Analyst Reaction To AbbVie (ABBV) Q[Quarter] Earnings: Positive Outlook On Growth

![Analyst Reaction To AbbVie (ABBV) Q[Quarter] Earnings: Positive Outlook On Growth Analyst Reaction To AbbVie (ABBV) Q[Quarter] Earnings: Positive Outlook On Growth](https://autolinq.de/image/analyst-reaction-to-abb-vie-abbv-q-quarter-earnings-positive-outlook-on-growth.jpeg)

Table of Contents

Key Financial Highlights of AbbVie's Q3 Earnings Report

Revenue Growth and Beat on Expectations

AbbVie's Q3 revenue significantly exceeded analyst expectations, demonstrating robust financial performance. AbbVie revenue for the quarter reached [Insert Actual Revenue Figure], surpassing the consensus estimate of [Insert Consensus Estimate]. This represents a [Insert Percentage]% increase compared to Q3 of the previous year. Key contributors to this growth include:

- Strong performance of its flagship drug, Humira, despite facing biosimilar competition in certain markets.

- Significant revenue contributions from newer drugs like Rinvoq and Skyrizi, which are experiencing strong uptake in their respective therapeutic areas.

- Successful market penetration and expansion of existing product lines.

This impressive revenue growth underscores AbbVie's ability to navigate challenges and maintain its position as a leading pharmaceutical company. The consistent performance across various revenue sources signals a healthy and diversified portfolio.

Earnings Per Share (EPS) and Profitability

AbbVie’s Q3 earnings also showcased impressive profitability. AbbVie EPS came in at [Insert Actual EPS Figure], exceeding the anticipated [Insert Analyst Estimate] and demonstrating a significant increase compared to the same period last year. This strong earnings per share performance reflects improved operational efficiency and cost management. Furthermore, key profitability metrics also showed positive trends:

- Gross margin expanded to [Insert Gross Margin Percentage], reflecting improved pricing and manufacturing efficiencies.

- Operating margin reached [Insert Operating Margin Percentage], indicating strong control over operating expenses.

This margin expansion further solidifies AbbVie's strong financial position and capacity for future growth.

Guidance for Future Quarters

AbbVie's guidance for future quarters is also encouraging, further fueling the positive analyst reaction. Management expressed confidence in achieving [Insert Key Guidance Metrics, e.g., full-year revenue targets] based on the strong Q3 performance and the continued momentum of its key products. The earnings outlook provided by AbbVie suggests continued revenue projections and future growth prospects, reassuring investors. This positive AbbVie guidance reinforces the bullish sentiment surrounding the company.

Analyst Reactions and Interpretations of the Results

Positive Sentiment from Key Analysts

The overwhelming analyst reaction to AbbVie's Q3 earnings report has been positive. Several key analyst firms have issued upgrades or maintained buy ratings on ABBV stock, citing the strong financial performance and promising future outlook. For example:

- [Analyst Firm 1] upgraded AbbVie to a "Buy" rating with a price target of [Price Target].

- [Analyst Firm 2] maintained its "Outperform" rating, highlighting the strength of AbbVie's drug pipeline.

These analyst ratings, coupled with generally positive commentary, reflect the strong confidence in AbbVie's ability to deliver sustainable growth.

Factors Driving Positive Outlook

Several factors are contributing to the positive analyst reaction and the overall bullish sentiment:

- Strong Sales of New Drugs: The continued success of newer drugs like Rinvoq and Skyrizi is driving substantial revenue growth and market share gains.

- Successful Clinical Trials: Positive results from ongoing clinical trials are expanding the potential market for existing and pipeline products.

- Strategic Acquisitions: AbbVie’s strategic acquisitions have added valuable assets to its portfolio, diversifying its revenue streams and strengthening its competitive position.

These factors collectively demonstrate AbbVie's competitive advantage and its ability to drive future growth in a dynamic pharmaceutical market. AbbVie's robust drug pipeline ensures a consistent stream of innovation and growth opportunities.

Potential Risks and Challenges

While the outlook is predominantly positive, analysts acknowledge certain potential risks and challenges:

- Patent cliff: The eventual patent expiration of key drugs could impact future revenue.

- Competition: Intense competition within the pharmaceutical industry requires continuous innovation and market adaptation.

- Regulatory risk: Navigating regulatory hurdles is an inherent risk in the pharmaceutical sector.

Despite these potential risks, the strength of AbbVie's current performance and future outlook appears to outweigh these concerns for most analysts. Managing these market uncertainties will be key to AbbVie’s sustained success.

Impact on AbbVie Stock Price and Investor Sentiment

Stock Price Movement Following Earnings Announcement

Following the Q3 earnings announcement, ABBV stock price experienced a [Describe the stock price movement, e.g., positive jump]. This positive stock market reaction reflects the overall positive investor sentiment towards AbbVie's performance and future prospects. The short-term implications suggest continued upward momentum, while the long-term outlook remains strongly positive. This market volatility following earnings reports is typical, but in AbbVie's case, the overall trend is positive.

Implications for Long-Term Investors

The strong Q3 earnings report and positive analyst reaction have significant implications for long-term investors. The results suggest that AbbVie is well-positioned for continued growth and profitability. For many, this supports a long-term investment strategy of buy or hold, depending on individual risk tolerance and portfolio diversification. Developing a sound investment strategy based on a thorough understanding of these results is key to successful portfolio management. A buy hold sell decision should be made based on individual investment goals and risk assessment.

Conclusion: Analyst Reaction to AbbVie (ABBV) Q3 Earnings: A Positive Outlook on Growth

In summary, the analyst reaction to AbbVie's Q3 earnings has been overwhelmingly positive. The strong financial performance, marked by robust revenue growth, exceeding EPS, and positive AbbVie guidance, has fueled optimism among analysts. Key factors driving this positive outlook include strong sales of new drugs, successful clinical trials, and strategic acquisitions. While potential risks exist, the overall sentiment points to a promising future for AbbVie. Understanding the analyst reaction to AbbVie's Q3 earnings is crucial for making informed investment decisions. Stay informed about future developments by following AbbVie's investor relations page: [Insert Link to AbbVie Investor Relations].

![Analyst Reaction To AbbVie (ABBV) Q[Quarter] Earnings: Positive Outlook On Growth Analyst Reaction To AbbVie (ABBV) Q[Quarter] Earnings: Positive Outlook On Growth](https://autolinq.de/image/analyst-reaction-to-abb-vie-abbv-q-quarter-earnings-positive-outlook-on-growth.jpeg)

Featured Posts

-

Lando Norriss Bizarre Party Injury Details Emerge

Apr 26, 2025

Lando Norriss Bizarre Party Injury Details Emerge

Apr 26, 2025 -

Benson Boone Brings Brian May To Coachella A Special Guest Performance

Apr 26, 2025

Benson Boone Brings Brian May To Coachella A Special Guest Performance

Apr 26, 2025 -

Mangalia Shipyard Desans Potential Takeover

Apr 26, 2025

Mangalia Shipyard Desans Potential Takeover

Apr 26, 2025 -

Een Onverklaarbaar Zoete Nederlandse Sandwich

Apr 26, 2025

Een Onverklaarbaar Zoete Nederlandse Sandwich

Apr 26, 2025 -

Indonesias Rare Rice Export Potential And Diplomatic Implications

Apr 26, 2025

Indonesias Rare Rice Export Potential And Diplomatic Implications

Apr 26, 2025

Latest Posts

-

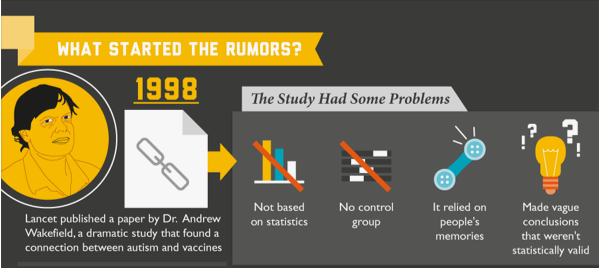

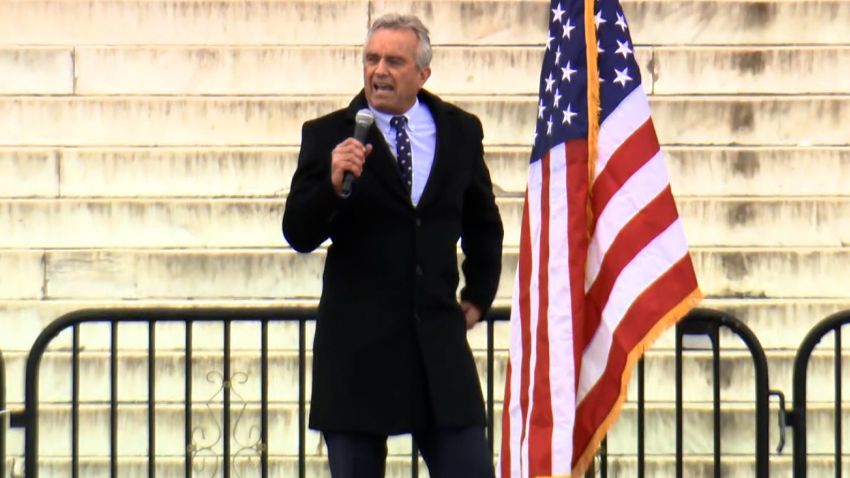

Immunization Autism Link Study Vaccine Skeptics Leadership Sparks Debate

Apr 27, 2025

Immunization Autism Link Study Vaccine Skeptics Leadership Sparks Debate

Apr 27, 2025 -

Vaccine Skeptic Leading Federal Autism Immunization Study A Troubling Appointment

Apr 27, 2025

Vaccine Skeptic Leading Federal Autism Immunization Study A Troubling Appointment

Apr 27, 2025 -

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025 -

Dubai Dice Adios A Paolini Y Pegula En El Wta 1000

Apr 27, 2025

Dubai Dice Adios A Paolini Y Pegula En El Wta 1000

Apr 27, 2025 -

Wta 1000 Dubai Paolini Y Pegula Fuera De Competencia

Apr 27, 2025

Wta 1000 Dubai Paolini Y Pegula Fuera De Competencia

Apr 27, 2025