Analyzing QBTS Stock Performance Ahead Of Earnings Announcement

Table of Contents

Recent QBTS Stock Performance and Market Trends

Analyzing recent QBTS stock price movements is the first step in predicting its future trajectory. Examining the stock's performance over the past few months, including highs, lows, and average trading volume, provides a valuable context. We need to look at the bigger picture, too.

-

QBTS Stock Price Chart Analysis: (Here, you would insert a chart showing the QBTS stock price over the relevant period. Clearly label the chart and highlight significant trends). A visual representation helps illustrate recent volatility and overall direction. Look for patterns and significant shifts.

-

Identifying Key Market Influences: Several factors can significantly impact QBTS stock price. These include:

- Industry News: Any major developments in the tech sector (or relevant sector depending on QBTS's industry) can influence investor sentiment. For example, new regulations, technological breakthroughs, or competitor actions can all impact the QBTS stock price.

- Economic Factors: Broad economic trends, such as interest rate changes, inflation rates, and overall economic growth, also play a significant role. A strong economy often benefits tech stocks, while economic downturns can lead to increased volatility.

- Competitor Actions: The actions of QBTS's competitors, such as new product launches, successful marketing campaigns, or strategic partnerships, can directly influence investor perception of QBTS and its future prospects.

-

Bullet Points: A Summary of Recent Data

- Review of QBTS's recent financial reports (if available): Analyze any publicly available financial reports, press releases, and investor presentations. Look for trends in revenue, expenses, and profitability.

- Comparison of QBTS's performance to competitors: Benchmark QBTS's performance against its key competitors to understand its relative strength and position within the market.

- Analysis of overall market sentiment towards the tech sector (or relevant sector): Consider the broader market sentiment towards the sector QBTS operates in. Is the overall market bullish or bearish? This context adds perspective.

Factors to Consider Before the Earnings Announcement

Before the earnings announcement, several factors require careful consideration. Understanding these will better prepare you for potential market movements.

-

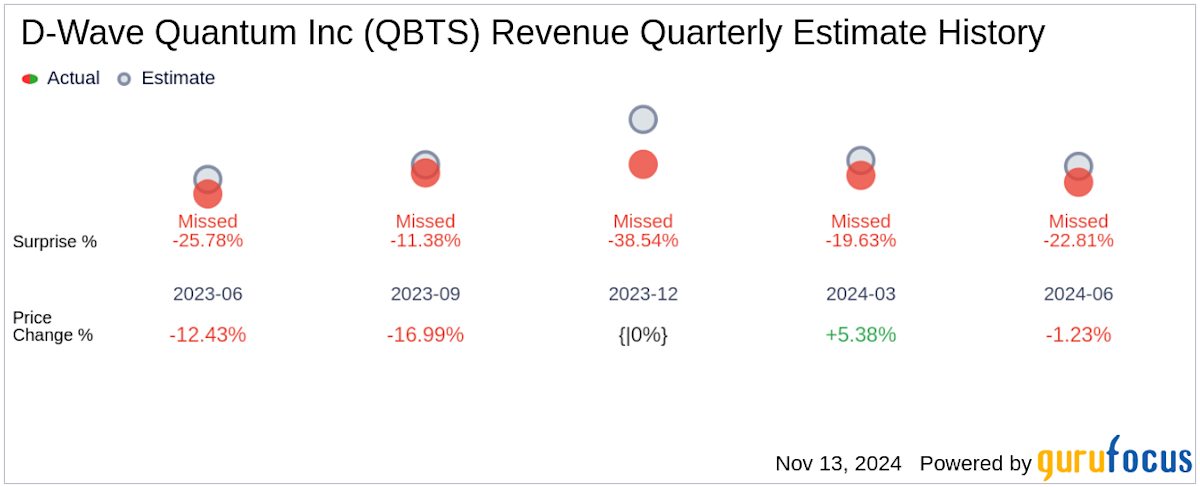

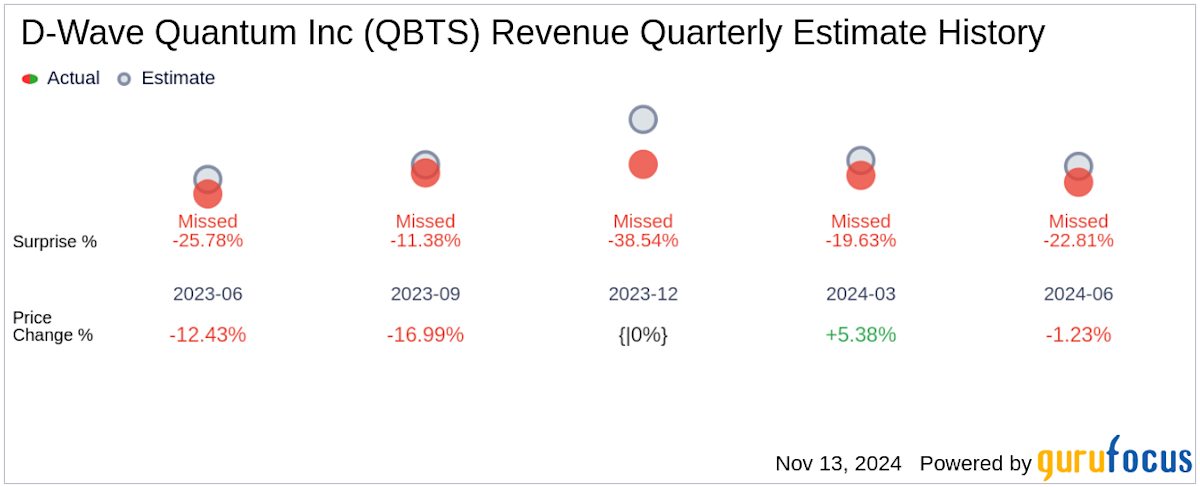

Analyst Expectations: Consensus estimates from financial analysts provide a valuable benchmark. Examine the range of earnings per share (EPS) and revenue predictions from various analysts to get a sense of the expected outcome. Discrepancies in these predictions might signal potential volatility.

-

Key Performance Indicators (KPIs): Focus on KPIs that are likely to heavily influence investor reactions. These might include:

- Earnings Per Share (EPS): The profitability of the company on a per-share basis. A significant increase or decrease will strongly affect the QBTS stock price.

- Revenue Growth: The percentage change in revenue compared to the same period last year. Consistent growth is a positive signal.

- Customer Acquisition Cost (CAC): A key metric for assessing the efficiency of the company's marketing and sales efforts. Lower CAC is generally preferred.

- Gross Margin: This shows how efficiently a company is producing its goods or services. A higher margin usually indicates better profitability.

-

Potential Risks and Opportunities: Identify potential positive and negative surprises.

-

Bullet Points: Important Considerations

- Impact of any recent product launches or partnerships: Have recent initiatives boosted QBTS’s prospects?

- Analysis of the company's debt levels and financial health: High debt levels can signal increased risk, while strong financial health reduces risk.

- Potential regulatory changes or legal challenges: Any legal or regulatory headwinds might negatively impact the stock price.

Strategies for Navigating QBTS Stock Post-Earnings

Developing a clear trading strategy before the earnings announcement is crucial. Consider these approaches:

-

Developing a Trading Strategy: Formulate different strategies depending on the potential earnings outcomes:

- Beating Expectations: If QBTS surpasses analyst expectations, the stock price is likely to rise. Have a plan to capitalize on this potential upside.

- Meeting Expectations: If QBTS meets expectations, the stock price may show modest movement. Be prepared for less dramatic changes.

- Missing Expectations: If QBTS misses expectations, the stock price could decline. Have a plan to mitigate potential losses.

-

Risk Management Considerations: Diversification and risk management are essential.

-

Alternative Investment Approaches: Options trading can offer leveraged exposure, but carries significantly higher risk. Thoroughly understand the associated risks before considering such strategies.

-

Bullet Points: Practical Steps

- Setting stop-loss orders: This limits potential losses if the stock price moves against your expectations.

- Utilizing technical analysis: Tools like charts and indicators can help identify potential entry and exit points.

- Considering the overall investment timeframe and risk tolerance: Align your trading strategy with your risk tolerance and long-term investment goals.

Conclusion

This analysis of QBTS stock performance ahead of the earnings announcement highlights the importance of considering various factors, including recent market trends, analyst expectations, and potential risks and opportunities. Understanding these elements is crucial for making well-informed investment decisions.

Call to Action: Stay informed about the upcoming QBTS earnings announcement and continue monitoring QBTS stock performance for optimal investment strategies. Remember to conduct thorough research and consider professional financial advice before making any investment decisions related to QBTS stock or any other security. Further analysis of QBTS stock is recommended before investing. Remember, investing in QBTS stock, or any stock, involves risk.

Featured Posts

-

Councillors Wife Fights Jail Term After Anti Migrant Social Media Post

May 21, 2025

Councillors Wife Fights Jail Term After Anti Migrant Social Media Post

May 21, 2025 -

Juergen Klopp Nereye Gidecek En Guencel Transfer Haberleri

May 21, 2025

Juergen Klopp Nereye Gidecek En Guencel Transfer Haberleri

May 21, 2025 -

Winter Storm And School Closings A Guide For Parents And Students

May 21, 2025

Winter Storm And School Closings A Guide For Parents And Students

May 21, 2025 -

The Ultimate Guide To Cassis Blackcurrant Cocktails

May 21, 2025

The Ultimate Guide To Cassis Blackcurrant Cocktails

May 21, 2025 -

Abn Amro Huizenprijzen En Renteprognoses 2024

May 21, 2025

Abn Amro Huizenprijzen En Renteprognoses 2024

May 21, 2025

Latest Posts

-

Racist Tweets Lead To Jail Time For Tory Councillors Wife Southport Incident

May 22, 2025

Racist Tweets Lead To Jail Time For Tory Councillors Wife Southport Incident

May 22, 2025 -

Tory Councillors Wife Jailed For Racist Tweets The Southport Case

May 22, 2025

Tory Councillors Wife Jailed For Racist Tweets The Southport Case

May 22, 2025 -

Councillors Wife Faces Jail After Anti Migrant Social Media Post

May 22, 2025

Councillors Wife Faces Jail After Anti Migrant Social Media Post

May 22, 2025 -

Southport Stabbing Mums Tweet Costs Her Freedom And Home

May 22, 2025

Southport Stabbing Mums Tweet Costs Her Freedom And Home

May 22, 2025 -

Southport Stabbing Tweet Leads To Mums Imprisonment And Housing Crisis

May 22, 2025

Southport Stabbing Tweet Leads To Mums Imprisonment And Housing Crisis

May 22, 2025