Addressing High Stock Market Valuations: Insights From BofA

Table of Contents

BofA's Assessment of Current Stock Market Valuations

BofA's assessment of current stock market valuations often involves a nuanced approach, considering a variety of factors beyond simply looking at headline numbers. While they don't offer a simple "high" or "low" declaration, their analysis frequently incorporates a range of valuation metrics to paint a comprehensive picture.

-

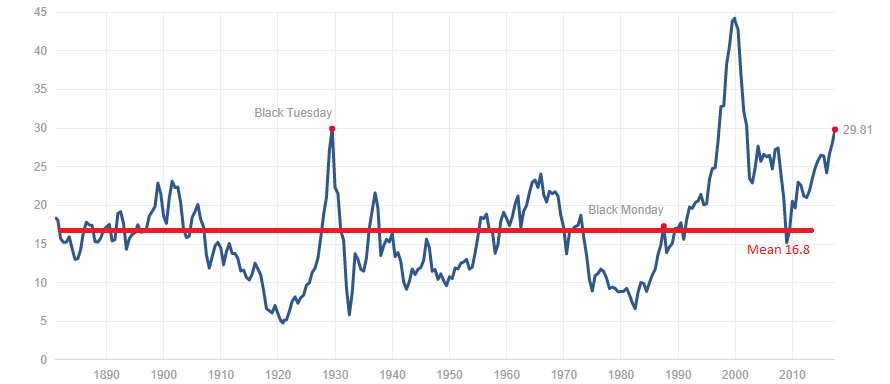

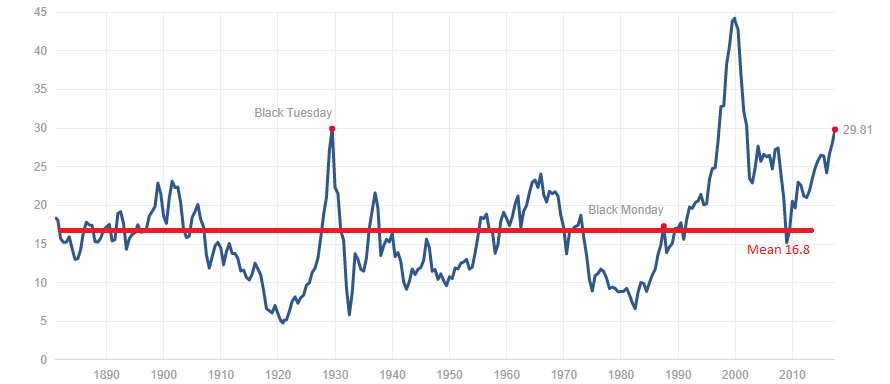

Specific Valuation Metrics: BofA analysts regularly utilize key metrics like the Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (CAPE or Shiller PE), and various other discounted cash flow (DCF) models to assess market valuation. They also consider sector-specific valuations, recognizing that some sectors may be overvalued while others remain relatively attractive.

-

Data Points and Percentages: While specific numbers fluctuate based on the time of reporting, BofA’s reports often highlight discrepancies between historical averages of these metrics and current readings. For instance, a consistently elevated Shiller PE ratio compared to its historical average might suggest a potentially overvalued market. They might also point to specific sectors showing significantly higher valuations compared to their historical norms.

-

Valuation Justification: BofA's analysis carefully weighs whether current valuations are justified by prevailing economic conditions. Factors like strong corporate earnings growth, low interest rates, and anticipated future growth are all considered. However, they also acknowledge that exceptionally high valuations might leave the market vulnerable to corrections. The justification, therefore, isn't a simple yes or no but a complex evaluation of multiple variables.

Factors Contributing to High Stock Market Valuations

Several interconnected factors contribute to the high stock market valuations often noted by BofA and other analysts. Understanding these factors is crucial for investors seeking to make informed decisions.

-

Low Interest Rates: Historically low interest rates have pushed investors towards higher-yielding assets, including stocks. When the cost of borrowing is low, companies can finance expansion more easily, and investors seek higher returns in the stock market rather than lower-yielding bonds. This increased demand inflates stock prices.

-

Strong Corporate Earnings Growth: Consistent and robust corporate earnings growth, fueled by technological advancements and strong consumer spending, can support higher stock valuations. High earnings justify higher price-to-earnings ratios.

-

Investor Sentiment and Risk Appetite: A positive investor sentiment and a high risk appetite often drive up stock prices, even if underlying fundamentals don't fully justify the increase. Confidence in future economic growth can lead to increased investment, boosting stock valuations.

-

Quantitative Easing and Monetary Policy: Central bank policies like quantitative easing, aimed at stimulating economic growth, often result in increased liquidity in the market. This abundance of money can fuel stock prices, leading to higher valuations.

-

Technological Advancements: The rapid pace of technological innovation, particularly in sectors like technology and healthcare, can drive significant growth and attract substantial investment, leading to elevated valuations for leading companies in these sectors.

Potential Risks Associated with High Valuations

While high stock market valuations can offer opportunities, they also present significant risks that BofA consistently emphasizes.

-

Market Corrections and Crashes: Overvalued markets are inherently more vulnerable to significant corrections or even crashes. A sudden shift in investor sentiment or unexpected negative economic news can trigger sharp declines.

-

Reduced Potential for Future Returns: When stock prices are high relative to their underlying fundamentals, the potential for future returns is often diminished. Investors paying high prices today may see lower returns than those who invest at more reasonable valuations.

-

Rising Interest Rates: Rising interest rates, often a response to inflationary pressures, tend to negatively impact stock valuations. Higher borrowing costs reduce corporate profitability and make bonds more attractive, leading to capital flight from the stock market.

-

Geopolitical Risks: Global geopolitical instability, such as trade wars or conflicts, can negatively influence investor sentiment and market stability, leading to declines in stock valuations.

-

Overvaluation in Specific Sectors: While the overall market might appear overvalued, some sectors might be significantly more overvalued than others. BofA's analysis often points out these specific overvalued areas, helping investors make more strategic choices.

BofA's Recommendations for Investors

Navigating high stock market valuations requires a strategic approach. BofA generally recommends:

-

Diversification: Diversifying across different asset classes (stocks, bonds, real estate) and sectors helps mitigate risk. Don't put all your eggs in one basket.

-

Sector-Specific Analysis: Carefully analyze individual sectors to identify undervalued opportunities and avoid overvalued ones. BofA frequently provides sector-specific outlooks to guide investors.

-

Asset Allocation: Adjust your asset allocation strategy based on your risk tolerance and investment goals. Consider shifting towards less risky investments if you are concerned about high market valuations.

-

Long-Term Investment Strategy: Maintain a long-term perspective and avoid making impulsive decisions based on short-term market fluctuations. High valuations are not inherently bad, especially for long-term investors.

-

Active Portfolio Risk Management: Regularly review and rebalance your portfolio to actively manage risk. This includes setting stop-loss orders and adjusting your positions as needed.

Conclusion

Understanding and addressing high stock market valuations is crucial for successful investing. BofA's analysis, incorporating various valuation metrics and considering contributing factors and potential risks, provides valuable insights. Their recommendations emphasize diversification, sector-specific analysis, and a long-term investment strategy. By actively managing portfolio risk and staying informed about BofA's ongoing analysis, investors can navigate the complexities of high stock market valuations more effectively. Regularly review your portfolio and consider seeking professional financial advice to effectively manage your investments in this dynamic market environment. Remember, staying informed about changes in stock market valuations is key to successful investment.

Featured Posts

-

Exclusive Polygraph Threats Leaks And Infighting Shake Up The Pentagon Hegseths Response

Apr 26, 2025

Exclusive Polygraph Threats Leaks And Infighting Shake Up The Pentagon Hegseths Response

Apr 26, 2025 -

Trade War Fears Market Strategists Lower European Stock Market Forecasts

Apr 26, 2025

Trade War Fears Market Strategists Lower European Stock Market Forecasts

Apr 26, 2025 -

Saab Ceo Defense Order Delivery Times Improving

Apr 26, 2025

Saab Ceo Defense Order Delivery Times Improving

Apr 26, 2025 -

California Surpasses Japan As Worlds Fourth Largest Economy

Apr 26, 2025

California Surpasses Japan As Worlds Fourth Largest Economy

Apr 26, 2025 -

Newsom Faces Backlash Over Toxic Democrat Label

Apr 26, 2025

Newsom Faces Backlash Over Toxic Democrat Label

Apr 26, 2025

Latest Posts

-

The Unlikely Path Of Ahmed Hassanein Could He Be The First Egyptian In The Nfl

Apr 26, 2025

The Unlikely Path Of Ahmed Hassanein Could He Be The First Egyptian In The Nfl

Apr 26, 2025 -

Ahmed Hassanein An Egyptians Path To The Nfl Draft

Apr 26, 2025

Ahmed Hassanein An Egyptians Path To The Nfl Draft

Apr 26, 2025 -

Is Ahmed Hassanein Egypts Next Nfl Star A Look At His Draft Prospects

Apr 26, 2025

Is Ahmed Hassanein Egypts Next Nfl Star A Look At His Draft Prospects

Apr 26, 2025 -

Thursday Night Football Nfl Drafts First Round Begins In Green Bay

Apr 26, 2025

Thursday Night Football Nfl Drafts First Round Begins In Green Bay

Apr 26, 2025 -

Will Ahmed Hassanein Break Barriers As Egypts First Nfl Draft Selection

Apr 26, 2025

Will Ahmed Hassanein Break Barriers As Egypts First Nfl Draft Selection

Apr 26, 2025