Amsterdam Stock Exchange Falls 2% On Trump's New Tariffs

Table of Contents

Impact of Trump's New Tariffs on the Amsterdam Stock Exchange

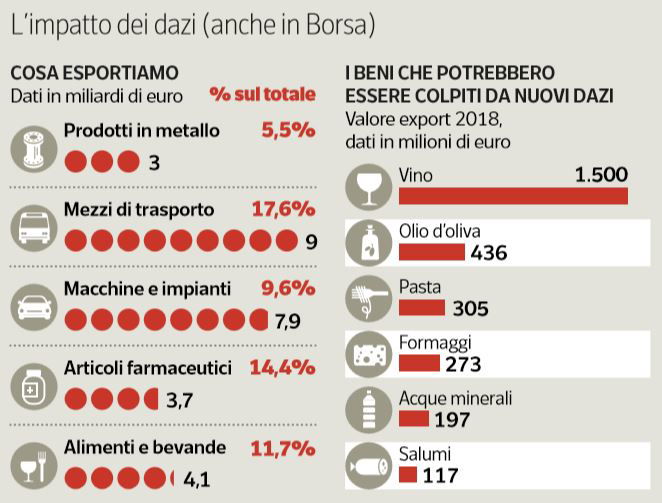

President Trump's newly announced tariffs, targeting specific sectors like technology and agriculture, have dealt a significant blow to the Amsterdam Stock Exchange. These tariffs, primarily aimed at [mention specific countries/goods targeted], are expected to disrupt established trade routes and increase the cost of imported goods. This has created immediate uncertainty and negatively impacted investor confidence.

-

Specific examples of companies significantly impacted and their percentage drop: ASML Holding, a major player in the semiconductor industry, saw its share price fall by 1.8% within the first hour of trading following the announcement. Companies heavily reliant on agricultural exports, such as [mention specific company names if applicable], also experienced significant drops, reflecting concerns about reduced market access and increased competition.

-

Analysis of the immediate market reaction (e.g., sell-off, decreased trading volume): The announcement triggered an immediate sell-off, with trading volume significantly exceeding the average for the day. This suggests a high degree of investor panic and a rush to liquidate assets.

-

Mention any related press releases or statements from the Amsterdam Stock Exchange: The Amsterdam Stock Exchange (AEX) issued a brief statement acknowledging the market volatility and emphasizing its commitment to maintaining market integrity and transparency during this period of uncertainty.

Wider European Market Reaction to the Tariffs

The fall of the Amsterdam Stock Exchange is not an isolated incident. The ripple effect of Trump's new tariffs is clearly visible across other major European markets, highlighting the interconnectedness of global finance.

-

Mention other major European stock exchanges and their percentage changes: The FTSE 100 in London experienced a 1.5% drop, while the DAX in Frankfurt fell by 1.2%. Other exchanges across Europe also reported significant declines, indicating a widespread negative reaction to the tariff announcement.

-

Analyze the overall sentiment among investors and analysts: Investor sentiment is currently characterized by fear and uncertainty. Analysts are expressing concerns about the potential for protracted trade wars and their damaging impact on global economic growth. Many are adopting a cautious approach, anticipating further market volatility in the coming weeks.

-

Discuss potential contagion effects and spillover into other asset classes: The impact extends beyond the stock market. The uncertainty surrounding trade relations is likely to affect other asset classes, including bonds and currencies, potentially leading to broader market instability.

Potential Long-Term Implications for the Amsterdam Stock Exchange and Dutch Economy

The long-term implications of Trump's new tariffs for the Amsterdam Stock Exchange and the Dutch economy are concerning. The initial shock is likely to be followed by a period of adjustment and potential restructuring within affected sectors.

-

Discuss potential job losses or economic slowdown in affected sectors: Sectors heavily reliant on exports, such as agriculture and technology, face potential job losses and reduced economic activity if the tariffs remain in place. This could lead to a broader economic slowdown in the Netherlands.

-

Analyze the government's potential response and policy implications: The Dutch government is likely to respond with a combination of fiscal and monetary policies to mitigate the impact of the tariffs and support affected businesses. This could include measures such as tax breaks, subsidies, and investment in diversification strategies.

-

Explore the possibility of long-term market instability: Prolonged trade tensions could lead to long-term market instability, hindering investment and economic growth in the Netherlands and across Europe.

Expert Opinions and Market Analysis

Financial analysts offer diverse perspectives on the situation. Some view the current downturn as a temporary correction, anticipating a recovery once the immediate uncertainty subsides. Others express greater concern, warning of potential for a more prolonged and significant economic downturn.

-

Expert predictions for the short-term and long-term recovery of the Amsterdam Stock Exchange: While short-term predictions vary widely, many analysts predict a period of market volatility before a gradual recovery. Long-term predictions depend heavily on the trajectory of trade negotiations and the overall global economic climate.

-

Different perspectives on the severity and duration of the market downturn: The severity and duration of the downturn depend largely on the actions taken by both the US and European governments in response to the tariffs, and the resilience of businesses in adapting to the changing trade landscape.

-

Mention any alternative investment strategies suggested by experts: In the face of uncertainty, some experts suggest diversification strategies, including investments in less trade-sensitive sectors or geographically diversified portfolios.

Conclusion

The Amsterdam Stock Exchange's 2% drop reflects the significant impact of President Trump's new tariffs. This downturn is not isolated, affecting other European markets and highlighting the interconnectedness of global finance. The long-term implications for the Dutch economy remain uncertain, with potential job losses and economic slowdown in affected sectors. The situation demands careful monitoring and strategic adaptation.

Call to Action: Stay informed about the evolving situation on the Amsterdam Stock Exchange and its impact on global markets. Monitor our website for ongoing updates and analysis of the Amsterdam Stock Exchange performance in the wake of these new tariffs. Continue to follow the Amsterdam Stock Exchange for further developments and crucial market updates.

Featured Posts

-

Alsltat Alalmanyt Wmdahmat Mshjey Krt Alqdm

May 24, 2025

Alsltat Alalmanyt Wmdahmat Mshjey Krt Alqdm

May 24, 2025 -

Dazi Usa Come Influenzano I Prezzi Dell Abbigliamento

May 24, 2025

Dazi Usa Come Influenzano I Prezzi Dell Abbigliamento

May 24, 2025 -

Escape To The Country Top Destinations And Hidden Gems

May 24, 2025

Escape To The Country Top Destinations And Hidden Gems

May 24, 2025 -

Porsche Investuoja I Elektromobiliu Infrastruktura Europoje

May 24, 2025

Porsche Investuoja I Elektromobiliu Infrastruktura Europoje

May 24, 2025 -

Apple Stock Aapl Important Price Levels And Their Implications

May 24, 2025

Apple Stock Aapl Important Price Levels And Their Implications

May 24, 2025

Latest Posts

-

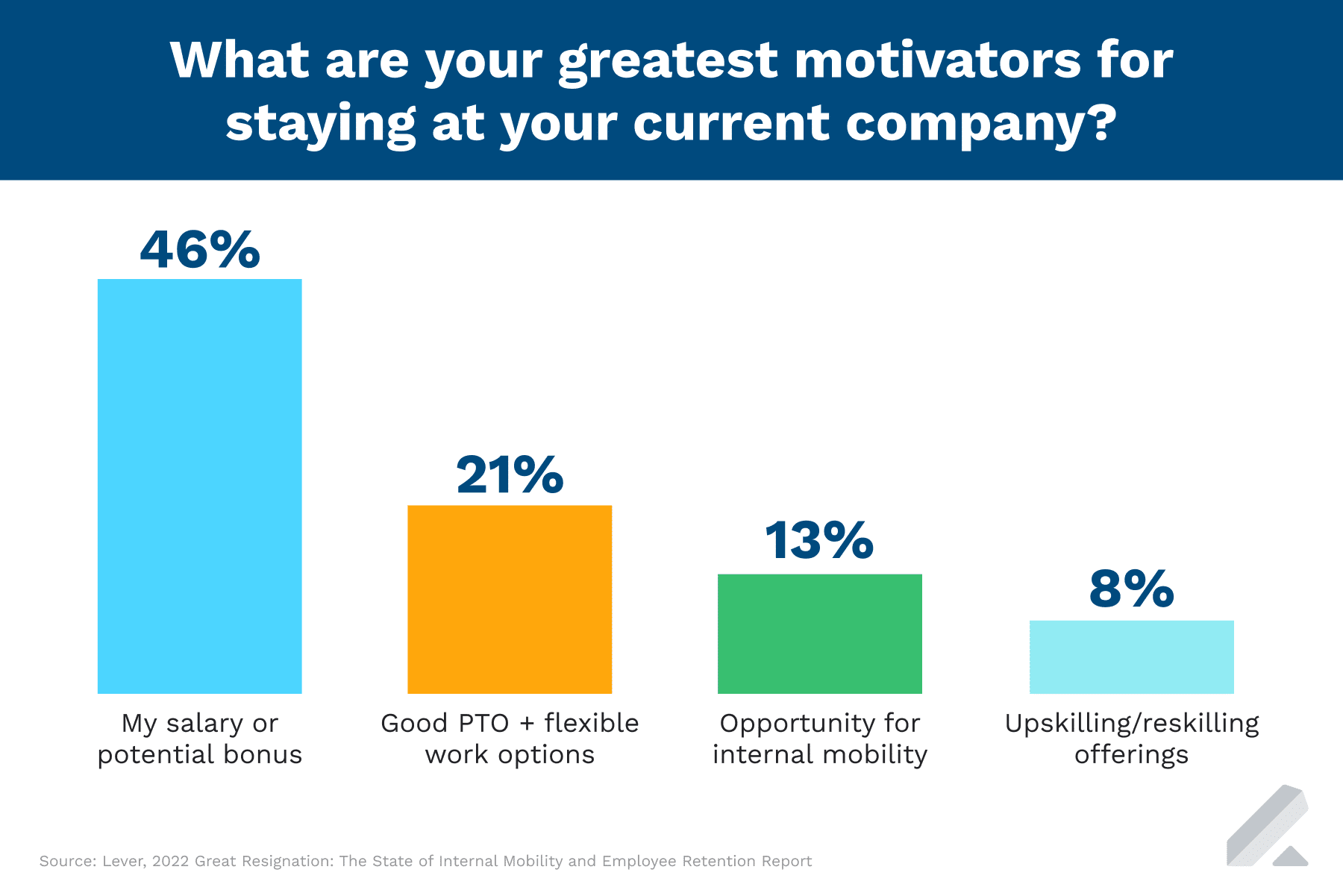

Investing In Middle Management A Key To Improved Productivity And Employee Retention

May 24, 2025

Investing In Middle Management A Key To Improved Productivity And Employee Retention

May 24, 2025 -

Chat Gpt Maker Open Ai Under Ftc Investigation A Deep Dive

May 24, 2025

Chat Gpt Maker Open Ai Under Ftc Investigation A Deep Dive

May 24, 2025 -

French Prosecutors Implicate Malaysias Najib Razak In 2002 Submarine Bribery Case

May 24, 2025

French Prosecutors Implicate Malaysias Najib Razak In 2002 Submarine Bribery Case

May 24, 2025 -

Over The Counter Birth Control Increased Access And Its Implications After Roe V Wade

May 24, 2025

Over The Counter Birth Control Increased Access And Its Implications After Roe V Wade

May 24, 2025 -

Ftc Challenges Microsofts Activision Acquisition The Appeal Explained

May 24, 2025

Ftc Challenges Microsofts Activision Acquisition The Appeal Explained

May 24, 2025