Analysis Of Trump's Oil Price Views: A Goldman Sachs Perspective

Table of Contents

Donald Trump's presidency significantly impacted the global oil market. This analysis delves into his views on oil prices, examining how these views were shaped, their influence on policy decisions, and their ultimate impact as interpreted by the financial experts at Goldman Sachs. We will explore the complexities of his approach and assess its long-term effects on energy markets. Understanding Trump's oil price views is crucial for comprehending the volatile energy landscape of recent years.

Trump's Stated Goals Regarding Oil Prices

Lowering Gas Prices for Consumers

Trump frequently emphasized lowering gas prices for American consumers. This promise was a cornerstone of his economic platform, tied to his broader promises of improved living standards and economic growth. Lowering fuel costs was presented as a direct benefit to everyday Americans, a key element of his populist appeal.

- Examples of Trump's statements: Numerous campaign speeches and tweets directly addressed the need to reduce gas prices, often criticizing previous administrations for their perceived failures in this area.

- Political motivations: Lower gas prices directly impact household budgets, making them a powerful political tool. Trump's focus on this issue resonated with voters concerned about rising costs.

- Potential impact on voter sentiment: The success or failure in achieving lower gas prices likely played a role in his electoral performance, influencing voter perception of his economic policies.

Energy Independence and Reduced Reliance on OPEC

A central tenet of Trump's energy policy was achieving American energy independence and reducing reliance on OPEC (Organization of the Petroleum Exporting Countries). This strategy aimed to enhance national security and provide greater control over oil prices.

- Specific policies implemented: This included deregulation of oil and gas production, particularly through streamlining environmental permits and easing restrictions on drilling on federal lands.

- Effects on domestic oil production: The deregulation efforts led to a significant increase in domestic oil and natural gas production, particularly from shale formations.

- Goldman Sachs's predictions regarding energy independence: Goldman Sachs analysts likely assessed the feasibility of complete energy independence, considering factors like global demand, domestic production capacity, and geopolitical risks. Their analyses likely incorporated these factors into their oil price forecasts.

Impact on Shale Oil Production

Trump's policies had a profound impact on the burgeoning shale oil industry. The easing of regulations encouraged increased investment and production, leading to a surge in US oil output.

- Analysis of investment in shale oil under Trump: Investment in shale oil exploration and extraction increased significantly during his presidency, driven by the perception of a more favorable regulatory environment.

- Goldman Sachs's projections for shale oil output: Goldman Sachs likely provided detailed projections for shale oil production, considering factors such as technological advancements, price volatility, and the long-term sustainability of this production method.

- Consideration of environmental impact: The environmental consequences of increased shale oil production, including water usage and greenhouse gas emissions, were likely a key consideration in Goldman Sachs's assessments.

Goldman Sachs's Analysis of Trump's Oil Policies

Goldman Sachs's Forecasts Under Trump's Presidency

Goldman Sachs, as a leading financial institution, regularly produced forecasts for oil prices, incorporating the potential impacts of Trump's policies.

- Specific price predictions: Their predictions likely accounted for the effects of deregulation, increased domestic production, and geopolitical factors influenced by Trump's administration.

- Reasons behind Goldman Sachs's assessments: The rationale behind their price predictions would have involved complex modeling, incorporating various economic, political, and geological data points.

- Comparison to actual oil price movements: A comparison of Goldman Sachs's forecasts with the actual movement of oil prices during Trump's presidency would provide a measure of the accuracy of their analyses.

Assessment of the Impact of Deregulation

Goldman Sachs likely offered comprehensive analyses of the economic effects of Trump's deregulation policies. These assessments would have explored both the potential benefits and drawbacks.

- Goldman Sachs's commentary on the benefits and risks: The benefits might include increased production, job creation, and lower energy prices. Risks might include environmental concerns and potential market instability.

- Consideration of environmental regulations: The impact of reduced environmental regulations on the oil and gas industry and the wider environment was certainly a key focus of Goldman Sachs's analysis.

- Assessment of market stability: Goldman Sachs would have assessed the potential effect of deregulation on the stability of the oil and gas market, examining factors like price volatility and supply chain disruptions.

Geopolitical Considerations

Goldman Sachs's analysis would have inherently considered the geopolitical landscape and Trump's foreign policy. International relations significantly affect global oil prices.

- Specific geopolitical events during Trump's presidency: These events could include changes in relations with OPEC nations, sanctions against Iran, and shifts in US alliances.

- Goldman Sachs's assessment of their impact on the oil market: Goldman Sachs's analysis would have assessed how these geopolitical events influenced oil supply, demand, and pricing.

- How Trump's foreign policy influenced these events: Trump's foreign policy decisions likely played a crucial role in shaping these geopolitical events and their subsequent impact on the oil market.

Conclusion

This analysis demonstrates that Trump's views on oil prices, characterized by a focus on lower gas prices, energy independence, and deregulation, significantly influenced his energy policies. Goldman Sachs's analysis likely provided detailed forecasts and assessments of the economic and geopolitical ramifications of these policies, considering factors like shale oil production, OPEC dynamics, and the environmental impact of deregulation. Their predictions were likely interwoven with the unfolding geopolitical landscape under the Trump administration. Understanding the interaction between Trump's stated goals, policy implementations, and their impact on the global energy market, as interpreted by experts like Goldman Sachs, offers valuable insight into the complexities of energy markets.

Call to Action: To gain a deeper understanding of the complex interplay between presidential policy and global oil markets, further research into Goldman Sachs's reports on energy policy and the impact of presidential administrations on oil prices is crucial. Understanding the nuances of Trump's oil price views, as analyzed by Goldman Sachs, offers valuable insights for investors and policymakers alike. Continue your analysis of Trump's oil price views and their lasting impact.

Featured Posts

-

Pressure Sales Tactics Taiwans Regulatory Scrutiny Of Etf Firms

May 15, 2025

Pressure Sales Tactics Taiwans Regulatory Scrutiny Of Etf Firms

May 15, 2025 -

Exploring The Power Of Chanel Through Tylas Persona

May 15, 2025

Exploring The Power Of Chanel Through Tylas Persona

May 15, 2025 -

Tampa Bay Rays Achieve Series Sweep Against Padres

May 15, 2025

Tampa Bay Rays Achieve Series Sweep Against Padres

May 15, 2025 -

Fernando Tatis Jr And The Padres A Look At Recent Performance And Future Prospects San Diego Union Tribune

May 15, 2025

Fernando Tatis Jr And The Padres A Look At Recent Performance And Future Prospects San Diego Union Tribune

May 15, 2025 -

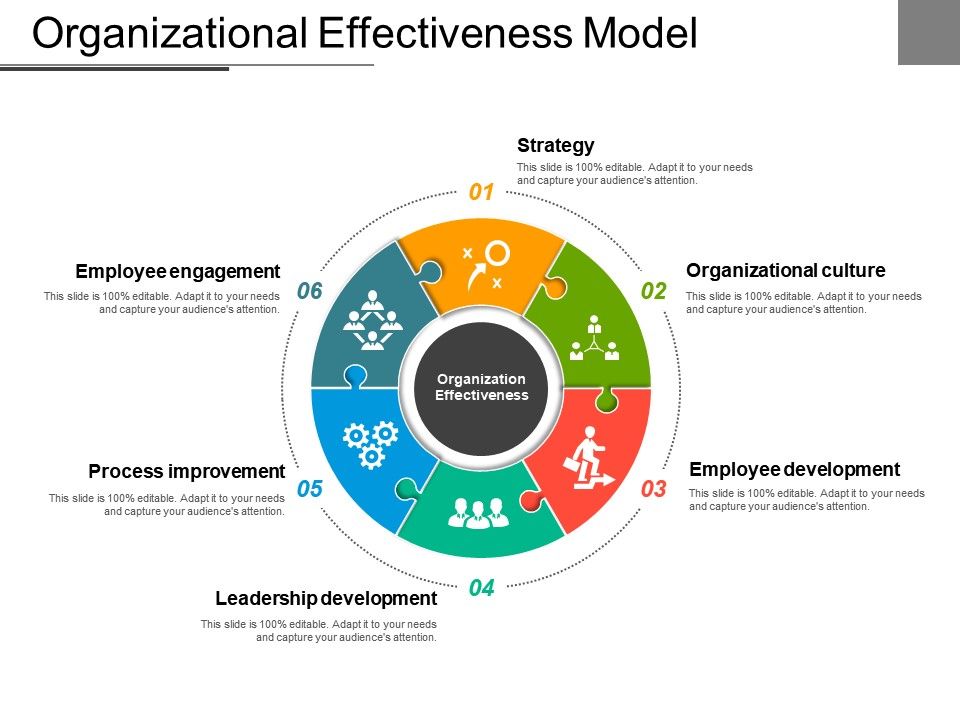

Investing In Middle Management A Key To Organizational Effectiveness

May 15, 2025

Investing In Middle Management A Key To Organizational Effectiveness

May 15, 2025

Latest Posts

-

Chandler Predicts Ufc 314 Clash With Pimblett Will Expose His Limitations

May 15, 2025

Chandler Predicts Ufc 314 Clash With Pimblett Will Expose His Limitations

May 15, 2025 -

After Chandler Fight Is A Ufc Title Next For Paddy Pimblett

May 15, 2025

After Chandler Fight Is A Ufc Title Next For Paddy Pimblett

May 15, 2025 -

Can Paddy Pimblett Win The Ufc Title A Legends Prediction

May 15, 2025

Can Paddy Pimblett Win The Ufc Title A Legends Prediction

May 15, 2025 -

Pimbletts Post Chandler Future A Ufc Title Shot On The Horizon

May 15, 2025

Pimbletts Post Chandler Future A Ufc Title Shot On The Horizon

May 15, 2025 -

Mlb History Rewritten Padres Accomplish Unheard Of Feat

May 15, 2025

Mlb History Rewritten Padres Accomplish Unheard Of Feat

May 15, 2025