Addressing Investor Concerns: BofA On Elevated Stock Market Valuations

Table of Contents

BofA's Assessment of Current Stock Market Valuations

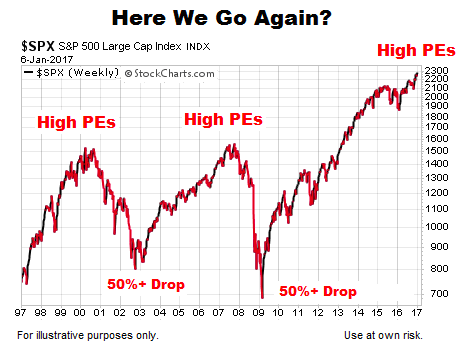

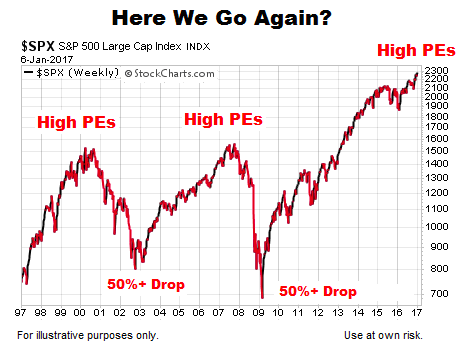

BofA's valuation analysis typically uses a variety of metrics to assess the overall market and individual sectors. While the specifics of their most recent report might vary, a common approach involves examining key valuation multiples such as the price-to-earnings ratio (P/E ratio) and the price-to-sales ratio (P/S ratio). These metrics compare a company's stock price to its earnings or sales, providing insights into whether a stock is overvalued or undervalued relative to its fundamentals. BofA likely considers these metrics across various sectors to paint a holistic picture.

- Key Findings: BofA's analysis likely reveals that certain sectors are trading at elevated multiples compared to historical averages. This doesn't necessarily signal an imminent crash, but it does highlight a potential vulnerability.

- Specific Companies/Sectors: The analysis might pinpoint specific companies or sectors exhibiting higher-than-average valuation multiples, indicating potential overvaluation. Conversely, some sectors might appear undervalued relative to their growth potential.

- Adjusted Metrics: BofA may have adjusted traditional valuation metrics to account for current low interest rate environments. Low rates can artificially inflate stock prices, making traditional metrics less reliable without adjustments.

Factors Contributing to Elevated Stock Market Valuations

Several factors contribute to the elevated stock market valuations that concern many investors. BofA's analysis likely considers these key elements:

- Low Interest Rates: Low interest rates make borrowing cheaper for businesses and increase the attractiveness of stocks compared to bonds, driving up demand and prices. This has been a significant factor in recent market performance.

- Monetary Policy: Quantitative easing and other expansionary monetary policies implemented by central banks inject liquidity into the financial system, fueling investment and increasing asset prices, including stocks.

- Economic Growth (or Lack Thereof): While strong economic growth typically supports higher valuations, even periods of slower growth can be accompanied by elevated stock prices if investors anticipate future expansion and low interest rates persist.

- Corporate Earnings and Profit Margins: Strong corporate earnings and healthy profit margins support higher valuations as investors anticipate future profitability. However, these must be considered in context with overall market valuations.

- Investor Sentiment and Market Psychology: Positive investor sentiment and a "fear of missing out" (FOMO) mentality can drive stock prices higher, even if underlying valuations aren't fully justified by fundamentals.

The Role of Inflation and Interest Rate Hikes

Inflation and potential interest rate hikes pose significant challenges to elevated stock market valuations. BofA's analysis likely includes a detailed assessment of these factors:

- Inflation's Effect: High inflation erodes the purchasing power of future earnings, potentially reducing the attractiveness of stocks. BofA's predictions on future inflation rates are critical here.

- Interest Rate Hikes: Increased interest rates increase borrowing costs for companies and make bonds more attractive compared to stocks, putting downward pressure on stock prices. BofA's assessment of the likelihood and magnitude of interest rate increases is crucial.

- Portfolio Adjustments: BofA might advise investors to adjust their portfolios to mitigate the risks associated with rising interest rates and inflation, perhaps shifting towards more defensive assets.

Potential Risks and Opportunities

Elevated stock market valuations present both risks and opportunities:

- Potential Risks: Overvaluation in specific sectors carries a higher risk of correction, potentially leading to significant price declines. A broader market downturn, while not inevitable, is a genuine possibility.

- Investment Opportunities: Despite the risks, BofA's analysis might identify undervalued sectors or companies presenting attractive investment opportunities. This is where careful research and sector-specific analysis become crucial.

- Risk Mitigation: Diversification, strategic asset allocation, and disciplined risk management are essential for mitigating the risks associated with elevated valuations. Consider hedging strategies to protect against potential market downturns.

Conclusion

BofA's assessment of elevated stock market valuations highlights the complex interplay of low interest rates, monetary policy, economic growth, corporate earnings, inflation, and investor sentiment. While strong earnings and low rates have supported high valuations, the potential for inflation, interest rate increases, and subsequent market corrections remains a significant concern. Understanding BofA's analysis is crucial for informed investment decisions. The key takeaways emphasize the need for careful consideration of valuation multiples, diversification, and a robust investment strategy aligned with your risk tolerance. Understanding BofA's assessment of elevated stock market valuations is crucial for informed investment decisions. Learn more about navigating these market conditions and develop a robust investment strategy today!

Featured Posts

-

Golden Knights Clinch Playoff Spot Despite Oilers 3 2 Victory

May 09, 2025

Golden Knights Clinch Playoff Spot Despite Oilers 3 2 Victory

May 09, 2025 -

Vegas Golden Nayts Pobedili Minnesotu V Overtayme Pley Off

May 09, 2025

Vegas Golden Nayts Pobedili Minnesotu V Overtayme Pley Off

May 09, 2025 -

Uk Government Tightens Visa Rules Impact On Work And Student Visas

May 09, 2025

Uk Government Tightens Visa Rules Impact On Work And Student Visas

May 09, 2025 -

Bodycam Video Shows Dramatic Rescue Of Toddler Choking On Tomato

May 09, 2025

Bodycam Video Shows Dramatic Rescue Of Toddler Choking On Tomato

May 09, 2025 -

Inter Milans First Leg Triumph Over Bayern In Champions League

May 09, 2025

Inter Milans First Leg Triumph Over Bayern In Champions League

May 09, 2025