Analysis: China's Steel Production Cuts And The Future Of Iron Ore

Table of Contents

The Scale and Impact of China's Steel Production Cuts

The Chinese government's recent pronouncements regarding steel production reductions represent a substantial shift in the global market. These cuts aim to address several key challenges simultaneously: environmental concerns, overcapacity within the steel industry, and a slowing domestic economy. The magnitude of these cuts is significant, with targeted reduction percentages varying depending on the region and specific steel mill. While precise figures fluctuate, we're talking about millions of tons of reduced steel output annually.

- Specific examples of production cuts: Reports indicate that major steel mills like Hebei Iron and Steel and Baowu Steel Group have implemented substantial production curtailments, ranging from 5% to 15% in certain quarters.

- Quantifiable data: Before the cuts, China accounted for roughly half of the world's steel production. Even a relatively small percentage reduction in this massive output translates into millions of tons less steel being produced globally. Data from organizations like the World Steel Association will be crucial in tracking the exact impact.

- Short-term impact on steel prices: The initial reaction to the production cuts has been a noticeable increase in steel prices, reflecting the decreased supply. However, the long-term price impact remains uncertain, depending on factors such as global demand and the effectiveness of the production cuts.

Consequences for Iron Ore Demand and Pricing

The relationship between steel production and iron ore demand is intrinsically linked. Iron ore is the primary raw material in steelmaking, making it directly vulnerable to changes in steel production. Reduced steel production inevitably translates into lower iron ore demand. This has significant ramifications for the iron ore market:

- Projected changes in iron ore imports by China: China is the world's largest importer of iron ore. The production cuts will likely lead to a considerable reduction in its iron ore imports, potentially impacting major suppliers like Australia and Brazil.

- Impact on major iron ore producers (Australia, Brazil): Australian and Brazilian iron ore producers, who heavily rely on Chinese demand, will feel the pinch. This could lead to price adjustments, increased competition, and a need for diversification of export markets.

- Potential for price volatility and speculation: The uncertainty surrounding the long-term effects of the production cuts creates an environment ripe for price volatility and market speculation. Investors will closely monitor supply and demand dynamics to gauge future iron ore prices.

Geopolitical Implications and Alternative Markets

China's reduced steel production and consequently, iron ore demand, have significant geopolitical implications. This necessitates a broader perspective on the global steel and iron ore landscape:

- Potential shifts in trade relationships: China's decreased reliance on specific iron ore suppliers could trigger shifts in trade relationships and create new opportunities for other nations.

- Growth opportunities for iron ore producers in other regions: Iron ore producers in other regions, such as Africa and South America, may see increased demand as China potentially diversifies its import sources.

- Potential trade disputes: The reduction in Chinese demand could lead to trade disputes and protectionist measures as countries compete for access to the remaining market share.

Long-Term Outlook and Sustainability

The long-term implications of China's steel production policies are far-reaching. Sustainability and environmental concerns are key drivers of these policies:

- Predictions for future iron ore prices and demand: Long-term predictions are complex, requiring careful consideration of numerous variables, including global economic growth, technological advancements, and environmental regulations.

- Role of sustainable steel production: The shift towards more sustainable steel production, using recycled materials and reducing emissions, will play a significant role in shaping future iron ore demand.

- Potential for alternative materials: The search for alternative materials to replace steel in certain applications could further influence the long-term demand for iron ore.

Conclusion: The Future of Iron Ore in the Shadow of China's Steel Production Cuts

China's steel production cuts represent a watershed moment for the global iron ore market. The reduced demand from China will undoubtedly create challenges for iron ore producers, leading to price volatility and necessitating strategic adjustments. However, it also presents opportunities for diversification and the adoption of more sustainable practices. Understanding and monitoring the evolution of China's steel production policies is crucial for predicting future iron ore market trends. Stay informed about developments in this dynamic sector by following reputable industry news sources and analysis concerning China's steel production cuts and the future of iron ore. Subscribe to our newsletter for regular updates on this critical market.

Featured Posts

-

Uk Student Visa Restrictions Impact On Asylum Seekers

May 09, 2025

Uk Student Visa Restrictions Impact On Asylum Seekers

May 09, 2025 -

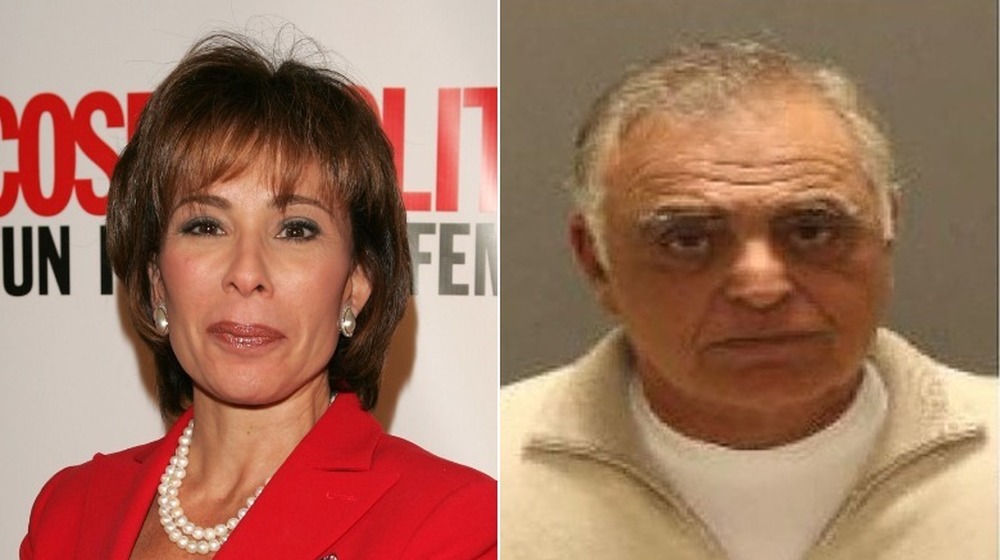

Jeanine Pirros Dc Attorney Nomination Controversy Over Past Incident

May 09, 2025

Jeanine Pirros Dc Attorney Nomination Controversy Over Past Incident

May 09, 2025 -

Leon Draisaitl Injury Oilers Leading Goal Scorer Leaves Game

May 09, 2025

Leon Draisaitl Injury Oilers Leading Goal Scorer Leaves Game

May 09, 2025 -

Wynne And Joanna All At Sea Plot Summary And Character Analysis

May 09, 2025

Wynne And Joanna All At Sea Plot Summary And Character Analysis

May 09, 2025 -

Franco Colapinto Sponsors Live Tv Slip Up Causes F1 Buzz

May 09, 2025

Franco Colapinto Sponsors Live Tv Slip Up Causes F1 Buzz

May 09, 2025