Ambani's Reliance Beats Expectations: Boost For India's Large-Cap Market

Table of Contents

Reliance Industries' Stellar Q2 2023 Performance

Reliance's Q2 2023 earnings showcased impressive revenue growth and robust profit margins, solidifying its position as a market leader. Key highlights include:

- Record Revenue: Reliance reported a consolidated revenue of ₹2.08 trillion (approximately $25 billion USD), exceeding analysts' estimates by a significant margin. This represents a substantial year-on-year increase, fueled by strong performances across its various business segments.

- Jio's Continued Dominance: Reliance Jio, the telecom giant, continued its impressive growth trajectory, adding millions of new subscribers and increasing its average revenue per user (ARPU). This reflects the success of its aggressive 5G rollout and competitive pricing strategies.

- Reliance Retail's Expansion: Reliance Retail, the retail arm of the conglomerate, showcased phenomenal growth, driven by increased foot traffic in its physical stores and strong online sales through its e-commerce platform. The expansion into new markets and product categories further contributed to its overall success.

- Improved Profit Margins: The company's improved operational efficiency and cost management strategies resulted in enhanced profit margins compared to the previous quarter and the same period last year. This reflects the company's ability to navigate economic headwinds and maintain profitability.

A comparison of Q2 2023 performance against Q1 2023 and industry benchmarks reveals a clear outperformance, confirming Reliance's strong competitive positioning within the Indian market. (Insert relevant chart/graph here visualizing the data).

Impact on India's Large-Cap Market

Reliance's stellar Q2 2023 performance had a significant positive impact on India's large-cap market.

- Boost to Indices: The impressive results immediately boosted major Indian stock market indices like the Sensex and Nifty, demonstrating the significant weight Reliance carries in the overall market capitalization.

- Increased Investor Sentiment: The strong performance improved investor sentiment, leading to increased trading volumes and a general sense of optimism among market participants. This is particularly significant given global economic uncertainties.

- FII Influx: Foreign Institutional Investors (FIIs) reacted positively, increasing their investments in Reliance and other large-cap stocks, further fueling the market's upward trajectory. This influx of foreign capital signifies a vote of confidence in the Indian economy.

- Ripple Effect: Reliance's success also had a positive ripple effect on other large-cap companies, bolstering overall market confidence and creating a more favorable investment environment.

The broader implications for the Indian economy are significant, reinforcing its position as a high-growth market attracting considerable global attention.

Attractive Investment Opportunities

Reliance Industries' strong performance presents several attractive investment opportunities for both long-term and short-term investors.

- Long-Term Growth Potential: Reliance's diversified business model, strong leadership, and focus on technological innovation position it for substantial long-term growth.

- Risk Assessment: While the Indian stock market offers significant opportunities, it's essential to acknowledge inherent risks associated with market volatility and geopolitical factors. Thorough due diligence and a well-defined investment strategy are crucial.

- Investment Strategies: Investors with a higher risk tolerance may consider direct stock investment in Reliance, while those seeking lower risk might opt for mutual funds or ETFs that include Reliance in their portfolio.

- Portfolio Diversification: It's crucial to diversify one's investment portfolio to mitigate risks. Reliance should be considered as part of a broader strategy, not the sole investment.

- Research and Selection: Thorough research and understanding of the company's financials, future plans, and the overall market conditions are vital before making any investment decisions.

Ambani's Strategic Vision and Future Outlook

Mukesh Ambani's strategic vision has been instrumental in Reliance's success. His focus on diversification, technological innovation, and digital transformation has propelled the company to the forefront of the Indian business landscape.

- Strategic Decisions: Key strategic decisions like the massive investment in Jio and the expansion of Reliance Retail have paid off handsomely, showcasing his astute understanding of market trends and consumer behavior.

- Future Plans: Reliance continues to invest heavily in new technologies, including renewable energy and advanced materials, positioning itself for future growth in these emerging sectors.

- Technological Innovation: The company's commitment to digital transformation is evident in Jio's success and its plans to further expand its digital services.

- Impact of Technological Trends: The adoption of AI, 5G, and other cutting-edge technologies will likely further accelerate Reliance's growth trajectory.

- Long-Term Implications: Reliance's continued success has significant implications for the Indian economy, contributing to job creation, technological advancement, and overall economic prosperity.

Conclusion

Reliance Industries' outstanding Q2 2023 performance underscores its position as a powerhouse in India's large-cap market and a key driver of the nation's economic growth. The results showcase Ambani's visionary leadership and the company's robust business model. This success has had a significant positive impact on investor confidence and the overall market sentiment.

Reliance Industries' success presents exciting opportunities for investors looking to capitalize on the growth potential of India's booming large-cap market. Learn more about strategic investment options in Reliance and other leading Indian companies. Stay informed about future developments and maximize your returns by following market trends related to Reliance Industries and the Indian large-cap sector.

Featured Posts

-

Kentucky Declares State Of Emergency Ahead Of Severe Flooding

Apr 29, 2025

Kentucky Declares State Of Emergency Ahead Of Severe Flooding

Apr 29, 2025 -

Buying Tickets To The Capital Summertime Ball 2025 A Practical Guide

Apr 29, 2025

Buying Tickets To The Capital Summertime Ball 2025 A Practical Guide

Apr 29, 2025 -

Increased Opposition From Car Dealers To Electric Vehicle Regulations

Apr 29, 2025

Increased Opposition From Car Dealers To Electric Vehicle Regulations

Apr 29, 2025 -

70 Off Hudsons Bay Liquidation Sale Now On

Apr 29, 2025

70 Off Hudsons Bay Liquidation Sale Now On

Apr 29, 2025 -

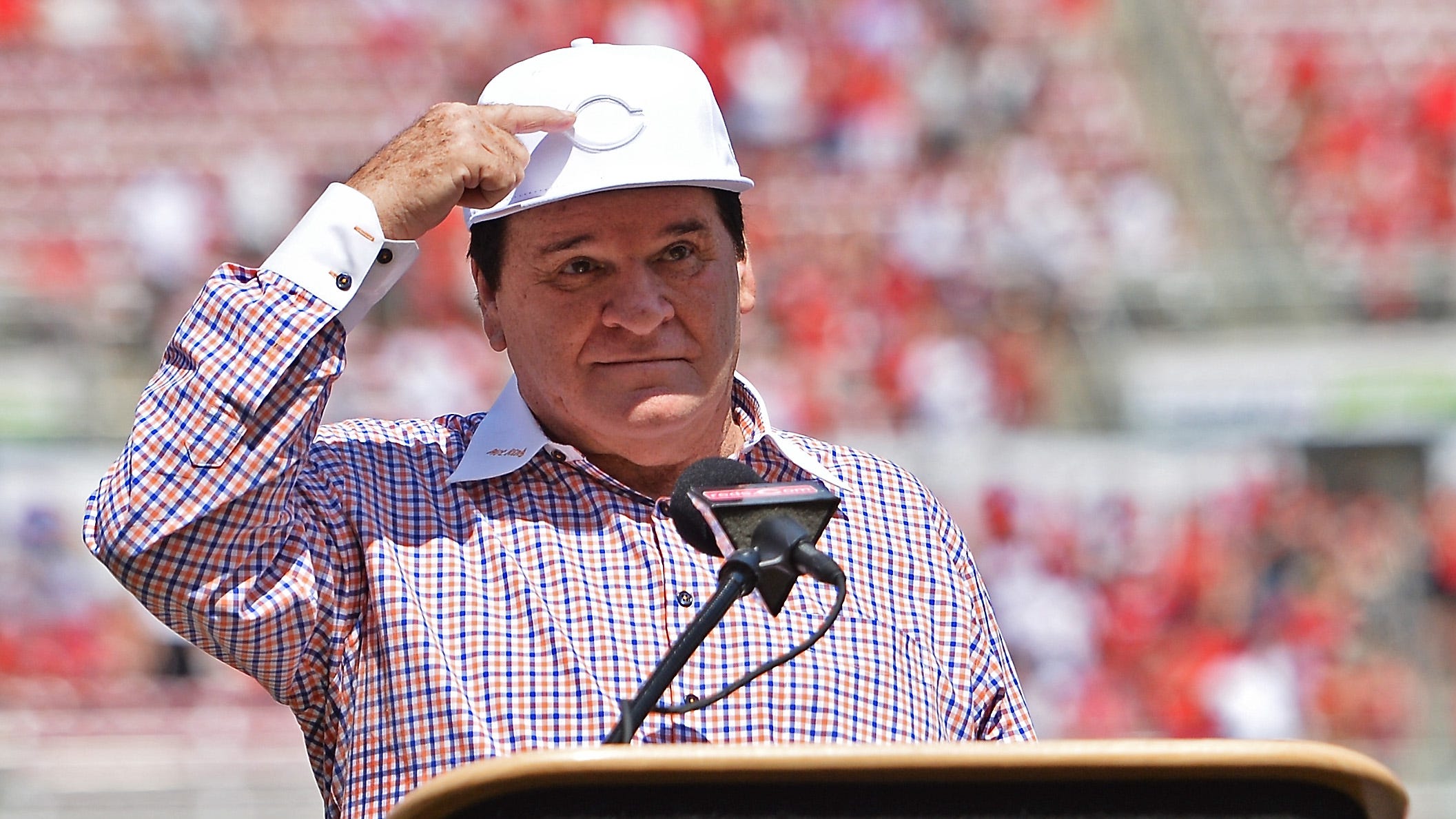

Pete Rose Pardon Trumps Posthumous Gesture Explained

Apr 29, 2025

Pete Rose Pardon Trumps Posthumous Gesture Explained

Apr 29, 2025

50 Godini Praznuva Lyubimetst Na Milioni

50 Godini Praznuva Lyubimetst Na Milioni