Analyst Predicts Bitcoin Rally: Key Support Levels And Chart Analysis (May 6th)

Table of Contents

Key Support Levels Holding Strong for Bitcoin

Identifying Critical Support Zones

The analyst has identified specific price points as crucial Bitcoin support levels. These act as potential barriers preventing further price decline. For example, $28,000 and $26,000 are highlighted as key zones. Technically, these levels represent areas where significant buying pressure previously emerged, suggesting potential for a rebound.

- Moving Averages: The 50-day and 200-day moving averages are converging near these support zones, providing technical confirmation.

- Trendlines: Strong upward-sloping trendlines intersect these support levels, indicating potential bounce points.

- Volume Analysis: Historically, high trading volumes around these levels suggest strong buying interest, capable of halting downward momentum.

Breaking these support levels would signal a potentially more significant bearish trend, while holding above them indicates continued strength and potential for a Bitcoin price prediction of upward movement.

Historical Support Levels and their Significance

Analyzing past Bitcoin price action reveals the importance of these support levels. These levels have acted as significant pivot points historically.

- Previous Bounces: In Q4 2022, Bitcoin bounced back from around the $16,000 level, demonstrating the resilience of these support areas. Similar instances occurred in 2020 and 2018, albeit at different price points, further highlighting their significance. [Insert relevant chart/graph here].

- Bounce Potential: The current convergence of indicators and historical precedent suggests a high probability of a "bounce" from these levels, fueling the Bitcoin rally prediction.

Technical Chart Analysis: Bullish Signals Emerging

Relative Strength Index (RSI) and other Indicators

The Bitcoin chart analysis reveals a compelling bullish picture.

- RSI: The Relative Strength Index (RSI) is currently approaching oversold territory, suggesting a potential reversal. An RSI reading below 30 often precedes a price bounce. [Insert RSI chart here].

- MACD: The Moving Average Convergence Divergence (MACD) indicator is showing signs of a potential bullish crossover, a strong bullish signal. [Insert MACD chart here].

- Bollinger Bands: The price is nearing the lower Bollinger Band, indicating potential for a price reversal towards the mean. [Insert Bollinger Bands chart here].

These indicators collectively suggest increasing bullish momentum and contribute to the optimistic Bitcoin price prediction.

Volume Analysis: Confirmation of Buying Pressure

Analyzing trading volume provides further confirmation of the potential Bitcoin rally.

- Volume and Price Correlation: High volume accompanying price increases confirms buying pressure, validating the upward trend.

- Accumulation Zones: Periods of sustained high volume around the identified support levels suggest significant accumulation by investors, setting the stage for a potential price surge. [Insert volume chart here]

Factors Contributing to the Predicted Bitcoin Rally

Macroeconomic Factors

Macroeconomic factors influence the crypto market, impacting Bitcoin's price.

- Inflation and Interest Rates: While high inflation and interest rates can negatively impact risk assets, the potential for Bitcoin to act as an inflation hedge could drive demand.

- Global Economic Uncertainty: In times of economic uncertainty, investors may seek refuge in alternative assets like Bitcoin, increasing demand.

Regulatory Developments and Institutional Adoption

Positive regulatory developments and growing institutional adoption are crucial factors.

- Regulatory Clarity: Increased regulatory clarity in certain jurisdictions could boost investor confidence and drive higher Bitcoin adoption.

- Institutional Investment: Continued institutional investment in Bitcoin indicates growing acceptance and validation as an asset class.

Halving Event Anticipation

The upcoming Bitcoin halving event significantly influences market sentiment.

- Halving's Historical Impact: Historically, Bitcoin halving events have preceded significant price increases due to reduced supply.

- Anticipation Effect: The anticipation of the halving itself can already drive price increases as investors position themselves for future gains.

Conclusion

The analyst's prediction of a Bitcoin rally is supported by strong evidence. Key Bitcoin support levels are holding, bullish technical indicators are emerging, and various macroeconomic and market factors contribute to a positive outlook. The potential for significant price increases exists, although cryptocurrency investments carry inherent risks. However, remember to always conduct thorough research and diversify your portfolio.

Call to Action: Stay updated on the evolving Bitcoin market and its potential for a significant rally by regularly checking back for updated analysis and predictions on Bitcoin support levels and chart analysis. Consider diversifying your cryptocurrency portfolio and conducting thorough research before investing in Bitcoin or other cryptocurrencies.

Featured Posts

-

Thunder Vs Pacers Latest Injury News Before March 29th Game

May 08, 2025

Thunder Vs Pacers Latest Injury News Before March 29th Game

May 08, 2025 -

Jokics Birthday Westbrooks Special Nuggets Rendition

May 08, 2025

Jokics Birthday Westbrooks Special Nuggets Rendition

May 08, 2025 -

Cadillac Celestiq First Drive Impressions Of The Bespoke Ev

May 08, 2025

Cadillac Celestiq First Drive Impressions Of The Bespoke Ev

May 08, 2025 -

Angels Vs Dodgers How Missing Shortstops Affected The Game

May 08, 2025

Angels Vs Dodgers How Missing Shortstops Affected The Game

May 08, 2025 -

Inters Road To The Champions League Final Conquering Barcelona

May 08, 2025

Inters Road To The Champions League Final Conquering Barcelona

May 08, 2025

Latest Posts

-

Counting Crows Snl Performance A Turning Point

May 08, 2025

Counting Crows Snl Performance A Turning Point

May 08, 2025 -

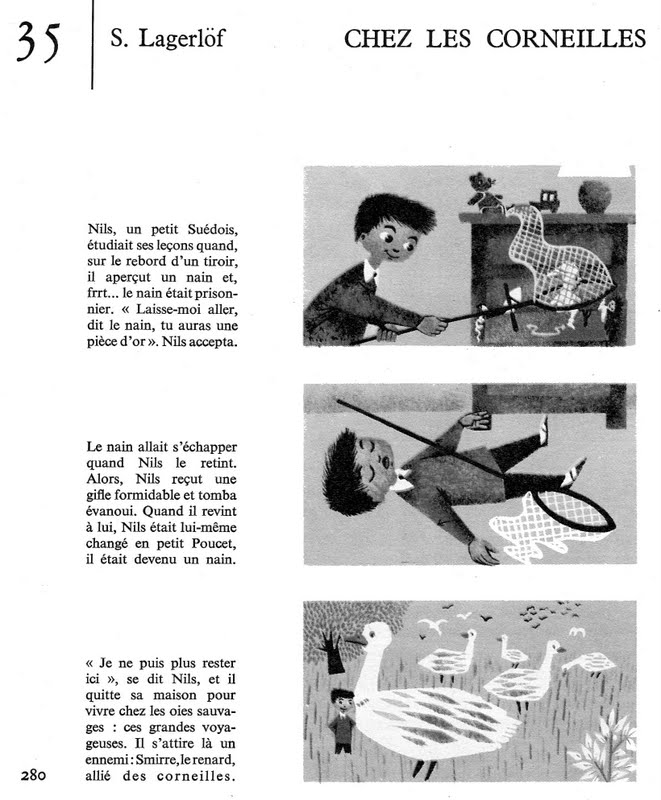

Capacites Cognitives Superieures Des Corneilles Une Etude De Cas En Geometrie

May 08, 2025

Capacites Cognitives Superieures Des Corneilles Une Etude De Cas En Geometrie

May 08, 2025 -

Etude Scientifique Sur Les Capacites Geometriques Des Corneilles

May 08, 2025

Etude Scientifique Sur Les Capacites Geometriques Des Corneilles

May 08, 2025 -

The Lasting Legacy Of Counting Crows Saturday Night Live Appearance

May 08, 2025

The Lasting Legacy Of Counting Crows Saturday Night Live Appearance

May 08, 2025 -

La Geometrie Chez Les Corneilles Une Performance Cognitive Remarquable

May 08, 2025

La Geometrie Chez Les Corneilles Une Performance Cognitive Remarquable

May 08, 2025