Analyzing Uber's (UBER) Financial Performance For Investment Decisions

Table of Contents

Main Points:

2.1. Revenue Streams and Growth Analysis:

Understanding Uber's Diverse Revenue Sources:

Uber's revenue isn't just about rides. The company boasts a diversified revenue model, generating income from various segments:

- Rides: This remains a significant portion of Uber's revenue, although the relative contribution fluctuates based on economic conditions and competition.

- Uber Eats: The food delivery service has become a substantial revenue driver, experiencing significant growth in recent years.

- Freight: Uber Freight connects shippers with carriers, providing a less volatile revenue stream compared to ride-sharing.

- Other Bets: This includes smaller revenue streams from various initiatives such as advertising and subscription services.

Analyzing the percentage contribution of each segment provides valuable insights into Uber's business model diversification and resilience. Year-over-year growth comparison reveals the dynamic nature of these revenue streams and the company's ability to adapt to market changes. Seasonal variations, such as increased demand during holidays or decreased usage during economic downturns, are also important to consider in a thorough Uber investment assessment.

Analyzing Revenue Growth Trends:

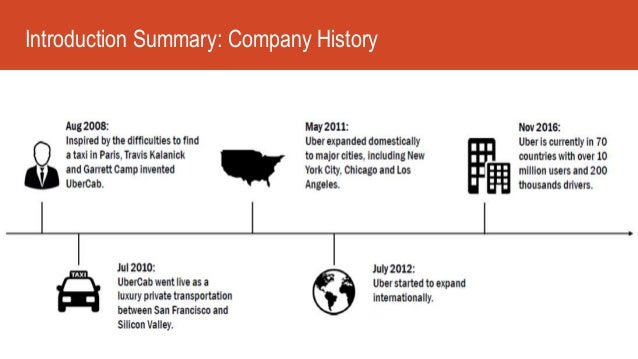

Examining Uber's historical revenue growth reveals its trajectory. While initial growth was explosive, sustained high-growth rates become increasingly difficult to maintain for large companies. Key drivers of growth have included expansion into new markets, strategic acquisitions, and the introduction of new services like Uber Eats. Headwinds include increasing competition, regulatory challenges, and economic fluctuations.

- Charts illustrating revenue growth: Analyzing visual representations of Uber's revenue growth over time offers a clear picture of its performance. Look for consistent upward trends, periods of acceleration or deceleration, and any significant deviations.

- Market share and competitive landscape: Uber’s market share in its various segments, especially in comparison to competitors like Lyft and DoorDash, provides an important metric. The competitive landscape, and Uber’s ability to innovate and maintain market share, is a key indicator for future revenue projections.

- Impact of economic factors: Macroeconomic conditions significantly influence Uber's revenue. Recessions can lead to lower ride-sharing and food delivery demand, impacting revenue. Conversely, economic booms may drive increased demand.

2.2. Cost Structure and Profitability:

Deconstructing Uber's Operating Expenses:

A significant portion of Uber's expenses relates to driver payments, reflecting the labor-intensive nature of its core business. Other major expense categories include:

- Marketing and Sales: Attracting new users and maintaining market share requires significant marketing investments.

- Research and Development: Continuous innovation in technology and services is vital for Uber's long-term success.

- General and Administrative Expenses: This encompasses a wide range of costs associated with running the company.

Analyzing the percentage breakdown of these operating expenses reveals areas where Uber can improve efficiency and profitability. Comparing Uber's expense structure to competitors' sheds light on its cost competitiveness and potential for cost-cutting measures.

Evaluating Profitability Metrics:

Understanding Uber's profitability requires analyzing several key metrics:

- Gross profit margin: This indicates the profitability of Uber's core operations before deducting operating expenses.

- Operating income: This reflects Uber's profitability after accounting for operating expenses.

- Net income: This represents the company's overall profitability after all expenses, including taxes and interest, are deducted.

Tracking these metrics over time, and comparing them to industry benchmarks, provides a crucial assessment of Uber's financial health. Identifying the drivers of profitability, like successful new services or cost-cutting initiatives, and understanding the challenges, like increasing competition or regulatory hurdles, are vital for investment decision making.

2.3. Debt and Financial Leverage:

Assessing Uber's Debt Levels:

Understanding Uber's debt levels is critical for assessing its financial risk. Key metrics to analyze include:

- Debt-to-equity ratio: This indicates the proportion of Uber's financing that comes from debt compared to equity. A high ratio suggests higher financial risk.

- Long-term debt: This represents debt with maturities exceeding one year.

- Short-term debt: This represents debt with maturities of less than one year, requiring frequent refinancing.

Analyzing these ratios over time and comparing them to industry averages helps determine if Uber's debt levels are sustainable and manageable. Analyzing its debt servicing capabilities helps assess the company’s ability to meet its debt obligations.

Understanding Uber's Capital Structure:

Uber's capital structure—the mix of debt and equity financing—affects its financial risk and growth potential. Analyzing the balance between equity financing (from investors) and debt financing provides insights into the company's financial strategy and its impact on its future:

- Equity financing: Provides capital without the burden of debt repayment but dilutes ownership.

- Debt financing: Provides capital but requires interest payments and can increase financial risk.

Understanding the implications of Uber’s capital structure on financial risk is essential for making informed investment decisions.

2.4. Future Outlook and Investment Implications:

Predicting Future Financial Performance:

Predicting Uber's future financial performance involves considering several factors:

- Growth in existing markets: Continued growth in ride-sharing and food delivery in established markets.

- Expansion into new markets: Opportunities to expand into new geographical areas or service offerings.

- Technological innovation: Developing new technologies and services to maintain a competitive edge.

- Regulatory changes: The impact of evolving regulations on Uber's operations.

These factors will affect future revenue growth, profitability improvement, and overall financial health. Growth projections and forecasts, coupled with sensitivity analysis of key assumptions (e.g., changes in fuel prices, driver compensation, or competition), provide a more nuanced perspective on the company's future.

Making Informed Investment Decisions:

Based on the analysis, investors can make a more informed decision:

- Buy, sell, or hold recommendations: The overall assessment of Uber's financial health will dictate the investment recommendation.

- Risk assessment and mitigation strategies: Identify potential risks (e.g., increased competition, regulatory changes, economic downturns) and outline strategies to mitigate those risks.

- Diversification strategies: Investors should consider diversifying their portfolio to reduce reliance on a single stock, especially in a volatile sector like technology.

Conclusion: Making Sound Investment Decisions with Uber (UBER) Financial Analysis

This analysis highlights the importance of a thorough understanding of Uber's financial position before investing. While Uber boasts a diversified revenue model and significant market presence, challenges remain in terms of profitability and managing its debt levels. Remember, investing in Uber stock or any company requires conducting your own in-depth UBER financial analysis. Utilize resources like SEC filings, financial news websites, and analyst reports to supplement your understanding. By carefully considering the strengths and weaknesses revealed through a comprehensive analysis, you can make informed investment decisions and potentially maximize your return while minimizing risk in the dynamic world of ride-sharing investment and tech stock analysis.

Featured Posts

-

Novak Djokovic Kortlarda Zirvenin Yenilmez Krali

May 17, 2025

Novak Djokovic Kortlarda Zirvenin Yenilmez Krali

May 17, 2025 -

Choosing The Right Bitcoin And Crypto Casino In 2025

May 17, 2025

Choosing The Right Bitcoin And Crypto Casino In 2025

May 17, 2025 -

How The Ultra Wealthy Are Weathering Market Storms Through Luxury Real Estate Investments

May 17, 2025

How The Ultra Wealthy Are Weathering Market Storms Through Luxury Real Estate Investments

May 17, 2025 -

Ai Powered Podcast Creation Digesting Repetitive Scatological Documents For Engaging Content

May 17, 2025

Ai Powered Podcast Creation Digesting Repetitive Scatological Documents For Engaging Content

May 17, 2025 -

Trumps Student Loan Privatization Plan What It Could Mean For Borrowers

May 17, 2025

Trumps Student Loan Privatization Plan What It Could Mean For Borrowers

May 17, 2025

Latest Posts

-

Update Valerio Therapeutics S A And The Approval Of Its Financial Statements

May 17, 2025

Update Valerio Therapeutics S A And The Approval Of Its Financial Statements

May 17, 2025 -

Valerio Therapeutics 2024 Financial Report Publication Delayed

May 17, 2025

Valerio Therapeutics 2024 Financial Report Publication Delayed

May 17, 2025 -

Analyzing The Knicks Overtime Loss What Went Wrong

May 17, 2025

Analyzing The Knicks Overtime Loss What Went Wrong

May 17, 2025 -

Knicks Overtime Heartbreak A Close Call

May 17, 2025

Knicks Overtime Heartbreak A Close Call

May 17, 2025 -

Rockwell Automation Angi And Borg Warner Among Top Performers Market Update

May 17, 2025

Rockwell Automation Angi And Borg Warner Among Top Performers Market Update

May 17, 2025