Analyzing Ripple's (XRP) Position As The World's Fourth-Largest Cryptocurrency.

Table of Contents

XRP's Technological Advantages and Use Cases

XRP's success isn't solely driven by speculation; its underlying technology and practical use cases play a crucial role.

The RippleNet Network and its Efficiency

RippleNet, Ripple's payment network, is designed for speed, cost-effectiveness, and global reach. It offers a significant advantage over traditional banking systems and even some other crypto networks. Its focus is on facilitating cross-border payments, a notoriously slow and expensive process for banks. RippleNet boasts significantly faster transaction speeds and lower fees compared to Bitcoin or Ethereum.

- Examples of banks and financial institutions using RippleNet: Several major banks globally, including Santander, SBI Holdings, and MoneyGram, have integrated RippleNet into their operations.

- Comparison of transaction times and fees: While Bitcoin transactions can take minutes to hours to confirm, and Ethereum transactions can be similarly slow and expensive depending on network congestion, RippleNet transactions are typically completed in seconds to minutes, with significantly lower fees. This efficiency is a key driver of its adoption.

XRP's Role in Facilitating Global Transactions

XRP serves as a bridge currency within RippleNet, enabling the seamless transfer of various fiat currencies. This facilitates global transactions, addressing the critical issues of remittance and international payments. Its on-demand liquidity feature further enhances efficiency by allowing institutions to instantly access liquidity in different currencies, reducing delays and minimizing reliance on correspondent banks.

- Statistics on cross-border transaction volume: The volume of transactions facilitated by RippleNet continues to grow, showcasing the increasing reliance on XRP for international payments. While precise figures can be difficult to obtain publicly, industry reports indicate substantial growth year over year.

- Real-world examples of XRP's use in facilitating international payments: Several real-world examples highlight XRP's practical applications. For instance, MoneyGram utilizes XRP to streamline cross-border transfers, improving speed and reducing costs for their customers.

Market Capitalization and Trading Volume of XRP

Understanding XRP's market position requires examining its market capitalization, trading volume, and price volatility.

Analyzing XRP's Market Ranking and Volatility

XRP consistently ranks among the top cryptocurrencies by market capitalization, although its precise ranking fluctuates. Its price has historically exhibited significant volatility, influenced by market sentiment, regulatory developments, and technological advancements. Analyzing XRP's price chart reveals periods of both substantial gains and considerable losses. Monitoring its crypto market ranking alongside BTC, ETH, and other major players provides a crucial context for assessing its performance.

- Comparison of XRP's market cap with other top cryptocurrencies (BTC, ETH, etc.): While Bitcoin and Ethereum maintain larger market caps, XRP's market cap remains substantial, placing it firmly within the top tier of cryptocurrencies.

- Analysis of price trends and factors influencing XRP's value: Several factors impact XRP's price, including overall crypto market trends, regulatory news (particularly concerning the SEC lawsuit), and the adoption rate of RippleNet by financial institutions.

XRP's Trading Liquidity and Accessibility

XRP boasts relatively high trading liquidity and accessibility. It's listed on numerous major cryptocurrency exchanges, ensuring ease of buying, selling, and trading. High exchange volume and deep order books generally contribute to smoother trading experiences.

- List of major exchanges that list XRP: Binance, Coinbase, Kraken, and many other prominent exchanges offer XRP trading pairs.

- Discussion of trading volume and order book depth on major exchanges: The considerable trading volume and order book depth on these exchanges contribute to XRP's liquidity, making it relatively easy to buy and sell large quantities without significantly impacting the price.

Regulatory Landscape and Legal Challenges Facing XRP

The regulatory landscape significantly impacts XRP's future. The most prominent challenge is the ongoing SEC lawsuit.

The SEC Lawsuit and its Implications

The SEC lawsuit against Ripple Labs, alleging that XRP is an unregistered security, presents a considerable hurdle. The outcome of this legal battle will significantly influence XRP's price and future adoption. The arguments presented by both the SEC and Ripple are complex and involve legal interpretations of securities law as it applies to cryptocurrencies.

- Key arguments presented by both the SEC and Ripple: The SEC argues that XRP sales constituted unregistered securities offerings. Ripple counters that XRP is a currency and not a security.

- Potential outcomes of the lawsuit and their implications for XRP: A ruling against Ripple could severely impact XRP's price and potentially lead to delisting from some exchanges. A favorable ruling, however, could boost its price and pave the way for wider adoption.

Global Regulatory Scrutiny of Cryptocurrencies

The regulatory landscape for cryptocurrencies is evolving globally. Different countries adopt varying approaches, ranging from outright bans to more permissive frameworks. This regulatory uncertainty creates challenges for XRP's global adoption, as compliance requirements vary significantly across jurisdictions.

- Examples of different countries' approaches to regulating cryptocurrencies: Some countries, like El Salvador, have embraced Bitcoin as legal tender, while others maintain stricter regulations or outright bans.

- The impact of varying regulatory frameworks on XRP's global adoption: The inconsistent regulatory environment adds complexity to XRP's international expansion, requiring Ripple to navigate a diverse and evolving legal landscape.

Conclusion: Assessing Ripple's (XRP) Future and Position in the Crypto Market

Ripple's (XRP) position as a leading cryptocurrency is complex. While its technology offers advantages in speed and cost-effectiveness for cross-border payments, its success is significantly intertwined with the ongoing legal challenges and the broader regulatory environment. The SEC lawsuit remains a crucial factor influencing XRP's price and adoption. Despite its technological merits and market presence, investing in XRP carries substantial risk, given the regulatory uncertainty. While XRP's technological capabilities are noteworthy and its market position remains significant, understanding the inherent risks associated with crypto investments, particularly in light of the ongoing SEC lawsuit, is critical. Therefore, before investing in Ripple's (XRP) position as the world's fourth-largest cryptocurrency, or any cryptocurrency, conduct thorough research and understand the potential rewards and risks involved.

Featured Posts

-

Target And Dei Examining The Change In Stance

May 01, 2025

Target And Dei Examining The Change In Stance

May 01, 2025 -

Noa Argamani Rescued Hostage Named To Times 100 Most Influential People

May 01, 2025

Noa Argamani Rescued Hostage Named To Times 100 Most Influential People

May 01, 2025 -

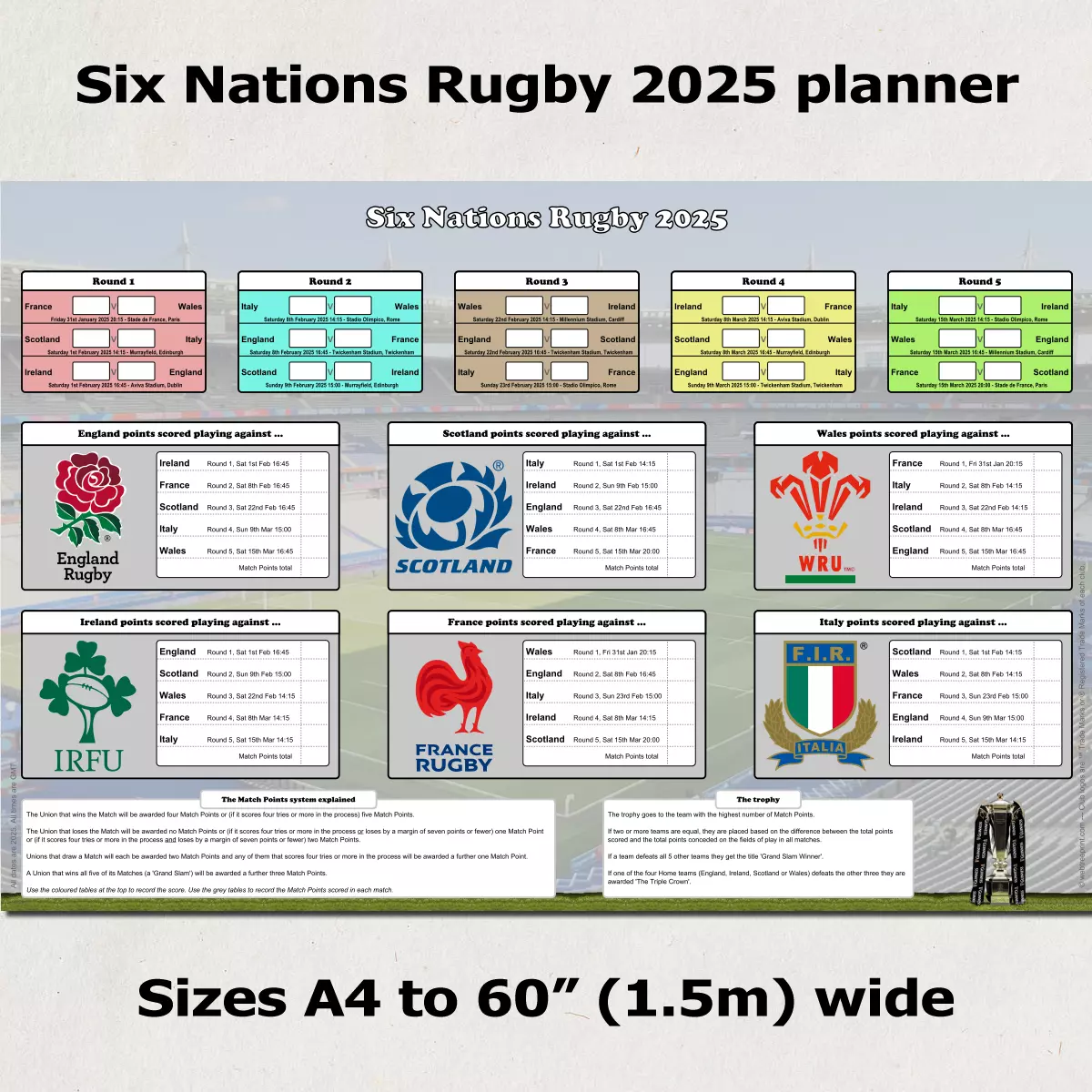

Analyzing Frances Rugby Prospects Six Nations 2025

May 01, 2025

Analyzing Frances Rugby Prospects Six Nations 2025

May 01, 2025 -

Will Complaining Get You Banned From A Cruise Ship The Facts

May 01, 2025

Will Complaining Get You Banned From A Cruise Ship The Facts

May 01, 2025 -

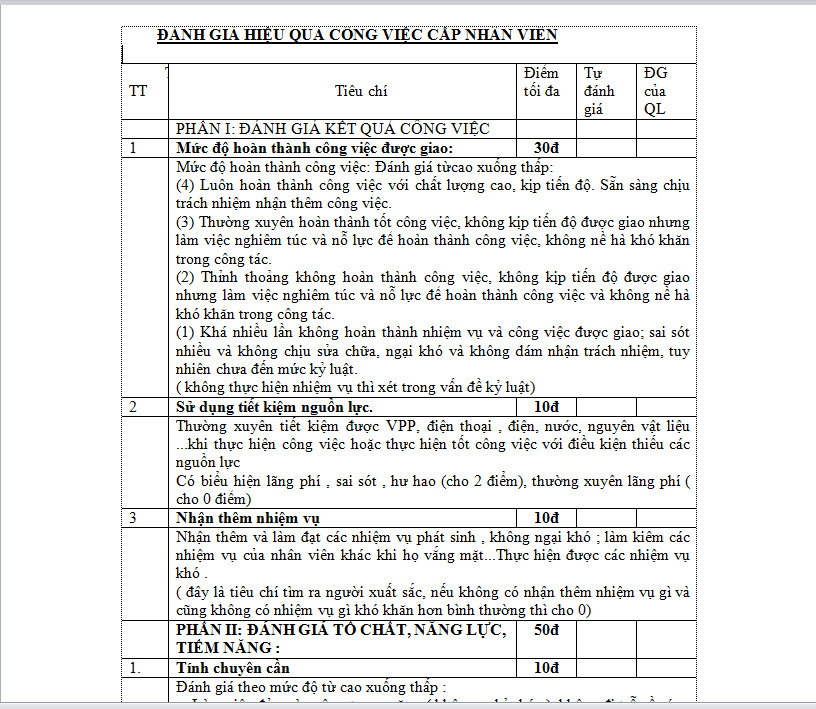

Gia Tieu Hom Nay Tin Tuc Thi Truong Tieu Moi Nhat

May 01, 2025

Gia Tieu Hom Nay Tin Tuc Thi Truong Tieu Moi Nhat

May 01, 2025