Analyzing The Economic Consequences Of Resuming Trump Tariffs On Europe

Table of Contents

Impact on US Businesses and Consumers

The reintroduction of Trump tariffs on European goods would likely have a profound impact on American businesses and consumers. The ripple effects would be felt across various sectors, potentially leading to a significant economic slowdown.

Increased Prices for Consumers

Re-imposed tariffs would almost certainly translate into higher prices for consumers. European goods, ranging from automobiles and luxury items to agricultural products and manufactured goods, would become more expensive.

- Examples: A potential increase in the price of German automobiles, French wines, and Italian clothing could be significant. Agricultural products like cheese and olive oil could also see substantial price hikes.

- Impact on Consumer Spending and Inflation: Higher prices for imported goods would reduce consumer purchasing power, potentially leading to decreased consumer spending and increased inflation. This could further stifle economic growth and harm overall consumer confidence.

Reduced Competitiveness for US Businesses

The increased cost of imported European goods could negatively affect the competitiveness of US businesses. Companies relying on European components for their production processes would face higher input costs, making their products less price-competitive both domestically and internationally.

- Examples: US manufacturers relying on European auto parts or specialized machinery would see their production costs rise. Companies in the agricultural sector that import European fertilizers or equipment would also be affected.

- Potential Job Losses and Reduced Economic Growth: Increased production costs could lead to job losses, reduced investment, and slower economic growth within affected sectors. This could trigger a domino effect, impacting related industries and potentially harming overall economic prosperity.

Retaliatory Tariffs and Trade Wars

The imposition of new tariffs on European goods by the US would almost certainly provoke retaliatory measures from the European Union. This could escalate into a full-blown trade war, with devastating consequences for both sides.

- Examples of Potential Retaliatory Measures: The EU could impose tariffs on American agricultural products, technology exports, or other goods, mirroring the US actions.

- Overall Negative Impact on Global Trade: A trade war between the US and EU would disrupt global supply chains, reduce overall trade volumes, and stifle economic growth globally. The uncertainty surrounding trade relations would discourage investment and hinder economic expansion worldwide.

Impact on the European Union

The economic repercussions of resumed Trump tariffs on Europe would be substantial, affecting various sectors and potentially triggering a significant economic slowdown within the EU.

Reduced Exports and Economic Slowdown

Reduced US demand for European goods due to tariffs would directly impact the EU's economy, particularly export-oriented sectors. Companies relying heavily on the US market would face significant challenges.

- Examples of Specific EU Sectors Affected: The automotive industry, luxury goods sector, and agricultural producers would likely be hit hard.

- Potential Impact on EU Employment and GDP Growth: Decreased exports would lead to job losses, reduced investment, and slower GDP growth within the EU, potentially exacerbating existing economic challenges.

Political and Geopolitical Implications

The economic fallout from renewed tariffs could also have significant political and geopolitical implications for the EU and its relationship with the US.

- Potential Impacts on Transatlantic Relations: Increased tensions due to trade disputes could strain already fragile transatlantic relations, impacting cooperation on other crucial issues such as security and climate change.

- Potential Shift in Trade Partnerships: The EU may be forced to seek new trade partnerships outside of the US to diversify its markets and reduce its dependence on the American economy.

Alternative Economic Scenarios and Mitigation Strategies

While the potential consequences of renewed Trump tariffs are significant, various alternative scenarios and mitigation strategies can be explored to lessen the negative impacts.

Negotiation and Trade Agreements

Negotiating new or revised trade agreements between the US and the EU could offer a pathway to avoid or mitigate the negative consequences of tariffs. Compromise and mutual concessions are essential to reach a beneficial outcome.

- Potential Areas of Compromise and Negotiation: Discussions could focus on addressing specific trade imbalances, reducing non-tariff barriers, and promoting fair competition.

- Examples of Successful Trade Agreements as Precedent: Existing trade agreements like the USMCA can serve as a model for potential compromises and solutions.

Diversification of Trade Partners

Both the EU and the US could explore the diversification of their trade partners to reduce their mutual dependence. This would lessen the impact of trade disputes between the two major economies.

- Examples of Potential Alternative Trading Partners: The EU could strengthen ties with Asian markets, while the US could focus on expanding trade relationships with countries in Latin America and Africa.

- Economic Viability and Challenges of Such Diversification: Diversifying trade partners is a long-term strategy that requires significant investment and adjustments. However, it can mitigate the risks associated with reliance on a single major trading partner.

Conclusion

The potential resumption of Trump tariffs on Europe carries significant economic risks for both sides of the Atlantic. Increased prices for consumers, reduced competitiveness for businesses, and the possibility of a trade war pose serious threats to economic growth and stability. Understanding the full impact of potential Trump tariffs on Europe is crucial. Staying informed about developments in EU-US trade to mitigate the potential negative economic consequences of tariffs is essential. Advocating for policies that promote free and fair trade, including exploring alternative economic scenarios and mitigation strategies like negotiation and trade diversification, is paramount to preserving economic prosperity and stability on both sides of the Atlantic.

Featured Posts

-

Idzes Bela Timnas Indonesia Dan Bersinar Di Laga Venezia Vs Atalanta

May 13, 2025

Idzes Bela Timnas Indonesia Dan Bersinar Di Laga Venezia Vs Atalanta

May 13, 2025 -

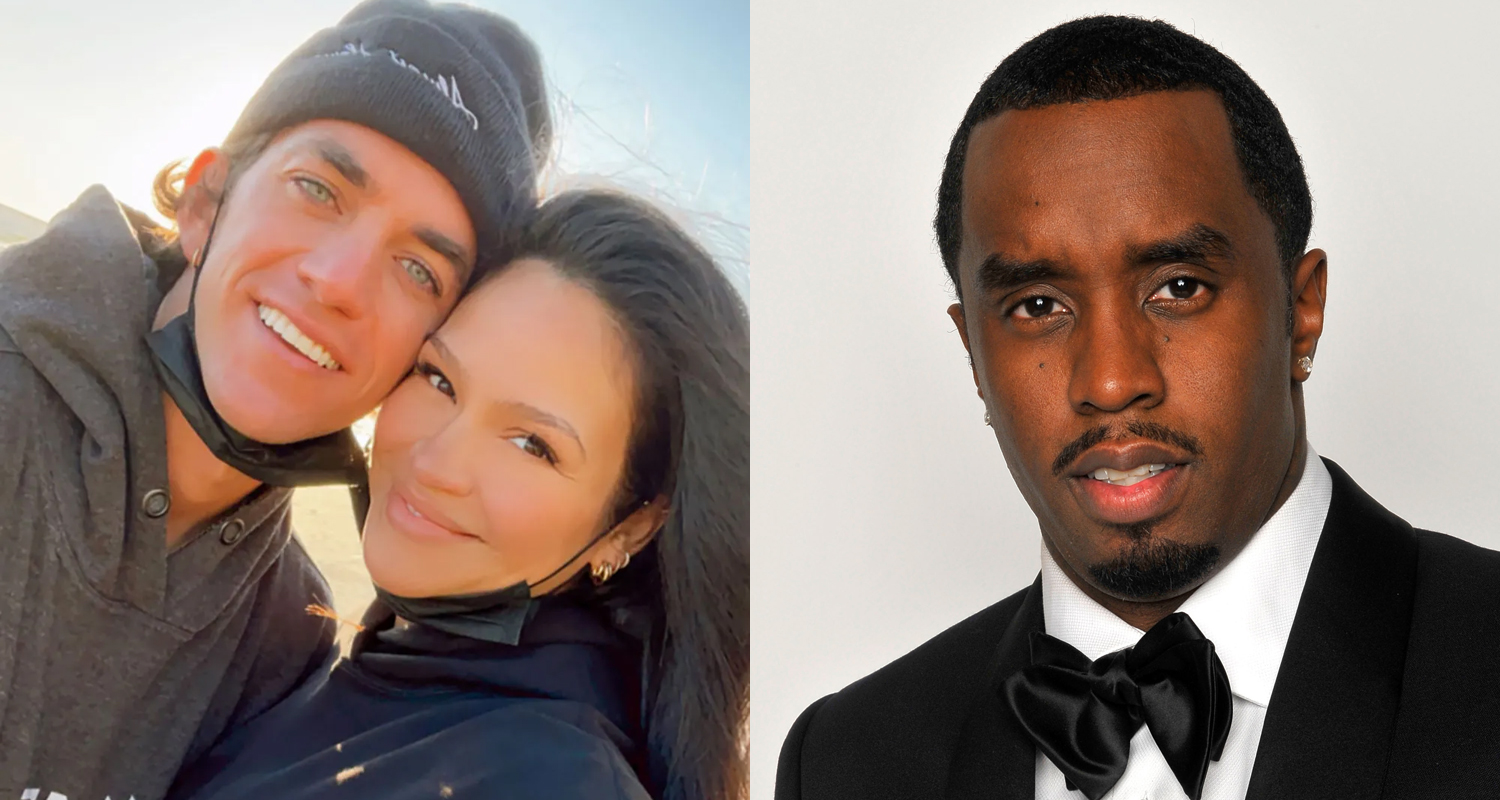

Cassie Ventura And Alex Fines Red Carpet Appearance Pregnant Cassies Debut

May 13, 2025

Cassie Ventura And Alex Fines Red Carpet Appearance Pregnant Cassies Debut

May 13, 2025 -

I Epistimi Kai O Megalos Kataklysmos Tis Mesogeioy Nea Apokalypseis

May 13, 2025

I Epistimi Kai O Megalos Kataklysmos Tis Mesogeioy Nea Apokalypseis

May 13, 2025 -

The Maluf Factor How Byd Is Overtaking Ford In Brazils Ev Sector

May 13, 2025

The Maluf Factor How Byd Is Overtaking Ford In Brazils Ev Sector

May 13, 2025 -

Cassie And Alex Fine First Red Carpet Appearance As Expectant Parents

May 13, 2025

Cassie And Alex Fine First Red Carpet Appearance As Expectant Parents

May 13, 2025