Analyzing Proxy Statements (Form DEF 14A) For Informed Decision-Making

Table of Contents

Understanding the Structure and Content of a DEF 14A

Proxy statements, also known as Form DEF 14A, are detailed reports companies send to shareholders before a shareholder meeting. Analyzing proxy statements effectively requires understanding their structure and content. Effective analyzing proxy statements involves a deep dive into various sections to gain a holistic view of the company's performance and future plans.

Key Sections and Their Significance

A DEF 14A contains several key sections vital for investment decisions. Understanding these sections is paramount for successful proxy voting analysis.

- Executive Compensation: This section details the compensation packages of company executives, including salary, bonuses, stock options, restricted stock units (RSUs), and other benefits. Executive compensation analysis is crucial for assessing pay-for-performance alignment and identifying potential conflicts of interest.

- Shareholder Proposals: This section outlines proposals submitted by shareholders, covering various issues like environmental, social, and governance (ESG) matters, corporate governance reforms, and other significant topics. Shareholder proposal analysis helps understand shareholder concerns and the company's response to them.

- Director Nominations: This section details the slate of nominees for the board of directors, along with their qualifications and backgrounds. Analyzing this section is key for evaluating the board's composition and its potential impact on company strategy.

- Merger and Acquisition Details: If the company is involved in a merger or acquisition, this section provides details about the transaction, including terms and conditions. Understanding these details is crucial for evaluating the potential impact on shareholders.

- Other Material Information: This section may include other information relevant to shareholders, such as significant financial data, legal proceedings, or other important company announcements.

Identifying Key Information for Informed Voting

Informed shareholder voting requires careful identification of crucial information within the proxy statement. Effective proxy voting strategies rely on this analysis.

- Understanding the Implications of Different Proposals: Carefully consider the potential impact of each shareholder proposal on the company's long-term strategy and shareholder value.

- Evaluating Director Qualifications: Assess the experience and expertise of director nominees and determine if they possess the skills necessary to guide the company effectively.

- Assessing Potential Conflicts of Interest: Look for potential conflicts of interest among executives, directors, and other related parties.

- Identifying Red Flags: Pay attention to any red flags that may signal potential problems within the company, such as unusual accounting practices, significant legal issues, or questionable executive compensation practices.

- Utilizing Financial Data: Analyze the financial data presented in the proxy statement to compare executive pay to company performance and industry benchmarks. This is vital for informed decision-making.

Analyzing Executive Compensation and its Implications

A critical aspect of analyzing proxy statements is the scrutiny of executive compensation. Understanding executive compensation disclosure is key to informed investing.

Deciphering Executive Pay Packages

Executive pay packages often involve complex structures. Understanding these structures requires careful analysis.

- Salary: Base salary provides a baseline understanding of compensation.

- Bonuses: Performance-based bonuses incentivize achievement of company objectives.

- Stock Options: Stock options provide executives with the right to purchase company stock at a predetermined price.

- Restricted Stock Units (RSUs): RSUs are shares of company stock that vest over time, subject to certain conditions.

- Other Compensation: This can include perks, benefits, and other forms of compensation.

Comparing executive pay to company performance and industry benchmarks helps assess whether compensation aligns with company success. Pay-for-performance analysis should reveal whether executive compensation is justified relative to company results.

Identifying Potential Conflicts of Interest

Scrutinizing executive compensation helps identify potential conflicts of interest.

- Golden Parachutes: Excessive severance packages for executives may incentivize poor decisions.

- Excessive Perks: Unnecessary perks suggest a lack of fiscal responsibility.

- Related-Party Transactions: Transactions with related parties can raise concerns about potential self-dealing.

Identifying these elements is crucial for objective investment decisions and assessing corporate governance. Conflict of interest analysis forms a core part of due diligence when reviewing proxy statements.

Evaluating Shareholder Proposals and Their Impact

Shareholder proposals provide insights into investor concerns and priorities, and are an essential part of analyzing proxy statements.

Understanding the Nature of Shareholder Proposals

Shareholder proposals address a variety of concerns:

- Environmental, Social, and Governance (ESG) Proposals: These address issues like climate change, social responsibility, and corporate governance. ESG investing is increasingly important, and these proposals reflect that trend.

- Corporate Governance Reforms: Proposals may seek improvements to board structure, executive compensation, or other governance practices.

- Other Significant Proposals: These could include changes to the company's bylaws or other significant corporate actions.

Assessing the merits of each proposal requires careful consideration of its potential implications for the company's future and shareholder value.

Assessing the Company's Response to Shareholder Proposals

Analyzing the company's response to shareholder proposals is vital. This includes:

- Management's Recommendation: Understand the company's position on each proposal and the rationale behind it.

- Rationale Behind the Recommendation: Scrutinize the explanations provided by management to assess their validity and alignment with shareholder interests.

- Potential Consequences: Consider the potential impact of adopting or rejecting the proposals on the company's future. Management response analysis helps determine whether the company is responsive to shareholder concerns. Proxy voting recommendations should be based on this comprehensive analysis.

Utilizing Resources and Tools for Efficient Analysis

Several resources and tools simplify analyzing proxy statements.

Online Resources and Databases

Several online resources are available:

- SEC's EDGAR Database: The SEC's Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system is the primary source for SEC filings, including proxy statements. [Link to EDGAR database]

- Specialized Financial Data Providers: Companies like Bloomberg and Refinitiv offer comprehensive financial data and analysis tools that can assist in analyzing proxy statements.

Software and Analytical Tools

While dedicated proxy statement analysis software is less common, various tools can assist:

- Spreadsheet Software: Excel or Google Sheets can help organize and analyze data extracted from proxy statements.

- Data Extraction Tools: Certain software can extract relevant data from the proxy statement, streamlining the analysis process.

The benefits of these tools include time savings and enhanced accuracy in the analysis.

Conclusion

Successfully analyzing proxy statements (Form DEF 14A) is vital for making well-informed investment decisions. By understanding the structure of a proxy statement, scrutinizing executive compensation, and carefully evaluating shareholder proposals, investors can significantly improve their ability to engage in corporate governance and safeguard their investments. Remember to utilize available online resources and tools to streamline your analysis process. Take control of your investment decisions by mastering the art of analyzing proxy statements – your informed participation makes a difference. Start analyzing proxy statements today and become a more active and informed investor!

Featured Posts

-

Best Crypto Casinos 2025 Top Bitcoin Casinos With Easy Withdrawals And Exclusive Bonuses

May 17, 2025

Best Crypto Casinos 2025 Top Bitcoin Casinos With Easy Withdrawals And Exclusive Bonuses

May 17, 2025 -

Rockwell Automations Strong Earnings Drive Market Rally Angi Bwa And More

May 17, 2025

Rockwell Automations Strong Earnings Drive Market Rally Angi Bwa And More

May 17, 2025 -

Reebok X Angel Reese Collaboration Shoes Apparel And Impact

May 17, 2025

Reebok X Angel Reese Collaboration Shoes Apparel And Impact

May 17, 2025 -

Market Movers Rockwell Automation Angi Borg Warner And More

May 17, 2025

Market Movers Rockwell Automation Angi Borg Warner And More

May 17, 2025 -

Fortnite Item Shop Navigating The New Feature

May 17, 2025

Fortnite Item Shop Navigating The New Feature

May 17, 2025

Latest Posts

-

Tvs Jupiter Ather 450 X Hero Pleasure

May 17, 2025

Tvs Jupiter Ather 450 X Hero Pleasure

May 17, 2025 -

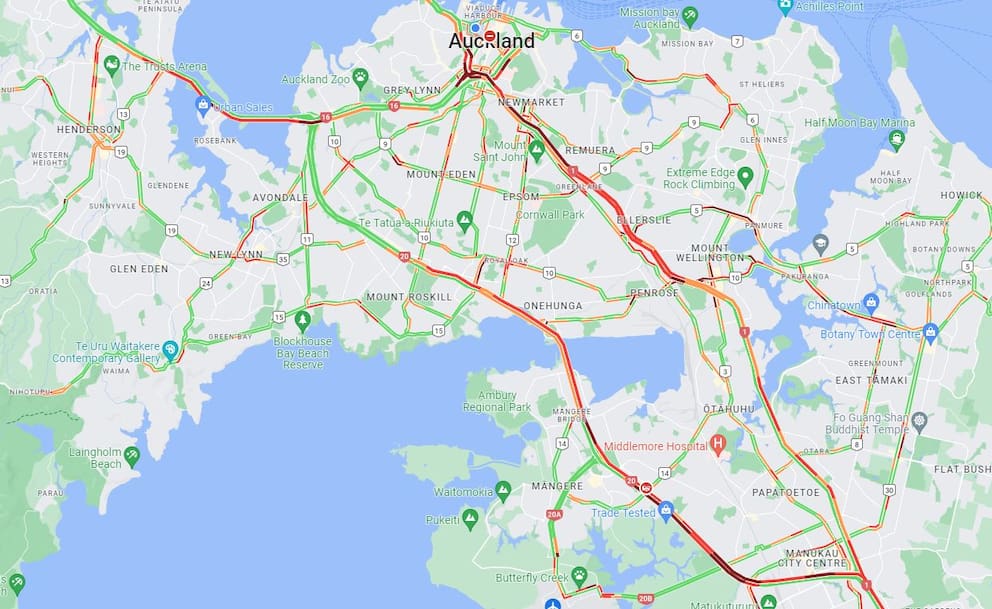

Risky E Scooter Ride On Aucklands Southern Motorway Dashcam Footage Released

May 17, 2025

Risky E Scooter Ride On Aucklands Southern Motorway Dashcam Footage Released

May 17, 2025 -

Dashcam Catches E Scooter On Busy Auckland Southern Motorway A Safety Concern

May 17, 2025

Dashcam Catches E Scooter On Busy Auckland Southern Motorway A Safety Concern

May 17, 2025 -

Tvs Jupiter Cng

May 17, 2025

Tvs Jupiter Cng

May 17, 2025 -

Comparatif Xiaomi Scooter 5 5 Pro Et 5 Max Laquelle Choisir

May 17, 2025

Comparatif Xiaomi Scooter 5 5 Pro Et 5 Max Laquelle Choisir

May 17, 2025