Analyzing The Bond Market's Response To Tariff Shocks

Table of Contents

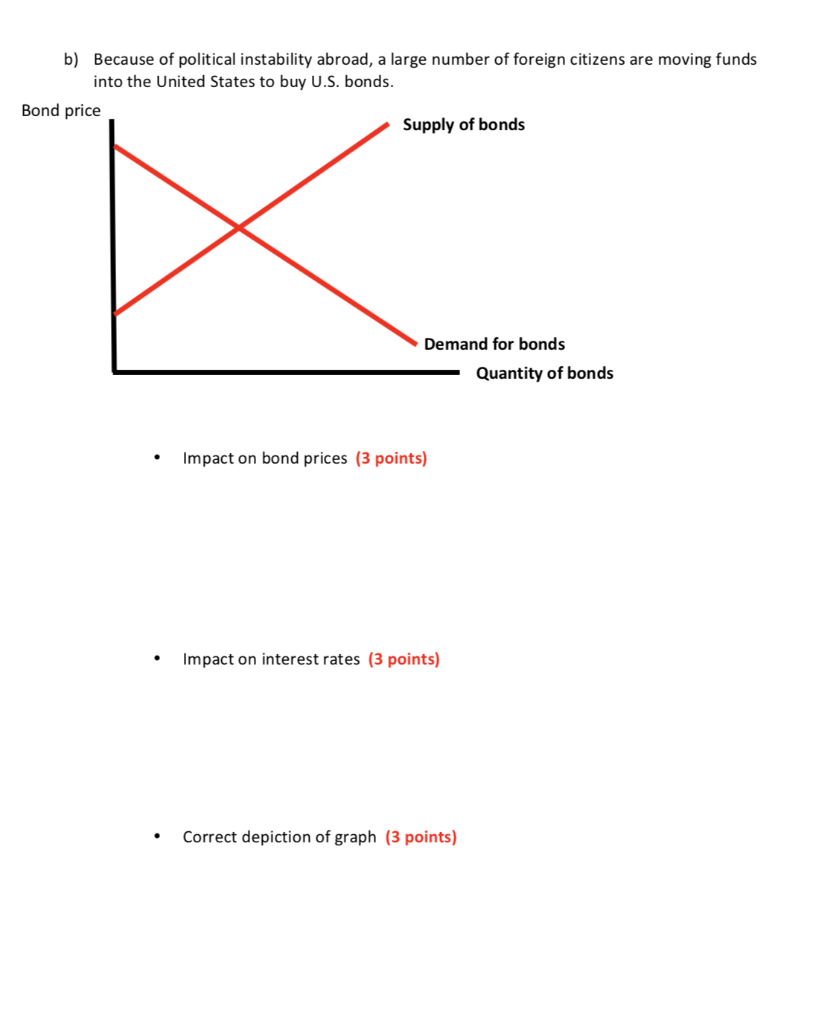

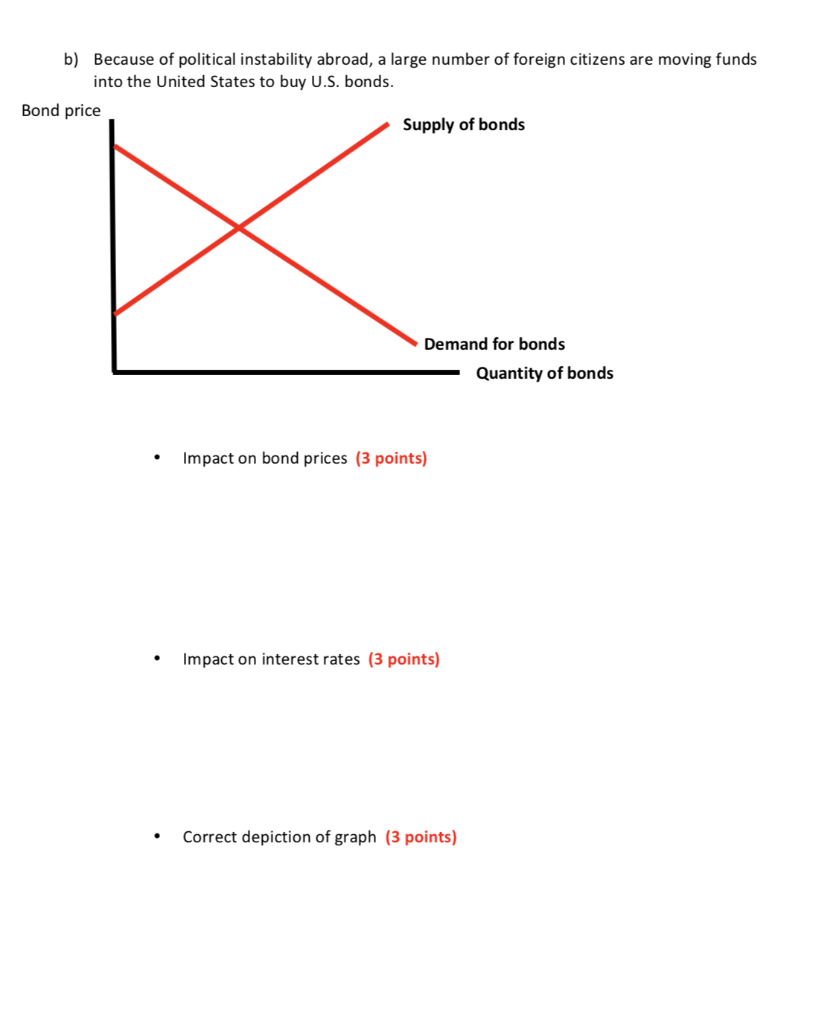

Historical Analysis of Tariff Impositions and Subsequent Bond Market Behavior

Analyzing historical instances of tariff imposition reveals valuable insights into the bond market's typical reactions. Understanding this historical tariff analysis helps in predicting future behavior and formulating effective risk management strategies.

Case studies of past tariff shocks

-

The Smoot-Hawley Tariff Act (1930): This act, enacted during the Great Depression, significantly raised tariffs on imported goods. The resulting trade war exacerbated the economic downturn, leading to a sharp decline in bond prices and a rise in bond yields. This highlights the strong correlation between protectionist trade policies and increased market uncertainty. The ensuing economic contraction directly influenced investor sentiment, leading to a flight to safety, but with limited effectiveness due to the severity of the economic crisis.

-

Recent US-China Trade Wars (2018-present): The escalating trade tensions between the US and China, marked by reciprocal tariff increases, created considerable uncertainty in the global economy. While the initial response wasn't uniformly negative across all bond markets, we observed increased volatility in bond yields, reflecting the heightened risk aversion among investors. The flight to safety pushed investors towards US Treasury bonds, driving down yields on these "safe haven" assets.

-

Specific examples of bond yield movements: During periods of heightened tariff uncertainty, we observed an increase in the yield spread between US Treasury bonds and corporate bonds, reflecting an increased risk premium demanded by investors for holding corporate debt. For example, in the initial stages of the US-China trade war, the yield spread widened considerably. These bond yield fluctuations clearly reflect the market's response to increased uncertainty.

Mechanisms Through Which Tariffs Impact Bond Markets

Tariffs affect bond markets through several key mechanisms, primarily influencing inflation expectations and overall economic growth and uncertainty.

Impact on Inflation Expectations

Tariffs can lead to increased inflation. By raising the price of imported goods, tariffs directly increase the cost of production for many businesses. This cost-push inflation often translates into higher consumer prices, impacting the purchasing power of consumers. Central banks might respond by increasing interest rates to control inflation. This relationship between inflation, interest rates, and bond prices is inverse: higher interest rates typically lead to lower bond prices.

- Relationship between inflation, interest rates and bond prices: Inflation erodes the real value of fixed-income securities, making bonds less attractive. Central banks combat inflation by raising interest rates, further decreasing the appeal of existing bonds with lower yields.

Impact on Economic Growth and Uncertainty

Tariffs can hinder economic growth and introduce significant market uncertainty. The imposition of tariffs often leads to retaliatory measures from other countries, disrupting global trade flows and creating uncertainty about future economic prospects. This uncertainty increases risk aversion among investors, influencing their allocation of capital toward safer assets like government bonds. The increased demand for these safe-haven assets pushes their prices up and yields down.

- Uncertainty and its impact on investor behavior: Increased uncertainty can lead to decreased investment and slower economic growth, ultimately impacting corporate profitability and credit ratings. This risk aversion often manifests as a flight to quality, where investors shift their portfolios towards government bonds and high-quality corporate bonds. This is visible in the fluctuations of bond market volatility.

Sector-Specific Analysis: How Different Bond Segments React to Tariff Shocks

Different segments of the bond market react differently to tariff shocks.

Treasury Bonds

Treasury bonds, issued by governments, are generally considered safe-haven assets. During times of economic uncertainty spurred by tariff disputes, investors tend to flock to these bonds, driving up their prices and pushing yields down. The demand for Treasury bond yields reflects investor preference for safety during periods of heightened risk.

Corporate Bonds

Corporate bonds, on the other hand, are more sensitive to economic downturns. The impact on corporate bond spreads (the difference between corporate bond yields and Treasury bond yields) is significant. During times of uncertainty caused by tariffs, the spread widens as investors demand a higher risk premium for holding corporate debt. This differentiation between investment-grade bonds and high-yield bonds becomes even more pronounced, with high-yield bonds bearing the brunt of the risk aversion.

Predictive Modeling and Forecasting Bond Market Reactions to Future Tariff Events

Accurately predicting the bond market's response to future tariff events is challenging, but essential for informed decision-making.

Limitations of Prediction

Predicting bond market reactions to future tariff shocks is extremely complex due to the interplay of various factors beyond tariffs alone. Geopolitical events, monetary policy decisions, and overall global economic conditions all influence investor sentiment and market dynamics. Therefore, relying on any single model is insufficient.

- Interplay of factors: The impact of tariffs is rarely isolated, and their effects often interact with other economic and political developments, making accurate prediction difficult.

Potential Modeling Approaches

Several approaches can be used to forecast the impact of tariffs on bond markets. Econometric modeling can incorporate various macroeconomic variables and historical data to establish correlations between tariffs and bond yields. Predictive analytics and quantitative analysis techniques can be used to assess and anticipate market reactions to future tariff scenarios based on past data.

- Use of quantitative analysis: The combination of historical data and statistical modeling can help quantify the risk associated with future tariff shocks.

Conclusion: Navigating the Bond Market Amidst Tariff Uncertainty

The bond market's response to tariff shocks is multifaceted, exhibiting significant variations depending on the severity of the shock, the specific bond segment, and the broader macroeconomic environment. Understanding the historical patterns, underlying mechanisms, and sector-specific reactions is crucial for navigating this turbulent landscape. While precise prediction remains challenging, employing diverse analytical methods, including quantitative analysis and a careful consideration of multiple economic factors, can enhance the accuracy of forecasting and effective risk management. Investors should consider diversifying their portfolios and utilizing hedging techniques to mitigate potential losses arising from tariff-induced volatility. Continue researching the bond market's response to tariff shocks and staying informed about global trade developments and their influence on bond markets is key to successful long-term investment strategies.

Featured Posts

-

Rory Mc Ilroy And Shane Lowry To Defend Zurich Classic Title

May 12, 2025

Rory Mc Ilroy And Shane Lowry To Defend Zurich Classic Title

May 12, 2025 -

The Challenge Season 41 Spoiler Alert Unexpected Twist

May 12, 2025

The Challenge Season 41 Spoiler Alert Unexpected Twist

May 12, 2025 -

Jessica Simpson Shares Emotional Aftermath Of Divorce

May 12, 2025

Jessica Simpson Shares Emotional Aftermath Of Divorce

May 12, 2025 -

India Pakistan Ceasefire Five Soldiers Killed Situation Tense

May 12, 2025

India Pakistan Ceasefire Five Soldiers Killed Situation Tense

May 12, 2025 -

Lily Collins Stars In Calvin Kleins New Campaign See Photo 5133601

May 12, 2025

Lily Collins Stars In Calvin Kleins New Campaign See Photo 5133601

May 12, 2025

Latest Posts

-

Top Australian Prospect Commits To Oregon Coach Graves Recruiting Success

May 13, 2025

Top Australian Prospect Commits To Oregon Coach Graves Recruiting Success

May 13, 2025 -

Finding Information On Angela Swartz

May 13, 2025

Finding Information On Angela Swartz

May 13, 2025 -

Angela Swartz In The Spotlight

May 13, 2025

Angela Swartz In The Spotlight

May 13, 2025 -

The Angela Swartz Story

May 13, 2025

The Angela Swartz Story

May 13, 2025 -

Angela Swartz News And Updates

May 13, 2025

Angela Swartz News And Updates

May 13, 2025