Analysis: Why Novo Nordisk Lags In The Weight-Loss Market Despite Ozempic

Table of Contents

Ozempic's Success and Market Limitations

Ozempic's success is undeniable. Its high efficacy in promoting weight loss, coupled with a strong marketing campaign and a first-mover advantage in the GLP-1 receptor agonist market, has established it as a leading weight-loss medication. However, several limitations constrain its broader market impact.

- High Cost: The price of Ozempic is a significant barrier to entry for many patients, limiting accessibility and potentially hindering market penetration. The "Ozempic price" is a frequent topic of discussion amongst potential users and healthcare providers.

- Accessibility Issues: Requiring a prescription restricts access, as patients need physician consultations and approvals, potentially delaying treatment or deterring some individuals altogether.

- Potential Side Effects: Like all medications, Ozempic carries potential side effects, including nausea, vomiting, and constipation. These "Ozempic side effects" can deter some patients from using the drug.

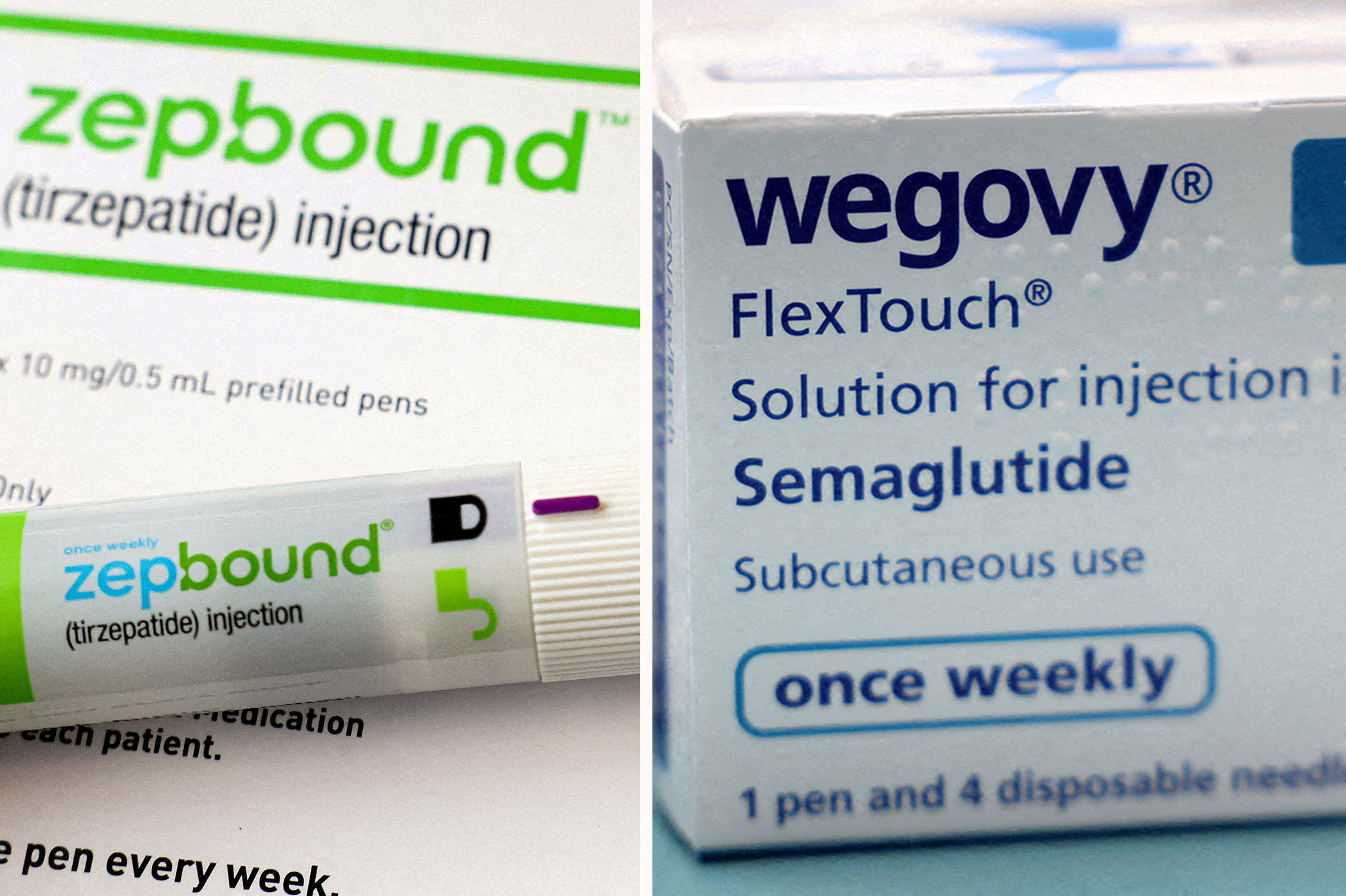

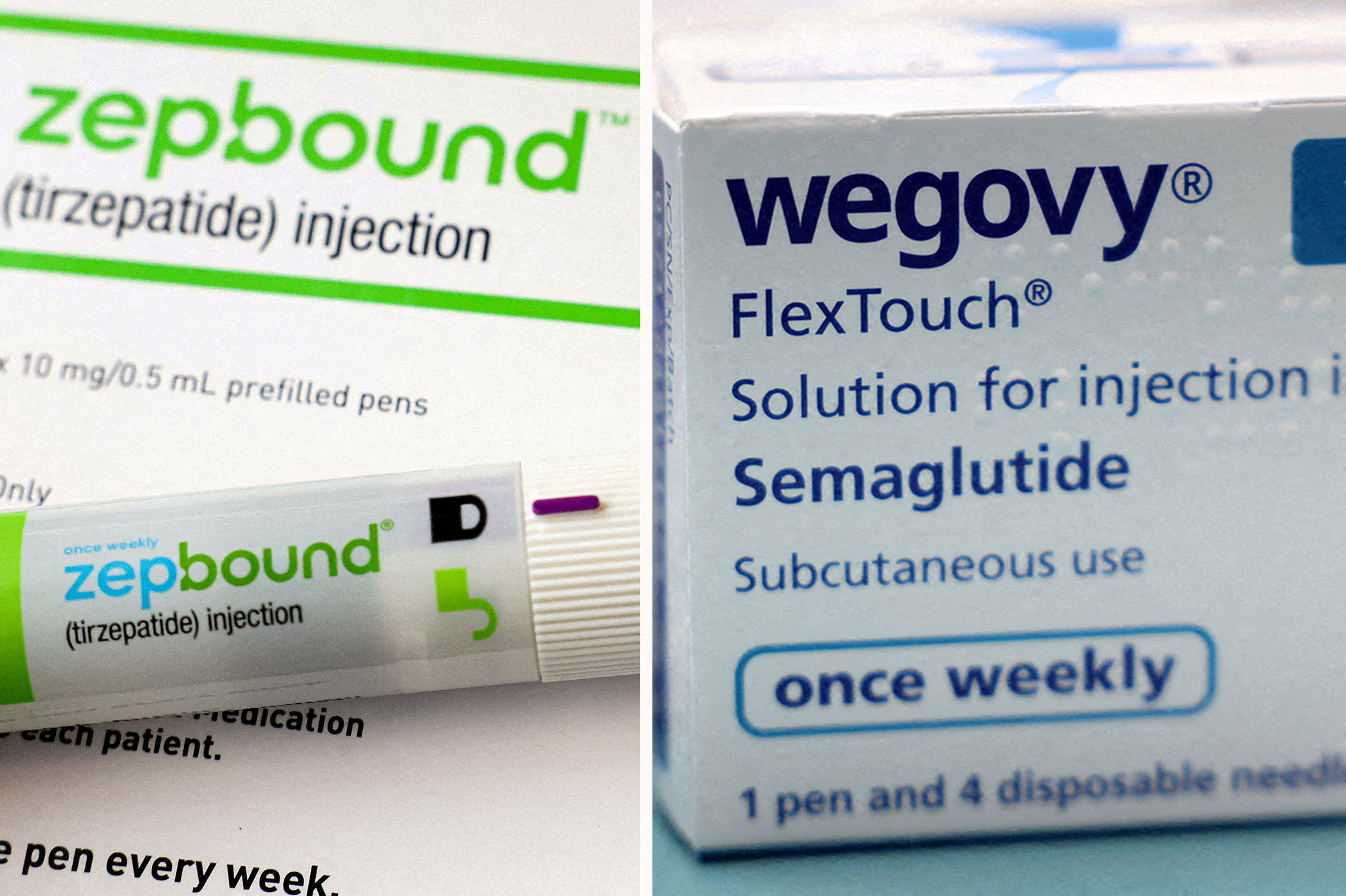

- Competition from Similar GLP-1 Receptor Agonists: The market for "GLP-1 receptor agonists" is becoming increasingly crowded, with other pharmaceutical companies introducing competing drugs with similar mechanisms of action.

Competition and Market Saturation

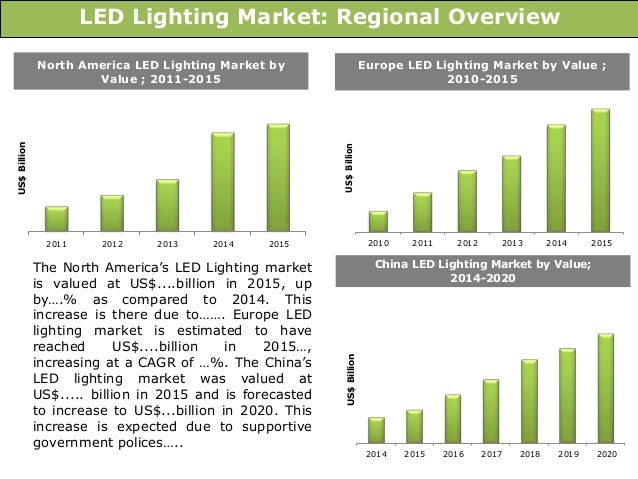

The weight-loss medication market is rapidly evolving, becoming increasingly competitive. Several pharmaceutical companies are aggressively pursuing a piece of the pie, challenging Novo Nordisk's dominance.

- Wegovy (also by Novo Nordisk): While also a GLP-1 agonist, Wegovy's higher dose and different administration present both a competitive edge and a risk for Novo Nordisk.

- Semaglutide analogs from other companies: Several companies are developing and marketing their own versions of semaglutide or other GLP-1 agonists, presenting a significant competitive threat.

- Innovative Drug Delivery Systems: Competitors are exploring innovative delivery methods, such as patches or injectables with extended durations, potentially offering advantages over Ozempic's current injection format. This is shifting the "competitive landscape weight loss drugs."

- Targeted Marketing: Competitors are utilizing more nuanced marketing strategies, targeting specific demographics and addressing particular health concerns more effectively than Novo Nordisk's current campaigns.

Novo Nordisk's Marketing and Distribution Strategies

Novo Nordisk's marketing strategies, while successful in launching Ozempic, may require refinement to maximize market share in this competitive environment. Their current approach, while effective, may not be optimally targeted or far-reaching enough.

- Limited Digital Presence: Investing more heavily in digital marketing and social media engagement could expand their reach to a wider audience of potential patients.

- Underutilization of Partnerships: Strengthening collaborations with weight-loss clinics and healthcare professionals would facilitate access and improve patient education. Improving patient access through streamlined insurance processes is also vital.

- Generic Competition: Addressing the threat of generic competitors entering the market with lower-cost alternatives demands proactive strategies.

Access and Affordability Challenges

The high "Ozempic cost" significantly limits access, particularly for uninsured or underinsured patients. Addressing this affordability challenge is crucial for expanding market reach and making these weight-loss medications available to a broader population.

- Insurance Partnerships: Collaborating with insurance providers to secure better coverage for Ozempic and other weight-loss medications could drastically improve accessibility.

- Lower-Cost Alternatives: Developing lower-cost formulations or alternative treatment options could make these therapies available to a larger segment of the population, fostering greater market penetration.

- Government Initiatives: Advocating for government subsidies or initiatives to reduce the cost of weight-loss medications could significantly enhance access for underserved populations. Increased awareness of "affordable weight loss options" is critical for increasing market adoption.

Conclusion: Addressing Novo Nordisk's Weight-Loss Market Challenges

Novo Nordisk's weight-loss market lag, despite Ozempic's success, highlights the complexities of the market. High costs, increasing competition, and potential marketing and distribution limitations are significant challenges that demand attention. Successfully navigating this landscape requires a multi-pronged approach focusing on improving affordability, enhancing marketing strategies, and fostering wider accessibility. Further research into "strategies for improving Novo Nordisk's weight loss market performance" is crucial to securing its future position in this rapidly evolving sector. We encourage further analysis of the "future of Novo Nordisk in the weight loss sector" and a thorough examination of "analyzing Novo Nordisk's weight loss market share" to fully understand the company's challenges and opportunities.

Featured Posts

-

Increased Carjacking Risk During Test Drives Safety Tips And Advice

May 30, 2025

Increased Carjacking Risk During Test Drives Safety Tips And Advice

May 30, 2025 -

Carlos Alcaraz Claims Sixth Masters 1000 Title In Monte Carlo

May 30, 2025

Carlos Alcaraz Claims Sixth Masters 1000 Title In Monte Carlo

May 30, 2025 -

Jayne Hintons Sundae Servings On Bolton Fm A Guide For Listeners

May 30, 2025

Jayne Hintons Sundae Servings On Bolton Fm A Guide For Listeners

May 30, 2025 -

Rapid Growth In The Vaccine Packaging Market Trends And Opportunities

May 30, 2025

Rapid Growth In The Vaccine Packaging Market Trends And Opportunities

May 30, 2025 -

Palestinian Envoys Emotional Un Plea For Gaza Children

May 30, 2025

Palestinian Envoys Emotional Un Plea For Gaza Children

May 30, 2025