Analysis: Trump's Possible Tariffs On Commercial Aircraft And Engines

Table of Contents

Economic Impact of Potential Tariffs

The economic repercussions of Trump's tariffs on commercial aircraft and engines are multifaceted and potentially devastating. The impact would be felt across the entire supply chain, from manufacturers to consumers.

Impact on Aircraft Manufacturers (Boeing and Airbus)

The most immediate impact would be felt by the giants of the aircraft manufacturing industry: Boeing and Airbus. Increased tariffs would significantly increase production costs, potentially reducing their competitiveness in the global market.

- Reduced Profitability: Higher input costs would directly impact profit margins, forcing companies to either absorb losses or pass increased costs onto airlines.

- Pricing Adjustments: To offset increased costs, Boeing and Airbus might raise aircraft prices, making them less attractive to airlines. This could trigger a domino effect, impacting airline profitability and expansion plans.

- Job Losses and Investment Shifts: Facing reduced profitability, manufacturers may resort to cost-cutting measures, potentially including job losses and shifts in investment to regions with more favorable trade policies. This could lead to a decline in research and development, hindering innovation in the sector.

- Economic Projections: Several economic models predict significant job losses in the US and EU aerospace sectors if tariffs are implemented, potentially reaching tens of thousands of jobs across the supply chain.

Impact on Airlines and Consumers

Airlines would inevitably bear the brunt of increased aircraft prices resulting from the tariffs. This would translate to higher operating costs, forcing them to potentially increase ticket prices.

- Increased Ticket Prices: Higher aircraft acquisition costs would inevitably lead to increased airfares, affecting consumers’ travel choices and affordability.

- Reduced Air Travel Demand: Higher ticket prices could significantly dampen air travel demand, particularly for leisure travel, impacting airline revenues and potentially leading to reduced flight frequencies on less profitable routes.

- Airline Profitability and Expansion: Airlines would face squeezed profit margins and might be forced to scale back expansion plans or even cut routes. Smaller airlines could be particularly vulnerable.

- Consumer Reactions: Consumers might respond by reducing air travel, opting for alternative modes of transportation or delaying travel plans until prices stabilize.

Impact on the Engine Manufacturing Sector

The engine manufacturing sector, dominated by companies like General Electric and Rolls-Royce, would also face significant challenges. Engine tariffs would increase the cost of engines, impacting both aircraft manufacturers and airlines.

- Impact on GE and Rolls-Royce: Both companies would experience reduced profitability and potentially face challenges in maintaining market share.

- Engine Production Costs and Availability: Increased tariffs could make it more expensive to produce engines, potentially impacting delivery timelines and reducing the availability of certain engine models.

- Aircraft Maintenance and Repair: Higher costs for spare parts and maintenance services could add further pressure on airlines' operating expenses.

- Specific Engine Models: The impact would vary depending on the specific engine model and its market share. Engines used in popular aircraft models would be particularly affected.

Geopolitical Implications of Trump's Tariffs

The potential imposition of Trump's tariffs on commercial aircraft and engines extends far beyond economic considerations, carrying significant geopolitical implications.

US-EU Trade Relations

The tariffs would almost certainly escalate trade tensions between the US and the EU, potentially damaging the already fragile transatlantic relationship. Retaliatory measures from the EU could further escalate the conflict.

Impact on Global Aviation Industry

The tariffs threaten to disrupt global supply chains within the aviation industry, which relies on international cooperation and a complex network of interconnected businesses. This could lead to inefficiencies and increased costs across the board.

Potential Retaliatory Measures

The EU and other affected countries are likely to retaliate with their own tariffs or other trade measures, potentially triggering a broader trade war with far-reaching consequences for the global economy. This could lead to further instability in the global aviation market.

- Scenario 1: The EU imposes retaliatory tariffs on US agricultural products.

- Scenario 2: China imposes tariffs on US-made aircraft parts.

- Scenario 3: A broader trade war ensues, impacting multiple sectors beyond aviation.

Potential Responses from Affected Companies

Faced with potential tariffs, aircraft and engine manufacturers are likely to implement various strategies to mitigate the negative impacts.

Boeing and Airbus Strategies

Both Boeing and Airbus will likely engage in extensive lobbying efforts to influence policymakers and potentially seek exemptions from the tariffs. They might also implement cost-cutting measures and explore options for relocating production to regions with more favorable trade policies.

Engine Manufacturers' Strategies

GE and Rolls-Royce will likely adopt similar strategies, focusing on lobbying, cost optimization, and potentially seeking alternative supply chains. They might also explore technological innovations to reduce reliance on components subject to tariffs.

- Lobbying and advocacy: Both manufacturers will heavily invest in lobbying to persuade governments to reconsider or amend the tariff policies.

- Cost-cutting and efficiency improvements: Internal restructuring and streamlining of operations will be key to absorbing the impact of tariffs.

- Supply chain diversification: Exploration of alternative suppliers outside the affected regions will be crucial.

Conclusion

Trump's potential tariffs on commercial aircraft and engines pose a significant threat to the global aviation industry. The economic consequences are far-reaching, impacting manufacturers, airlines, and consumers alike. The geopolitical implications are equally troubling, threatening to escalate trade tensions and disrupt international cooperation. The responses of affected companies will be critical in shaping the outcome, but the situation remains highly volatile. The ongoing debate surrounding these tariffs underscores the need for continuous analysis and informed discussion. Stay informed about developments related to Trump's tariffs on commercial aircraft and engines by following reputable news sources and industry experts. Understanding the complex dynamics of this situation is crucial for navigating the challenges ahead in the global aviation industry.

Featured Posts

-

Warren Buffett Among Billionaires Hit Hard By Trumps Tariffs

May 10, 2025

Warren Buffett Among Billionaires Hit Hard By Trumps Tariffs

May 10, 2025 -

How The Fentanyl Crisis Influenced Us China Trade Discussions

May 10, 2025

How The Fentanyl Crisis Influenced Us China Trade Discussions

May 10, 2025 -

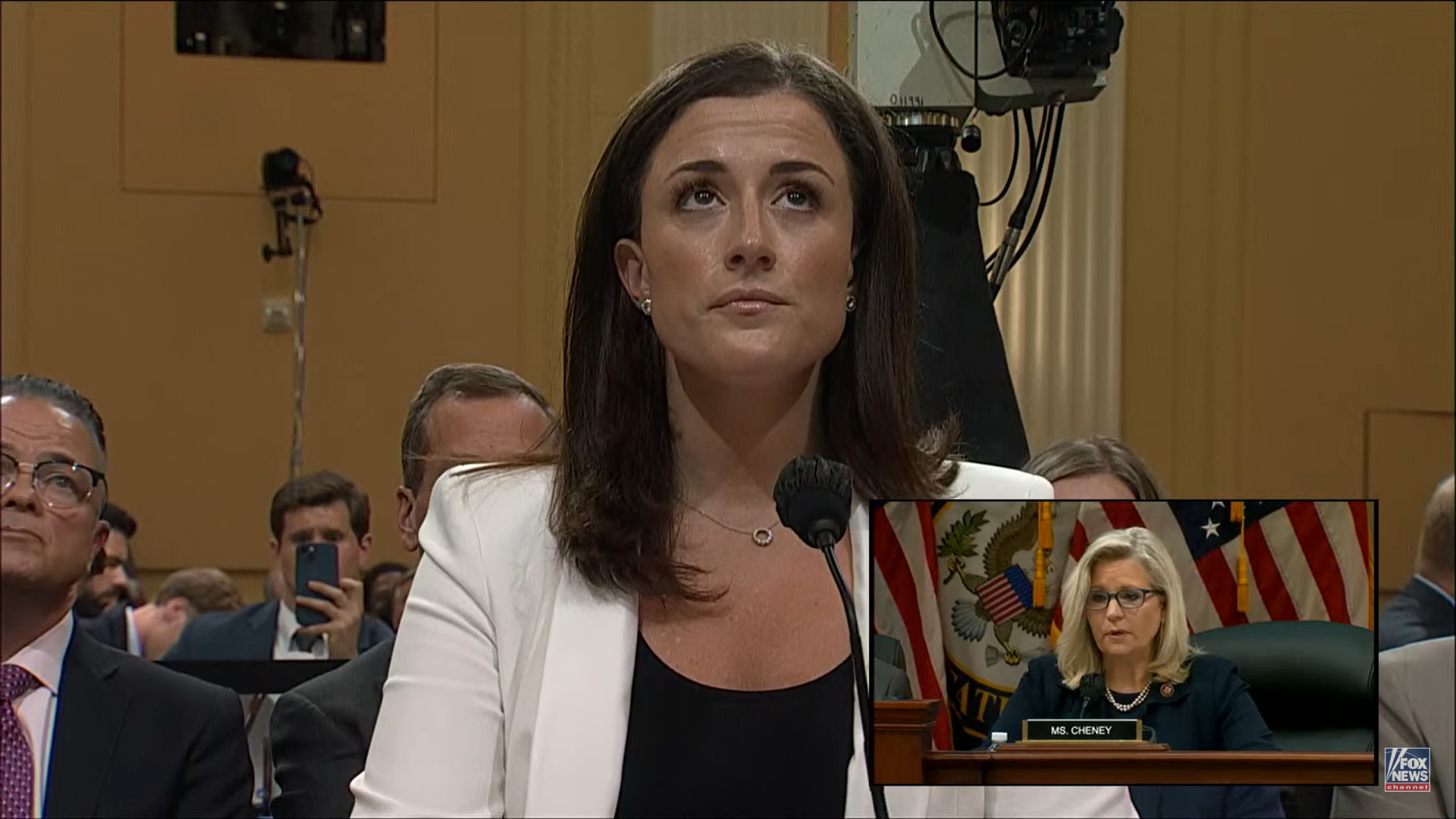

Cassidy Hutchinson Memoir A Deeper Look At The January 6th Attack

May 10, 2025

Cassidy Hutchinson Memoir A Deeper Look At The January 6th Attack

May 10, 2025 -

Adae Fyraty Fy Aldwry Alqtry Thlyl Bed Antqalh Mn Alahly

May 10, 2025

Adae Fyraty Fy Aldwry Alqtry Thlyl Bed Antqalh Mn Alahly

May 10, 2025 -

Dakota Johnson El Exito Del Bolso Hereu Entre Las Celebrities

May 10, 2025

Dakota Johnson El Exito Del Bolso Hereu Entre Las Celebrities

May 10, 2025