Analyst Predicts Canadian Dollar Fall With Minority Government

Table of Contents

Political Instability and its Impact on the Canadian Dollar

Minority governments often lead to political gridlock and uncertainty, significantly impacting investor confidence and the Canadian dollar forecast. The inherent fragility of a minority government creates an environment of unpredictability, making it difficult for businesses and investors to plan long-term strategies. This uncertainty directly translates into a weakened Canadian dollar (CAD).

- Increased difficulty in passing crucial economic legislation: A minority government often requires compromise and negotiation with other parties, potentially leading to delays or even the failure to pass essential economic bills, hindering economic growth and impacting the CAD exchange rate.

- Potential for snap elections creating further uncertainty: The constant threat of a snap election adds to the instability, further eroding investor confidence and negatively affecting the Canadian dollar.

- Reduced predictability for businesses and investors: The lack of clear policy direction makes it harder for businesses to make investment decisions, impacting economic activity and the value of the CAD.

- Negative impact on foreign direct investment: Uncertainty surrounding government policy discourages foreign investment, potentially slowing economic growth and further weakening the Canadian dollar.

Potential Economic Slowdown and its Correlation with the Canadian Dollar

A minority government may lead to a slower economic growth rate due to policy delays and disagreements. This slowdown directly correlates with a decline in the Canadian dollar value. The Canadian economy is significantly influenced by commodity prices, particularly oil, and any slowdown will impact these prices, further affecting the CAD value.

- Impact on commodity prices (oil, etc.) which heavily influence the CAD: A weakened economy often leads to lower demand for commodities, pushing down their prices and weakening the Canadian dollar, which is heavily tied to commodity exports.

- Reduced consumer spending due to economic uncertainty: Uncertainty about the future often leads to reduced consumer spending, impacting economic growth and weakening the Canadian dollar.

- Potential for increased interest rates as a response to instability: To combat inflation or stabilize the economy, the Bank of Canada might increase interest rates, which can make the Canadian dollar more attractive to investors in the short term, but also potentially slow down economic growth.

- Effect on Canadian exports and imports: A weaker Canadian dollar can make exports more competitive but also increase the cost of imports, potentially leading to trade imbalances.

The Role of the Bank of Canada in Managing the Fall

The Bank of Canada plays a crucial role in mitigating the predicted fall of the Canadian dollar. They may employ various monetary policy tools to manage the situation.

- Potential interest rate adjustments: The Bank of Canada might adjust interest rates to influence the CAD exchange rate and stabilize the economy. Interest rate hikes can attract foreign investment, strengthening the Canadian dollar.

- Intervention in the foreign exchange market: In extreme cases, the Bank of Canada might intervene directly in the foreign exchange market to influence the CAD value.

- Communication strategies to manage investor expectations: Clear and transparent communication about the Bank of Canada's monetary policy and outlook can help to manage investor expectations and stabilize the market.

Alternative Perspectives and Potential for Rebound

While the prediction of a Canadian dollar fall is concerning, it's crucial to consider alternative perspectives. The Canadian economy possesses strong fundamentals that could outweigh the negative impact of political instability.

- Potential for strong economic fundamentals to outweigh political instability: A robust and diversified economy could absorb some of the negative impacts of political uncertainty.

- Possibility of successful collaboration within the minority government: Effective cooperation between the governing party and other parties could lead to the passage of crucial legislation and limit the negative impact on the economy.

- Factors that could support the Canadian dollar despite political challenges: Strong global demand for Canadian resources or other positive economic indicators could offset the negative effects of political instability on the CAD.

Conclusion

The analyst's prediction of a Canadian dollar fall due to a minority government highlights potential economic challenges. The reduced investor confidence, potential economic slowdown, and the resulting impact on commodity prices and the CAD exchange rate are significant concerns. The Bank of Canada's response, through monetary policy adjustments and communication, will be critical in managing this situation. Understanding the potential impact of the Canadian dollar's fluctuations on personal finances and investments is crucial. Stay informed about the evolving situation affecting the Canadian dollar and its future trajectory. Monitor the CAD exchange rate closely and consider consulting a financial advisor to assess the impact on your investments and plan accordingly. Keep an eye on news regarding the Canadian dollar forecast to make informed decisions.

Featured Posts

-

Remember Monday Uk Eurovision 2025 Hopefuls

Apr 30, 2025

Remember Monday Uk Eurovision 2025 Hopefuls

Apr 30, 2025 -

Beyonces Grammy Win Blue Ivys Priceless Reaction Sparks Online Frenzy

Apr 30, 2025

Beyonces Grammy Win Blue Ivys Priceless Reaction Sparks Online Frenzy

Apr 30, 2025 -

Is The Ai Partnership Between Altman And Nadella Fracturing

Apr 30, 2025

Is The Ai Partnership Between Altman And Nadella Fracturing

Apr 30, 2025 -

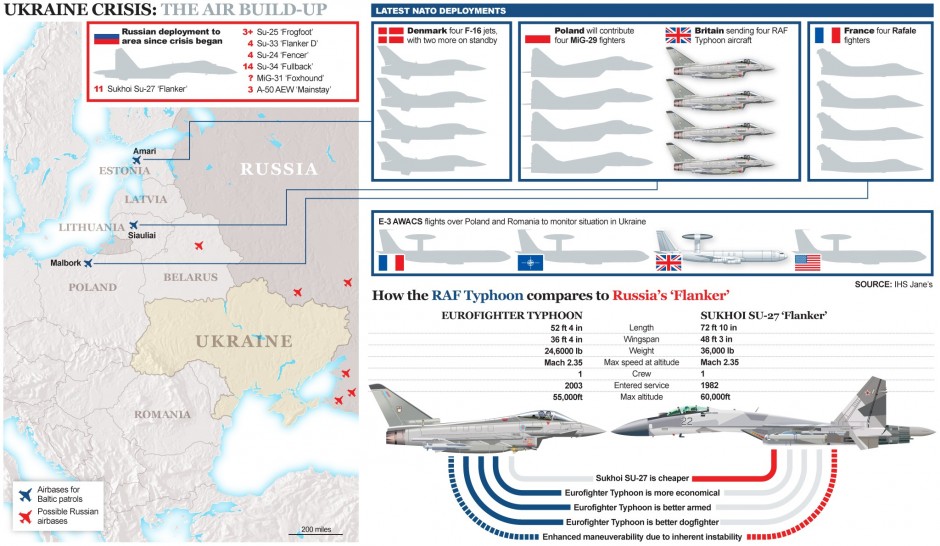

Europes Rising Military Spending In The Face Of Russian Aggression

Apr 30, 2025

Europes Rising Military Spending In The Face Of Russian Aggression

Apr 30, 2025 -

2025 Nfl Draft Washington Commanders Big Board And Player Evaluations All 3 Days

Apr 30, 2025

2025 Nfl Draft Washington Commanders Big Board And Player Evaluations All 3 Days

Apr 30, 2025