Amsterdam Stock Market Plunges 7%: Trade War Fears Fuel Sharp Drop

Table of Contents

Trade War Fears: The Primary Driver of the Amsterdam Stock Market Decline

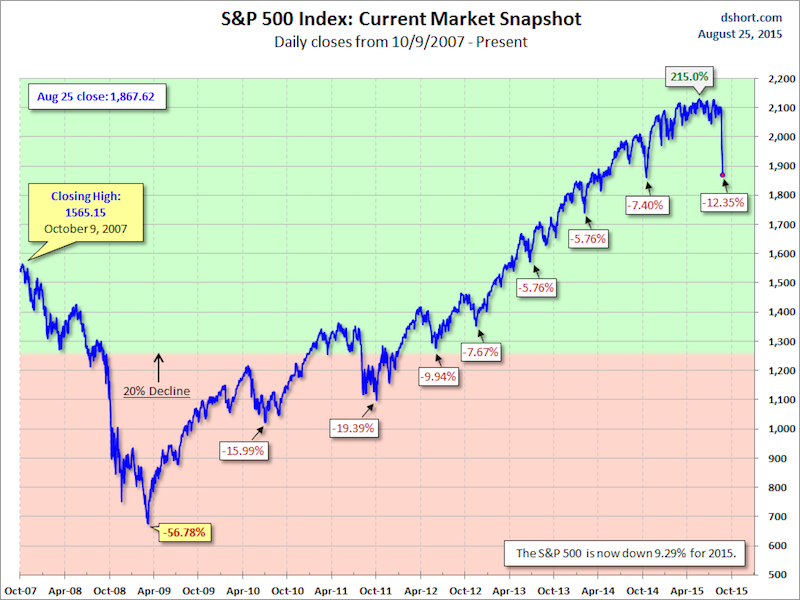

The primary catalyst for the significant Amsterdam stock market decline was the escalating fear of a full-blown trade war. Specifically, increasing US-EU trade tensions and the threat of new tariffs on Dutch exports played a crucial role. This uncertainty created a domino effect, impacting investor confidence and leading to a significant sell-off.

-

Increased uncertainty about future trade relations: The lack of clarity regarding the future trajectory of global trade agreements fueled anxiety among investors. The unpredictable nature of trade policies makes long-term investment planning exceedingly difficult, prompting many to take a more cautious approach.

-

Impact on specific Dutch sectors: The agricultural and technology sectors, key contributors to the Dutch economy, felt the brunt of the trade war anxieties. The threat of tariffs on agricultural products caused significant concern amongst Dutch farmers, while tech companies worried about potential restrictions on data flows and trade in technology components.

-

Analysis of market sentiment shifts due to trade war news: News headlines regarding escalating trade disputes directly correlated with the sharp decline in the Amsterdam Stock Exchange (AEX) index. Negative sentiment quickly spread, triggering a chain reaction of selling pressure. The market’s swift reaction underscores the significant influence of global trade dynamics on the Amsterdam stock market's performance.

Impact on Key Amsterdam-Listed Companies

The 7% drop in the Amsterdam Stock Market significantly impacted numerous companies listed on the AEX index. Major players across various sectors experienced considerable losses.

-

Performance of leading financial institutions: Leading banks and insurance companies saw their share prices decline, reflecting investor concerns about the broader economic implications of the trade war. The uncertainty surrounding global trade negatively impacted forecasts for future profitability and growth within the financial sector.

-

Impact on energy companies: Energy companies, particularly those involved in international trade, also suffered significant losses as trade uncertainty dampened investor confidence in the sector's future prospects. Concerns about potential supply chain disruptions further contributed to the decline.

-

Effects on technology and consumer goods sectors: Technology and consumer goods companies felt the impact as well, with shares experiencing considerable drops. The fear of reduced consumer spending and potential disruptions to supply chains fueled the decline in investor confidence within these sectors.

Investor Reactions and Market Volatility

The Amsterdam stock market plunge sparked immediate and dramatic reactions from investors. Market volatility increased significantly in the aftermath of the drop.

-

Increased trading volume: The immediate reaction to the news resulted in a surge in trading volume as investors rushed to either sell off assets or rebalance their portfolios. This spike in activity further exacerbated the market's volatility.

-

Changes in investor confidence: Investor confidence plummeted, causing a significant shift in market sentiment. This negative sentiment contributed to the ongoing sell-off and increased market instability.

-

Predictions for future market trends: Analysts offered differing predictions regarding future market trends, with some forecasting a period of prolonged volatility while others anticipated a gradual recovery. The uncertainty surrounding global trade policies makes accurate market predictions exceptionally challenging.

Government and Central Bank Responses to the Amsterdam Stock Market Crisis

The Dutch government and the central bank are closely monitoring the situation and exploring potential interventions to mitigate the impact of the stock market crash and stabilize the economy.

-

Statements from government officials: Government officials have issued statements acknowledging the severity of the situation and pledged to closely monitor the economic implications of the trade war. They emphasized the government’s commitment to supporting businesses and maintaining economic stability.

-

Potential economic stimulus measures: Discussions regarding potential economic stimulus measures are underway, aiming to boost investor confidence and support impacted sectors. These measures could include tax cuts, infrastructure investments, and other initiatives designed to stimulate economic growth.

-

Central bank actions to stabilize the market: The central bank is likely to consider measures to stabilize the market, potentially including adjusting interest rates or implementing other monetary policy tools to mitigate the impact of the stock market crash.

Conclusion: Understanding and Navigating the Amsterdam Stock Market Plunge

The 7% drop in the Amsterdam stock market was largely driven by escalating trade war fears and the resulting uncertainty surrounding global trade relations. The impact on key Amsterdam-listed companies, investor sentiment, and the broader Dutch economy is significant. Understanding these factors is crucial for investors navigating the Amsterdam stock market. Staying informed about Amsterdam stock market fluctuations, understanding the intricacies of the Amsterdam stock market crisis, and actively engaging in market analysis are essential to managing investment risk and making informed decisions. Stay updated on the latest news and developments to effectively navigate the dynamic landscape of the Amsterdam stock market.

Featured Posts

-

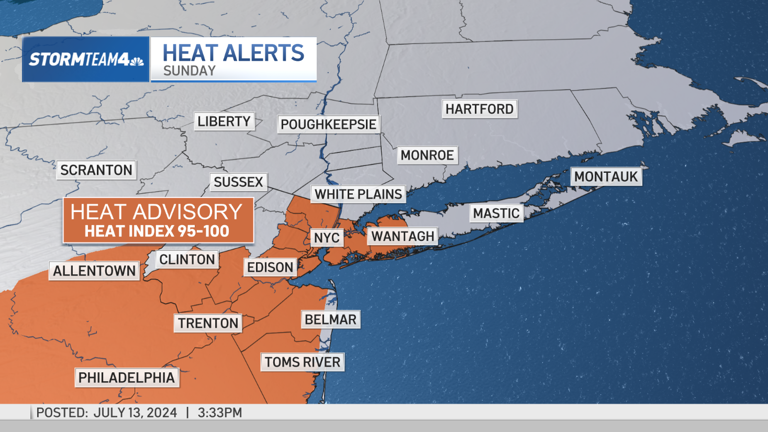

Responding To The Threat Flood Advisories And Severe Weather In Miami Valley

May 25, 2025

Responding To The Threat Flood Advisories And Severe Weather In Miami Valley

May 25, 2025 -

The History And Demise Of Black Lives Matter Plaza In Washington D C

May 25, 2025

The History And Demise Of Black Lives Matter Plaza In Washington D C

May 25, 2025 -

George Russell 1 5m Debt Repaid Fueling Mercedes Contract Speculation

May 25, 2025

George Russell 1 5m Debt Repaid Fueling Mercedes Contract Speculation

May 25, 2025 -

New Ae Xplore Campaign Takes Off England Airpark And Alexandria International Airport Connect Local And Global Communities

May 25, 2025

New Ae Xplore Campaign Takes Off England Airpark And Alexandria International Airport Connect Local And Global Communities

May 25, 2025 -

Tik Tok Tourism Backlash Amsterdam Residents Sue City Over Snack Bar Crowds

May 25, 2025

Tik Tok Tourism Backlash Amsterdam Residents Sue City Over Snack Bar Crowds

May 25, 2025

Latest Posts

-

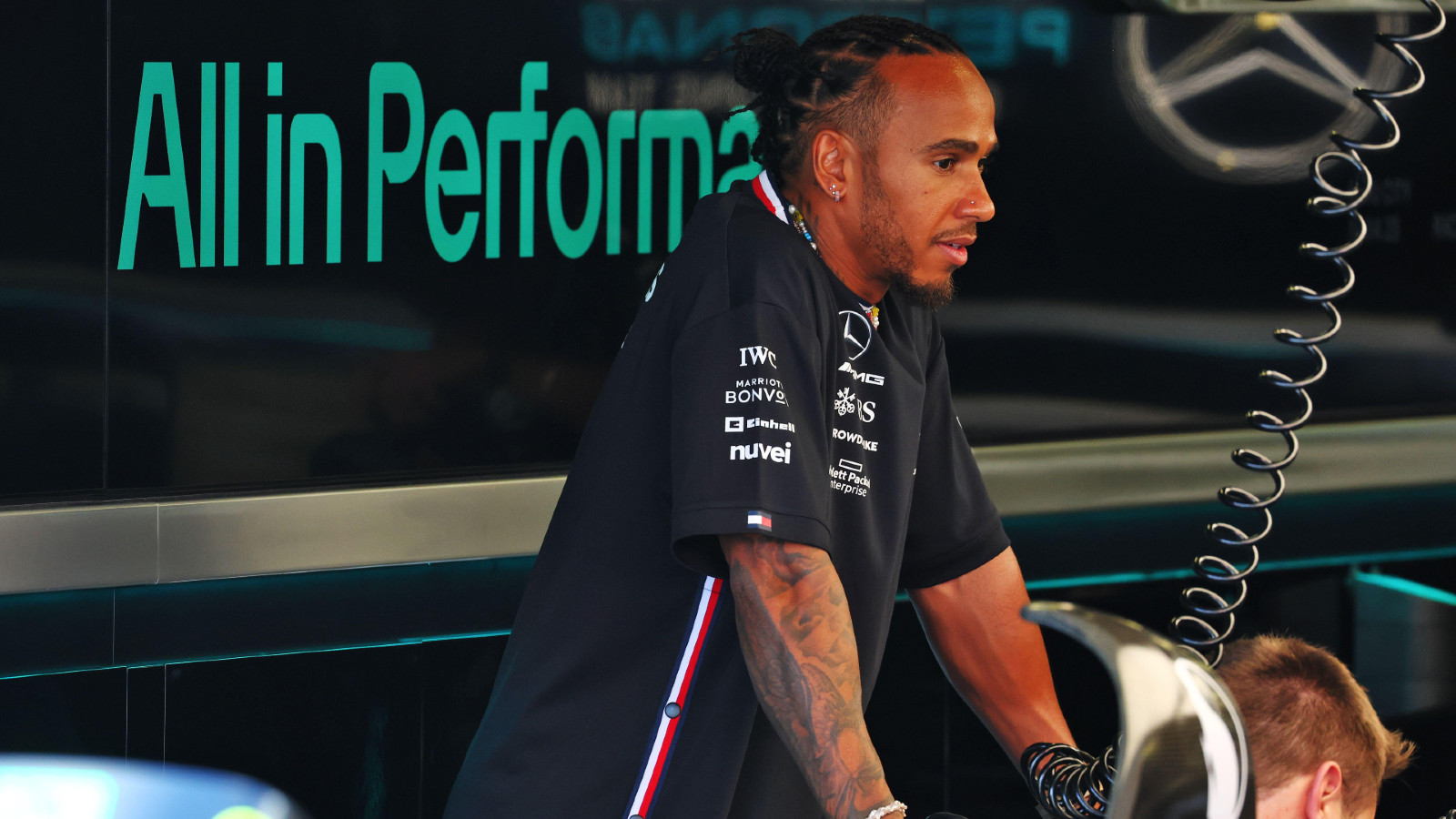

Lewis Hamilton And Former Team Mate A Touching Moment Caught On Camera During Testing

May 25, 2025

Lewis Hamilton And Former Team Mate A Touching Moment Caught On Camera During Testing

May 25, 2025 -

Zheng Qinwens Historic Win Upsets Sabalenka At Italian Open

May 25, 2025

Zheng Qinwens Historic Win Upsets Sabalenka At Italian Open

May 25, 2025 -

Claire Williams And George Russell A Look At Their F1 Relationship

May 25, 2025

Claire Williams And George Russell A Look At Their F1 Relationship

May 25, 2025 -

F1 Testing Lewis Hamiltons Unexpected Gesture To Ex Team Mate Revealed

May 25, 2025

F1 Testing Lewis Hamiltons Unexpected Gesture To Ex Team Mate Revealed

May 25, 2025 -

New Footage Shows Lewis Hamiltons Act Of Sportsmanship Towards Former Team Mate

May 25, 2025

New Footage Shows Lewis Hamiltons Act Of Sportsmanship Towards Former Team Mate

May 25, 2025