Analyzing The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

Factors Influencing the Amundi Dow Jones Industrial Average UCITS ETF NAV

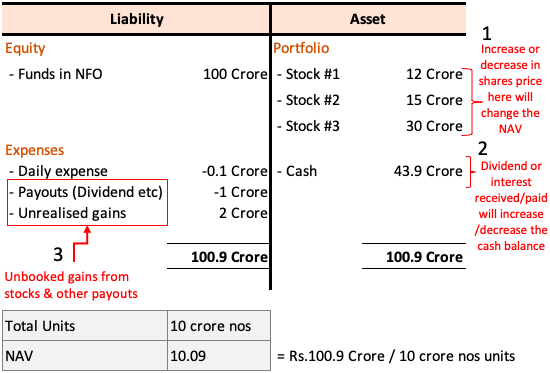

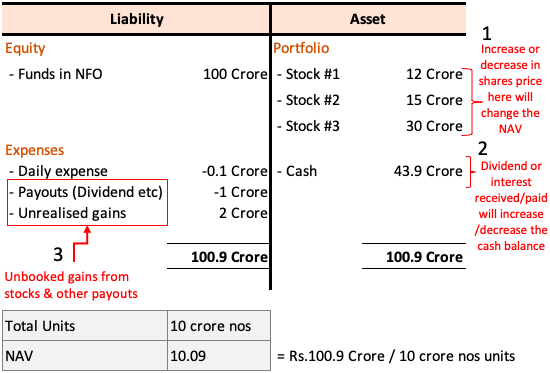

The Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is a dynamic figure, influenced by several key factors. Understanding these factors is essential for interpreting NAV fluctuations and making informed investment choices.

-

Underlying Assets and Their Impact: The ETF's NAV is directly tied to the performance of the 30 constituent companies of the Dow Jones Industrial Average.

- Individual stock price movements have a direct, proportional impact on the overall ETF NAV. A rise in the price of a major component like Apple will generally increase the ETF's NAV. Conversely, a decline in a significant component's price will reduce the NAV.

- Dividends paid by the underlying companies also affect the NAV. When a component company distributes dividends, the ETF receives its share, which generally increases the NAV, though this is often offset by a slight decrease in the share price.

- Keywords: Dow Jones Industrial Average components, stock prices, dividends, ETF NAV calculation.

-

Currency Fluctuations and Their Effect: For investors holding the ETF in a currency other than USD, exchange rate fluctuations can significantly impact the NAV.

- Exchange rate changes between the USD and the investor's local currency directly affect the value of the ETF expressed in their local currency. A strengthening USD will generally decrease the NAV for non-USD investors, and vice versa.

- Some ETFs employ hedging strategies to mitigate currency risk. The presence or absence of hedging will affect the sensitivity of the NAV to currency fluctuations. Understanding the ETF's hedging policy is important.

- Keywords: currency risk, exchange rates, hedging, USD, EUR.

-

ETF Expenses and Their Influence: The ETF's expense ratio (management fees) gradually erodes the NAV over time.

- The expense ratio represents the annual cost of owning the ETF, expressed as a percentage of assets under management. These costs are deducted from the fund's assets, reducing the NAV.

- Comparing the expense ratio of the Amundi Dow Jones Industrial Average UCITS ETF to similar ETFs is crucial for assessing cost-effectiveness. Lower expense ratios mean better growth potential for your NAV.

- Keywords: expense ratio, management fees, ETF costs, cost-effectiveness.

How to Access and Interpret the Amundi Dow Jones Industrial Average UCITS ETF NAV

Accessing and interpreting the NAV is straightforward, thanks to readily available resources.

-

Accessing NAV Data: You can find the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF on the , as well as through major financial data providers like and , and most brokerage platforms. You can usually access both real-time and historical NAV data.

- Keywords: Amundi website, financial platforms, real-time NAV, historical NAV data.

-

Interpreting the NAV: The NAV represents the net asset value per share of the ETF. It's crucial to compare this to the ETF's market share price.

- A premium to NAV indicates the market price is higher than the underlying asset value, while a discount to NAV indicates the opposite. These discrepancies can arise due to supply and demand dynamics.

- Tracking error measures the difference between the ETF's performance and the performance of the underlying index (Dow Jones Industrial Average). A high tracking error might suggest the NAV is not perfectly reflecting the index performance.

- Keywords: share price, premium, discount, tracking error, NAV comparison.

Using NAV Analysis for Investment Strategies

Understanding the NAV is key to developing effective investment strategies.

-

Buy/Sell Decisions: Consistent NAV growth, reflecting strong underlying asset performance, can be considered a positive buy signal. Conversely, prolonged periods of NAV decline might signal a potential sell signal, though it's important to consider your long-term investment goals and overall market conditions.

- Comparing the current NAV to previous periods (e.g., month-over-month, year-over-year) allows you to assess the ETF's performance and inform your decisions.

- Keywords: buy signals, sell signals, investment strategy, long-term investment, performance analysis.

-

Comparing to Other ETFs: Utilize the NAV to compare the Amundi Dow Jones Industrial Average UCITS ETF to similar ETFs tracking the same or comparable indices. This benchmark comparison helps to determine whether it's performing in line with expectations or underperforming relative to its peers.

- Analyzing competitor ETFs reveals insights into management fees, tracking error, and overall efficiency.

- Keywords: benchmarking, competitor ETFs, index fund comparison, investment comparison.

Conclusion: Making Informed Decisions with Amundi Dow Jones Industrial Average UCITS ETF NAV Analysis

Regularly analyzing the Amundi Dow Jones Industrial Average UCITS ETF NAV is essential for making informed investment decisions. Understanding the factors influencing the NAV, accessing the data effectively, and interpreting it in context with the market are key to optimizing your investment strategy. By considering the impact of underlying asset performance, currency fluctuations, and expense ratios, you can gain a clearer picture of the ETF's value and its potential for growth. Regularly analyze the Amundi Dow Jones Industrial Average UCITS ETF NAV to optimize your investment strategy! Remember to diversify your portfolio and seek professional financial advice when necessary.

Featured Posts

-

How To Check The Net Asset Value Of Your Amundi Dow Jones Industrial Average Ucits Etf Investment

May 25, 2025

How To Check The Net Asset Value Of Your Amundi Dow Jones Industrial Average Ucits Etf Investment

May 25, 2025 -

Yevrobachennya 2013 2023 Shlyakh Peremozhtsiv Ta Yikhni Podalshi Kar Yeri

May 25, 2025

Yevrobachennya 2013 2023 Shlyakh Peremozhtsiv Ta Yikhni Podalshi Kar Yeri

May 25, 2025 -

New York Times Connections Hints And Answers March 18 2025 646

May 25, 2025

New York Times Connections Hints And Answers March 18 2025 646

May 25, 2025 -

How Nicki Chapman Made 700 000 From A Country Home Investment An Escape To The Country Story

May 25, 2025

How Nicki Chapman Made 700 000 From A Country Home Investment An Escape To The Country Story

May 25, 2025 -

Philips Future Health Index 2025 Urgent Call To Action On Ai In Healthcare

May 25, 2025

Philips Future Health Index 2025 Urgent Call To Action On Ai In Healthcare

May 25, 2025

Latest Posts

-

Find Housing Finance Solutions And Family Fun At The Iam Expat Fair

May 25, 2025

Find Housing Finance Solutions And Family Fun At The Iam Expat Fair

May 25, 2025 -

2024 Philips Annual General Meeting Financial Results And Future Plans

May 25, 2025

2024 Philips Annual General Meeting Financial Results And Future Plans

May 25, 2025 -

Report Philips Holds Annual General Meeting For Shareholders

May 25, 2025

Report Philips Holds Annual General Meeting For Shareholders

May 25, 2025 -

Philips Convenes Annual General Meeting Review And Outlook

May 25, 2025

Philips Convenes Annual General Meeting Review And Outlook

May 25, 2025 -

Royal Philips Details On The 2025 Shareholders Annual General Meeting

May 25, 2025

Royal Philips Details On The 2025 Shareholders Annual General Meeting

May 25, 2025