Analyzing The CoreWeave (CRWV) Stock Dip On Tuesday

Table of Contents

Market-Wide Factors Influencing CRWV Stock Performance

Several macroeconomic factors could have contributed to the CoreWeave (CRWV) stock dip. Understanding the broader market context is crucial for a complete analysis.

Broad Market Trends

Tuesday's market showed signs of overall volatility. Negative investor sentiment, driven by various factors, likely impacted the tech sector, where CRWV operates. Keywords like "market volatility," "tech stock downturn," and "investor sentiment" dominated the day's financial news.

- Rising Interest Rates: Continued increases in interest rates by central banks worldwide put pressure on growth stocks, impacting companies like CoreWeave.

- Inflation Concerns: Persistent inflation concerns led to a cautious approach from investors, prompting them to sell off riskier assets, including many tech stocks.

- Geopolitical Instability: Ongoing geopolitical uncertainties added to the overall market anxiety, further exacerbating the sell-off.

Sector-Specific Pressures

The cloud computing sector, where CoreWeave is a key player, wasn't immune to the broader market downturn. The "cloud computing stocks," "data center industry," and "competition in cloud services" all experienced pressure.

- Competitor Performance: Underperformance by other major players in the cloud computing space could have negatively influenced investor perception of the entire sector, impacting CRWV.

- Slowing Growth Projections: Any negative news regarding the overall growth projections for the cloud computing sector could have triggered a sell-off in related stocks, including CoreWeave.

Company-Specific News and Developments Impacting CRWV

While market-wide factors played a role, it's crucial to examine any company-specific news or developments that might have contributed to the CoreWeave (CRWV) stock dip.

Absence of Positive News

The absence of positive news or announcements from CoreWeave could have left the stock vulnerable to the negative market sentiment. Keywords like "earnings report," "product launch," and "partnership announcement" were conspicuously absent from the company's news cycle.

- Delayed Earnings Report: A delay or postponement of an anticipated earnings report might have fuelled speculation and uncertainty among investors, contributing to the dip.

- Lack of Significant Announcements: The absence of any major product launches, partnerships, or other positive developments left the stock price susceptible to negative market pressures.

Potential Negative News or Rumors

Although no confirmed negative news emerged directly from CoreWeave, market speculation plays a significant role. Keywords like "regulatory scrutiny," "customer churn," and "financial concerns" might have been circulating among investors.

- Speculation about Regulatory Scrutiny: Rumors of potential regulatory investigations or increased scrutiny could have spooked investors, leading to a sell-off.

- Unconfirmed Reports of Customer Churn: Unverified reports of potential customer churn or contract losses, even if unfounded, can negatively impact investor confidence.

Technical Analysis of the CRWV Stock Chart

Analyzing the CRWV stock chart on Tuesday provides insights into the technical aspects of the dip.

Chart Patterns and Indicators

Technical indicators revealed several concerning patterns on Tuesday's CRWV stock chart.

- High Trading Volume: The significant drop was accompanied by high trading volume, suggesting a strong sell-off driven by significant investor activity.

- Breaking Support Levels: The stock price broke below key support levels, indicating a potential shift in market sentiment and further downside potential.

- Negative RSI and MACD Readings: Technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) likely showed negative readings, suggesting bearish momentum. (Note: Including a chart here would greatly enhance this section.)

Short-Term and Long-Term Implications

The technical analysis suggests a few possible scenarios.

- Short-Term Correction: The dip could represent a short-term correction within a longer-term upward trend. A "buy-the-dip" strategy might be considered by some investors.

- Long-Term Growth Potential: Despite the dip, CoreWeave's long-term growth potential remains significant, given the growth of the cloud computing sector.

- Trend Reversal: Conversely, the dip could signal a more significant trend reversal, highlighting the need for caution.

Conclusion: Assessing the Future of CoreWeave (CRWV) Stock

The CoreWeave (CRWV) stock dip on Tuesday resulted from a combination of market-wide factors, including broader market volatility impacting tech stocks, and potential company-specific concerns, although no definitive negative news emerged. The technical analysis adds further complexity, highlighting the need for careful consideration before making investment decisions.

It is crucial to remember that stock price fluctuations are influenced by both market-wide conditions and company-specific news. While the short-term outlook might seem uncertain, CoreWeave's long-term potential within the rapidly growing cloud computing sector remains significant. However, investors should carefully weigh the potential risks and opportunities before making any investment decisions.

Conduct thorough research, consider consulting a financial advisor, and continuously monitor the CoreWeave (CRWV) stock and its performance before committing to any investment strategy. Understanding the intricacies of the CoreWeave (CRWV) stock is vital for informed decision-making.

Featured Posts

-

Une Navette Gratuite Entre La Haye Fouassiere Et Haute Goulaine Test En Cours

May 22, 2025

Une Navette Gratuite Entre La Haye Fouassiere Et Haute Goulaine Test En Cours

May 22, 2025 -

Exploring The Richness Of Cassis Blackcurrant From Liqueurs To Culinary Delights

May 22, 2025

Exploring The Richness Of Cassis Blackcurrant From Liqueurs To Culinary Delights

May 22, 2025 -

Netflix Adds Sesame Street Todays Headlines And More

May 22, 2025

Netflix Adds Sesame Street Todays Headlines And More

May 22, 2025 -

Dropout Kings Lead Singer Adam Ramey A Legacy Remembered

May 22, 2025

Dropout Kings Lead Singer Adam Ramey A Legacy Remembered

May 22, 2025 -

Betaalbare Huizen Nederland Een Kritische Blik Van Geen Stijl En Abn Amro

May 22, 2025

Betaalbare Huizen Nederland Een Kritische Blik Van Geen Stijl En Abn Amro

May 22, 2025

Latest Posts

-

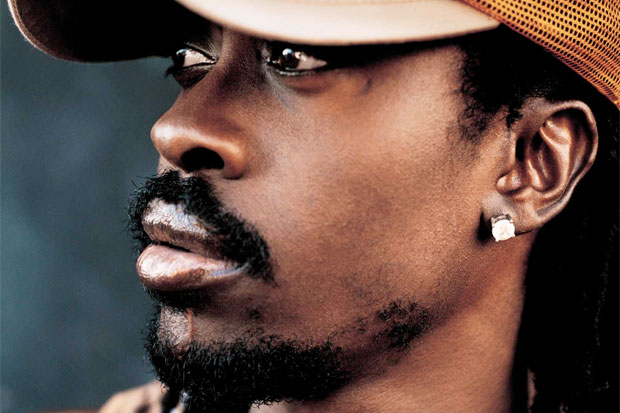

Beenie Man Announces New York Domination A New Era For It A Stream

May 23, 2025

Beenie Man Announces New York Domination A New Era For It A Stream

May 23, 2025 -

Beenie Mans New York Takeover Is This The Future Of It A Stream

May 23, 2025

Beenie Mans New York Takeover Is This The Future Of It A Stream

May 23, 2025 -

Trinidad Concert Defence Minister To Decide On Age And Song Restrictions For Kartel Show

May 23, 2025

Trinidad Concert Defence Minister To Decide On Age And Song Restrictions For Kartel Show

May 23, 2025 -

Vybz Kartel Opens Up Skin Bleaching And The Search For Self Love

May 23, 2025

Vybz Kartel Opens Up Skin Bleaching And The Search For Self Love

May 23, 2025 -

Kartels Trinidad Show Defence Minister Debates Age Restrictions And Song Bans

May 23, 2025

Kartels Trinidad Show Defence Minister Debates Age Restrictions And Song Bans

May 23, 2025