Addressing Market Concerns: BofA's Rationale For High Stock Valuations

Table of Contents

BofA's Strong Financial Performance & Growth Projections

BofA's high stock valuation is largely underpinned by its consistently strong financial performance and promising growth projections. Let's examine the key drivers:

Robust Revenue Growth

BofA has demonstrated robust revenue growth across multiple segments. Recent financial reports reveal significant increases in key areas:

- Investment Banking: Double-digit percentage growth in advisory fees and underwriting, exceeding industry averages. This success is attributed to BofA's expertise in mergers and acquisitions and its strong client relationships.

- Wealth Management: Steady growth driven by increased assets under management, reflecting strong client inflows and successful investment strategies. This segment benefits from a growing affluent population and BofA's comprehensive wealth management offerings.

- Consumer Banking: Consistent growth in loan originations and deposit balances fueled by economic recovery and increased consumer spending. BofA's extensive branch network and digital banking capabilities contribute significantly to this segment's performance.

This diversified revenue stream provides stability and resilience, even amidst market uncertainties.

Improved Profitability Metrics

BofA's profitability has also shown significant improvement. Key metrics like Return on Equity (ROE) and Net Interest Margin (NIM) have consistently outperformed previous years and surpassed many industry benchmarks.

- ROE: A substantial increase in ROE demonstrates efficient capital utilization and strong profitability. This improvement reflects cost-cutting measures and operational efficiencies implemented across the bank.

- NIM: An expanding NIM indicates the bank's success in managing interest rates and optimizing its lending and borrowing activities. This reflects BofA's strategic asset allocation and effective interest rate management.

[Insert Chart/Graph visually representing ROE and NIM trends]

Positive Future Outlook

BofA's positive outlook is based on several factors, including ongoing digital transformation, strategic expansion into new markets, and anticipation of continued economic growth. While challenges like inflation and geopolitical uncertainty exist, BofA's strategic plans aim to mitigate these risks.

Strategic Initiatives & Competitive Advantages

Beyond strong financials, BofA's strategic initiatives contribute significantly to its high stock valuations.

Technological Investments & Digital Transformation

BofA's substantial investments in technology and digital banking have resulted in enhanced efficiency, improved customer experience, and cost savings. This includes:

- Enhanced mobile banking app: Offering seamless transactions and personalized financial management tools.

- Advanced analytics platforms: Enabling better risk management and personalized customer offers.

- Artificial Intelligence (AI) integration: Automating processes, improving fraud detection, and personalizing customer service.

These technologies improve operational efficiency and enhance customer loyalty.

Focus on Customer Acquisition & Retention

BofA actively focuses on acquiring and retaining customers through:

- Personalized financial advice: Providing tailored solutions to meet individual customer needs.

- Loyalty programs and rewards: Incentivizing customer engagement and long-term relationships.

- Proactive customer service: Addressing customer issues promptly and effectively.

These strategies result in increased customer satisfaction and improved customer lifetime value.

Market Leadership & Brand Recognition

BofA's extensive network, strong brand recognition, and market leadership position further bolster its valuation. Its established presence and reputation provide a significant competitive advantage.

Addressing Market Concerns & Investor Sentiment

Despite the positive factors, certain market concerns influence investor sentiment towards BofA's stock.

Macroeconomic Factors

Macroeconomic factors such as inflation and interest rate hikes pose challenges. However, BofA's diversified business model and robust risk management strategies help mitigate these risks.

Regulatory Changes & Compliance

Stringent regulatory changes and compliance requirements are ongoing considerations. BofA demonstrates a proactive approach to compliance, investing in robust systems and processes to ensure adherence to all regulations.

Investor Perception & Analyst Ratings

While many analysts hold a positive outlook on BofA, conflicting opinions exist. It’s essential to consider various perspectives and conduct thorough due diligence before making investment decisions.

Conclusion

BofA's high stock valuations are justified by its strong financial performance, demonstrated by robust revenue growth and improved profitability metrics. Its strategic initiatives, including significant investments in technology and a focus on customer acquisition and retention, further solidify its position. While macroeconomic factors and regulatory changes remain considerations, BofA's proactive risk management and diversified business model mitigate these concerns. To gain a comprehensive understanding of BofA's high stock valuations and its future prospects, we encourage you to delve deeper into its financial reports and investor relations materials. Understanding the rationale behind BofA's high stock valuations is crucial for making informed investment decisions.

Featured Posts

-

Metallica Announces Two Night Dublin Show Aviva Stadium June 2026

May 23, 2025

Metallica Announces Two Night Dublin Show Aviva Stadium June 2026

May 23, 2025 -

Relocating From Dubai To Sharjah A Mothers Story Of Increased Living Space

May 23, 2025

Relocating From Dubai To Sharjah A Mothers Story Of Increased Living Space

May 23, 2025 -

Andy Peebles Remembered Bbc Lancashires Andy Bayes Shares Memories

May 23, 2025

Andy Peebles Remembered Bbc Lancashires Andy Bayes Shares Memories

May 23, 2025 -

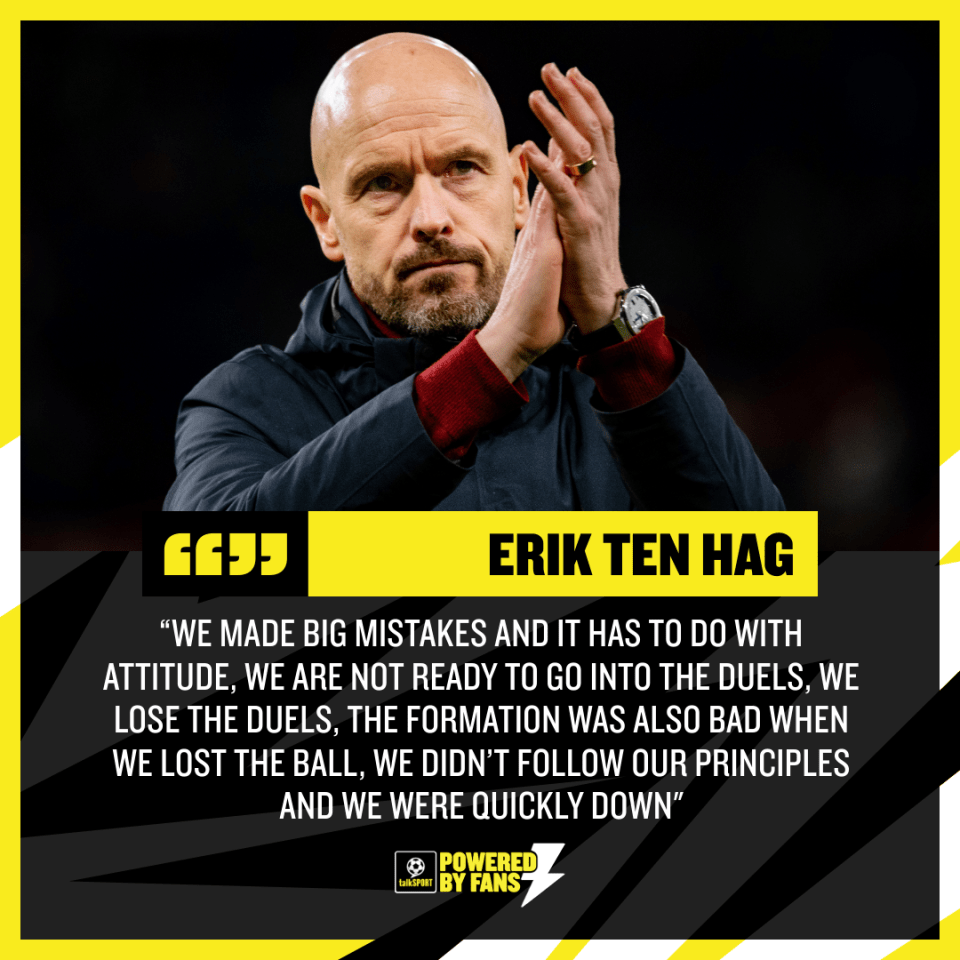

Erik Ten Hags Future Latest Updates On Manchester United And Leverkusen Interest

May 23, 2025

Erik Ten Hags Future Latest Updates On Manchester United And Leverkusen Interest

May 23, 2025 -

Compre Seu Ingresso Para A Atlantida Celebration Em Santa Catarina Line Up Completo

May 23, 2025

Compre Seu Ingresso Para A Atlantida Celebration Em Santa Catarina Line Up Completo

May 23, 2025

Latest Posts

-

Dallas Welcomes The Usa Film Festival Free Movies And Star Guests

May 23, 2025

Dallas Welcomes The Usa Film Festival Free Movies And Star Guests

May 23, 2025 -

Dc Legends Of Tomorrow The Ultimate Fans Resource

May 23, 2025

Dc Legends Of Tomorrow The Ultimate Fans Resource

May 23, 2025 -

Usa Film Festival In Dallas A Celebration Of Cinema With Free Screenings

May 23, 2025

Usa Film Festival In Dallas A Celebration Of Cinema With Free Screenings

May 23, 2025 -

2025 Memorial Day Sales The Ultimate Guide To The Best Deals

May 23, 2025

2025 Memorial Day Sales The Ultimate Guide To The Best Deals

May 23, 2025 -

Dc Legends Of Tomorrow Tips And Tricks For Beginners

May 23, 2025

Dc Legends Of Tomorrow Tips And Tricks For Beginners

May 23, 2025