

Apr 30, 2025

The X Files Ryan Coogler On Discussions With Gillian Anderson For A Reboot

Apr 30, 2025