Airbus Shifts US Tariff Costs To Airlines

Table of Contents

The US Tariffs on Airbus Aircraft

The US imposed tariffs on Airbus aircraft following a World Trade Organization (WTO) ruling that found illegal subsidies given to Airbus by European governments. These tariffs are a retaliatory measure against similar tariffs imposed by the EU on Boeing aircraft. The trade war between these two aviation giants has had significant consequences.

- Tariff Percentage: The tariffs imposed on Airbus aircraft are substantial, reaching percentages in the double digits. The exact percentage can vary depending on the aircraft model and specific components.

- Aircraft Affected: A wide range of Airbus aircraft models, including popular passenger jets like the A320 family and larger aircraft such as the A350, are subject to these tariffs. This significantly impacts US airlines which utilize these aircraft.

- Timeline: The implementation of these tariffs began in 2019 and has continued to impact the aviation market ever since, influencing the price of aircraft imports. The tariffs increase the cost of importing Airbus planes into the US, making them less competitive compared to Boeing aircraft, at least from a purely price perspective.

Airbus' Strategy of Passing on Tariff Costs

Faced with increased import costs due to US tariffs, Airbus has implemented a pricing strategy designed to offset the financial burden. This means that the airlines purchasing these aircraft are bearing a significant portion of these additional costs.

- Direct Price Increases: Airbus has directly increased the prices of its aircraft to reflect the tariffs, passing on the additional expense to its customers - the airlines.

- Maintenance and Spare Parts: Airlines should also expect potential increases in the cost of maintenance and spare parts for Airbus aircraft, adding further financial strain.

- Contract Negotiations: The impact of tariffs is visible in altered contract negotiations between Airbus and airlines, with adjustments to pricing and terms reflecting the new cost landscape.

- Absorbed Costs: While Airbus has undoubtedly absorbed some costs initially, the extent of cost absorption is unknown. The company's strategy centers on minimizing its loss and ensuring long-term market viability.

These price increases directly impact airlines' profitability, potentially forcing them to adjust their own pricing strategies or limit fleet expansions.

Impact on Airlines and the Aviation Industry

The consequences of Airbus passing on tariff costs are far-reaching and directly affect US airlines that rely on Airbus aircraft.

- Airline Ticket Prices: The increased cost of acquiring and maintaining Airbus aircraft could lead to higher airline ticket prices for consumers, impacting air travel affordability.

- Reduced Aircraft Orders: Facing higher acquisition costs, airlines might reduce their orders of Airbus aircraft, potentially impacting Airbus’s market share and production plans.

- Airbus vs. Boeing: The tariffs create a more favorable competitive environment for Boeing in the US market, as Boeing aircraft are not subject to these same tariffs. This could result in a significant shift in market share.

- Airline Profitability and Expansion: Increased aircraft costs and potential ticket price increases pose a significant threat to airline profitability and could force airlines to curtail expansion plans.

The broader aviation industry feels the effects due to the interconnected nature of global markets. Supply chain disruptions and market instability are all possible consequences.

Long-Term Implications and Potential Solutions

The long-term effects of the tariff dispute between Airbus and the US are uncertain, but potentially substantial for both parties.

- Trade War Escalation: There's always the possibility of further escalation of the trade war, leading to more significant disruptions and economic losses for both sides.

- Negotiated Settlements: Negotiated settlements or resolutions are a possibility, but achieving a mutually acceptable agreement is challenging given the complexities involved.

- Policy Changes: Policy changes by either the US or the EU could significantly mitigate the impacts of the tariffs, including potential tariff reductions or exemptions.

- Alternative Sourcing: US airlines might explore alternative sources for aircraft or parts to reduce their dependence on Airbus and mitigate the impacts of tariffs.

Conclusion:

Airbus' decision to pass on the increased costs associated with US tariffs to airlines has significant implications for the aviation industry. Higher aircraft prices lead to potential price hikes for consumers, reduced aircraft orders, and a more favorable competitive environment for Boeing. This situation directly impacts airline profitability and expansion plans, underscoring the considerable ramifications of this trade dispute. Both Airbus and US airlines face a challenging economic landscape, and the long-term consequences are still unfolding.

Call to Action: Stay informed about the evolving situation regarding Airbus and US tariffs. Follow our blog for the latest updates on the impact of the Airbus tariff dispute and its consequences for the aviation industry. Understanding the complexities surrounding Airbus and US tariffs is crucial for navigating this challenging economic landscape.

Featured Posts

-

Smart Rings A Solution For Relationship Trust Issues

May 03, 2025

Smart Rings A Solution For Relationship Trust Issues

May 03, 2025 -

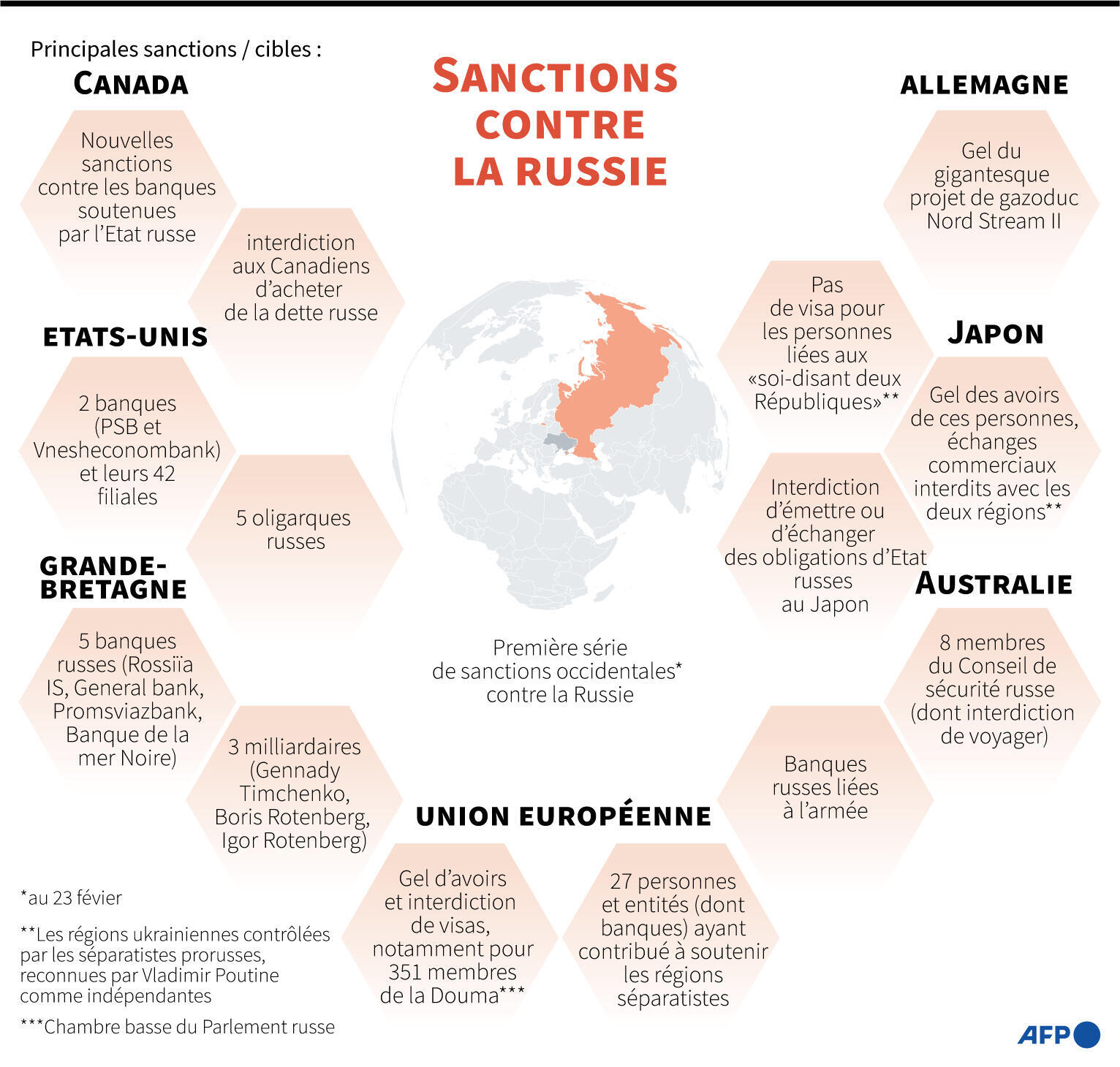

Tensions Accrues Macron Prepare De Nouvelles Sanctions Contre La Russie

May 03, 2025

Tensions Accrues Macron Prepare De Nouvelles Sanctions Contre La Russie

May 03, 2025 -

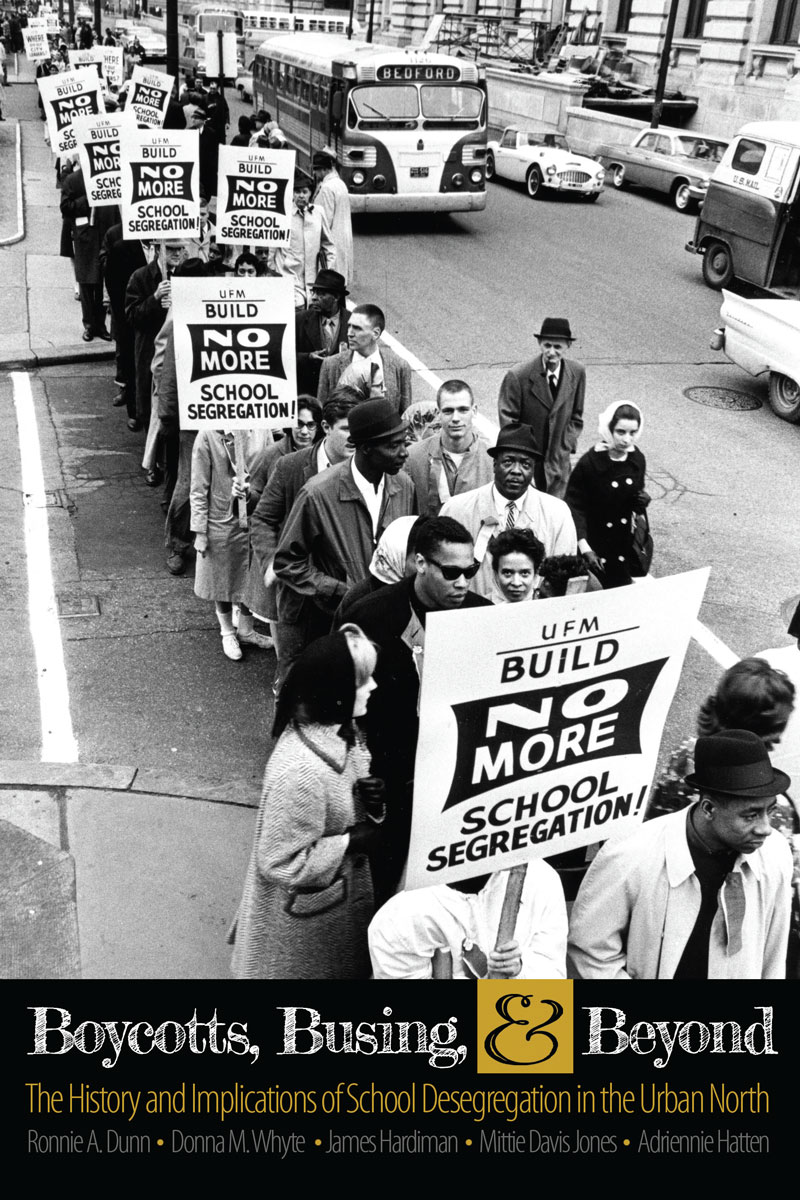

Justice Departments Decision The Implications Of Ending School Desegregation Orders

May 03, 2025

Justice Departments Decision The Implications Of Ending School Desegregation Orders

May 03, 2025 -

Edinburgh Fringe 2025 Pussy Riots Maria Alyokhina Presents Riot Day

May 03, 2025

Edinburgh Fringe 2025 Pussy Riots Maria Alyokhina Presents Riot Day

May 03, 2025 -

Check Todays Winning Numbers Lotto Lotto Plus 1 And Lotto Plus 2

May 03, 2025

Check Todays Winning Numbers Lotto Lotto Plus 1 And Lotto Plus 2

May 03, 2025