Analysis Of Fremantle's Q1 2024 Performance: A 5.6% Revenue Decrease

Table of Contents

Factors Contributing to Fremantle's Q1 2024 Revenue Decline

Several interconnected factors contributed to Fremantle's disappointing Q1 2024 financial performance. Understanding these challenges is crucial to evaluating the company's future prospects.

Impact of Global Economic Slowdown

The global economic slowdown, characterized by high inflation and recessionary fears, significantly impacted Fremantle's revenue. This macroeconomic environment directly affected both advertising revenue and production budgets.

- Reduced advertiser spending: Brands reacted to economic uncertainty by cutting back on advertising budgets, impacting Fremantle's revenue streams from advertising-supported content. Reports indicate a 7% decrease in advertising spend across major television networks in the same period, a trend likely mirrored in the digital realm.

- Postponed production projects: The economic climate made securing financing for new projects more challenging, leading to delays and postponements of productions, directly impacting Q1 revenue.

- Difficulties securing financing: Increased risk aversion amongst investors led to higher interest rates and stricter lending criteria, making it harder for Fremantle to secure the necessary funding for large-scale productions.

Increased Production Costs and Challenges

Rising production costs presented another major hurdle for Fremantle in Q1 2024. These escalating costs significantly impacted profitability and squeezed margins.

- Rising labor costs in key production hubs: Increased demand for skilled labor in major production centers, coupled with inflation, drove up labor costs substantially.

- Supply chain disruptions affecting production timelines: Global supply chain disruptions continued to impact production schedules, leading to delays and increased costs associated with sourcing materials and equipment.

- Increased insurance premiums: The complexity and risk associated with large-scale productions resulted in higher insurance premiums, adding to the overall production budget. For example, insurance costs for filming in high-risk locations saw a notable increase.

Competition and Market Saturation

The media landscape is increasingly saturated, with intense competition from established players and emerging streaming platforms. This competition impacted Fremantle's ability to maintain market share and attract audiences.

- Competition for talent and intellectual property: The battle for securing top-tier talent and acquiring compelling intellectual property is fierce, driving up costs and increasing the pressure on Fremantle's profitability.

- Market share erosion: The emergence of new streaming platforms and the diversification of content consumption habits have led to a decline in market share for traditional media companies, including Fremantle.

- Challenges in attracting and retaining subscribers: In a crowded marketplace, attracting and retaining subscribers requires a continuous stream of high-quality, engaging content, which adds significant pressure on production and marketing budgets. Competitors like Netflix and Disney+ have aggressive strategies for acquiring and retaining viewers.

Fremantle's Strategic Response to the Revenue Decrease

Fremantle has implemented various strategic measures to address the revenue decline and position itself for future growth.

Cost-Cutting Measures and Efficiency Initiatives

To mitigate the impact of the revenue decrease, Fremantle has focused on implementing cost-cutting measures and improving operational efficiency.

- Streamlining production processes: Fremantle is actively seeking ways to streamline its production processes, reducing waste and improving overall efficiency. This includes the adoption of new technologies and workflows.

- Renegotiation of contracts with suppliers: The company is actively negotiating contracts with suppliers to secure more favorable terms and reduce costs.

- Restructuring and targeted staff reductions: While not explicitly stated in public announcements, industry insiders suggest Fremantle may have undertaken some restructuring and targeted staff reductions in certain departments to reduce operational expenses.

Content Strategy and Portfolio Diversification

Fremantle's response also involves a refined content strategy aimed at diversifying its portfolio and attracting new audiences.

- Investment in new genres and formats: The company is investing in developing content in new genres and formats to appeal to broader audiences and stay competitive. This might include exploring emerging formats like interactive narratives or expanding into the podcasting space.

- Expansion into new markets: Fremantle is exploring expansion into new geographical markets to diversify its revenue streams and reduce reliance on any single market.

- Strategic partnerships with other media companies: Collaborations with other companies can provide access to new audiences, resources, and technologies. This strategic approach allows for shared risk and amplified distribution.

Long-Term Outlook and Growth Prospects

Despite the challenges of Q1 2024, Fremantle remains optimistic about its long-term growth prospects. The company's long-term strategy focuses on adapting to the evolving media landscape.

- Potential for recovery in subsequent quarters: Industry analysts anticipate a gradual recovery in the advertising market and a stabilization of production costs, suggesting a potential rebound in Fremantle's financial performance in later quarters.

- Long-term growth targets: Fremantle has outlined ambitious long-term growth targets, focusing on strategic investments and efficient operations.

- Plans for expansion into new markets: The company's commitment to expanding into new markets positions them for growth and reduces dependence on any single region's economic performance.

Conclusion: Assessing Fremantle's Q1 2024 Performance and Future Trajectory

Fremantle's 5.6% revenue decrease in Q1 2024 is a consequence of several factors, including the global economic slowdown, rising production costs, and intensified competition within the media industry. However, the company's strategic responses, focusing on cost optimization, content diversification, and market expansion, demonstrate a proactive approach to navigating these challenges. While the short-term outlook presents hurdles, Fremantle’s long-term prospects remain promising, contingent on successful execution of its strategic plan.

Stay informed about Fremantle's performance and the evolving dynamics of the media industry by regularly checking our website for updates on Fremantle's financial reporting and analysis. Understanding Fremantle's Q1 2024 revenue decrease is crucial for anyone following the global media landscape.

Featured Posts

-

Filmo Bado Zaidynes Zvaigzde Jennifer Lawrence Ir Jos Antras Vaikas Vardai Ir Detales

May 20, 2025

Filmo Bado Zaidynes Zvaigzde Jennifer Lawrence Ir Jos Antras Vaikas Vardai Ir Detales

May 20, 2025 -

New Business Hotspots A National Map And Analysis

May 20, 2025

New Business Hotspots A National Map And Analysis

May 20, 2025 -

Millions Could Be Owed Hmrc Refunds Check Your Payslip Now

May 20, 2025

Millions Could Be Owed Hmrc Refunds Check Your Payslip Now

May 20, 2025 -

Dimotiko Odeio Rodoy Synaylia Kathigiton Stin Dimokratiki

May 20, 2025

Dimotiko Odeio Rodoy Synaylia Kathigiton Stin Dimokratiki

May 20, 2025 -

Agatha Christies Poirot A Critical Look At The Stories And Adaptations

May 20, 2025

Agatha Christies Poirot A Critical Look At The Stories And Adaptations

May 20, 2025

Latest Posts

-

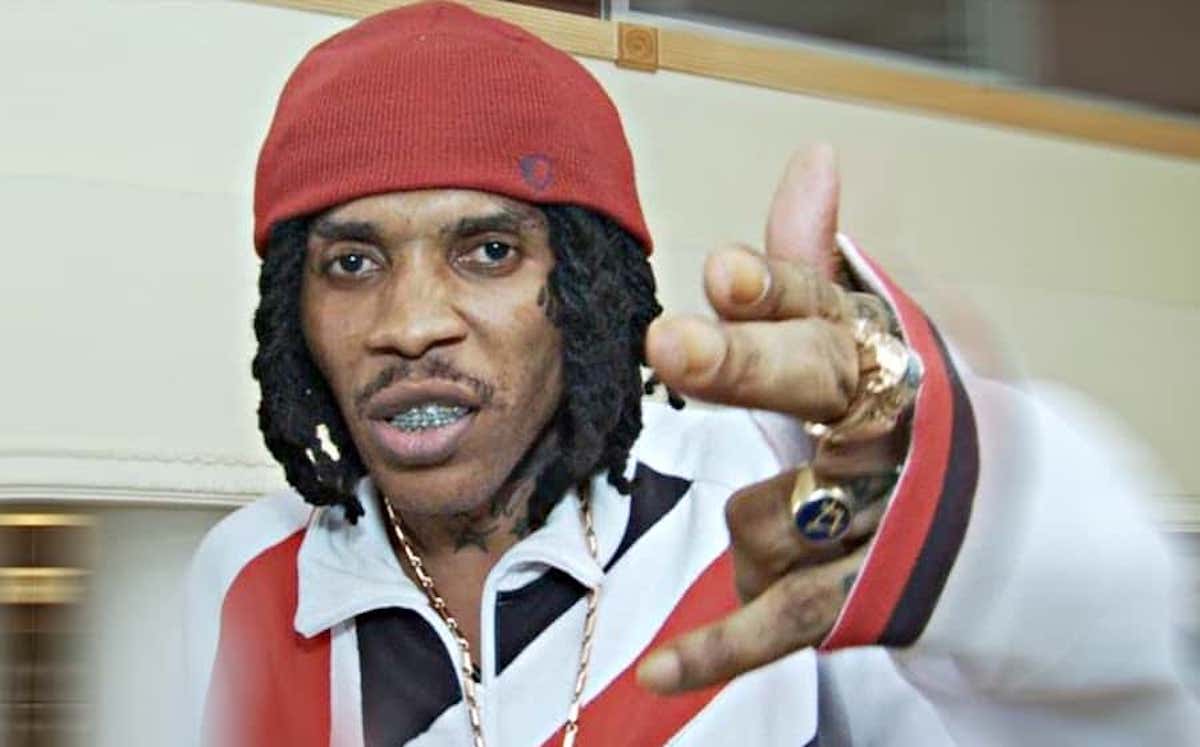

New Music On The Horizon Vybz Kartel Addresses Prison Life Family And Future

May 21, 2025

New Music On The Horizon Vybz Kartel Addresses Prison Life Family And Future

May 21, 2025 -

Vybz Kartel A Prison Update Family Freedom And Upcoming Music

May 21, 2025

Vybz Kartel A Prison Update Family Freedom And Upcoming Music

May 21, 2025 -

Vybz Kartel Speaks Prison Life Freedom Family And New Music

May 21, 2025

Vybz Kartel Speaks Prison Life Freedom Family And New Music

May 21, 2025 -

The Impact Of Beenie Mans New York Venture On It A Stream

May 21, 2025

The Impact Of Beenie Mans New York Venture On It A Stream

May 21, 2025 -

Vybz Kartel In New York A Landmark Concert Event

May 21, 2025

Vybz Kartel In New York A Landmark Concert Event

May 21, 2025