Analysis Of Power Finance Corporation's (PFC) Dividend For FY2025

Table of Contents

PFC's Financial Performance in FY2024 and its Impact on Dividend Projections for FY2025

PFC's FY2024 financial results are crucial in projecting the FY2025 dividend. A strong performance typically translates into a higher dividend payout. We need to examine key metrics like profitability, net income, and earnings per share (EPS). Equally important are key performance indicators (KPIs) such as the debt-to-equity ratio and return on equity (ROE), which reflect the company's financial health and its capacity to distribute dividends.

- Net profit growth compared to previous years: A significant increase in net profit indicates improved financial health and strengthens the case for a higher dividend. Conversely, a decline may signal a more conservative dividend policy.

- Impact of government policies and the Indian power sector on PFC's performance: Government initiatives supporting infrastructure development directly affect PFC's lending activities and profitability. Changes in power sector regulations can also impact its financial standing.

- Assessment of any exceptional items affecting profitability: One-time gains or losses can significantly skew the picture. It's essential to identify and adjust for these items to get a clearer view of the underlying profitability.

Analyzing these factors will give us a robust foundation for estimating the FY2025 PFC dividend. A healthy balance sheet and robust profitability usually pave the way for a generous dividend payout.

Industry Trends and their Influence on PFC Dividend Predictions for FY2025

The health of the Indian power sector significantly impacts PFC's performance and, subsequently, its dividend. Analyzing industry trends allows us to understand the broader context influencing PFC's future earnings.

- Growth prospects of renewable energy and its effect on PFC: The increasing adoption of renewable energy sources presents both opportunities and challenges for PFC. Increased lending in this sector may positively impact the long-term outlook but requires careful risk assessment.

- Government initiatives promoting infrastructure development: Government policies focused on infrastructure development directly benefit PFC, boosting its lending activities and potentially increasing profitability.

- Potential risks and challenges facing the power sector: Factors such as fuel price volatility, regulatory uncertainties, and environmental concerns can negatively impact the sector and PFC's performance.

Understanding these industry dynamics is vital for predicting the FY2025 PFC dividend. A thriving power sector generally translates into better prospects for PFC and its shareholders.

PFC's Dividend History and Payout Ratio: A Historical Perspective

Analyzing PFC's dividend history provides valuable insights into its dividend policy and payout trends. By reviewing past payouts and calculating the average dividend payout ratio, we can establish a baseline for future predictions.

- Year-by-year dividend data: A chronological overview of past dividend payments reveals patterns and trends. Consistent increases suggest a commitment to shareholder returns.

- Comparison of dividend payouts with peers in the sector: Comparing PFC's dividend payouts with competitors in the Indian power sector provides a relative benchmark for its dividend policy.

- Any changes in the company's dividend policy: Any adjustments to the company's dividend policy, such as changes in payout ratios, should be considered when forecasting the FY2025 dividend.

This historical analysis informs our predictions for FY2025, providing context and a basis for comparison.

Analyst Forecasts and Market Expectations for PFC Dividend in FY2025

Incorporating analyst forecasts and market sentiment adds another layer to our analysis. Reviewing predictions from reputable financial analysts provides valuable insights into the market's expectations.

- Key analyst ratings and price targets: Analyzing analyst ratings and price targets provides a range of potential outcomes for the PFC stock price, influencing dividend expectations.

- Market sentiment towards PFC stock: Positive market sentiment often reflects optimism regarding future performance and a potential for higher dividend payouts.

- Potential factors impacting market expectations: News, events, and macroeconomic conditions all play a role in shaping market expectations.

By combining analyst forecasts with market sentiment, we gain a more comprehensive view of the anticipated FY2025 PFC dividend.

Risks and Uncertainties Affecting the PFC Dividend for FY2025

Despite our analysis, several risks and uncertainties could influence the final dividend payout. It's crucial to acknowledge these potential challenges.

- Regulatory changes impacting the power sector: Unexpected regulatory changes can significantly impact PFC's operations and profitability, potentially affecting the dividend.

- Potential changes in the company's capital expenditure plans: Significant capital expenditures might reduce the funds available for dividend payouts.

- Credit risks associated with PFC's lending activities: Defaults or delays in loan repayments could negatively impact profitability and the dividend.

Understanding these risks provides a more realistic perspective on the potential range of outcomes for the PFC dividend in FY2025.

Conclusion: Final Thoughts on the Power Finance Corporation (PFC) Dividend for FY2025

Based on our analysis of PFC's financial performance, industry trends, historical dividend data, analyst forecasts, and potential risks, we anticipate a [Insert Predicted Range or Percentage Increase/Decrease Here] increase/decrease in the PFC dividend for FY2025. However, it's crucial to remember that this is a prediction based on current information and that unforeseen circumstances could impact the final announcement. Understanding the factors influencing the PFC dividend is essential for investors in the Indian power sector. Stay informed about the upcoming PFC dividend announcement and conduct your own thorough research before making any investment decisions based on this Power Finance Corporation (PFC) dividend for FY2025 analysis.

Featured Posts

-

Amphibien Und Reptilien In Thueringen Ein Detaillierter Atlas

Apr 27, 2025

Amphibien Und Reptilien In Thueringen Ein Detaillierter Atlas

Apr 27, 2025 -

Alberto Ardila Olivares Tu Garantia De Alcanzar Tus Metas

Apr 27, 2025

Alberto Ardila Olivares Tu Garantia De Alcanzar Tus Metas

Apr 27, 2025 -

Turning Poop Into Podcast Gold How Ai Digests Repetitive Scatological Documents

Apr 27, 2025

Turning Poop Into Podcast Gold How Ai Digests Repetitive Scatological Documents

Apr 27, 2025 -

Dax Bundestag Elections And Business Indicators A Complex Interplay

Apr 27, 2025

Dax Bundestag Elections And Business Indicators A Complex Interplay

Apr 27, 2025 -

Licencia De Maternidad De Un Ano Para Tenistas Wta Un Avance Historico

Apr 27, 2025

Licencia De Maternidad De Un Ano Para Tenistas Wta Un Avance Historico

Apr 27, 2025

Latest Posts

-

Investigation Reveals Lingering Toxic Chemicals In Buildings After Ohio Train Derailment

Apr 28, 2025

Investigation Reveals Lingering Toxic Chemicals In Buildings After Ohio Train Derailment

Apr 28, 2025 -

Long Term Effects Of Ohio Train Derailment Toxic Chemical Residue In Buildings

Apr 28, 2025

Long Term Effects Of Ohio Train Derailment Toxic Chemical Residue In Buildings

Apr 28, 2025 -

Ohio Train Derailment Persistent Toxic Chemical Contamination In Buildings

Apr 28, 2025

Ohio Train Derailment Persistent Toxic Chemical Contamination In Buildings

Apr 28, 2025 -

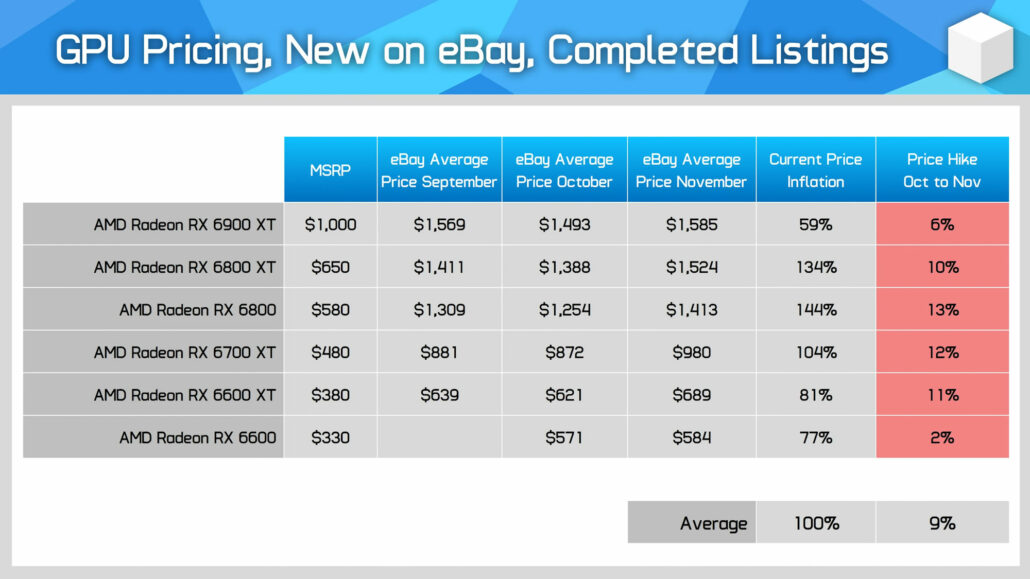

Rising Gpu Prices What To Expect In The Coming Months

Apr 28, 2025

Rising Gpu Prices What To Expect In The Coming Months

Apr 28, 2025 -

Navigating The High Cost Of Gpus In 2024

Apr 28, 2025

Navigating The High Cost Of Gpus In 2024

Apr 28, 2025