Amsterdam Stock Market Soars 8% After Trump's Tariff Announcement

Table of Contents

Trump's Tariff Announcement and its Unexpected Impact

President Trump's announcement regarding a significant shift in tariff policy on certain imported goods took the market by surprise. While previous tariff announcements had often led to market uncertainty and volatility, this particular announcement differed due to its unexpected nature and specific exemptions granted to certain sectors.

-

Specific details of the tariff announcement: The announcement included a reduction in tariffs on specific goods imported from the Netherlands, a move widely viewed as a strategic concession. This was particularly unexpected given the tense trade relations between the US and some EU member states in recent years.

-

Previous related tariff announcements and their market impact: Previous tariff announcements, especially those targeting European goods, had often resulted in negative market reactions, characterized by immediate drops followed by periods of uncertainty. The AEX, and indeed other European indices, had seen such responses previously.

-

Specific sectors positively impacted by the news: Sectors heavily reliant on US exports from the Netherlands (e.g., agricultural products, certain manufactured goods) saw immediate boosts as the revised tariff policy removed significant trade barriers.

-

The element of surprise and its impact on market psychology: The element of surprise was crucial. The market had braced itself for a continuation of protectionist policies but the sudden reversal sparked a wave of optimism, triggering a rapid buying spree. This is a classic example of how market psychology influences trading decisions even beyond fundamentals.

Analysis of the Amsterdam Stock Market's Reaction

The AEX index saw an unprecedented 8% increase within a single trading day following the tariff announcement, reaching its highest point in over three months. The surge began within minutes of the official announcement and continued for several hours, indicating a significant influx of buying pressure. The increase impacted not just the headline index but also individual stocks that saw substantial price jumps.

-

Leading sectors experiencing significant gains: The technology sector and financial institutions within the AEX were among the leading gainers, experiencing double-digit percentage increases in some cases. This indicated a flight to perceived safety and high-growth sectors.

-

Individual stock performance of prominent Dutch companies: Companies like ASML Holding, a leading semiconductor equipment manufacturer, and Unilever, saw particularly strong gains, reflecting the positive sentiment across multiple sectors.

-

Trading volume during the surge: Trading volume on the Amsterdam Stock Exchange increased dramatically during the surge, exceeding average daily volumes by more than 50%. This high volume further reinforced the significance of the market's reaction.

-

Potential short-term vs. long-term market reactions: While the short-term reaction was undeniably positive, the long-term outlook remains uncertain. Analysts caution against assuming that this single event will guarantee continued growth, emphasizing the need for cautious optimism.

Investor Sentiment and Market Volatility

Investor confidence, which had been relatively subdued prior to the announcement, experienced a sharp upturn. News outlets reported a surge in investor optimism, characterized by increased buying activity and a reduction in risk aversion.

-

Related news articles and expert opinions: Several prominent financial news sources reported a consensus among market analysts that the announcement was a significant positive development. Experts emphasized the potential for improved trade relations.

-

The role of speculation and market sentiment: Market sentiment, driven by speculation surrounding the lasting effects of the announcement, played a significant role. This underscores the importance of fundamental analysis alongside monitoring market psychology.

-

Potential for continued volatility or stabilization: While the initial reaction was dramatic, the market may experience further short-term volatility in the coming weeks as investors assess the long-term implications of Trump's revised policy.

Global Market Implications and the Interconnectedness of the Global Economy

The Amsterdam Stock Market's surge wasn’t an isolated event. The news rippled through global markets, demonstrating the interconnected nature of the global economy.

-

Specific examples of other markets reacting to the news: Other European stock markets experienced significant gains, although the percentage increases were generally lower than those seen in Amsterdam. Asian markets, which were open during the announcement, also showed positive responses.

-

The interconnectedness of the global economy: The reaction highlights the increasing interconnectedness of global financial markets. A significant event in one market can trigger immediate and often substantial reactions in others.

-

Potential for further trade negotiations and their impact on the global market: The announcement fuels speculation about further trade negotiations between the US and the EU, creating a potentially volatile environment as investors await more news and clarity.

Long-Term Outlook and Future Predictions for the Amsterdam Stock Market

Predicting the long-term future of the Amsterdam Stock Market following this event is challenging, but several key factors need to be considered.

-

Different potential scenarios and their probabilities: The most likely scenario is a period of moderate growth, punctuated by occasional volatility as the broader global economic climate shifts. A more optimistic outlook suggests that the improved US-Netherlands trade relations could generate significant long-term growth. A less optimistic view suggests the gains could be short-lived, potentially leading to a market correction.

-

Potential risks and opportunities: Risks include potential shifts in global macroeconomic conditions and any unforeseen geopolitical developments that could negatively impact investment flows. Opportunities exist for investors with a long-term view, especially in sectors directly benefiting from the revised tariff policy.

-

Recommendations for investors: Investors should adopt a balanced approach, diversifying their portfolios and carefully monitoring market developments. A long-term strategy that takes into account potential volatility is crucial.

Conclusion

The 8% surge in the Amsterdam stock market following Trump's tariff announcement underscores the unpredictable nature of global finance and the significant impact of political decisions. While the short-term gains are evident, careful analysis is crucial for investors to navigate the potential long-term consequences. Understanding the interconnectedness of global markets and anticipating future volatility is paramount.

Call to Action: Stay informed on the latest developments affecting the Amsterdam stock market and global trade policies to make informed investment decisions. Continue to monitor the Amsterdam stock market for further insights and analysis. For in-depth insights and expert opinions on navigating the complexities of the Amsterdam stock market, [link to relevant resource/service].

Featured Posts

-

Your Step By Step Guide To Bbc Radio 1 Big Weekend Tickets

May 25, 2025

Your Step By Step Guide To Bbc Radio 1 Big Weekend Tickets

May 25, 2025 -

10 Let Evrovideniya Chto Stalo S Triumfatorami

May 25, 2025

10 Let Evrovideniya Chto Stalo S Triumfatorami

May 25, 2025 -

A Look Inside Nicki Chapmans Bespoke Chiswick Garden

May 25, 2025

A Look Inside Nicki Chapmans Bespoke Chiswick Garden

May 25, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf How Nav Impacts Your Investment

May 25, 2025

Amundi Dow Jones Industrial Average Ucits Etf How Nav Impacts Your Investment

May 25, 2025 -

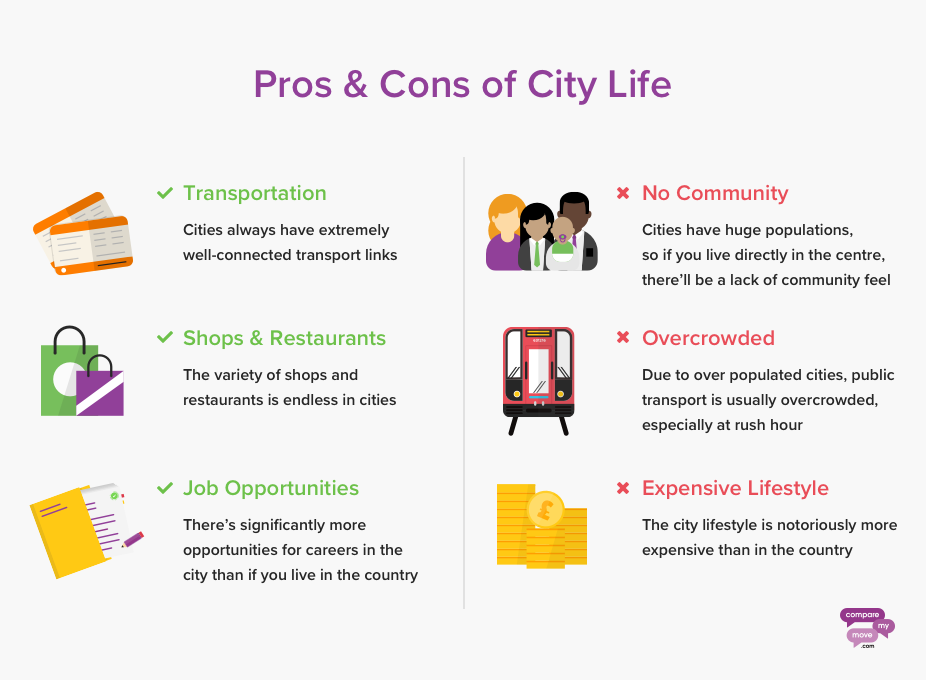

Escape To The Country The Pros And Cons Of Country Life

May 25, 2025

Escape To The Country The Pros And Cons Of Country Life

May 25, 2025

Latest Posts

-

Frank Sinatras Marital History Details On His Four Wives And Relationships

May 25, 2025

Frank Sinatras Marital History Details On His Four Wives And Relationships

May 25, 2025 -

Frank Sinatras Wives Exploring His Four Marriages And Love Life

May 25, 2025

Frank Sinatras Wives Exploring His Four Marriages And Love Life

May 25, 2025 -

The Mia Farrow Trump Dispute A Focus On Venezuelan Gang Member Deportations

May 25, 2025

The Mia Farrow Trump Dispute A Focus On Venezuelan Gang Member Deportations

May 25, 2025 -

Sean Penn Challenges Dylan Farrows Account Of Woody Allen Sexual Abuse

May 25, 2025

Sean Penn Challenges Dylan Farrows Account Of Woody Allen Sexual Abuse

May 25, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy A Closer Look

May 25, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Closer Look

May 25, 2025