Analyzing The Effectiveness Of Minnesota's Film Tax Credit Program

Table of Contents

- Economic Impact of the Minnesota Film Tax Credit Program

- Job Creation and Workforce Development through the Minnesota Film Tax Credit

- Return on Investment (ROI) of the Minnesota Film Tax Credit Program

- Challenges and Limitations of the Minnesota Film Tax Credit Program

- Assessing the Future of the Minnesota Film Tax Credit Program

Economic Impact of the Minnesota Film Tax Credit Program

The Minnesota film tax credit program significantly contributes to the state's economy. Film productions, incentivized by the tax credits, inject substantial capital into local communities. This "direct spending" encompasses expenses on production services, crew salaries, and location rentals. However, the economic impact extends beyond this direct injection, creating an "indirect spending" effect that ripples outwards.

- Increased revenue for local businesses: Hotels, restaurants, equipment rental companies, and caterers experience a significant boost in revenue during film productions. The influx of crew and cast members creates a surge in demand for local goods and services.

- Stimulus to related industries: Industries such as transportation, construction (for set building), and even local farmers (providing food for catering) benefit indirectly from the increased activity.

- Growth in tourism related to filming locations: Successful films shot in Minnesota can lead to increased tourism as fans visit locations featured in the movies or shows. This creates a lasting economic benefit beyond the initial production.

- Data on tax revenue generated vs. tax credits given: While precise figures require detailed economic modeling, studies comparing tax revenue generated from the increased economic activity against the value of tax credits offered are crucial for evaluating the overall effectiveness of the program. Analyzing this data will reveal the true net economic benefit.

For example, the production of [insert name of a successful film shot in Minnesota and benefited from the tax credit] resulted in [insert quantifiable data, e.g., X million dollars in direct spending and Y million dollars in indirect spending within the local economy].

Job Creation and Workforce Development through the Minnesota Film Tax Credit

The Minnesota film tax credit program is not just about economic stimulus; it also plays a vital role in job creation and workforce development. By attracting film productions, the program generates employment opportunities across a wide range of skills and experience levels.

- Statistics on job creation in the film industry since the program's inception: Analyzing job growth data since the program's implementation can demonstrate its impact on employment numbers within the film sector.

- Analysis of employment rates for Minnesotans in the film industry: Focusing on the employment of Minnesota residents highlights the program's success in providing jobs for local citizens.

- Mention of training initiatives supported or indirectly facilitated by the program: Does the program support training initiatives? Does the increased activity lead to greater opportunities for apprenticeship and skills development within the local film community?

- Discussion on the creation of high-paying jobs: The film industry often offers well-compensated jobs, contributing to a higher average income within participating communities.

The program supports jobs ranging from high-profile director and acting roles to essential crew positions like grips, gaffers, and sound technicians, along with numerous support staff roles. This diverse job creation fosters a skilled and experienced workforce within the state.

Return on Investment (ROI) of the Minnesota Film Tax Credit Program

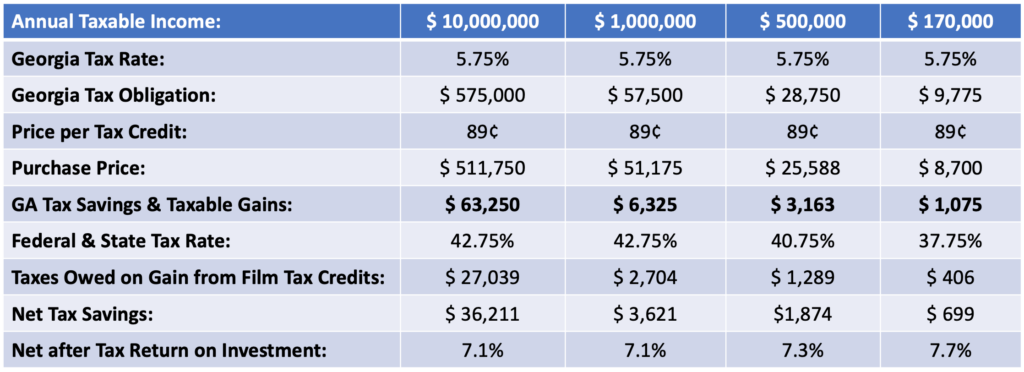

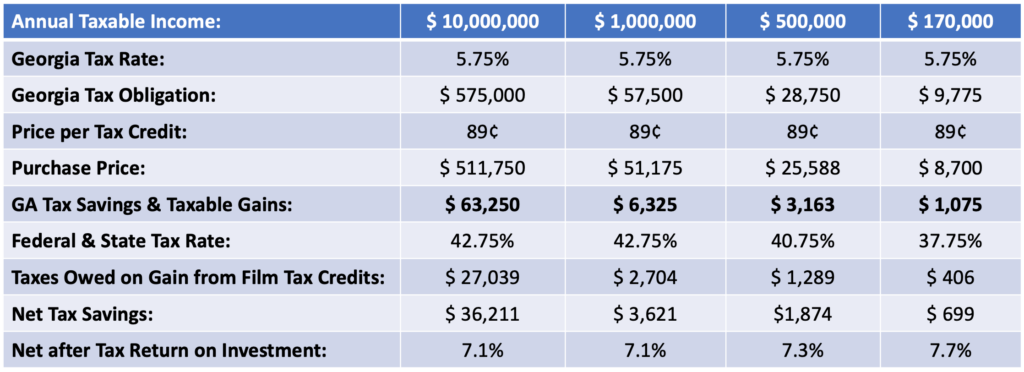

A crucial aspect of evaluating the Minnesota film tax credit program is determining its return on investment. This requires a comprehensive analysis that weighs the cost of the tax credits against the economic benefits they generate.

- Comparison of Minnesota’s program ROI to similar programs in other states: Benchmarking against other states provides a valuable comparative perspective on effectiveness.

- Discussion of methodologies used to calculate ROI: Transparency in the methodology is key to a credible assessment. This includes defining the scope of economic impact considered (direct vs. indirect) and the timeframe for analysis.

- Analysis of different scenarios and assumptions impacting ROI calculations: Acknowledging the inherent uncertainties and assumptions involved in economic modeling builds credibility.

- Presentation of economic models used in the evaluation: The use of sophisticated economic models, incorporating multipliers and other factors, adds rigor to the ROI calculation.

Determining a precise ROI requires in-depth economic modeling; however, a robust evaluation will consider both short-term economic gains (during productions) and long-term benefits (increased tourism, workforce development).

Challenges and Limitations of the Minnesota Film Tax Credit Program

While the Minnesota film tax credit program offers significant benefits, it's crucial to acknowledge its limitations and areas for potential improvement.

- Discussion of potential program loopholes: Are there ways the program could be exploited or misused? Identifying these potential vulnerabilities is essential to refine the program's design.

- Areas where the program may not be reaching its full potential: Is the program effectively reaching smaller, independent film productions, or does it disproportionately benefit larger productions?

- Suggestions for improvement based on best practices from other states: Learning from other states' successful film incentive programs can inform strategies to enhance Minnesota's program.

- Analysis of the program's impact on smaller, independent film productions: Ensuring that the program benefits a diverse range of film projects, not just large-budget productions, is crucial for fostering a thriving and inclusive film industry.

Assessing the Future of the Minnesota Film Tax Credit Program

In conclusion, the Minnesota film tax credit program demonstrates potential for significant economic impact, job creation, and workforce development. However, a comprehensive analysis requires ongoing evaluation of its ROI and a continuous effort to address its limitations. A thorough understanding of the program's effectiveness – considering both its benefits and drawbacks – is critical for informed policy decisions. We encourage further discussion, research into the specifics of the program’s impact, and contributions to the ongoing conversation about the future of film incentives in Minnesota. Let's work together to ensure the continued growth and success of the Minnesota film industry and the effectiveness of its supporting initiatives like the Minnesota film industry incentives.

Alberta Economy Hit By Dow Project Delay Tariff Fallout

Alberta Economy Hit By Dow Project Delay Tariff Fallout

New Evidence Reveals Pilot Error In Near Collision At Reagan Airport

New Evidence Reveals Pilot Error In Near Collision At Reagan Airport

Does Group Support Help Manage Adhd A Data Driven Analysis

Does Group Support Help Manage Adhd A Data Driven Analysis

From Humble Beginnings The Story Of Macario Martinezs Rise To National Celebrity Status

From Humble Beginnings The Story Of Macario Martinezs Rise To National Celebrity Status

Temu Price Hikes The Impact Of Trump Era Tariffs On Us Consumers

Temu Price Hikes The Impact Of Trump Era Tariffs On Us Consumers

Anunoby Scores 27 As Knicks Beat Sixers 105 91 Extending Losing Streak To Nine

Anunoby Scores 27 As Knicks Beat Sixers 105 91 Extending Losing Streak To Nine

Knicks Defeat 76ers 105 91 Anunobys 27 Points Key To Ninth Straight Sixers Loss

Knicks Defeat 76ers 105 91 Anunobys 27 Points Key To Ninth Straight Sixers Loss

Analyzing Piston And Knicks Success Key Factors And Predictions

Analyzing Piston And Knicks Success Key Factors And Predictions

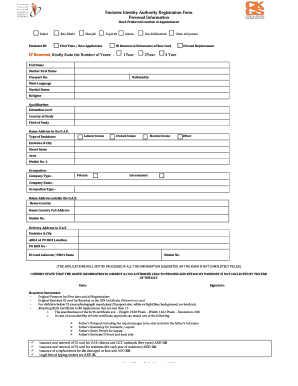

Emirates Id Application For Newborns Fees And Requirements Uae March 2025

Emirates Id Application For Newborns Fees And Requirements Uae March 2025

Detroit Pistons Vs New York Knicks Predicting The 2023 2024 Season

Detroit Pistons Vs New York Knicks Predicting The 2023 2024 Season