Analyzing Sovereign Bond Markets With Swissquote Bank

Table of Contents

Understanding Sovereign Bonds and Their Risks

Sovereign bonds are debt securities issued by national governments to finance their spending. These bonds, often referred to as government bonds or treasury bills depending on the maturity and issuing entity, play a crucial role in global finance, providing a benchmark for interest rates and offering investors a relatively low-risk investment opportunity (though not without risk!).

Different types of sovereign bonds exist, each with varying maturities and risk profiles. For example, Treasury bills are short-term debt instruments, while government bonds can have maturities ranging from several years to decades.

Investing in sovereign bonds, however, isn't without risk. Key risks include:

- Credit Risk: The risk that the issuing government may default on its debt obligations. This risk is typically lower for financially stable nations but can increase during times of economic or political instability.

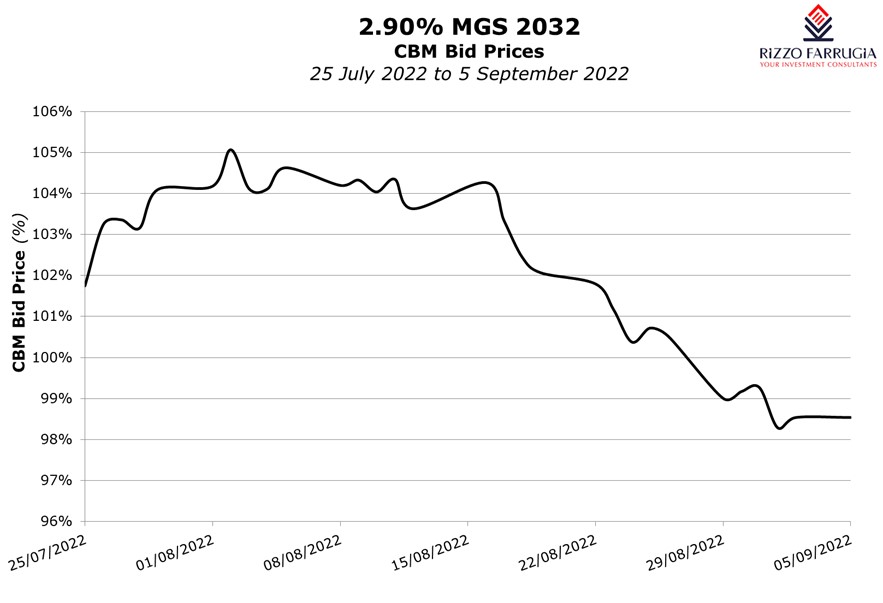

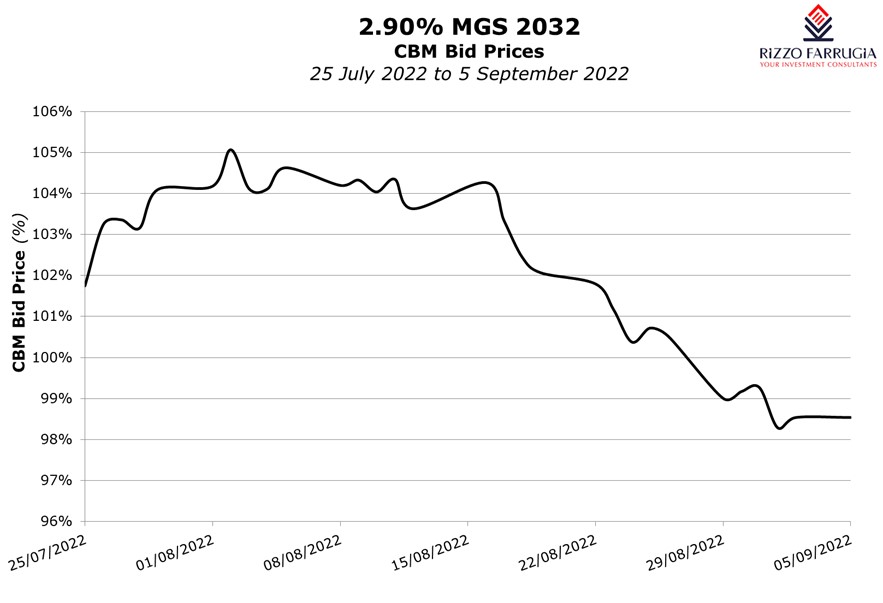

- Interest Rate Risk: The risk that changes in interest rates will affect the value of your bond holdings. Rising interest rates generally lead to falling bond prices, and vice versa.

- Inflation Risk: The risk that inflation will erode the purchasing power of your bond's returns. Inflation can significantly reduce the real return on your investment.

- Currency Risk: For bonds issued in foreign currencies, fluctuations in exchange rates can impact the value of your investment in your home currency.

Bullet Points:

- Credit rating agencies, such as Moody's, S&P, and Fitch, assess the creditworthiness of governments, influencing bond yields. Higher ratings typically correspond to lower yields (as they are perceived as less risky).

- Inflation and bond prices have an inverse relationship. Rising inflation generally pushes bond prices down, as investors demand higher yields to compensate for the erosion of purchasing power.

- Geopolitical events can significantly impact sovereign bond markets. Political instability, wars, or economic sanctions can lead to increased volatility and potentially lower bond prices.

Utilizing Swissquote Bank's Platform for Analysis

Swissquote Bank provides a robust platform for accessing real-time sovereign bond market data, equipping investors with the tools necessary for thorough analysis. Their platform offers:

- Real-time data feeds: Providing up-to-the-minute information on bond prices, yields, and other crucial metrics.

- Advanced charting tools: Allowing you to visualize market trends, identify patterns, and perform technical analysis.

- In-depth research reports: Offering expert insights and analysis on sovereign bond markets and individual issuers.

- Comprehensive market news: Keeping you informed about significant events that might influence bond prices.

Bullet Points:

- Navigating the platform: Swissquote's intuitive interface allows you to easily search for specific sovereign bonds, view their key characteristics, and place trades. A detailed tutorial is usually available on their website.

- Key data points: Understand terms such as yield (the return on investment), maturity (the date the bond expires), spread (the difference between the yield of a bond and a benchmark), and coupon (the periodic interest payment).

- Charting tools: Utilize Swissquote's charting tools to identify trends, support and resistance levels, and other technical indicators to help inform your trading decisions.

Key Metrics for Sovereign Bond Market Analysis

Several key metrics are essential for evaluating sovereign bonds and understanding the market's health:

- Yield Curves: A graph showing the relationship between the yields of bonds with different maturities. The shape of the yield curve can indicate future economic prospects. An upward-sloping curve typically suggests economic growth, while an inverted curve can signal a potential recession.

- Spreads: The difference in yield between two bonds with similar characteristics but different issuers (e.g., the yield spread between a U.S. Treasury bond and a corporate bond). Wider spreads generally indicate higher risk.

- Credit Ratings: Ratings assigned by credit rating agencies reflecting the creditworthiness of the issuing government. Higher ratings usually imply lower yields and lower risk.

Bullet Points:

- Yield curve analysis: A steepening yield curve suggests expectations of higher future interest rates, potentially indicating stronger economic growth. A flattening curve might signal uncertainty or slowing growth.

- Understanding credit spreads: A widening spread between government bonds and corporate bonds may suggest investors are becoming more risk-averse.

- Interpreting credit ratings: Changes in credit ratings can significantly impact bond prices. A downgrade typically leads to lower bond prices and higher yields.

Developing an Investment Strategy with Swissquote Bank

Using the insights gained through Swissquote Bank's platform, you can build a diversified portfolio of sovereign bonds aligned with your risk tolerance and investment goals.

Consider these strategies:

- Buy-and-hold strategy: A long-term approach focusing on accumulating bonds and holding them until maturity. Suitable for risk-averse investors seeking stable returns.

- Active trading strategy: A short-to-medium-term approach involving frequent buying and selling of bonds to capitalize on market fluctuations. Requires a higher risk tolerance and a deeper understanding of market dynamics.

Bullet Points:

- Diversification strategies: Diversify across different countries, maturities, and currencies to minimize risk.

- Risk management techniques: Employ strategies like hedging to protect against interest rate or currency fluctuations.

- Examples of successful strategies: A well-diversified portfolio combining high-quality government bonds with a small allocation to higher-yielding bonds can offer a balance between risk and return.

Conclusion: Mastering Sovereign Bond Market Analysis with Swissquote Bank

Analyzing sovereign bond markets effectively requires access to reliable data and sophisticated analytical tools. Swissquote Bank’s platform provides both, empowering investors to make informed decisions. By understanding key metrics, managing risks, and employing diverse investment strategies, you can navigate this critical asset class successfully. Mastering the analysis of sovereign bonds with Swissquote Bank's comprehensive resources allows you to participate confidently in a fundamental component of the global financial system. Ready to enhance your understanding of sovereign bond markets? Visit Swissquote Bank today and start your analysis! [Link to Swissquote Bank's relevant page]

Featured Posts

-

Az Rbaycan S Fur 2025 Avroviziya Mahni Muesabiq Sinin Soezcuesue

May 19, 2025

Az Rbaycan S Fur 2025 Avroviziya Mahni Muesabiq Sinin Soezcuesue

May 19, 2025 -

Un Classique Revisite Recette Du Salami Au Chocolat A La Francaise

May 19, 2025

Un Classique Revisite Recette Du Salami Au Chocolat A La Francaise

May 19, 2025 -

Actor Mark Rylance Speaks Out Against Music Festivals Prison Like Conditions In London Parks

May 19, 2025

Actor Mark Rylance Speaks Out Against Music Festivals Prison Like Conditions In London Parks

May 19, 2025 -

Understanding The Royal Mail Stamp Price Increases On April 7th

May 19, 2025

Understanding The Royal Mail Stamp Price Increases On April 7th

May 19, 2025 -

Muere Joan Aguilera El Primer Espanol En Ganar Un Masters 1000 Nos Deja

May 19, 2025

Muere Joan Aguilera El Primer Espanol En Ganar Un Masters 1000 Nos Deja

May 19, 2025