Analyzing The Bitcoin Rebound: Potential For Further Growth

Table of Contents

Factors Contributing to the Bitcoin Rebound

Several interconnected factors have contributed to the recent Bitcoin rebound, creating a confluence of positive influences that propelled its price upward.

Institutional Investment

The increasing involvement of institutional investors is a significant driver of the Bitcoin rebound. Large-scale adoption by hedge funds, corporations, and asset management firms signals growing confidence in Bitcoin as a viable asset class.

- Examples: BlackRock's application for a Bitcoin ETF, MicroStrategy's continued accumulation of BTC, and the growing adoption of Bitcoin by treasury departments of publicly-traded companies demonstrate this trend.

- Impact: Large institutional purchases inject significant liquidity into the market, driving up demand and subsequently, the price. This also lends credibility and legitimacy to Bitcoin as an asset class for more conservative investors.

- Future Potential: Further institutional adoption, particularly with the approval of a Bitcoin ETF in major markets, could trigger a substantial price surge, solidifying the Bitcoin rebound. Keywords: Institutional Bitcoin adoption, corporate Bitcoin holdings, hedge fund Bitcoin investments.

Regulatory Clarity (or Lack Thereof)

While regulatory clarity is still evolving globally, the lack of outright bans or extreme restrictions in key markets has positively impacted sentiment. In certain jurisdictions, a more hands-off approach to Bitcoin regulation has been interpreted favorably by the market.

- Examples: The relatively measured regulatory response in some jurisdictions contrasted with the more aggressive stances of others has played a part. The ongoing debate surrounding regulation, while uncertain, hasn't resulted in catastrophic events that previously crashed the market.

- Market Sentiment: The absence of overly harsh regulations has fueled a more optimistic outlook among investors, reducing uncertainty and encouraging further investment.

- Future Regulations: The potential for future regulatory frameworks, both positive and negative, remains a significant wildcard impacting the Bitcoin price. Keywords: Bitcoin regulation, cryptocurrency regulation, government Bitcoin policy.

Macroeconomic Factors

Global economic conditions significantly influence Bitcoin's price. High inflation and volatile interest rates have pushed some investors to seek alternative assets, including Bitcoin, as a potential hedge against inflation.

- Correlation: Historically, Bitcoin has shown a negative correlation with the US dollar, often rising when the dollar weakens. This relationship is complex and not always consistent.

- Inflation Hedge: Bitcoin's limited supply and decentralized nature make it attractive as a hedge against inflation for some investors. This narrative becomes particularly strong when fiat currencies lose purchasing power.

- Interest Rates: Increasing interest rates often lead to decreased risk appetite, potentially impacting Bitcoin's price. However, the strength of this effect depends on various other market factors. Keywords: Bitcoin inflation hedge, macroeconomic Bitcoin analysis, Bitcoin and interest rates.

Technological Advancements

Continuous technological advancements within the Bitcoin ecosystem enhance its efficiency, scalability, and security, bolstering investor confidence.

- Lightning Network: This second-layer scaling solution enables faster and cheaper Bitcoin transactions, improving usability and adoption.

- Taproot Upgrade: This upgrade enhanced Bitcoin's privacy and efficiency, making it more attractive to users and developers.

- Impact: These improvements address some of Bitcoin's historical limitations, making it a more robust and viable system for mainstream adoption. Keywords: Bitcoin scalability, Bitcoin technology upgrades, Lightning Network, Taproot.

Assessing the Potential for Further Growth

Analyzing the potential for continued growth requires examining multiple perspectives.

Technical Analysis

Technical indicators provide valuable insights into potential price movements.

- Moving Averages: The 50-day and 200-day moving averages can indicate short-term and long-term trends. A bullish crossover (50-day crossing above the 200-day) is often seen as a positive signal.

- RSI (Relative Strength Index): This momentum indicator can help identify overbought or oversold conditions.

- Support and Resistance Levels: Identifying key price levels where buying or selling pressure is expected can offer insights into potential price targets. Keywords: Bitcoin technical analysis, Bitcoin chart analysis, Bitcoin price prediction.

On-Chain Metrics

On-chain data provides valuable insights into network activity and user behavior.

- Transaction Volume: Higher transaction volumes can suggest increased demand and potential price appreciation.

- Active Addresses: A rising number of active addresses points to growing user adoption and network participation.

- Miner Revenue: Analyzing miner revenue helps assess the health and profitability of the Bitcoin network. Keywords: Bitcoin on-chain analysis, Bitcoin network activity, Bitcoin transaction volume.

Sentiment Analysis

Gauging market sentiment is crucial for understanding the overall outlook.

- Social Media Sentiment: Analyzing social media trends and discussions can offer insights into investor psychology.

- News Coverage: Positive or negative news coverage can influence market sentiment and subsequent price movements.

- Investor Surveys: Surveys can provide a snapshot of investor confidence and expectations. Keywords: Bitcoin sentiment, Bitcoin market sentiment analysis, crypto market sentiment.

Conclusion

The Bitcoin rebound is fueled by a combination of institutional adoption, evolving regulatory landscapes, macroeconomic factors, and ongoing technological improvements. While technical analysis, on-chain metrics, and sentiment analysis suggest a potential for further growth, the cryptocurrency market remains inherently volatile. The continued strength of the Bitcoin rebound hinges on several factors, including the success of Bitcoin ETFs, continued institutional investment, and global macroeconomic conditions. While this analysis suggests a potential for further growth in the Bitcoin rebound, it’s crucial to conduct thorough research and understand the inherent risks before investing. Stay informed about the latest developments in the Bitcoin market and consider diversifying your investment portfolio. Remember that any Bitcoin price prediction should be approached with caution, and professional financial advice should be sought before making any investment decisions related to the Bitcoin rebound.

Featured Posts

-

Lidery Frantsii Velikobritanii Germanii I Polshi Ne Posetyat Kiev 9 Maya

May 09, 2025

Lidery Frantsii Velikobritanii Germanii I Polshi Ne Posetyat Kiev 9 Maya

May 09, 2025 -

Decoding Palantirs Q1 Results Key Insights Into Government And Commercial Contracts

May 09, 2025

Decoding Palantirs Q1 Results Key Insights Into Government And Commercial Contracts

May 09, 2025 -

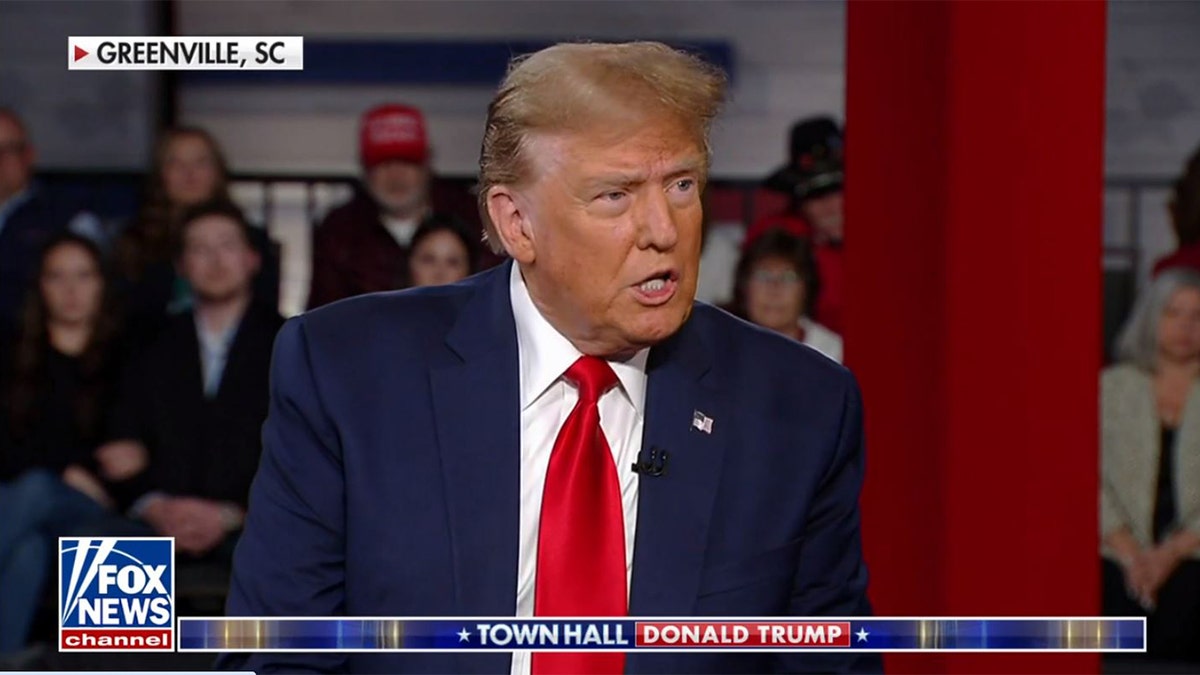

Aoc Condemns Trump On Fox News Sharp Exchange

May 09, 2025

Aoc Condemns Trump On Fox News Sharp Exchange

May 09, 2025 -

Mulher Polonesa Presa No Reino Unido Afirma Ser Maddie Mc Cann

May 09, 2025

Mulher Polonesa Presa No Reino Unido Afirma Ser Maddie Mc Cann

May 09, 2025 -

Ray Epps Vs Fox News A Defamation Case Examining January 6th Narratives

May 09, 2025

Ray Epps Vs Fox News A Defamation Case Examining January 6th Narratives

May 09, 2025