Analyzing The Economic Effects Of A U.S.-China Tariff Rollback

Table of Contents

The ongoing trade tensions between the United States and China have significantly impacted global markets. The imposition of tariffs during the U.S.-China trade war created ripples felt worldwide, impacting businesses, consumers, and international relations. A potential rollback of these tariffs could have profound and multifaceted economic consequences. This article analyzes the potential effects of such a significant policy shift, examining its ripple effects across various sectors and the overall global economy. Understanding the potential ramifications of a U.S.-China tariff rollback is crucial for businesses, policymakers, and investors alike.

Impact on Consumer Prices and Inflation

A tariff rollback would likely have a direct impact on consumer prices and inflation.

Reduced Costs for Consumers:

- Lower import prices: A rollback would lead to lower prices for numerous imported goods from China. Consumers could see cheaper electronics, clothing, furniture, and many other products.

- Easing inflationary pressures: This reduction in prices would ease inflationary pressures, particularly for goods heavily impacted by the previous tariffs. The decrease in costs could provide substantial relief for consumers facing rising living expenses.

- Increased purchasing power: Lower prices effectively boost consumer purchasing power, potentially stimulating domestic demand and economic growth. For example, lower tariffs on furniture could significantly reduce the overall spending on household furnishings for many consumers.

Potential for Deflationary Pressures: In some sectors, a dramatic price reduction could lead to deflationary pressures. This is a complex issue requiring careful monitoring and potential policy intervention by central banks to ensure economic stability. The potential for deflation needs to be carefully considered, as it could have negative consequences for economic growth.

Effects on U.S. Manufacturing and Supply Chains

The impact on U.S. manufacturing and supply chains would be complex and potentially contradictory.

Reshoring and Domestic Production:

- Attractiveness of imports: Reduced tariffs might make importing from China more attractive than domestic production for some businesses. This could potentially slow the reshoring trend—the return of manufacturing to the U.S.

- Re-evaluation of relocation: Companies might reconsider plans to relocate production to the U.S., opting instead to continue sourcing from China due to lower import costs.

- Balancing cost savings with other factors: Businesses will need to carefully weigh the cost savings of importing against potential drawbacks like logistical complexities, trade risks, and political considerations.

Supply Chain Resilience:

- Increased reliance on China: Lower tariffs could lead to an increased reliance on Chinese manufacturers, potentially increasing vulnerability to future supply chain disruptions.

- Need for diversification: Diversifying supply chains remains essential for economic resilience. Relying heavily on a single source, even with lower tariffs, exposes businesses to significant risks.

- Complexities and risks: Increased reliance on a single supplier, even with lower tariffs, introduces further complexities and risks into already fragile global supply chains.

Impact on Agricultural Exports and the Farm Sector

The agricultural sector could experience notable shifts with a tariff rollback.

Increased Demand for U.S. Agricultural Products:

- Improved trade relations: De-escalation of trade tensions could lead to significantly increased demand for U.S. agricultural products in the Chinese market.

- Positive impact on farmers: This increased demand would provide a much-needed boost for American farmers and related industries.

- Offsetting potential losses: The increased agricultural exports could help offset potential negative impacts from other economic shifts stemming from the tariff rollback.

Market Competition and Global Trade Dynamics: While a tariff rollback is beneficial, global agricultural market competition remains fierce. The actual increase in U.S. agricultural exports depends on various factors beyond tariffs, including global demand, crop yields, and competitor pricing strategies.

Geopolitical Implications and International Trade Relations

The geopolitical implications of a U.S.-China tariff rollback are significant.

Improved U.S.-China Relations:

- Easing trade tensions: A tariff rollback would likely signal a move toward easing trade tensions and improving overall bilateral relations between the U.S. and China.

- Stable global trading environment: This could contribute to a more stable and predictable global trading environment, benefiting all participants.

- Positive spillover effects: Improved U.S.-China relations could positively affect other aspects of international relations and global cooperation.

Potential for Future Trade Disputes: However, addressing underlying structural issues regarding trade imbalances and intellectual property rights remains crucial to prevent future trade disputes. Simply rolling back tariffs doesn't resolve the fundamental causes of the trade war.

Conclusion:

A U.S.-China tariff rollback presents a multifaceted scenario with potentially significant economic consequences. While it offers potential benefits such as lower consumer prices and potentially increased agricultural exports, it also raises concerns regarding the resilience of U.S. supply chains and the potential for increased dependence on Chinese manufacturers. Policymakers must carefully weigh these diverse impacts to develop effective strategies that mitigate any negative consequences. Further research into the sector-specific impacts is crucial for fully understanding the implications of a U.S.-China tariff rollback and for creating effective strategies to manage its complexities. Continued monitoring and analysis of the U.S.-China tariff rollback and its effects are critical for navigating this pivotal moment in global trade relations.

Featured Posts

-

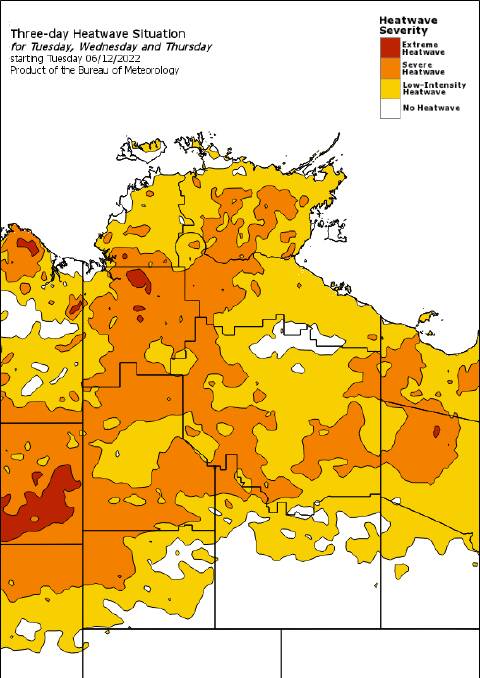

Noida And Ghaziabad Heatwave Warning Advisory For Outdoor Workers

May 13, 2025

Noida And Ghaziabad Heatwave Warning Advisory For Outdoor Workers

May 13, 2025 -

Final Destination 25th Anniversary Devon Sawas Potential Return To Horror

May 13, 2025

Final Destination 25th Anniversary Devon Sawas Potential Return To Horror

May 13, 2025 -

Doom The Dark Ages Key Features And Gameplay

May 13, 2025

Doom The Dark Ages Key Features And Gameplay

May 13, 2025 -

Athlitikes Metadoseis Serie A Sygkritiki Analysi Platformon

May 13, 2025

Athlitikes Metadoseis Serie A Sygkritiki Analysi Platformon

May 13, 2025 -

Dodgers Fall Short In 11 10 Slugfest

May 13, 2025

Dodgers Fall Short In 11 10 Slugfest

May 13, 2025