Analyzing Jim Cramer's Foot Locker (FL) Investment Advice

Table of Contents

Cramer's Historical FL Recommendations

Jim Cramer has discussed Foot Locker on various platforms, including "Mad Money" and "Squawk on the Street," offering insights and recommendations over the years. Pinpointing every instance requires extensive archival research, but we can highlight several key moments to illustrate his approach. His commentary often reflects prevailing market sentiment and his assessment of Foot Locker's performance relative to competitors and broader economic trends.

- Date of recommendation: (Note: Due to the dynamic nature of financial markets and the difficulty of accessing a comprehensive historical record of Cramer’s comments without a paid subscription to a financial data service, specific dates and quotes will require further research. This section should be populated with real data once such research is completed.) For example, a hypothetical recommendation might be: October 26, 2023 – Buy rating.

- Cramer's stated rationale: (This should be replaced with actual quotes and analysis from Cramer’s shows regarding FL) Hypothetical Example: "Foot Locker is poised for growth due to the resurgence in popularity of retro sneakers."

- FL stock price at the time of the recommendation: (This requires access to historical stock price data. Replace with actual data.) Hypothetical Example: $25 per share.

Using keywords like Jim Cramer Foot Locker, Mad Money Foot Locker, FL stock prediction, and Cramer's stock picks will help improve the article's SEO.

Performance Analysis of Cramer's FL Advice

Analyzing the actual performance of Foot Locker stock following Cramer's recommendations is crucial. This requires comparing the stock's price movement against his buy, sell, or hold signals. (Insert charts and graphs here illustrating the relationship between Cramer's recommendations and the subsequent price action of FL stock. These visuals are vital for attracting readers and enhancing engagement.)

- Percentage change in FL stock price after each recommendation: (Insert data derived from reliable financial sources. This section needs quantitative data for effective analysis.)

- Comparison of FL performance to the overall market performance: (This requires a benchmark, such as the S&P 500, to gauge the relative performance of FL.)

- Key factors influencing FL stock price during the relevant periods: These might include macroeconomic conditions (interest rates, inflation), industry trends (e.g., changes in consumer spending habits, competition from online retailers), and specific company announcements (e.g., earnings reports, new product launches, changes in management). Keywords like Foot Locker stock chart, FL stock performance, stock market analysis, and investment strategy are essential here.

Evaluating Cramer's Methodology for FL

Understanding the underlying methodology behind Cramer's Foot Locker analysis requires careful examination. What key performance indicators (KPIs) did he emphasize? Did he focus primarily on earnings reports, sales figures, consumer sentiment, or other factors? Analyzing these aspects helps determine the strengths and weaknesses of his approach.

- Specific indicators Cramer might have considered: Earnings per share (EPS), revenue growth, debt levels, inventory turnover, same-store sales growth, and competitor analysis are all potential factors.

- Assessment of the validity of Cramer's analysis: Did his analysis accurately reflect the underlying financial health and future prospects of Foot Locker? How did his predictions compare to the reality?

- Discussion on diversification and risk management: Did Cramer's advice adequately emphasize the importance of diversification and appropriate risk management? This section should cover the limitations of basing investment decisions solely on one analyst's opinion. Relevant keywords include investment analysis, stock market strategy, due diligence, and risk assessment.

Alternative Perspectives on Foot Locker Investment

To get a complete picture, we must look beyond Cramer's perspective. Other financial analysts and news sources offer varying opinions on Foot Locker's investment potential.

- Summaries of other analysts' ratings and predictions for FL: Include a variety of ratings (buy, hold, sell) from reputable financial institutions.

- Comparison of different viewpoints on FL's future: Highlight the contrasting views and their underlying rationales.

- Importance of independent research and risk assessment: Emphasize the need for individual investors to conduct their own thorough research before making any investment decisions. Keywords such as financial analysis, stock market research, expert opinion, and investment decision are important for SEO purposes.

Conclusion: Summarizing Jim Cramer's Foot Locker (FL) Investment Advice

This analysis of Jim Cramer's Foot Locker (FL) investment advice reveals that while his opinions can be insightful, they should not be the sole basis for investment decisions. The accuracy of his past recommendations on FL (or any stock) varies, highlighting the inherent volatility and complexity of the stock market. Remember that even experienced analysts can be wrong, and macroeconomic factors often play a more significant role than any single analyst's prediction. Conducting thorough independent Foot Locker (FL) investment analysis, evaluating multiple perspectives, and understanding your own risk tolerance are critical for successful investing. Don't rely solely on anyone's opinion; always perform your own comprehensive due diligence before investing in any stock, including Foot Locker.

Featured Posts

-

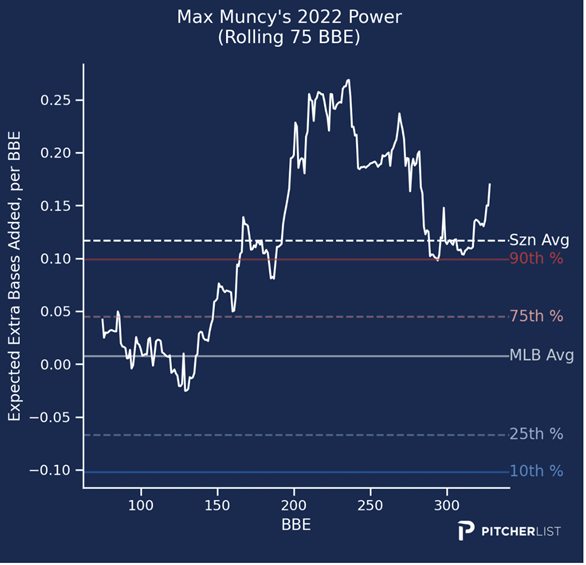

As Baseball Muncy In The Lineup At Second Base

May 16, 2025

As Baseball Muncy In The Lineup At Second Base

May 16, 2025 -

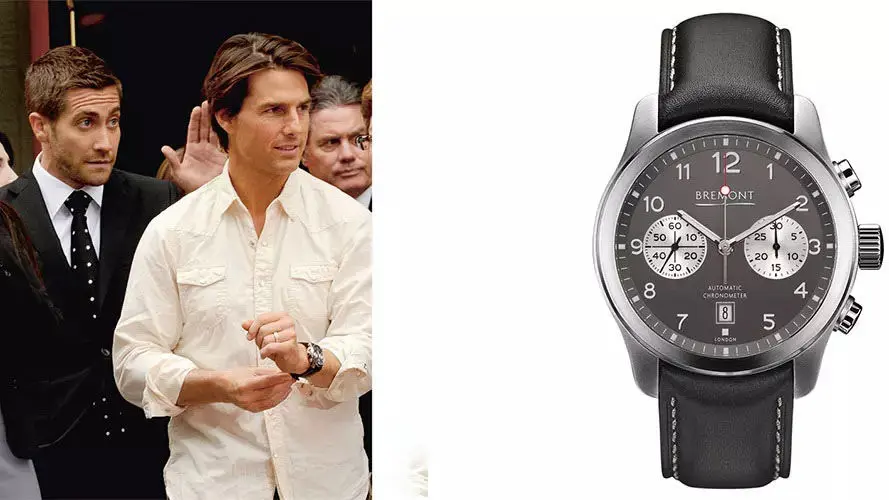

Kya Tam Krwz Ksy Mshhwr Adakarh Kw Dyt Kr Rhe Hyn

May 16, 2025

Kya Tam Krwz Ksy Mshhwr Adakarh Kw Dyt Kr Rhe Hyn

May 16, 2025 -

Nhls Canadian Stanley Cup Playoffs Partnership With Ndax Announced

May 16, 2025

Nhls Canadian Stanley Cup Playoffs Partnership With Ndax Announced

May 16, 2025 -

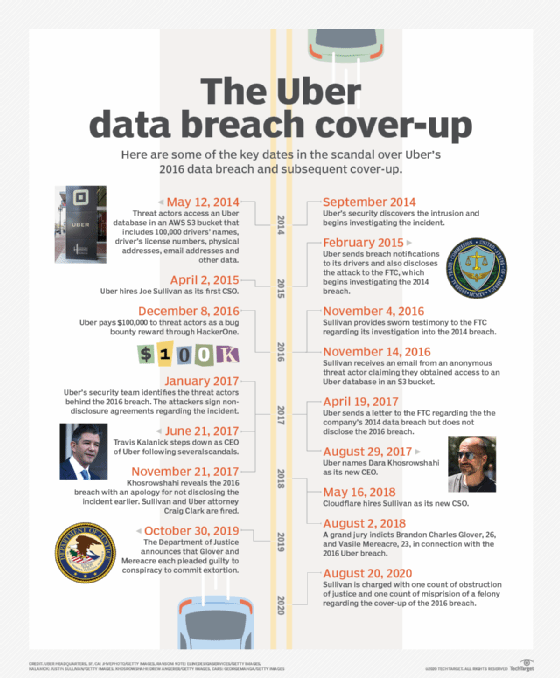

16 Million Penalty For T Mobile A Three Year Data Breach Timeline

May 16, 2025

16 Million Penalty For T Mobile A Three Year Data Breach Timeline

May 16, 2025 -

Ancelotti Vs Tebas Clash Over Real Madrids Match Schedule

May 16, 2025

Ancelotti Vs Tebas Clash Over Real Madrids Match Schedule

May 16, 2025

Latest Posts

-

How To Buy An Angel Reese Wnba Jersey For Opening Weekend

May 17, 2025

How To Buy An Angel Reese Wnba Jersey For Opening Weekend

May 17, 2025 -

Wnba Star Accuses Angel Reese Of Tampering

May 17, 2025

Wnba Star Accuses Angel Reese Of Tampering

May 17, 2025 -

Wnba Opening Weekend Get Your Angel Reese Jersey Now

May 17, 2025

Wnba Opening Weekend Get Your Angel Reese Jersey Now

May 17, 2025 -

The Pope The Knicks And Tom Thibodeau An Unexpected Connection

May 17, 2025

The Pope The Knicks And Tom Thibodeau An Unexpected Connection

May 17, 2025 -

Knicks Turnaround Thibodeaus Transformation And The Key To Success

May 17, 2025

Knicks Turnaround Thibodeaus Transformation And The Key To Success

May 17, 2025