Analysis: Saudi Arabia's Rule Change And The Future Of Its ABS Market

Table of Contents

Saudi Arabia's asset-backed securities (ABS) market is undergoing a significant transformation. Recent regulatory changes are poised to reshape the landscape, presenting both challenges and unprecedented opportunities for investors and market participants. This analysis delves into the key aspects of these changes, exploring their impact on the Saudi Arabia's ABS market and offering a glimpse into its future potential within the broader Middle Eastern financial ecosystem. We will focus on the outlook for this dynamic market and the opportunities it presents.

The New Regulatory Landscape: Key Changes and Their Impact

The Saudi Arabian Monetary Authority (SAMA), the kingdom's central bank, has implemented several crucial amendments to regulations governing the securitization of assets. These changes aim to stimulate economic growth, enhance financial stability, and attract substantial foreign investment. The key alterations include:

- Relaxed Eligibility Criteria: Previously stringent requirements for eligible assets have been relaxed, opening the door for a wider range of assets to be securitized. This includes assets from previously underserved sectors.

- Streamlined Securitization Process: The process of securitizing assets has been simplified, reducing bureaucratic hurdles and accelerating the time to market for ABS issuances. This aims to improve efficiency and reduce costs.

- Enhanced Investor Protection: New rules provide stronger safeguards for investors, boosting confidence and attracting a broader investor base. This includes stricter requirements for disclosure and transparency.

- Increased Transparency and Disclosure: Regulations now mandate greater transparency and disclosure requirements for ABS issuances, enhancing investor confidence and promoting market integrity. This is critical for attracting both domestic and international investors.

These changes reflect SAMA's strategic vision to modernize the financial sector and integrate it further into the global economy. The rationale behind these regulatory amendments is clear: to foster economic diversification, improve access to finance, and support the growth of non-oil sectors. Data from SAMA regarding the pre- and post-reform issuance volumes will provide crucial insights into the effectiveness of these changes in the coming years.

Opportunities Emerging in the Post-Reform ABS Market

The reformed regulatory landscape presents several compelling opportunities for growth within Saudi Arabia's ABS market:

- Real Estate: The burgeoning real estate sector, with its significant asset base, stands to benefit immensely from securitization. ABS issuances can unlock liquidity and stimulate further development.

- Infrastructure Projects: The Kingdom's ambitious Vision 2030 initiative includes massive infrastructure projects, creating a substantial pipeline of assets suitable for securitization.

- Consumer Finance: The growth of the consumer finance sector presents an opportunity for securitization of consumer loans and other receivables.

- Islamic Finance-Compliant ABS: The significant presence of Islamic finance in Saudi Arabia provides a unique opportunity for the development of Sharia-compliant ABS, tapping into a substantial and growing market.

The increased issuance of ABS in these sectors will likely attract significant domestic and international investment, further boosting the Saudi Arabia's ABS market's growth trajectory. The potential for attracting foreign investors seeking exposure to the Kingdom's growing economy is significant.

Challenges and Risks Facing the Saudi ABS Market

Despite the promising opportunities, the Saudi ABS market faces several challenges:

- Market Liquidity: Developing a sufficiently liquid secondary market for ABS will be crucial for long-term growth. This requires investor education and participation.

- Investor Education: Raising awareness and understanding of ABS among potential investors is essential. Comprehensive investor education programs are vital for success.

- Credit Risk Assessment: Accurate and robust credit risk assessment methodologies are paramount, especially considering the diverse range of assets that may be securitized.

- Regulatory Uncertainty: While the recent reforms are positive, any future regulatory changes could impact market stability. Maintaining regulatory clarity is critical.

- Global Economic Factors: Global economic downturns could negatively affect the performance of ABS, highlighting the importance of sound risk management practices.

Addressing these challenges proactively will be critical for ensuring the sustainable growth of the Saudi ABS market.

Comparative Analysis: Saudi Arabia's ABS Market in a Global Context

Compared to other GCC countries, Saudi Arabia’s ABS market is relatively nascent. However, the recent regulatory changes position it for significant growth, potentially closing the gap with more established markets. Compared to developed markets like the US and UK, the Saudi market is smaller but offers the potential for rapid expansion. Key differences include regulatory frameworks, market maturity, and the unique characteristics of the Islamic finance sector. A comparative analysis reveals both competitive advantages (e.g., high growth potential, supportive government policies) and disadvantages (e.g., market liquidity, investor sophistication) when benchmarking against global counterparts. Further research comparing key performance indicators (KPIs) across various jurisdictions will be beneficial in identifying areas for improvement.

Conclusion: Navigating the Future of Saudi Arabia's ABS Market

The regulatory overhaul of Saudi Arabia's ABS market marks a pivotal moment. The changes present substantial opportunities for growth across diverse sectors, attracting both domestic and international investment. However, addressing the inherent challenges – such as developing market liquidity and fostering investor education – is crucial for sustainable development. The future of Saudi Arabia's ABS market looks promising, with the potential to become a major player in the region and beyond. Stay informed about the latest developments in the Saudi Arabia's ABS market. Consider consulting with financial experts specializing in the Saudi Arabian market to explore potential investment and participation opportunities. Share this article to help others understand the dynamics of the Saudi ABS market.

Featured Posts

-

Mental Health A Key Driver Of Productivity And Employee Wellbeing

May 03, 2025

Mental Health A Key Driver Of Productivity And Employee Wellbeing

May 03, 2025 -

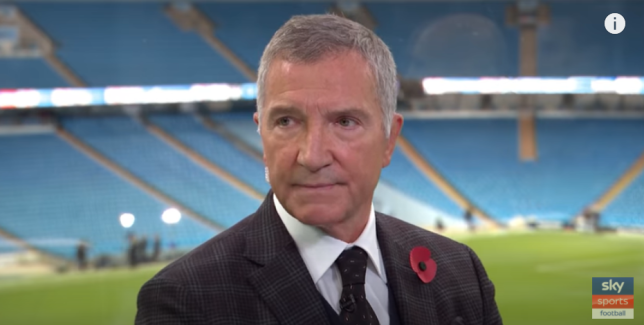

Graeme Souness On Manchester Uniteds Transfer Mistakes

May 03, 2025

Graeme Souness On Manchester Uniteds Transfer Mistakes

May 03, 2025 -

Farage Accused Of Far Right Ties Union Condemnation

May 03, 2025

Farage Accused Of Far Right Ties Union Condemnation

May 03, 2025 -

Navigating The Belgian Energy Market Securing Funding For A 270 M Wh Bess

May 03, 2025

Navigating The Belgian Energy Market Securing Funding For A 270 M Wh Bess

May 03, 2025 -

Daisy May Cooper Shows Off Huge Diamond Engagement Ring

May 03, 2025

Daisy May Cooper Shows Off Huge Diamond Engagement Ring

May 03, 2025