Amsterdam Exchange Plunges 11% In Three Days: Major Losses Continue

Table of Contents

Causes of the Amsterdam Exchange Plunge

The sharp Amsterdam Exchange plunge is a result of a confluence of factors, both global and specific to the Netherlands. Understanding these contributing elements is crucial to grasping the extent of the crisis.

Impact of Global Market Volatility

The current global economic climate has significantly impacted the Amsterdam Exchange. The interconnected nature of global markets means that instability in one region can quickly ripple outwards, affecting even seemingly stable exchanges like Amsterdam's.

- Rising Interest Rates: Central banks worldwide are aggressively raising interest rates to combat inflation, dampening economic growth and reducing investor appetite for riskier assets. This has led to a general sell-off in global stock markets, including the Amsterdam Exchange.

- Inflation Concerns: Persistently high inflation erodes purchasing power and increases uncertainty, prompting investors to seek safer havens for their capital. This outflow of investment contributes to market declines.

- Geopolitical Instability: The ongoing war in Ukraine has created significant geopolitical uncertainty, disrupting supply chains and increasing energy prices. This uncertainty directly impacts investor confidence and market stability.

- Energy Crisis: The European energy crisis, exacerbated by the war in Ukraine, adds further pressure on businesses and consumers, impacting corporate profitability and investor sentiment. The resulting higher energy costs are weighing heavily on many Dutch companies.

The correlation between the Amsterdam Exchange decline and other major global stock exchanges, such as the Dow Jones Industrial Average and the FTSE 100, is clearly evident, highlighting the interconnected nature of the global financial system. For example, a 2% drop in the Dow Jones often correlates with a similar percentage drop in the Amsterdam AEX index.

Specific Factors Affecting Dutch Companies

Beyond global factors, several specific challenges have impacted listed Dutch companies, contributing to the Amsterdam Exchange fall.

- Weakening Euro: The weakening Euro against the US dollar increases the cost of imports for Dutch companies, squeezing profit margins and reducing competitiveness. This is particularly challenging for export-oriented businesses.

- Decline in Specific Sectors: Sectors like technology and energy have been particularly hard hit, experiencing significant declines in valuations. This sector-specific weakness has disproportionately affected the Amsterdam Exchange, given the significant presence of these sectors in the Dutch economy.

- Impact of Supply Chain Disruptions: Lingering supply chain disruptions continue to hinder production and increase costs for many Dutch businesses. This impacts their profitability and consequently their stock prices.

For instance, [Insert name of a Dutch technology company] saw a 15% drop in its share price this week, reflecting the broader downturn in the technology sector. Similarly, [Insert name of a Dutch energy company] experienced a significant decline due to the ongoing energy crisis.

Investor Sentiment and Market Panic

The sharp Amsterdam Exchange drop was also fueled by a rapid shift in investor sentiment and the subsequent market panic.

- Sell-off Triggered by Negative News: Negative news headlines, analyst downgrades, and concerns about the global economy triggered a significant sell-off, accelerating the downward spiral.

- Herd Behavior: Investor fear and herd behavior led to a cascade of selling, exacerbating the decline. This behavior is typical during periods of market uncertainty.

- Impact of Social Media and News Coverage: Social media and news coverage can amplify fear and uncertainty, further fueling the sell-off. Negative news cycles can quickly escalate into widespread panic.

- Analyst Predictions and Rating Downgrades: Negative analyst predictions and rating downgrades can significantly influence investor decisions, accelerating market declines.

The rapid spread of negative sentiment and the resulting market panic significantly contributed to the severity of the Amsterdam exchange plunge.

Consequences of the Amsterdam Exchange Plunge

The consequences of this significant Amsterdam Exchange crash are far-reaching and extend beyond the immediate losses suffered by investors.

Impact on Dutch Economy

The Amsterdam Exchange decline has significant implications for the Dutch economy.

- Reduced Consumer Spending: Market uncertainty and potential job losses may lead to reduced consumer spending, slowing economic growth.

- Impact on Employment: If the downturn persists, it could lead to job losses in various sectors, further dampening economic activity.

- Government Intervention Measures: The Dutch government may need to implement economic stimulus measures to mitigate the impact of the market decline.

- Effects on Foreign Investment: The market turmoil could deter foreign investment in the Netherlands, potentially hindering economic growth in the long term.

Investor Losses and Market Uncertainty

The Amsterdam Exchange's sharp drop has resulted in substantial losses for various investors.

- Pension Funds: Pension funds, which often hold significant investments in the Amsterdam Exchange, have experienced substantial losses.

- Retail Investors: Individual retail investors have also suffered losses, potentially impacting their retirement savings and investment strategies.

- Institutional Investors: Institutional investors, such as mutual funds and hedge funds, have also been impacted by the market downturn.

The resulting market uncertainty makes it difficult to predict future investment returns, leading to hesitancy and caution among investors. This uncertainty could further depress market activity.

Regulatory Scrutiny and Potential Interventions

The Amsterdam Exchange crash is likely to lead to increased regulatory scrutiny and potential interventions.

- Investigations into Market Manipulation: Authorities may investigate potential market manipulation or other irregularities that contributed to the decline.

- Increased Oversight: Expect increased regulatory oversight of the Amsterdam Exchange and other financial markets to prevent similar events in the future.

- Potential Policy Changes: The Dutch government and European Union may consider policy changes to strengthen financial market stability and protect investors.

- Government Statements and Actions: The government's response, including any statements or actions taken to address the situation, will be crucial in shaping the market's recovery.

Conclusion

The unprecedented 11% Amsterdam Exchange plunge over three days underscores the fragility of the global financial system and highlights the significant risks faced by investors. The confluence of global market volatility, specific challenges facing Dutch companies, and widespread market panic contributed to this dramatic decline. The consequences are far-reaching, impacting not only investors but also the Dutch economy as a whole. Understanding the causes and consequences of this Amsterdam Exchange plunge is crucial for navigating the current market uncertainty. Staying informed about further developments and analyzing future market trends is vital for investors and policymakers alike. Keep an eye on news regarding the Amsterdam Exchange plunge and its impact on related indices for the latest updates and analysis.

Featured Posts

-

Dog Walker Dispute Kyle And Teddis Fiery Exchange

May 24, 2025

Dog Walker Dispute Kyle And Teddis Fiery Exchange

May 24, 2025 -

Analiz Proizvedeniya Gryozy Lyubvi Ili Ilicha Iz Gazety Trud

May 24, 2025

Analiz Proizvedeniya Gryozy Lyubvi Ili Ilicha Iz Gazety Trud

May 24, 2025 -

Is An Escape To The Country Right For You Considerations And Advice

May 24, 2025

Is An Escape To The Country Right For You Considerations And Advice

May 24, 2025 -

Jordan Bardella A Contender In The French Presidential Race

May 24, 2025

Jordan Bardella A Contender In The French Presidential Race

May 24, 2025 -

Analisis Saham Mtel And Mbma Setelah Termasuk Dalam Msci Small Cap Index

May 24, 2025

Analisis Saham Mtel And Mbma Setelah Termasuk Dalam Msci Small Cap Index

May 24, 2025

Latest Posts

-

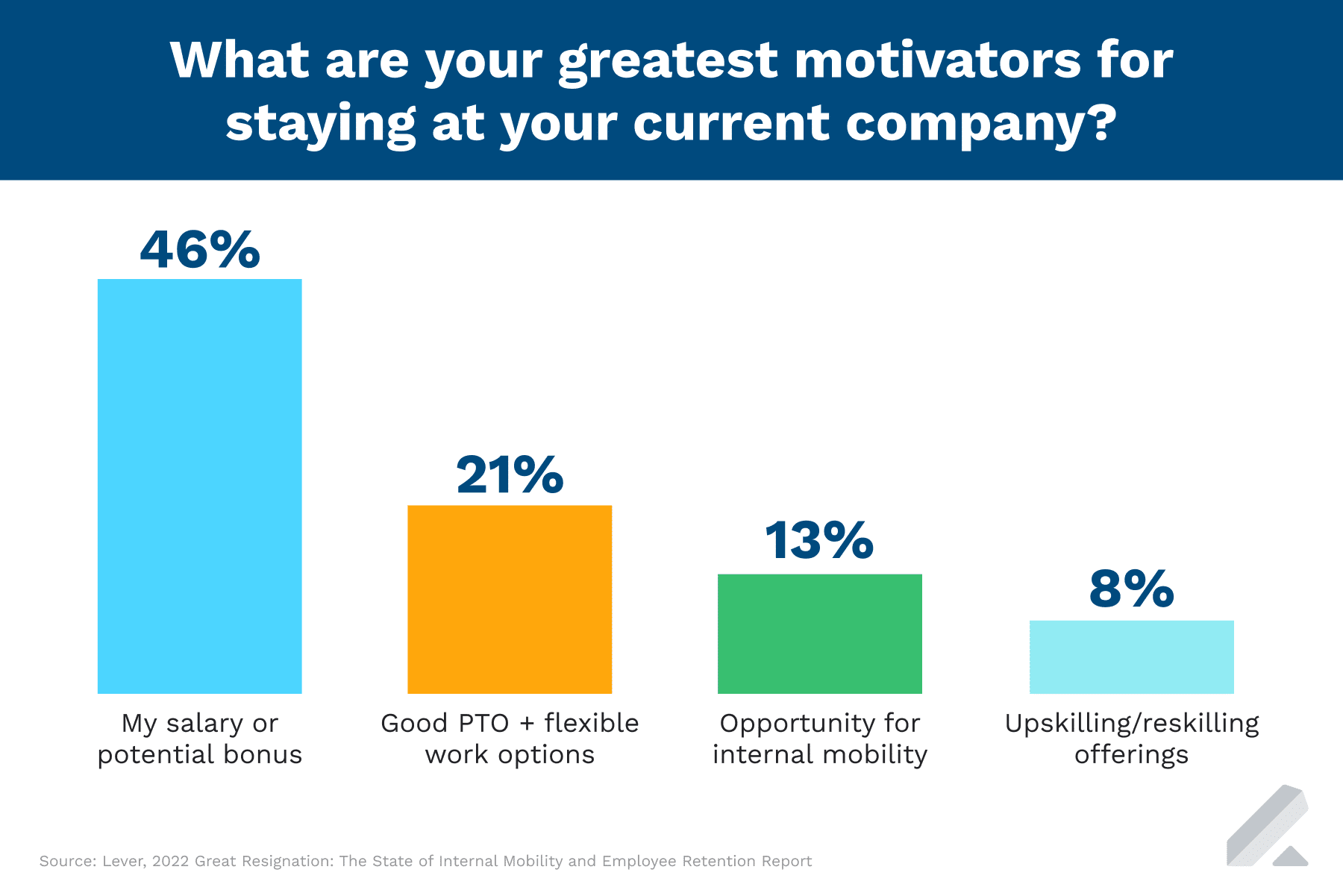

Investing In Middle Management A Key To Improved Productivity And Employee Retention

May 24, 2025

Investing In Middle Management A Key To Improved Productivity And Employee Retention

May 24, 2025 -

Chat Gpt Maker Open Ai Under Ftc Investigation A Deep Dive

May 24, 2025

Chat Gpt Maker Open Ai Under Ftc Investigation A Deep Dive

May 24, 2025 -

French Prosecutors Implicate Malaysias Najib Razak In 2002 Submarine Bribery Case

May 24, 2025

French Prosecutors Implicate Malaysias Najib Razak In 2002 Submarine Bribery Case

May 24, 2025 -

Over The Counter Birth Control Increased Access And Its Implications After Roe V Wade

May 24, 2025

Over The Counter Birth Control Increased Access And Its Implications After Roe V Wade

May 24, 2025 -

Ftc Challenges Microsofts Activision Acquisition The Appeal Explained

May 24, 2025

Ftc Challenges Microsofts Activision Acquisition The Appeal Explained

May 24, 2025