Analyzing The Impact Of Trump's Trade Strategies On America's Financial Dominance

Table of Contents

The global landscape of trade shifted dramatically during the Trump administration, prompting questions about the future of America's financial dominance. The implementation of unprecedented trade policies sparked heated debates, both domestically and internationally. This article aims to analyze the effects of Trump's trade strategies on America's economic standing, examining both the intended consequences and the unintended repercussions.

<h2>The Tariffs and Trade Wars: A Double-Edged Sword</h2>

A cornerstone of Trump's trade agenda was the imposition of tariffs, particularly on steel and aluminum imports. The rationale behind these protectionist measures was to safeguard American industries from foreign competition and bolster domestic manufacturing. However, this strategy proved to be a double-edged sword.

-

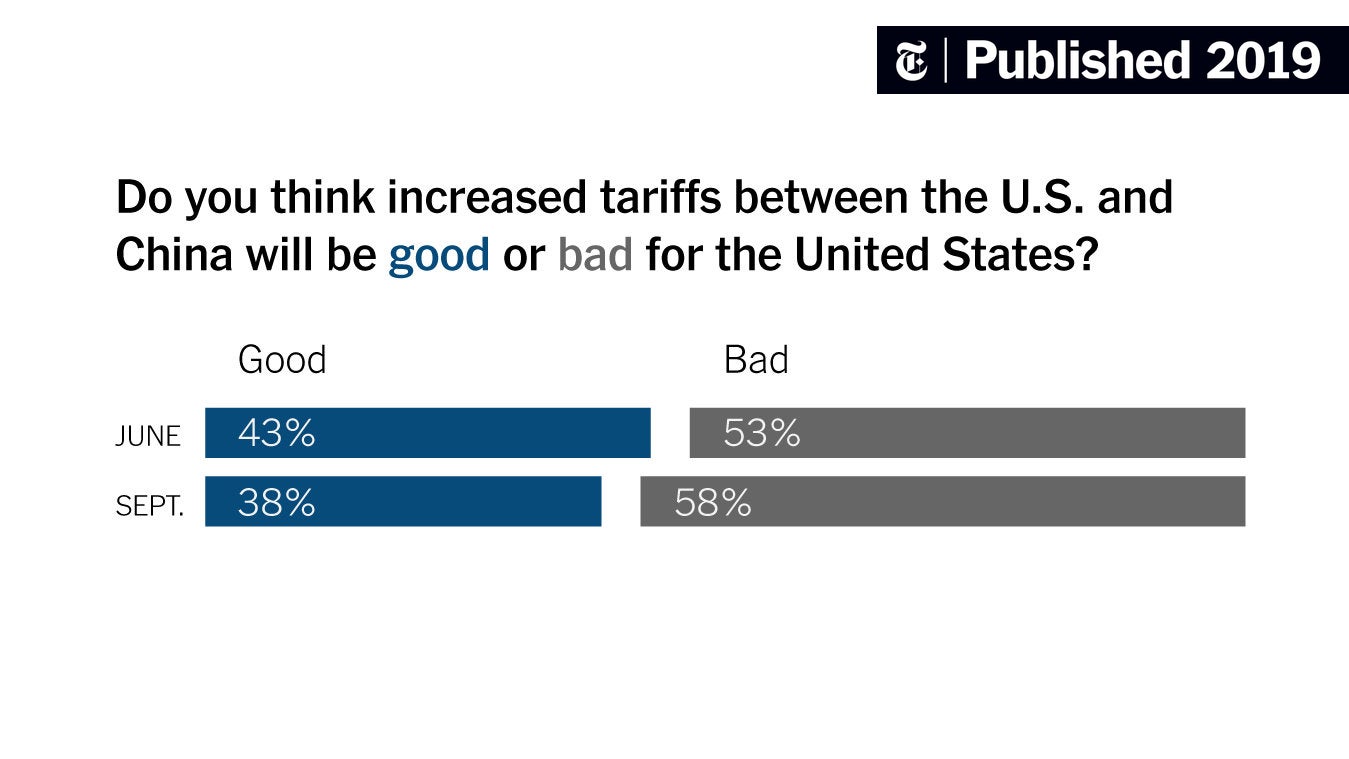

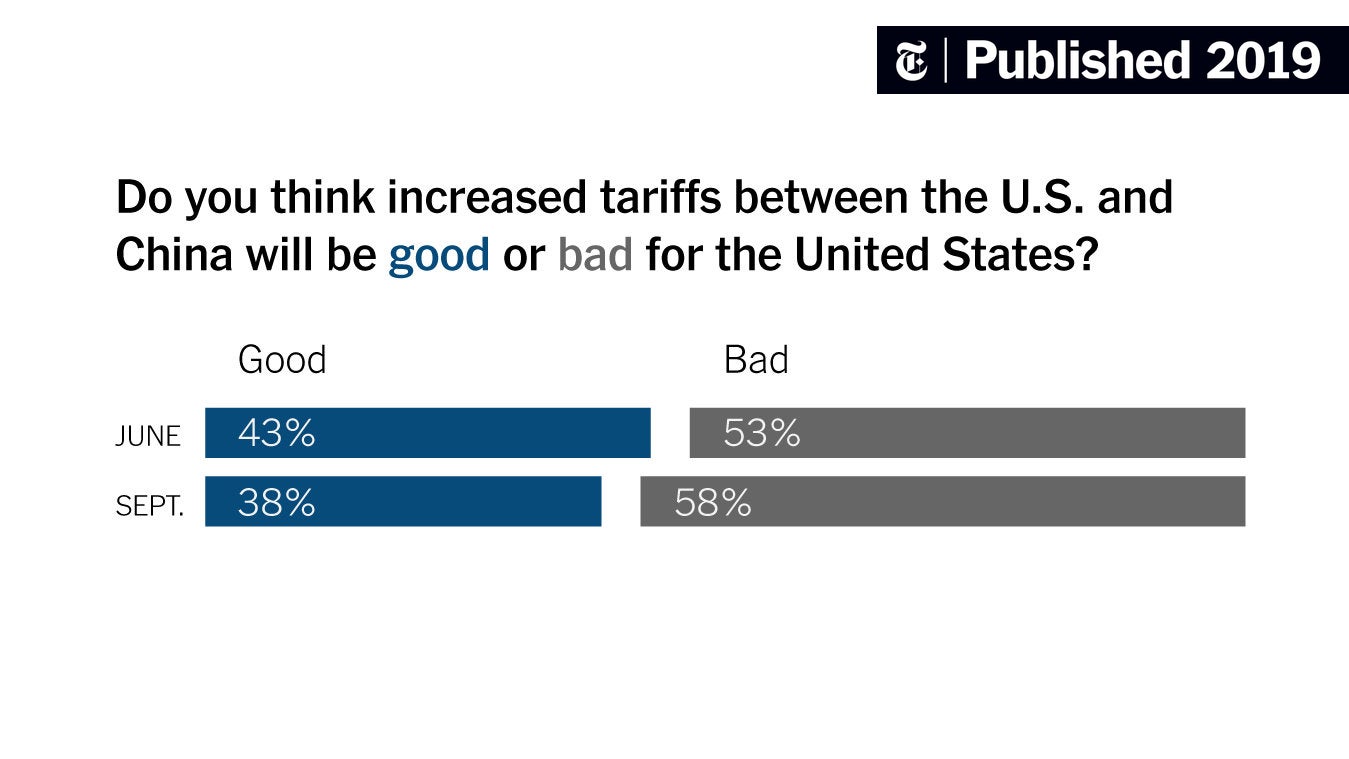

Immediate Impacts: The tariffs immediately led to increased prices for consumers, impacting the cost of goods ranging from cars to canned goods. Furthermore, these actions provoked retaliatory tariffs from other countries, triggering a series of trade wars that disrupted global supply chains and created uncertainty in international markets.

-

Long-Term Effects: The long-term consequences remain a subject of ongoing debate. Some argue that the tariffs fostered domestic production in certain sectors, while others contend they reduced the competitiveness of American businesses in the global marketplace by increasing their input costs. Specific sectors, such as agriculture and manufacturing, experienced varying degrees of impact, with some benefiting from increased domestic demand while others faced reduced export opportunities. These trade conflicts also led to shifts in global trade alliances, forcing the US to re-evaluate its relationships with traditional partners and seek new ones.

<h2>Renegotiation of Trade Agreements: NAFTA and Beyond</h2>

Another significant aspect of Trump's trade strategies was the renegotiation of existing trade agreements. The most prominent example was the renegotiation of the North American Free Trade Agreement (NAFTA) into the United States-Mexico-Canada Agreement (USMCA).

-

Changes and Impacts: The USMCA introduced changes to labor standards, environmental regulations, and intellectual property protections. These changes aimed to improve the competitiveness of American businesses and protect American workers. However, the impact on businesses and workers has been varied, with some sectors benefiting from enhanced protections while others faced challenges in adapting to new rules and regulations. Supply chains within North America experienced adjustments, with some shifting to take advantage of the new trade rules. The overall effect on the volume of trade between the three countries is still being assessed.

-

Success or Failure? The success of the USMCA in achieving Trump's stated goals remains a matter of ongoing analysis and debate among economists and trade experts. While some argue that it achieved modest improvements in labor and environmental standards, others criticize it for not going far enough in addressing trade imbalances or protecting American industries effectively.

<h3>Impact on specific industries – Case Studies</h3>

The impact of Trump's trade policies varied significantly across different industries. For example:

-

Agriculture: The trade war with China significantly impacted American farmers, as China imposed retaliatory tariffs on agricultural exports, leading to substantial losses.

-

Automotive: The automotive industry also felt the effects, facing both increased input costs due to tariffs on steel and aluminum and reduced export opportunities due to retaliatory measures from trading partners.

Detailed analysis of these and other industries using comprehensive data and statistics is essential to fully understand the consequences of these policies.

<h2>The Impact on the US Dollar and Global Financial Markets</h2>

Trump's trade policies created considerable volatility in global financial markets. The imposition of tariffs and the threat of further trade actions contributed to uncertainty, impacting investor confidence and currency valuations.

-

US Dollar Value: The effect on the US dollar's value was complex and varied over time. While some analysts suggested that a strong dollar could have mitigated the impact of tariffs, others noted that trade wars could lead to decreased investor confidence and, consequently, weaken the dollar.

-

Global Market Volatility: The uncertainty surrounding Trump's trade actions led to increased volatility in global financial markets, impacting investments and international trade flows.

-

Foreign Investment: The impact on foreign direct investment in the US is another crucial aspect that needs further in-depth research. Some scholars believe that the uncertainty surrounding trade policy could deter foreign investors, while others argue that the policies may have boosted investment in certain sectors.

<h2>Alternative Perspectives and Counterarguments</h2>

It's crucial to acknowledge alternative perspectives on Trump's trade strategies. Some economists argue that protectionist measures were necessary to address long-standing trade imbalances and protect American industries from unfair competition. Others suggest that the tariffs were ultimately ineffective and led to higher costs for consumers and businesses without significantly boosting domestic production. The role of other factors, such as technological advancements, automation, and global economic trends, also played a role in shaping the US economy during this period, and should not be overlooked when evaluating the impact of Trump's trade strategies.

<h2>Conclusion: Evaluating Trump's Legacy on America's Financial Dominance</h2>

Trump's trade strategies had a profound and multifaceted impact on America's financial position. While intended to strengthen American industries and address trade imbalances, the resultant trade wars and policy changes led to increased costs for consumers, disruptions to global supply chains, and volatility in financial markets. The long-term consequences for America's financial dominance remain a subject of ongoing debate and necessitate further research. A comprehensive evaluation requires considering not only the direct effects of tariffs and trade negotiations but also the broader implications for global trade relationships and investor confidence. We encourage further research and discussion on the lasting effects of Trump’s trade strategies, prompting a deeper analysis of their complex ramifications for the global economy. Further investigation into the specifics of Trump's trade strategies and their lasting impact is crucial for understanding their full influence on the American economy and its global standing.

Featured Posts

-

Pope Francis Dies At 88 Reflecting On His Papacys Impact

Apr 22, 2025

Pope Francis Dies At 88 Reflecting On His Papacys Impact

Apr 22, 2025 -

The Zuckerberg Trump Dynamic Implications For Technology And Policy

Apr 22, 2025

The Zuckerberg Trump Dynamic Implications For Technology And Policy

Apr 22, 2025 -

Is A Google Breakup Inevitable Analyzing The Risks And Repercussions

Apr 22, 2025

Is A Google Breakup Inevitable Analyzing The Risks And Repercussions

Apr 22, 2025 -

Is Google Facing Its Biggest Threat Yet A Potential Breakup

Apr 22, 2025

Is Google Facing Its Biggest Threat Yet A Potential Breakup

Apr 22, 2025 -

Chinas Impact On Bmw And Porsche Market Share And Future Strategies

Apr 22, 2025

Chinas Impact On Bmw And Porsche Market Share And Future Strategies

Apr 22, 2025