Analyzing The Recent Rise In CoreWeave (CRWV) Stock Value

Table of Contents

Strong Underlying Fundamentals Driving CRWV Stock Growth

CoreWeave's impressive trajectory isn't solely based on market hype; it's rooted in strong underlying fundamentals. The company's success is a testament to its strategic positioning within a rapidly expanding market.

Increased Demand for High-Performance Computing

The world is increasingly reliant on high-performance computing. The rise of artificial intelligence (AI), machine learning (ML), deep learning algorithms, and data-intensive applications across various sectors is fueling an insatiable appetite for HPC resources. Industries like financial modeling, scientific research (including genomics and drug discovery), and even the gaming industry are all heavily reliant on the power that CoreWeave provides.

- Growing adoption of AI/ML models: These models require immense computational power, and CoreWeave’s infrastructure is designed to handle such demands efficiently.

- Increasing data volumes: The exponential growth of data necessitates faster processing capabilities, a need CoreWeave directly addresses.

- Expanding use cases in various industries: From autonomous vehicles to personalized medicine, the applications for HPC are constantly growing, leading to increased demand for providers like CoreWeave. The company directly benefits from this growing necessity for data analytics and high-performance computing.

CoreWeave's Competitive Advantages

CoreWeave differentiates itself through several key competitive advantages. Unlike many general-purpose cloud providers, CoreWeave specializes in HPC, allowing it to offer superior performance and tailor-made solutions.

- Superior performance compared to traditional cloud providers: CoreWeave leverages cutting-edge technology, often utilizing Nvidia GPUs within its data center infrastructure, to provide unparalleled processing speeds.

- Competitive pricing strategies: By optimizing its infrastructure and operations, CoreWeave is able to offer competitive pricing, making its services accessible to a wider range of clients.

- Strong partnerships with leading technology companies: Strategic partnerships provide CoreWeave with access to advanced technologies and expand its market reach. These alliances strengthen its position within the GPU cloud and cloud computing infrastructure markets.

External Factors Influencing CRWV Stock Price

While CoreWeave's internal strengths are undeniable, external factors also contribute significantly to the CRWV stock price surge.

Overall Positive Market Sentiment Towards Cloud Computing

The overall cloud computing market is experiencing phenomenal growth. This positive market sentiment significantly boosts investor confidence in companies like CoreWeave. The market's embrace of SaaS, PaaS, and IaaS solutions fuels the growth of businesses operating within this sphere. CoreWeave's market capitalization reflects this broader industry trend and investor belief in the long-term potential of cloud computing.

- Increasing investment in cloud technologies: Venture capital and private equity firms are heavily investing in cloud-based companies.

- Positive industry forecasts for future growth: Analysts predict continued significant growth for the cloud computing market over the next decade.

- Growing adoption of cloud-based services across various sectors: More and more businesses are migrating their operations to the cloud, driving demand for cloud services like those offered by CoreWeave.

Impact of Recent News and Announcements

Positive news and announcements surrounding CoreWeave have undoubtedly influenced investor sentiment. [Insert specific examples here, such as new product launches, strategic acquisitions, or significant partnerships, with links to relevant news articles where possible]. These events showcase CoreWeave's innovation, growth trajectory, and strategic vision.

- Specific examples of positive news events: [List specific events, briefly describe them, and explain their positive impact on investor perception.]

- Analysis of the impact of these events on investor confidence: [Explain how these announcements boosted confidence and fueled investment in CRWV stock.]

Conclusion: Investing in the Future of CoreWeave (CRWV)

The recent rise in CoreWeave (CRWV) stock price is a result of a confluence of factors. The company’s strong fundamentals, including its specialization in the rapidly growing HPC market and its competitive advantages, are complemented by a positive overall market sentiment towards cloud computing and positive news coverage. However, potential investors should also be aware of inherent risks such as competition within the cloud computing investment space, potential market saturation, and the impact of a broader economic downturn.

While CoreWeave presents a compelling investment opportunity within the high-performance computing investment and cloud computing investment spaces, remember that this analysis is not financial advice. Before making any investment decisions, thorough due diligence is crucial. We strongly encourage readers to conduct their own research on CoreWeave stock (CRWV) and consider its potential within your own investment strategy. Remember to assess your risk tolerance and seek professional financial advice before investing in any stock, including CRWV stock.

Featured Posts

-

Core Weave Crwv Stocks Thursday Performance A Comprehensive Overview

May 22, 2025

Core Weave Crwv Stocks Thursday Performance A Comprehensive Overview

May 22, 2025 -

Air Traffic Control Outages Beyond Newarks Black Screens And Silent Radios

May 22, 2025

Air Traffic Control Outages Beyond Newarks Black Screens And Silent Radios

May 22, 2025 -

Potential Canada Post Strike Preparing Your Business For Disruption

May 22, 2025

Potential Canada Post Strike Preparing Your Business For Disruption

May 22, 2025 -

The Blockbuster Phenomenon A Bgt Special Perspective

May 22, 2025

The Blockbuster Phenomenon A Bgt Special Perspective

May 22, 2025 -

Hai Lo Vuong Nho Tren Usb Ban Co Biet Chung La Gi Khong

May 22, 2025

Hai Lo Vuong Nho Tren Usb Ban Co Biet Chung La Gi Khong

May 22, 2025

Latest Posts

-

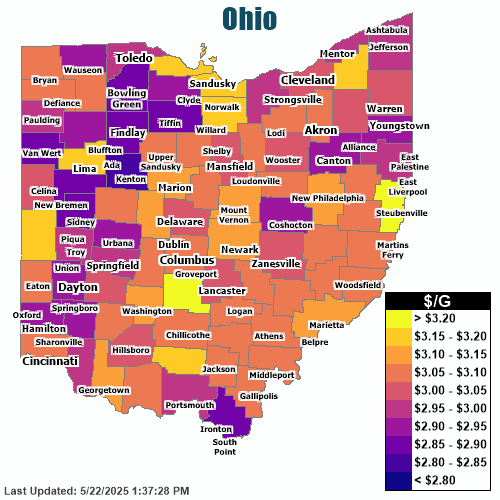

Wide Gas Price Range In Columbus 2 83 3 31 Gallon

May 22, 2025

Wide Gas Price Range In Columbus 2 83 3 31 Gallon

May 22, 2025 -

Solve Nyt Wordle 1368 March 18 Hints And The Answer

May 22, 2025

Solve Nyt Wordle 1368 March 18 Hints And The Answer

May 22, 2025 -

Columbus Gas Station Prices Vary By 48 Cents

May 22, 2025

Columbus Gas Station Prices Vary By 48 Cents

May 22, 2025 -

Wordle 367 March 17th Hints Clues And Answer

May 22, 2025

Wordle 367 March 17th Hints Clues And Answer

May 22, 2025 -

Columbus Gas Prices 2 83 To 3 31 Per Gallon

May 22, 2025

Columbus Gas Prices 2 83 To 3 31 Per Gallon

May 22, 2025