Analyzing The U.S. Dollar: A Troubling Parallel To The Nixon Presidency

Table of Contents

Inflationary Pressures: Then and Now

The 1960s Inflationary Spiral:

The decade leading up to Nixon's shock decision saw a significant inflationary spiral in the United States. Several factors contributed to this economic instability. The costly Vietnam War fueled massive government deficits, leading to increased money supply and upward pressure on prices. Expansionary monetary policies, intended to stimulate economic growth, inadvertently exacerbated the problem. Rising oil prices further fueled inflation, impacting the purchasing power of the dollar significantly.

- Increased military spending: The Vietnam War placed immense strain on the U.S. budget.

- Expansionary monetary policy: The Federal Reserve's actions, while aiming for growth, contributed to inflation.

- Rising oil prices: The increasing cost of oil impacted various sectors of the economy.

By 1970, inflation had reached a rate exceeding 5%, eroding the value of the U.S. dollar and impacting American households.

Modern Inflationary Challenges:

Today, the U.S. faces another period of significant inflation. While the causes differ slightly, the consequences are strikingly similar. Supply chain disruptions caused by the COVID-19 pandemic and the war in Ukraine have led to shortages and increased prices for goods and services. The energy crisis, driven by geopolitical instability and reduced supply, has further amplified inflationary pressures. Government stimulus packages, while intended to alleviate economic hardship, have also been cited as a contributing factor.

- Supply chain bottlenecks: Global disruptions have constricted the flow of goods.

- Increased energy costs: The price of oil and natural gas has soared, impacting transportation and production.

- Government stimulus packages: While offering short-term relief, these measures may have contributed to inflation.

Current inflation rates are exceeding those seen in the 1960s, raising concerns about the long-term value of the U.S. dollar and its potential impact on economic stability.

The Role of the U.S. Dollar in International Trade

The Bretton Woods System and its Collapse:

The Bretton Woods system, established after World War II, pegged the value of the U.S. dollar to gold, creating a relatively stable international monetary system. Other currencies were then pegged to the dollar. However, persistent trade deficits and increasing inflation in the U.S. put immense pressure on this system. Nixon's closure of the "gold window" in 1971 effectively ended the Bretton Woods system and ushered in an era of floating exchange rates. This decision had profound consequences, impacting the U.S. dollar's value and leading to increased global economic volatility.

The U.S. Dollar's Current Global Standing:

Despite the end of the gold standard, the U.S. dollar remains the world's dominant reserve currency. However, its position is increasingly challenged. The rise of the Euro and the Chinese Yuan as alternative currencies, coupled with geopolitical tensions and concerns about U.S. national debt levels, pose significant threats to the dollar's global dominance. Large and persistent U.S. trade deficits weaken the dollar's value over time.

- Rise of the Euro and Chinese Yuan: These currencies are increasingly used in international trade and finance.

- Geopolitical risks impacting global trade: Uncertainty and conflict affect the stability of the U.S. dollar.

- U.S. national debt levels: High levels of debt can weaken the dollar's long-term value.

Economic Policy Parallels and Divergences

Nixon's Economic Policies and their Effects:

Nixon implemented wage and price controls in an attempt to curb inflation. While these measures provided short-term relief, they ultimately proved ineffective in the long run and distorted the market. They contributed to shortages and further economic instability. The long-term effects included increased inflation once the controls were lifted.

Current Economic Policies and their Implications for the Dollar:

Current U.S. economic policies are attempting to address inflation through a combination of monetary and fiscal measures. The Federal Reserve is raising interest rates to cool down the economy, while the government is exploring various fiscal strategies. However, the effectiveness of these policies in stabilizing the U.S. dollar remains to be seen. The impact of global economic events, such as the war in Ukraine and ongoing supply chain disruptions, continues to complicate matters.

- Current Federal Reserve policies: Interest rate hikes are aimed at controlling inflation.

- Government spending initiatives: Fiscal policies are being adjusted to address the economic situation.

- Impact of global economic events: International factors significantly influence the U.S. dollar's value.

Conclusion:

The similarities between the economic conditions preceding Nixon's decision to end the gold standard and the current situation are striking. Inflation, trade imbalances, and the overall health of the U.S. dollar present significant challenges. The historical parallels offer valuable insights into potential future outcomes, including currency devaluation and economic instability. Understanding the history of the U.S. dollar and the lessons from the Nixon era is crucial for navigating the current economic landscape. Further research into the factors affecting the U.S. dollar is recommended to gain a more comprehensive understanding of its future trajectory. Stay informed about developments affecting the U.S. dollar and its global impact.

Featured Posts

-

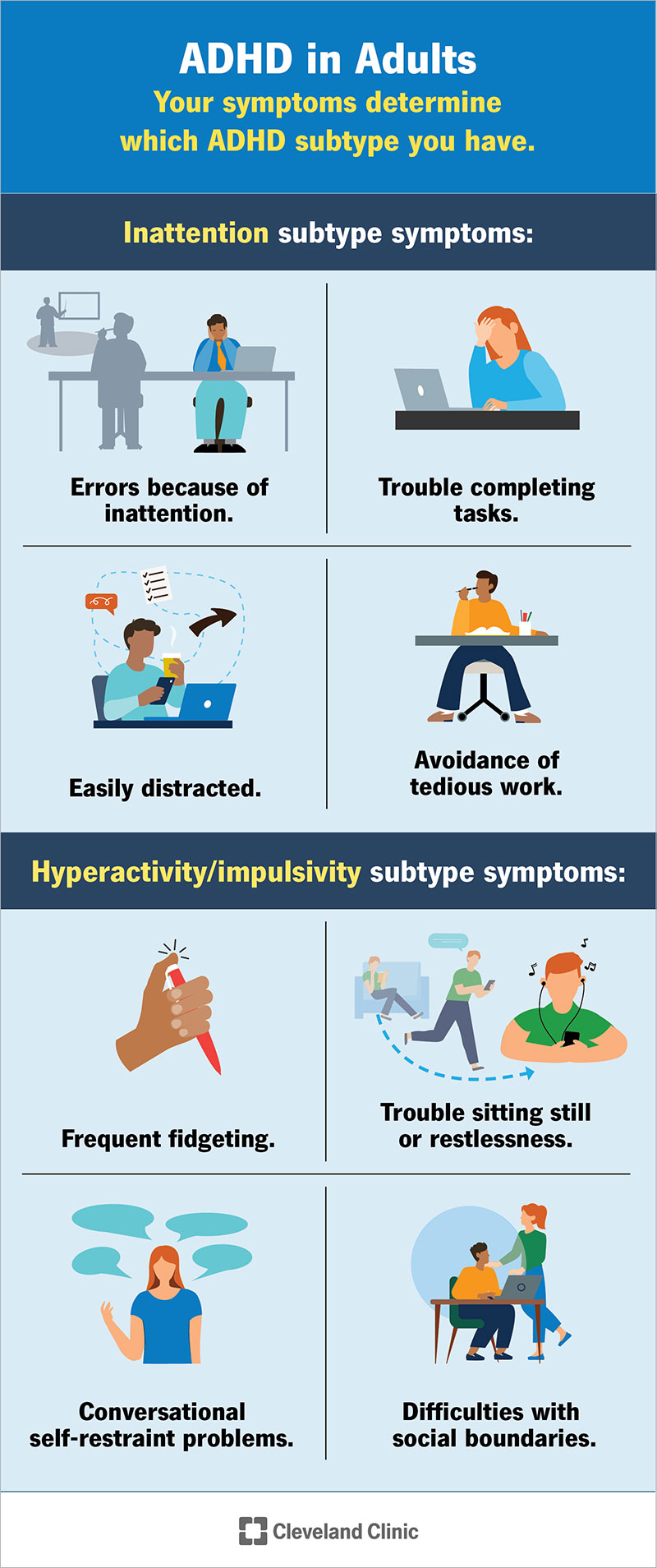

Adult Adhd Next Steps After A Suspected Diagnosis

Apr 29, 2025

Adult Adhd Next Steps After A Suspected Diagnosis

Apr 29, 2025 -

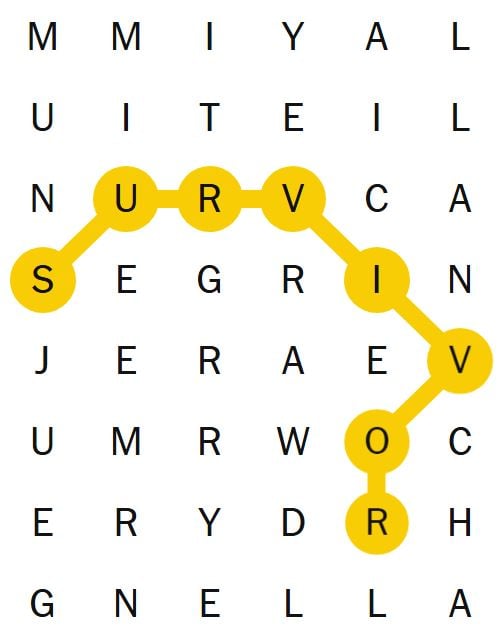

Nyt Spelling Bee February 28 2025 Solutions Answers And Pangram

Apr 29, 2025

Nyt Spelling Bee February 28 2025 Solutions Answers And Pangram

Apr 29, 2025 -

Seven Days Missing The Disappearance Of A British Paralympian In Las Vegas

Apr 29, 2025

Seven Days Missing The Disappearance Of A British Paralympian In Las Vegas

Apr 29, 2025 -

The Growing Number Of Young Adults With Adhd Insights From Aiims Opd

Apr 29, 2025

The Growing Number Of Young Adults With Adhd Insights From Aiims Opd

Apr 29, 2025 -

The Disturbing Trend Of Betting On The Los Angeles Wildfires

Apr 29, 2025

The Disturbing Trend Of Betting On The Los Angeles Wildfires

Apr 29, 2025