Analyzing Nike's Potential Five-Year Revenue Low

Table of Contents

Main Points:

2.1. Weakening Consumer Demand and Shifting Market Trends

H3: Declining Disposable Incomes and Inflation

Inflationary pressures and reduced disposable incomes are significantly impacting consumer spending. Athletic apparel, often considered a discretionary purchase, is particularly vulnerable.

- Statistic: The US inflation rate reached X% in [Month, Year], impacting consumer confidence and reducing discretionary spending.

- Statistic: Consumer confidence indices show a Y% decrease in [Time Period], indicating a reluctance to make non-essential purchases.

- Market Research: A recent study by [Source] revealed a Z% decrease in consumer spending on premium athletic apparel in [Region]. This suggests a potential shift towards more affordable alternatives.

H3: Increased Competition from Emerging Brands

Nike faces growing pressure from both established competitors like Adidas and Under Armour, and a wave of new, disruptive brands utilizing innovative marketing and direct-to-consumer strategies.

- Competitor Analysis: Adidas' successful collaborations and targeted marketing campaigns have eroded Nike's market share in [Specific Market Segment].

- Competitor Analysis: Under Armour’s focus on performance technology continues to attract a dedicated customer base, challenging Nike’s dominance.

- Direct-to-Consumer Impact: The rise of direct-to-consumer brands allows for greater price flexibility and personalized marketing, attracting customers away from traditional retail giants like Nike.

H3: Changing Consumer Preferences

Consumer preferences are evolving rapidly. Sustainability, ethical sourcing, and unique style are increasingly important factors influencing purchasing decisions.

- Sustainability Trend: The demand for eco-friendly and ethically produced athletic apparel is growing, pushing brands like Nike to adopt more sustainable practices.

- Athleisure Trend: The blurring lines between athletic wear and everyday clothing are influencing design choices and creating new market opportunities, but also increasing competition.

- Nike's Response: Nike's initiatives like the use of recycled materials and partnerships with sustainable suppliers indicate its efforts to address these changing preferences, however the effectiveness of these efforts remain to be seen.

2.2. Supply Chain Disruptions and Production Challenges

H3: Geopolitical Instability and Manufacturing Bottlenecks

Global events continue to disrupt Nike's supply chain, impacting production timelines and increasing costs.

- Pandemic Impact: The lingering effects of the COVID-19 pandemic, including factory closures and shipping delays, have created bottlenecks and increased lead times.

- Geopolitical Factors: Trade wars and political instability in key manufacturing regions have added complexity and uncertainty to Nike’s supply chain management.

- Cost Implications: Production delays can lead to missed sales opportunities and reduced revenue, further impacting Nike’s financial performance.

H3: Rising Raw Material Costs and Transportation Expenses

Increased costs for raw materials, such as cotton and synthetic fibers, coupled with soaring transportation expenses, significantly impact Nike's profitability.

- Raw Material Inflation: The price of cotton has increased by X% in the past year, directly impacting Nike's production costs.

- Transportation Costs: Global shipping costs remain elevated, adding to the overall cost of getting products to market.

- Nike's Mitigation Strategies: Nike is implementing cost-cutting measures and exploring alternative sourcing strategies to mitigate the impact of rising raw material and transportation costs, but their success is yet to be fully assessed.

2.3. Nike's Strategic Response and Future Outlook

H3: Nike's Strategies to Combat the Potential Revenue Decline

Nike is actively implementing several strategies to mitigate risks and stimulate revenue growth.

- New Product Launches: Continuous innovation and the launch of new products and technologies are crucial to maintaining market relevance and attracting customers.

- Targeted Marketing Campaigns: Nike's marketing efforts are focused on enhancing brand engagement and reaching new customer segments through targeted digital advertising and influencer collaborations.

- Digital Transformation: Investing in its digital platforms and enhancing its e-commerce capabilities are key strategies to improve customer experience and drive online sales.

- Market Expansion: Exploring new and emerging markets provides opportunities for revenue growth and diversification.

H3: Financial Projections and Expert Opinions

Financial analysts offer varying perspectives on Nike's future financial performance.

- Analyst Forecast 1: [Analyst Name] at [Financial Institution] predicts a Y% revenue growth for Nike over the next five years.

- Analyst Forecast 2: [Analyst Name] at [Financial Institution] expresses caution, suggesting a potential for slower growth due to the aforementioned challenges.

- Industry Expert Opinion: [Expert Name] highlights the importance of Nike's adaptability and innovation in navigating the current economic climate.

Conclusion: Navigating the Potential for Nike's Five-Year Revenue Low

Several factors, including weakening consumer demand, supply chain disruptions, and increased competition, contribute to the potential for a five-year revenue low for Nike. While Nike is actively implementing strategies to mitigate these risks, the success of these initiatives remains to be seen. Staying updated on Nike's financial performance and the ongoing analysis of its potential five-year revenue low is crucial for both investors and consumers interested in the athletic apparel market. Understanding these challenges and Nike's response will be key to predicting the future of this iconic brand.

Featured Posts

-

Watch Celtics Vs Suns Live April 4th Game Time Tv And Streaming Options

May 06, 2025

Watch Celtics Vs Suns Live April 4th Game Time Tv And Streaming Options

May 06, 2025 -

Celtics Vs Knicks Live Stream Tv Channel And How To Watch

May 06, 2025

Celtics Vs Knicks Live Stream Tv Channel And How To Watch

May 06, 2025 -

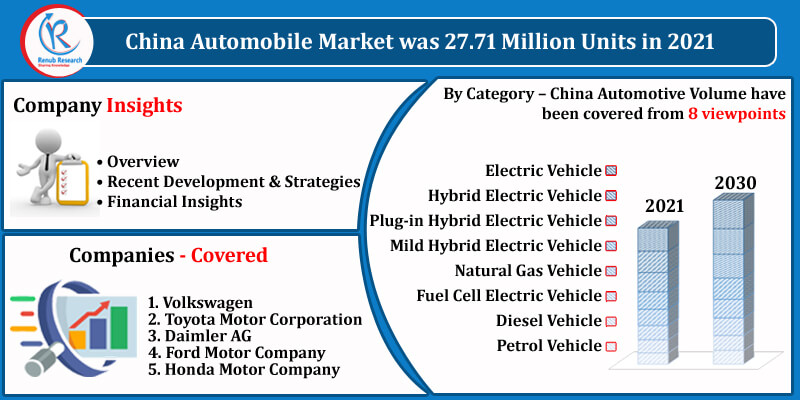

Navigating The Chinese Automotive Market Lessons From Bmw And Porsches Experiences

May 06, 2025

Navigating The Chinese Automotive Market Lessons From Bmw And Porsches Experiences

May 06, 2025 -

V Mware Costs To Skyrocket At And T Details 1 050 Price Hike From Broadcom

May 06, 2025

V Mware Costs To Skyrocket At And T Details 1 050 Price Hike From Broadcom

May 06, 2025 -

Princess Dianas Bold Met Gala Look A Risque Dress And A Secret Redesign

May 06, 2025

Princess Dianas Bold Met Gala Look A Risque Dress And A Secret Redesign

May 06, 2025

Latest Posts

-

Rihannas Savage X Fenty The Ultimate Wedding Night Lingerie

May 06, 2025

Rihannas Savage X Fenty The Ultimate Wedding Night Lingerie

May 06, 2025 -

Denzel Washingtons Impact On Colman Domingos Career

May 06, 2025

Denzel Washingtons Impact On Colman Domingos Career

May 06, 2025 -

New Savage X Fenty Lingerie Collection Designed For Your Wedding Night

May 06, 2025

New Savage X Fenty Lingerie Collection Designed For Your Wedding Night

May 06, 2025 -

Colman Domingos Reflections On Denzel Washingtons Mentorship

May 06, 2025

Colman Domingos Reflections On Denzel Washingtons Mentorship

May 06, 2025 -

A Look At Rihannas Luxurious Savage X Fenty Bridal Line

May 06, 2025

A Look At Rihannas Luxurious Savage X Fenty Bridal Line

May 06, 2025