Amsterdam Exchange Falls 2% On Trump's New Tariffs

Table of Contents

Impact of Trump's Tariffs on European Markets

Trump's tariffs specifically target numerous European goods, creating a ripple effect across the continent's financial landscape. The Amsterdam Exchange, a crucial player in the European market, felt this impact acutely. The interconnectedness of global markets means that even seemingly localized trade disputes can have far-reaching consequences. The instability caused by these tariffs contributes significantly to market volatility and negatively influences investor confidence.

- Specific sectors heavily affected: The automotive industry, a major component of the Amsterdam Exchange, suffered significant losses, along with the agricultural sector, which exports substantially to the US.

- Investor sentiment and sell-offs: Investor sentiment turned sharply negative following the tariff announcements, leading to widespread sell-offs across multiple sectors listed on the Euronext Amsterdam. Uncertainty about future trade relations fueled this decline.

- Comparison to other European stock market performances: While other European stock markets also experienced declines, the Amsterdam Exchange's 2% drop was notably steeper, indicating a higher level of vulnerability to the specific goods targeted by the new tariffs.

Amsterdam Exchange's Vulnerability to Global Trade Disputes

The Amsterdam Exchange's susceptibility to international trade conflicts is notable. Its vulnerability stems from the nature of the companies listed and their extensive involvement in international trade. Unlike exchanges focused primarily on domestic markets, the Amsterdam Exchange's reliance on global commerce makes it particularly sensitive to geopolitical risk and economic uncertainty caused by trade wars.

- Reliance on international trade: Many companies listed on Euronext Amsterdam heavily rely on exports and imports, making them directly impacted by trade barriers and tariffs.

- Historical data: Analyzing past reactions to similar trade disputes reveals a consistent pattern of negative impacts on the Amsterdam Exchange, indicating a long-standing vulnerability to such events.

- Expert opinions: Financial experts predict continued vulnerability for the Amsterdam Exchange, unless a de-escalation of global trade disputes occurs.

Analysis of Affected Sectors within the Amsterdam Exchange

The impact of the tariffs varied across sectors within the Amsterdam Exchange. Some experienced significantly more pronounced drops than others. Understanding these discrepancies is crucial for investors to adapt their strategies.

- Percentage drops in key sectors: The automotive sector saw a [Insert Percentage]% drop, while the agricultural sector experienced a [Insert Percentage]% decline. Other sectors such as [mention other affected sectors] also suffered substantial losses.

- Individual company examples: [Mention specific companies and their performance]. These examples highlight the direct impact of the tariffs on individual businesses.

- Reasons for sector-specific impacts: The disparity in impact reflects the varying degrees of reliance on US markets and the susceptibility of specific goods to tariffs.

Potential Long-Term Consequences for the Amsterdam Exchange

The long-term implications of Trump's tariffs on the Amsterdam Exchange remain uncertain. However, several scenarios are possible, ranging from a slow recovery to a more prolonged decline depending on the trajectory of trade relations.

- Predictions from financial analysts: Analysts offer differing predictions, some forecasting a gradual recovery as businesses adapt, while others foresee a more sustained negative impact.

- Government responses and interventions: The response of the European Union and the Dutch government will play a crucial role in shaping the long-term outlook. Potential interventions or support packages could mitigate the damage.

- Mitigation strategies for investors: Investors are advised to diversify their portfolios, closely monitor market developments, and consider hedging strategies to protect themselves against further volatility.

Conclusion

The 2% drop in the Amsterdam Exchange on [Date] demonstrates the immediate and significant impact of Trump's new tariffs. The analysis shows a strong correlation between the tariff announcements and the sharp decline, particularly impacting sectors heavily reliant on international trade. The Amsterdam Exchange's vulnerability to global trade tensions highlights the interconnectedness of the global economy and the need for investors and policymakers to carefully consider these risks. The long-term consequences remain uncertain, emphasizing the importance of continued monitoring and informed decision-making.

Stay updated on the latest developments affecting the Amsterdam Exchange and the impact of Trump's tariffs. Follow [your website/news source] for continuous coverage on the Amsterdam Exchange’s performance and insightful analysis of the evolving global trade landscape.

Featured Posts

-

Terrapins Softball Edges Delaware In Thrilling 5 4 Contest

May 24, 2025

Terrapins Softball Edges Delaware In Thrilling 5 4 Contest

May 24, 2025 -

Joy Crookes Releases New Track I Know You D Kill Details And Release Date

May 24, 2025

Joy Crookes Releases New Track I Know You D Kill Details And Release Date

May 24, 2025 -

Piazza Affari La Fed Influenza La Borsa Banche In Difficolta Italgas In Crescita

May 24, 2025

Piazza Affari La Fed Influenza La Borsa Banche In Difficolta Italgas In Crescita

May 24, 2025 -

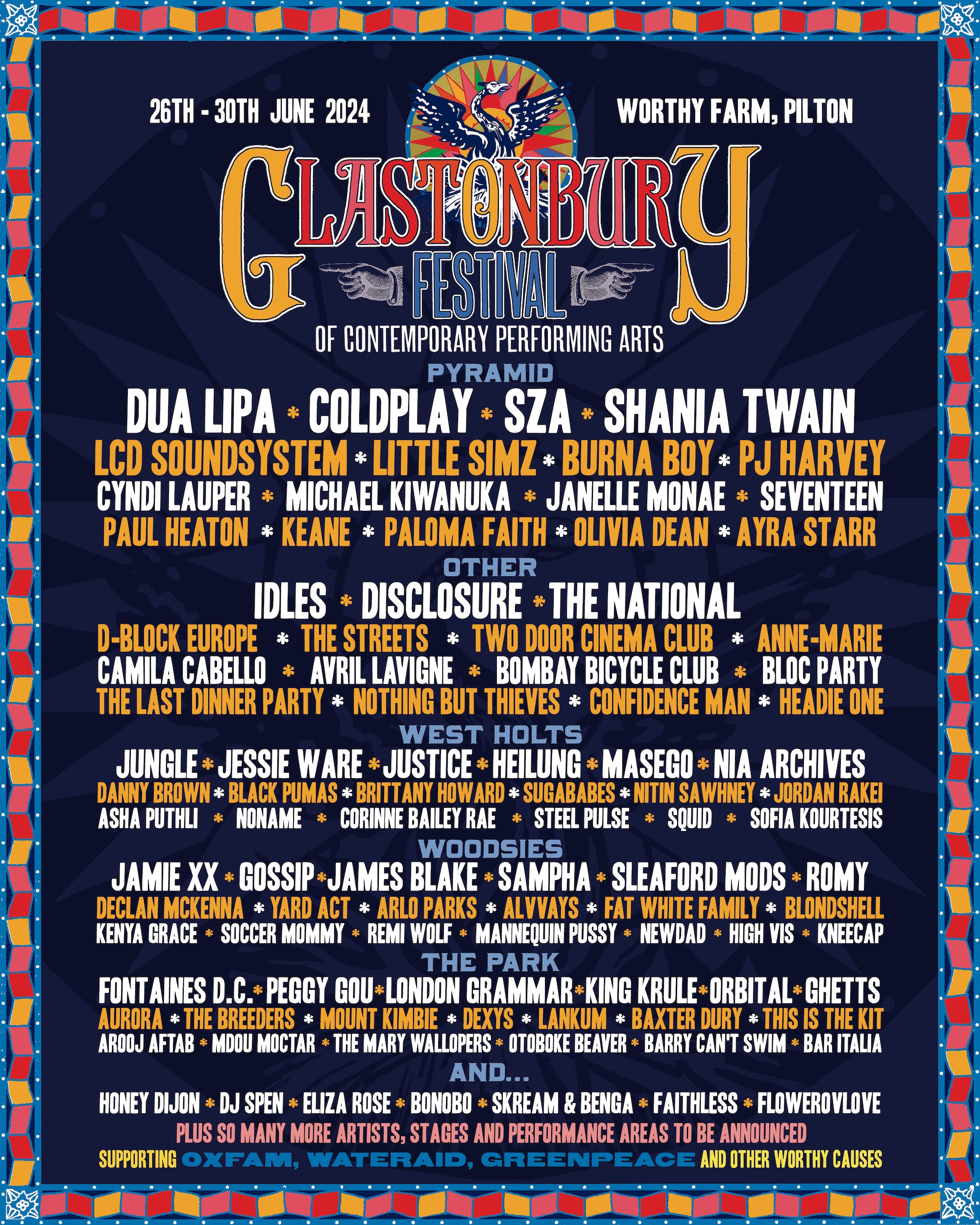

Official Glastonbury 2025 Lineup Where To Get Tickets Following Leak

May 24, 2025

Official Glastonbury 2025 Lineup Where To Get Tickets Following Leak

May 24, 2025 -

Conchita Wurst And Jj At Eurovision Village 2025 Concert Details

May 24, 2025

Conchita Wurst And Jj At Eurovision Village 2025 Concert Details

May 24, 2025

Latest Posts

-

Is Sean Penns Support Of Woody Allen A Me Too Blind Spot A Critical Analysis

May 24, 2025

Is Sean Penns Support Of Woody Allen A Me Too Blind Spot A Critical Analysis

May 24, 2025 -

Sean Penn And Woody Allen Examining A Continued Me Too Blind Spot

May 24, 2025

Sean Penn And Woody Allen Examining A Continued Me Too Blind Spot

May 24, 2025 -

Sean Penns Support For Woody Allen A Me Too Blind Spot

May 24, 2025

Sean Penns Support For Woody Allen A Me Too Blind Spot

May 24, 2025 -

Mia Farrows Comeback A Look At Ronan Farrows Influence

May 24, 2025

Mia Farrows Comeback A Look At Ronan Farrows Influence

May 24, 2025 -

Michael Caine Mia Farrow Sex Scene And An Ex Husbands Surprise

May 24, 2025

Michael Caine Mia Farrow Sex Scene And An Ex Husbands Surprise

May 24, 2025