Analyzing Trump's Backing Of The Nippon Steel Deal

Table of Contents

The Nippon Steel Deal: A Summary of the Merger

The merger between Nippon Steel Corporation and Sumitomo Metal Industries, finalized in 2012, created the world's second-largest steelmaker, Nippon Steel & Sumitomo Metal Corporation (NSSMC). This consolidation significantly reshaped the global steel market.

- Key Players: Nippon Steel Corporation, Sumitomo Metal Industries, various international investors and stakeholders.

- Size and Scope: The merger involved the combination of two industry giants, impacting global steel production, distribution, and pricing.

- Industries Affected: The steel industry globally, with downstream effects on automotive, construction, and manufacturing sectors. The deal also had ramifications for related industries reliant on steel production. The impact on the US steel industry was particularly noteworthy, given its dependence on global steel markets.

Trump's Rationale for Supporting the Deal:

While Trump's administration didn't directly initiate the Nippon Steel merger (it predated his presidency), his stance towards it reflected broader trade and economic policies. His support arguably stemmed from a desire to strengthen US national security and boost domestic economic growth through protectionist measures.

- Stated Reasons: Trump's administration likely viewed the consolidation of global steel production as needing a strong response to ensure competitive pricing in the US and protect domestic jobs. Public pronouncements focused on the importance of a strong domestic steel industry for national security.

- Analyses of Public Pronouncements: While Trump didn't explicitly endorse the Nippon Steel merger in the same way he championed certain other deals, his overall trade policy favored strengthening domestic industries, even if it meant dealing with larger, consolidated foreign competitors.

- Supporting Evidence: His administration’s actions, such as imposing tariffs on steel imports, suggest an underlying policy of supporting strong, consolidated entities, even those foreign-based, that could compete effectively with China and other global powers.

Economic Impact of the Nippon Steel Deal:

The economic consequences of the Nippon Steel merger, especially concerning its interaction with Trump's policies, are complex and multifaceted.

- Job Creation/Loss: While the merger itself didn't directly result in significant job losses in the US, its impact on steel pricing and global competition could have indirectly affected the US job market. Trump's protectionist policies aimed to mitigate potential negative effects.

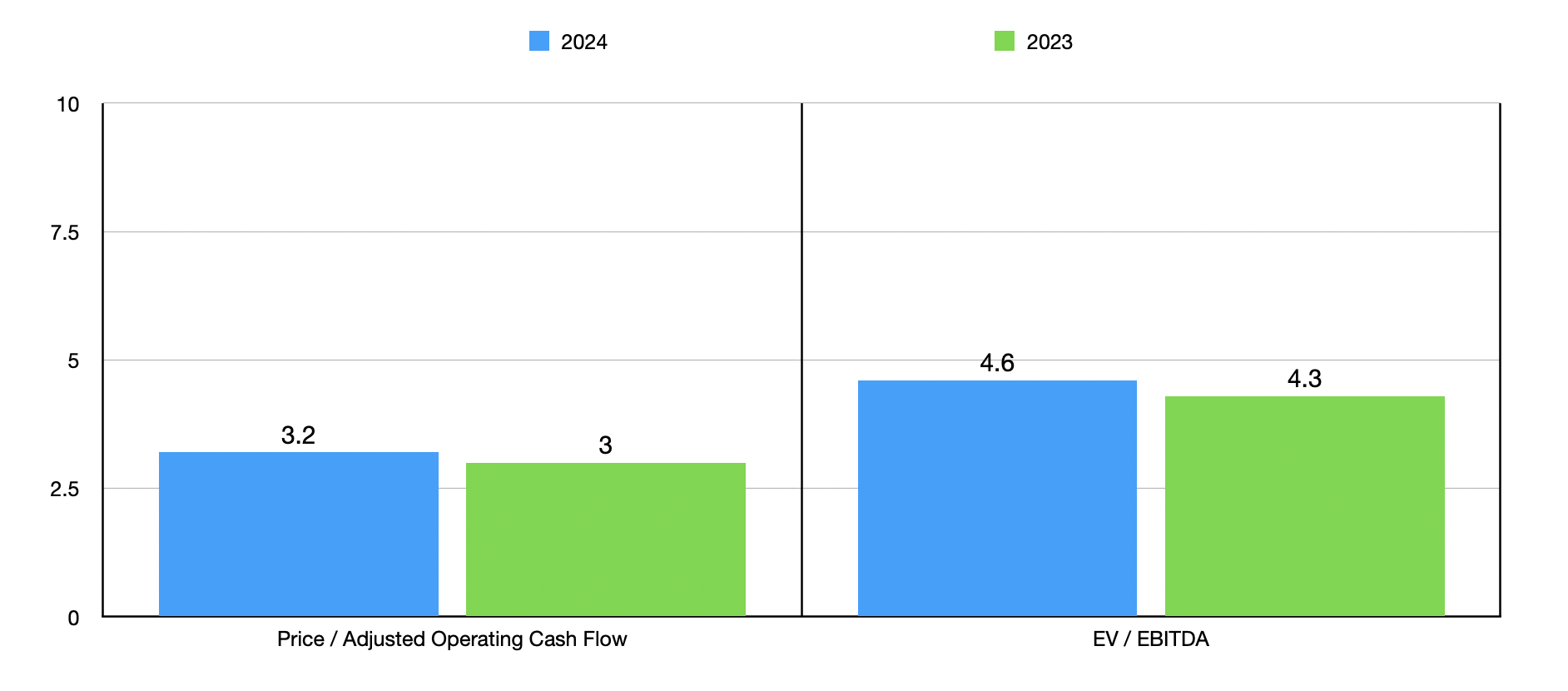

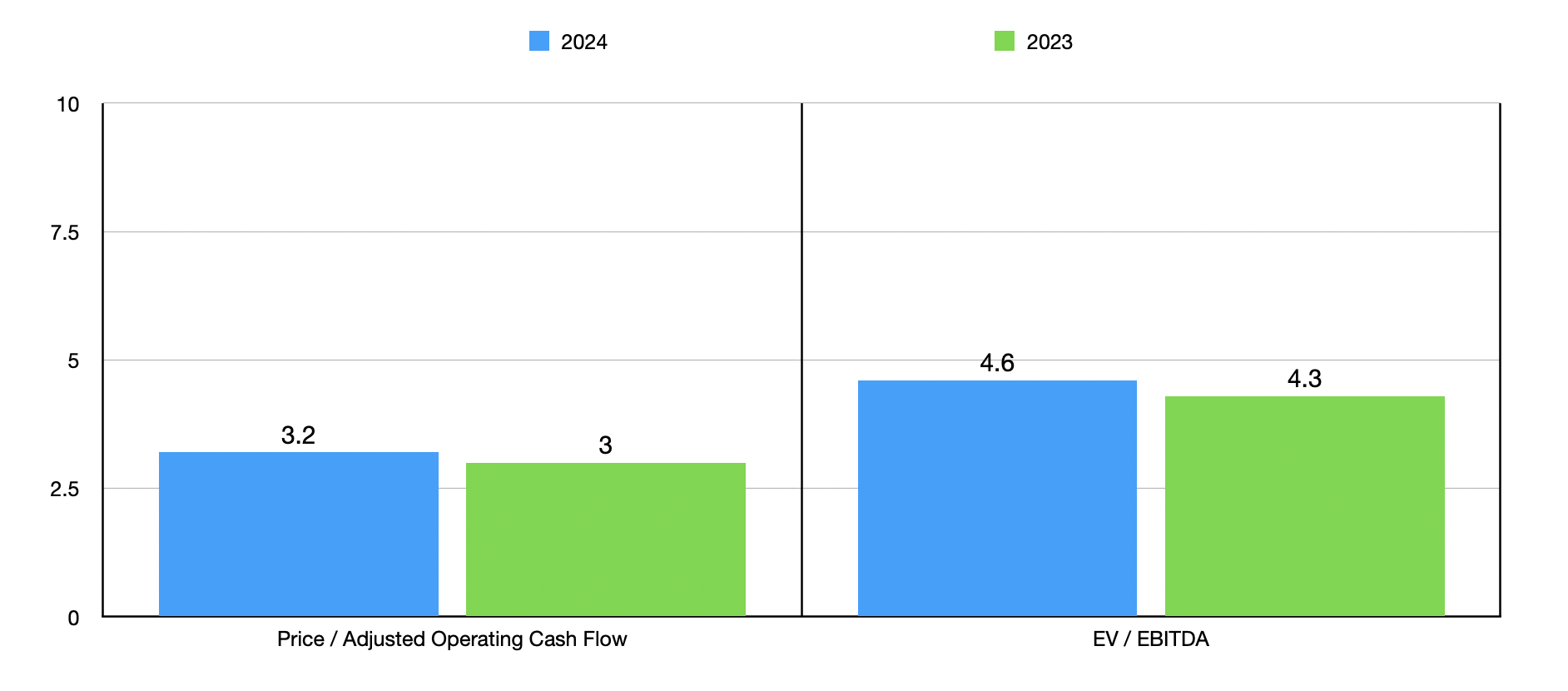

- Impact on Steel Prices: The consolidation of market share could have led to both price increases and potential efficiencies in production. The net impact on US steel prices remained a point of contention.

- Changes in Market Share: The merger significantly altered global market share, creating a larger competitor to US steel producers. This influenced future trade negotiations and agreements.

- Effects on Related Industries: Industries using steel as a raw material, such as automotive and construction, experienced indirect impacts due to price fluctuations and supply chain changes.

The Deal's Impact on US-Japan Trade Relations:

The Nippon Steel merger's impact on US-Japan relations is subtle but noteworthy. Trump's overall trade policy toward Japan, which involved both cooperation and conflict, was influenced by this broader context.

- Changes in Trade Balances: The merger could have indirectly affected trade balances between the US and Japan, though it's challenging to isolate this impact from other factors.

- Impact on Future Trade Negotiations: The existence of a larger, more consolidated Japanese steel producer influenced the power dynamics during subsequent bilateral trade discussions.

- Implications for Other Bilateral Agreements: The merger highlights broader concerns about global industry consolidation and its influence on international trade negotiations and agreements.

Criticisms and Controversy Surrounding the Deal:

Trump's approach towards the Nippon Steel merger wasn't without critics. Concerns focused on potential monopolies, decreased competition, and job displacement.

- Arguments Against the Merger: Critics argued that increased consolidation in the steel industry could lead to higher prices and reduced innovation. The lack of direct US involvement in preventing the merger was a major point of contention.

- Critiques from Opposing Political Parties: The Democratic Party, in particular, criticized Trump's broader trade policies, viewing them as protectionist and potentially detrimental to the long-term competitiveness of the US economy.

- Concerns from Industry Experts: Industry analysts expressed concerns about reduced competition and the potential for anti-competitive practices by the newly formed entity, which could result in price fixing and negatively impact consumers.

Conclusion:

Analyzing Trump's position on the Nippon Steel merger reveals the complexities of his trade strategy and its impact on the US steel industry, US-Japan relations, and global trade dynamics. While Trump's policies aimed to protect domestic industries, the implications of allowing large foreign mergers to proceed remain a subject of debate. The economic consequences were multi-faceted, ranging from potential job losses to shifts in global market share. Criticisms highlight concerns about reduced competition and monopolistic tendencies.

Further analysis of Trump's backing of the Nippon Steel deal is crucial to understanding the intricacies of his trade strategy and its lasting impact. We encourage you to research other related mergers and trade policies to form your own informed opinion. Share your thoughts and insights on Trump's economic policies and their effects on the Nippon Steel deal and similar mergers in the comments below. Understanding the complexities of global trade, particularly concerning major mergers like this one, is vital to navigating the future of the steel industry and broader international relations.

Featured Posts

-

Tracker Season 3 Premiere Date Episode Guide And What To Expect

May 27, 2025

Tracker Season 3 Premiere Date Episode Guide And What To Expect

May 27, 2025 -

Tracker Season 2 Episode 15 The Grey Goose Preview

May 27, 2025

Tracker Season 2 Episode 15 The Grey Goose Preview

May 27, 2025 -

Berkane Vs Constantine Calendrier Complet Coupe De La Caf

May 27, 2025

Berkane Vs Constantine Calendrier Complet Coupe De La Caf

May 27, 2025 -

20 Maggio Almanacco Eventi Storici Compleanni E Proverbio

May 27, 2025

20 Maggio Almanacco Eventi Storici Compleanni E Proverbio

May 27, 2025 -

Eisvoli Liston Se Katoikia Sti Xalkidiki Leptomereies Gia Tin Egklimatiki Energeia

May 27, 2025

Eisvoli Liston Se Katoikia Sti Xalkidiki Leptomereies Gia Tin Egklimatiki Energeia

May 27, 2025

Latest Posts

-

El Odio Y La Admiracion Un Tenista Argentino Y La Leyenda De Rios

May 30, 2025

El Odio Y La Admiracion Un Tenista Argentino Y La Leyenda De Rios

May 30, 2025 -

Marcelo Rios El Dios Del Tenis Segun Un Rival Argentino

May 30, 2025

Marcelo Rios El Dios Del Tenis Segun Un Rival Argentino

May 30, 2025 -

De La Raqueta A La El Sorprendente Regreso De Andre Agassi Al Deporte

May 30, 2025

De La Raqueta A La El Sorprendente Regreso De Andre Agassi Al Deporte

May 30, 2025 -

So Spielen Steffi Graf Und Andre Agassi Erfolgreich Pickleball

May 30, 2025

So Spielen Steffi Graf Und Andre Agassi Erfolgreich Pickleball

May 30, 2025 -

Un Tenista Argentino Reconoce La Grandeza De Rios A Pesar De Su Odio

May 30, 2025

Un Tenista Argentino Reconoce La Grandeza De Rios A Pesar De Su Odio

May 30, 2025