Analysis Of Leveraged Semiconductor ETF Performance Leading Up To Market Surge

Table of Contents

The semiconductor industry is known for its breathtaking volatility. A recent surge saw the Nasdaq Composite soar by X%, highlighting the explosive potential – and inherent risk – within this sector. Understanding the behavior of leveraged semiconductor ETFs before these market surges is crucial for investors seeking both high returns and risk mitigation. This article will analyze the performance of leveraged semiconductor ETFs in the lead-up to market surges, identifying key trends and factors influencing their behavior. We'll explore the mechanics of these ETFs, examine historical data, and discuss effective risk management strategies.

Understanding Leveraged Semiconductor ETFs and Their Mechanics

Leveraged ETFs aim to deliver a multiple (e.g., 2x, 3x) of the daily performance of an underlying index. Crucially, they reset daily (or sometimes weekly). This means their returns are not simply a multiple of the underlying index's total return over a longer period. The daily reset mechanism can lead to significant deviations from the intended multiple return over longer timeframes, especially in volatile markets.

The semiconductor industry is the backbone of modern technology, encompassing the design, manufacture, and distribution of integrated circuits, microprocessors, memory chips, and other related components. Its importance in the tech sector cannot be overstated, driving innovation across various industries, from smartphones and computers to automobiles and medical devices.

Several prominent leveraged semiconductor ETFs exist, including (but not limited to) SOXL (ProShares Ultra Semiconductor). These ETFs often track indices that represent a basket of semiconductor companies. It's essential to understand the specific index each ETF tracks to assess its holdings and risk profile.

Inherent Risks of Leveraged Investing:

- Volatility: Leveraged ETFs amplify both gains and losses, leading to heightened volatility.

- Decay: The daily reset mechanism can lead to a phenomenon known as "volatility decay," where the ETF's return over a longer period underperforms the intended multiple of the underlying index's return, particularly in sideways or slightly declining markets.

- Expense Ratios: Leveraged ETFs generally have higher expense ratios than traditional ETFs.

Examples of Semiconductor Companies Included in ETF Indices:

- Taiwan Semiconductor Manufacturing Company (TSM)

- Intel Corporation (INTC)

- Nvidia Corporation (NVDA)

- Qualcomm Incorporated (QCOM)

- Advanced Micro Devices, Inc. (AMD)

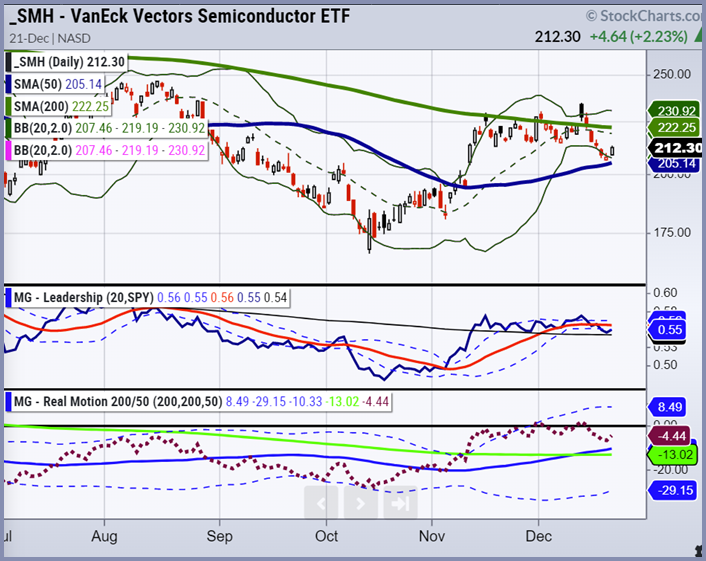

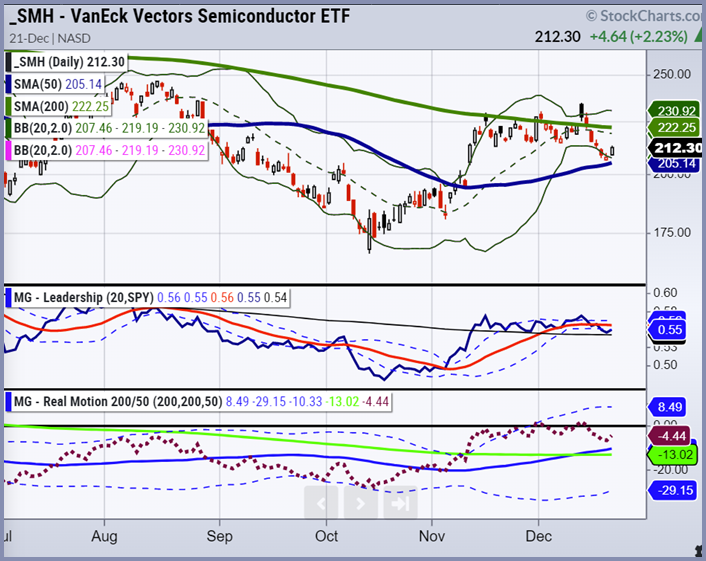

Analyzing Historical Performance Leading Up to Market Surges

Analyzing historical data on leveraged semiconductor ETFs reveals interesting patterns. We need to examine periods preceding significant market upturns in the semiconductor sector. (Insert charts and graphs here comparing the performance of selected leveraged semiconductor ETFs against broader market indices during specific periods leading up to market surges. Clearly label the axes and provide a legend).

Patterns and Trends:

- Often, a period of consolidation or slight decline precedes a major surge. During this period, the leveraged ETF may underperform due to volatility decay.

- As the market begins its uptrend, leveraged ETFs typically show amplified gains, significantly outperforming the broader market.

- The magnitude of the ETF's gains will generally be dependent on the duration and sharpness of the market surge.

Comparing Performance to Broader Market Indices:

Leveraged semiconductor ETFs often exhibit significantly higher volatility than broader market indices like the S&P 500 or the Nasdaq Composite. During periods of market uncertainty, they can experience much steeper declines, but conversely, they also benefit from amplified gains during uptrends.

Examples of Market Surges and Corresponding ETF Performance:

- Insert specific examples with quantifiable data showing ETF performance relative to market performance.

Key Factors Influencing ETF Performance Before Surges

Several factors influence the performance of leveraged semiconductor ETFs before market surges:

Macroeconomic Factors:

- Interest Rates: Changes in interest rates affect borrowing costs and overall investment sentiment.

- Global Economic Growth: Strong global economic growth typically fuels demand for semiconductors, benefiting the sector.

Industry-Specific Factors:

- Technological Advancements: Breakthroughs in areas like artificial intelligence, 5G, and the Internet of Things (IoT) drive demand for advanced semiconductors.

- Supply Chain Disruptions: Geopolitical events and logistical challenges can impact semiconductor supply, creating price volatility.

- Government Regulations: Government policies and trade regulations can influence the semiconductor industry's landscape.

Investor Sentiment and Market Psychology:

Investor expectations play a crucial role. Positive news and forecasts can lead to increased demand for semiconductor ETFs, driving up prices, while negative sentiment can result in sharp declines.

Examples of Significant Events Affecting the Semiconductor Industry and the Resulting ETF Performance:

- Insert specific examples of news events and their impact on ETF performance.

Risk Management Strategies for Leveraged Semiconductor ETFs

Investing in leveraged ETFs demands a sophisticated approach to risk management.

Strategies for Mitigating Risks:

- Diversification: Don't put all your eggs in one basket. Diversify your portfolio across different asset classes and sectors.

- Stop-Loss Orders: Set stop-loss orders to limit potential losses.

- Hedging: Consider hedging strategies to protect against potential downsides.

- Position Sizing: Carefully manage your position size to avoid excessive risk.

Understanding Your Risk Tolerance:

Only invest in leveraged semiconductor ETFs if you fully understand the inherent risks and have a high-risk tolerance. These are not suitable for conservative investors.

Specific Examples of Risk Management Strategies in Practice:

- Explain practical applications of the strategies mentioned above.

Conclusion: Leveraged Semiconductor ETFs and the Road Ahead

This analysis has revealed that leveraged semiconductor ETFs exhibit significantly amplified returns compared to the underlying index, particularly during periods leading up to market surges. However, the daily reset mechanism introduces significant risks, including volatility decay, particularly during periods of sideways or slightly declining markets. Understanding these risks is paramount before investing.

The future performance of these ETFs will depend heavily on macroeconomic conditions, technological advancements within the semiconductor industry, and overall investor sentiment. While the potential for high returns exists, investors must be fully aware of the substantial risks involved.

Before investing in leveraged semiconductor ETFs, conduct thorough research and understand the inherent risks. Further analysis of these instruments is recommended for informed investment decisions.

Featured Posts

-

Pl Retro On Sky Sports How To Find And Watch Premier League Classics In Hd

May 13, 2025

Pl Retro On Sky Sports How To Find And Watch Premier League Classics In Hd

May 13, 2025 -

Scarlett Johansson Visszater A Marvel Be A Kult Sztarja Megszolalt

May 13, 2025

Scarlett Johansson Visszater A Marvel Be A Kult Sztarja Megszolalt

May 13, 2025 -

Ob Avena Prva Zbirka Romski Ba Ki

May 13, 2025

Ob Avena Prva Zbirka Romski Ba Ki

May 13, 2025 -

Nba 2025 Draft Lottery A Look At The Odds And The Cooper Flagg Race

May 13, 2025

Nba 2025 Draft Lottery A Look At The Odds And The Cooper Flagg Race

May 13, 2025 -

Miami Open 2024 Sabalenka Claims Title After Pegula Clash

May 13, 2025

Miami Open 2024 Sabalenka Claims Title After Pegula Clash

May 13, 2025