Analyzing The BigBear.ai (BBAI) Stock Price Fall Of 2025

Table of Contents

Market Sentiment and Investor Confidence: The Shifting Tides for BBAI

The sharp drop in BBAI's stock price wasn't isolated; it reflected a broader shift in market sentiment and investor confidence. Several factors played a crucial role in this downturn.

Negative News and Press Coverage

Negative news significantly impacted investor perception of BBAI.

- Missed Earnings Expectations: Several quarters of missed earnings expectations fueled concerns about the company's growth trajectory and profitability. [Link to hypothetical Q3 2025 Earnings Report]

- Contract Losses: The loss of several key government contracts, particularly in the crucial defense sector, eroded investor confidence in BBAI's future revenue streams. [Link to hypothetical news article about contract loss]

- Regulatory Scrutiny: Increased regulatory scrutiny surrounding the company's data handling practices added to the negative narrative. [Link to hypothetical regulatory filing]

This negative press coverage created a snowball effect, leading to further sell-offs.

Broader Market Trends

The BigBear.ai (BBAI) stock price fall of 2025 wasn't solely attributable to internal factors. The broader market climate also played a significant role.

- Interest Rate Hikes: Aggressive interest rate hikes by central banks aimed at combating inflation created a more risk-averse investment environment. Investors shifted towards safer assets, leading to a decline in tech stocks, including BBAI.

- Recession Fears: Growing concerns about a potential economic recession further dampened investor sentiment, causing widespread sell-offs across various sectors.

- Sector-Specific Downturn: A general downturn in the technology and artificial intelligence sector, perhaps due to overvaluation in previous years, might have disproportionately affected BBAI.

The correlation between the overall market decline and BBAI's performance was undeniable.

Competition and Industry Dynamics

Increased competition within the AI and data analytics sector also contributed to BBAI's struggles.

- Emergence of New Competitors: Several agile startups emerged, offering innovative solutions and potentially disrupting BBAI's market share.

- Aggressive Pricing Strategies: Established competitors adopted more aggressive pricing strategies, putting pressure on BBAI's margins and profitability.

- Technological Advancements: Rapid technological advancements in AI and machine learning may have rendered some of BBAI's existing offerings less competitive, requiring substantial investment in R&D to stay relevant.

Financial Performance and Internal Factors: Examining BBAI's Financials

A closer look at BBAI's financial performance reveals further contributing factors to the BigBear.ai (BBAI) stock price fall of 2025.

Earnings Reports and Financial Results

BBAI's financial results in the period leading up to the stock price decline showed a deteriorating trend.

- Declining Revenue: Revenue growth significantly slowed, failing to meet analysts' expectations.

- Shrinking Profit Margins: Profit margins were squeezed by increased competition and rising operational costs.

- Rising Debt Levels: The company's debt levels increased, raising concerns about its financial stability.

Management Changes and Corporate Strategy

Changes within BBAI's leadership and corporate strategy also contributed to the decline.

- CEO Resignation: The unexpected resignation of the CEO during a crucial period raised questions about the company's future direction.

- Strategic Realignment: A significant strategic realignment, while potentially necessary, created uncertainty among investors.

- Internal Restructuring: A major internal restructuring, though intended to streamline operations, temporarily disrupted the company's workflow and impacted performance.

Operational Challenges and Risks

BBAI faced several operational challenges and unforeseen risks:

- Supply Chain Disruptions: Disruptions to the global supply chain impacted the company's ability to deliver products and services on time.

- Cybersecurity Incidents: Concerns around cybersecurity incidents and data breaches also negatively affected investor confidence.

- Talent Acquisition Difficulties: Difficulties in attracting and retaining top talent in the competitive AI industry hindered growth and innovation.

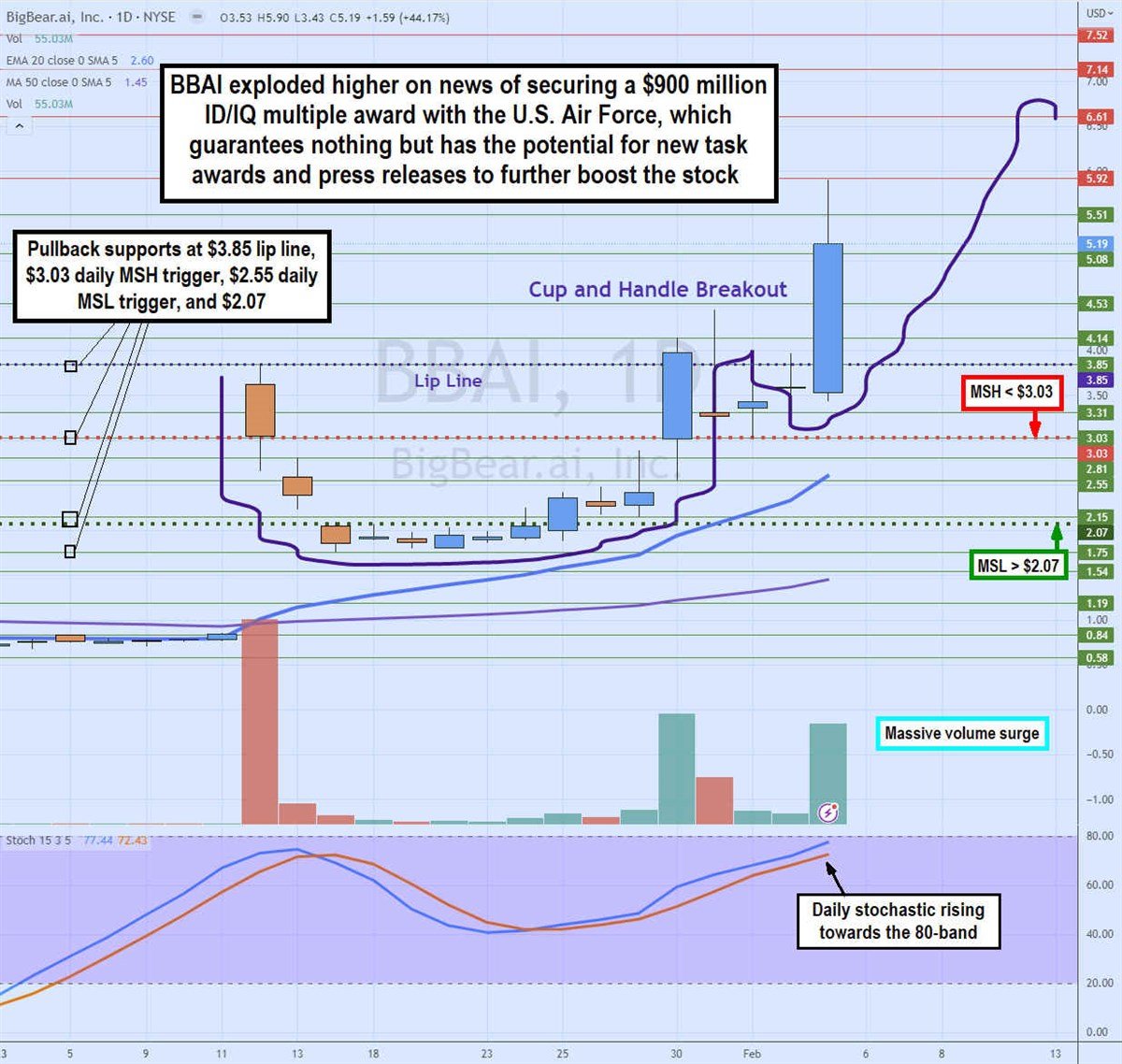

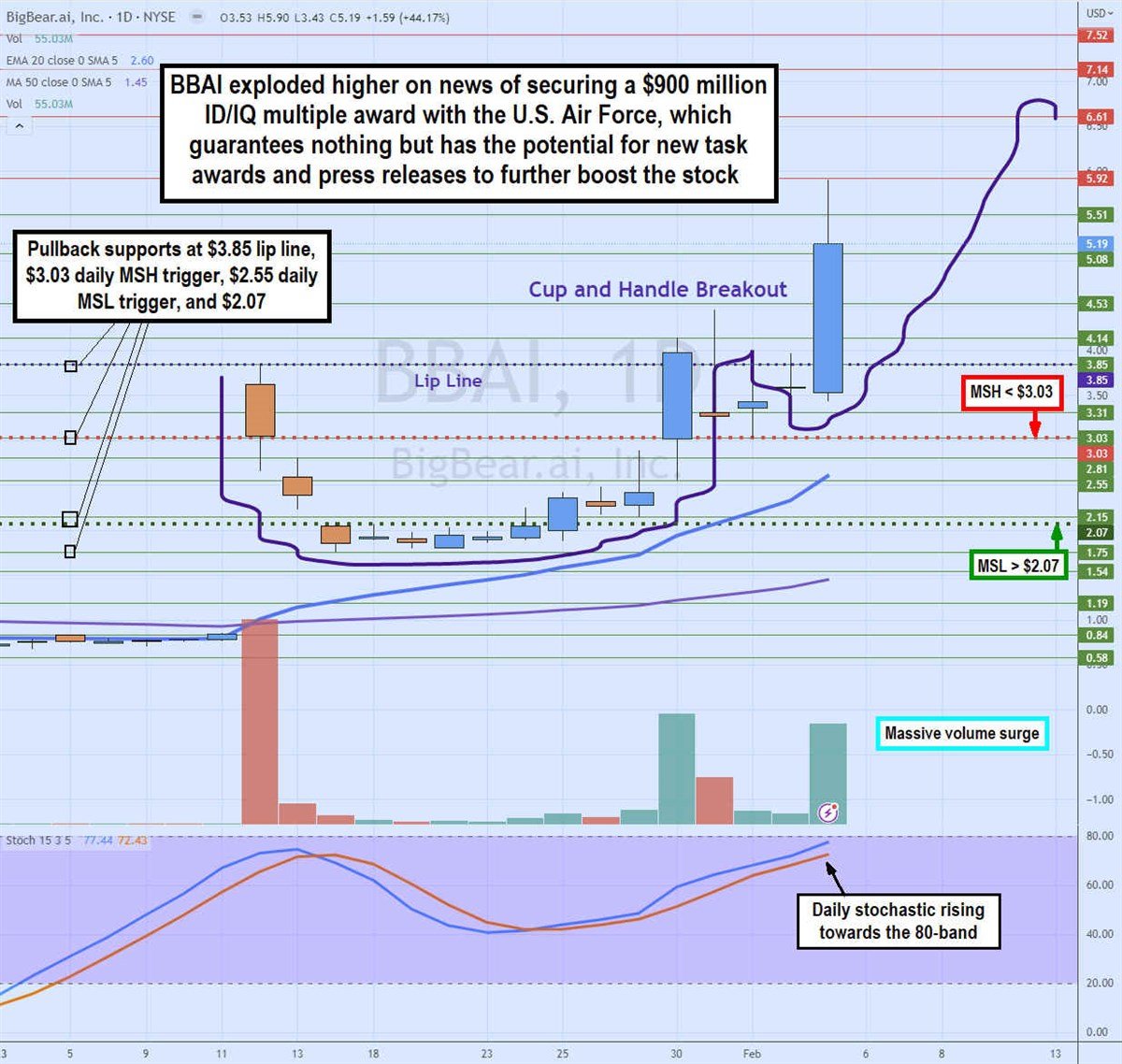

Technical Analysis of the BBAI Stock Price Fall: Chart Patterns and Indicators

Technical analysis offers another perspective on the BigBear.ai (BBAI) stock price fall of 2025.

Chart Patterns

Several chart patterns signaled the impending decline:

- Head and Shoulders Pattern: The formation of a classic head and shoulders pattern on the BBAI stock chart suggested a potential price reversal. [Insert hypothetical chart]

- Falling Wedge Pattern: A falling wedge pattern indicated a potential bearish breakout, confirming the downward trend. [Insert hypothetical chart]

Technical Indicators

Key technical indicators reinforced the bearish sentiment:

- RSI (Relative Strength Index): The RSI dipped below oversold levels, suggesting that the stock was significantly undervalued but still declining.

- MACD (Moving Average Convergence Divergence): The MACD signaled a bearish crossover, indicating a potential continuation of the downtrend.

Trading Volume and Volatility

High trading volume during the decline highlighted increased investor activity, indicating significant sell-offs. Increased volatility further reflected the uncertainty and panic in the market.

Conclusion: Lessons Learned from the BigBear.ai (BBAI) Stock Price Fall of 2025

The BigBear.ai (BBAI) stock price fall of 2025 was a complex event resulting from a confluence of factors. Negative news, broader market trends, internal challenges, and technical indicators all contributed to the significant decline. This event underscores the importance of understanding market sentiment, meticulously analyzing financial performance, and utilizing technical analysis tools when assessing the risk associated with investing in volatile stocks. Before investing in any stock, especially those as volatile as BBAI, conduct thorough due diligence and research. Understanding the potential risks involved in the BigBear.ai (BBAI) Stock Price and similar situations is crucial for informed decision-making. Further research into BigBear.ai (BBAI) stock price analysis and related companies is highly recommended.

Featured Posts

-

Bp Ceo Pay Cut A 31 Decrease Explained

May 21, 2025

Bp Ceo Pay Cut A 31 Decrease Explained

May 21, 2025 -

The Future Of Abc News Shows A Look At Recent Layoffs

May 21, 2025

The Future Of Abc News Shows A Look At Recent Layoffs

May 21, 2025 -

Restauration Du Patrimoine Breton Plouzane Et Clisson Beneficiaires De La Mission Patrimoine 2025

May 21, 2025

Restauration Du Patrimoine Breton Plouzane Et Clisson Beneficiaires De La Mission Patrimoine 2025

May 21, 2025 -

Reddits Viral Missing Girl Story The Unexpected Path To A Sydney Sweeney Film

May 21, 2025

Reddits Viral Missing Girl Story The Unexpected Path To A Sydney Sweeney Film

May 21, 2025 -

Trans Australia Run Current Record Holder Under Pressure

May 21, 2025

Trans Australia Run Current Record Holder Under Pressure

May 21, 2025

Latest Posts

-

United Kingdom News Tory Wifes Imprisonment For Southport Incident

May 22, 2025

United Kingdom News Tory Wifes Imprisonment For Southport Incident

May 22, 2025 -

Jail Term Stands Update On Tory Politicians Wifes Migrant Remarks Case

May 22, 2025

Jail Term Stands Update On Tory Politicians Wifes Migrant Remarks Case

May 22, 2025 -

Update Ex Tory Councillors Wifes Appeal For Racial Hatred Tweet

May 22, 2025

Update Ex Tory Councillors Wifes Appeal For Racial Hatred Tweet

May 22, 2025 -

Connollys Racial Hatred Conviction Upheld Appeal Rejected

May 22, 2025

Connollys Racial Hatred Conviction Upheld Appeal Rejected

May 22, 2025 -

Southport Stabbing Mothers Tweet Imprisonment And Housing Struggle

May 22, 2025

Southport Stabbing Mothers Tweet Imprisonment And Housing Struggle

May 22, 2025